Table of Contents

Annuity

What is an Annuity?

An annuity plan is a type of pension or retirement plan structured for securing a consistent cash Income flow during your retirement period. It is a plan where the income is paid at a regular interval of time in return for a lump sum amount that is paid upfront. You put money into the plan - be it immediate annuity or variable annuity - and as a result, the insurance company agrees to pay you a specified amount at regular intervals.

Such money is helpful during the later stages of your life when there are no regular paychecks. These pension plans ensure that you are self-sufficient in the twilight of your career and do not depend on anyone.

Annuity Formula

The formula is used to calculate the periodic payment of annuities.

Here,

- P - payment,

- PV - present value - stands for the initial payout

- r - rate per period

- n - number of periods

The formula assumes that the rate of interest remains constant and the payments stay the same.

Types of Annuities

Here are the types of Annuity options offered by Life Insurance and pension plan:

1. Deferred Annuity

It means that the plan will commence only after some specified period of time has elapsed, say 10 or 15 years after you make the final purchase premium payment of the annuity insurance.

2. Immediate Annuity

In this type, a chunk of money is invested in the annuity plan and it immediately starts paying out the income at regular intervals.

Talk to our investment specialist

3. Variable Annuity

Apart from the above-mentioned type, there exists another type known as variable annuity. In this, you invest money in different investment options of your choice. These investment vehicles pay regular income in your retirement. The level of income is determined by the performance of the investment that you have chosen. Thus, the income may vary depending on the performance of the investment channel.

4. Lumpsum Annuity

It is a one-time payment from your pension administrator. A lump sum annuity payment can give you access to a large sum of money, which you can invest, pay large debts quickly or spend as you see fit. But the disadvantage is that your retirement money could run out before you die if not managed properly.

5. Fixed Annuity

In the Fixed Annuity plan, the payments stays consistent/fixed over the whole time frame. Fixed annuities are good investments for people interested in premium protection and low risk.

6. Periodic Annuity

It could be more systematic type of annuity as the payments are made at regular intervals.

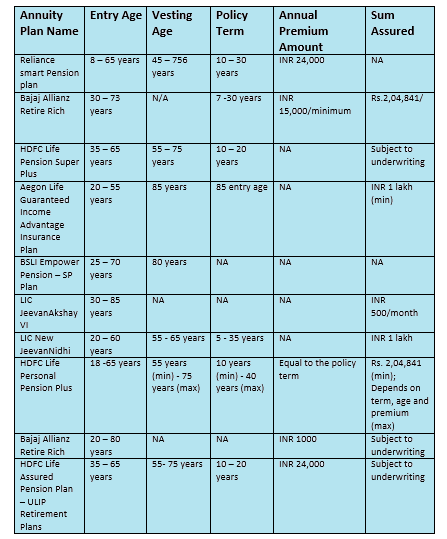

Annuity Plan

Different Insurance companies offer retirement products or pension products. We have a list of some of the popular retirement plans in the country:

How to Choose Right Pension Plan for You?

With so many pension/retirement plans available in the Market, it may be difficult to choose the right product for yourself. However, before Investing in a retirement plan, you must consider the following factors:

Vesting Age

Select a retirement plan with a vesting age that match your requirements. There are some plans with the vesting age of 40 years. You need to choose when do you want to start that regular income.

Higher Sum Assured

Select a pension plan that will give out a higher sum assured on vesting along with bonuses and other benefits if applicable.

Liquidity

Make sure there is some kind of flexibility in terms of withdrawing the money before the lock-in period. There are certain plans available which give you that freedom.

Tax Benefits

Annuity insurance payments can help you save tax to a degree. Find out more about the tax benefit that you might get on investing into that pension product.

Additional Benefits

These plans often give additional benefits like life cover, tax benefits, etc. Explore more about such benefits before you choose to invest.

Annuity Benefits

There are many people in our country fast approaching retirement. There is no shortage of insurers Offering a wide Range of pension plans. You may also plan out your retirement early by choosing and investing in a right pension plan that will help you post-retirement. We have listed some of the benefits that you enjoy by investing in right pension plan:

1. Regular Income after Retirement

The biggest advantage of these plans is that your income doesn't stop after retirement. You keep on receiving portions of money that you have invested at regular intervals.

2. Money when you need it

Some of the pension plans give you a lump sum amount that will cover some major life expenses post-retirement.

3. Tax Benefits

By investing in such plans, you avail tax benefit on both the premium and returns as well.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.