+91-22-48913909

+91-22-48913909

Table of Contents

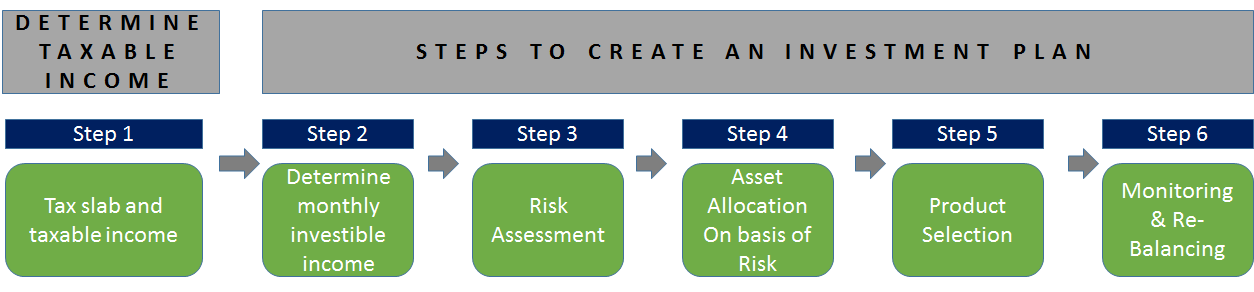

- 1. Determine Taxable Income

- 2. Determine Monthly Investment Amount

- 3. Risk Assessment

- 4. Asset Allocation

- 5. Product Selection

- 6. Monitoring and Rebalancing

- FAQs

- 1. What is Sec 80C?

- 2. What is TDS?

- 3. How is TDS connected to 80C?

- 4. What are the other sections that can help you gain tax benefits other than 80C?

- 5. What are the tax benefits under 80D?

- 6. What is the tax benefit under 80E?

- 7. Should asset allocation be a part of your investment planning?

- 8. Who manages the various products in which you can invest?

6 Best Ways to Invest Money

How to invest? This is a very common question a new-bee would ask. But, at the first place, is there any best way to invest money? Yes, the ideal way would vary person to person. It is based of parameters like tenure, risk appetite, liquidity and taxation. There are various high-return investment options in India, however, it is essential to understand options well depending on your source of income.

1. Determine Taxable Income

Let’s take an example that your income being 4 lakhs, so what will be your tax bracket.

| Income Range Per Annum | Existing Tax Rate (2019-20) | New Tax Rate (2021-22) |

|---|---|---|

| Upto INR 2,50,000 | Exempt | Exempt |

| INR 2,50,000 to 5,00,000 | 5% | 5% |

| INR 5,00,000 to 7,50,000 | 20% | 10% |

| INR 7,50,000 to 10,00,000 | 20% | 15% |

| INR 10,00,000 to 12,50,000 | 30% | 20% |

| INR 12,50,000 to 15,00,000 | 30% | 25% |

| Above INR 15,00,000 | 30% | 30% |

Since we have determined the taxable income, we need to ensure that we make the relevant Tax Saving Investments (as per various sections of income tax act, Section 80C, 80D etc.). One can choose from a number of options like ELSS, health insurance, ULIP, etc. These are all long-term investments and should be chosen after a careful consideration. An ELSS (also known as Equity Linked Savings Scheme) is a hot favourite due to its relatively lower lock-in period of 3 years.

A comparison of ELSS and PPF (Public Provident Fund) is below:

Talk to our investment specialist

| PPF (Public Provident Fund | ELSS (Equity Linked Saving Schemes) |

|---|---|

| PPF is safe being backed by Government of India | ELSS is like equity, with volatility and risk |

| Fixed returns @ 7.60% p.a. | Expected returns: 12-17% p.a. |

| Tax Exemption: EEE (Exempt, Exempt, Exempt) | Tax Exemption: EEE (Exempt, Exempt, Exempt) |

| Lock-in Period: 15 years | Lock-in Period: 3 years |

| Better suited for risk averse investors | Better suited for investors with moderate to high risk appetite |

| Can deposit up to INR 1,50,000 | No deposit limit |

Best ELSS to Invest in 2024

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDFC Tax Advantage (ELSS) Fund Growth ₹137.953

↓ -0.10 ₹6,140 3.8 15.1 37.5 22.3 19.4 28.3 Tata India Tax Savings Fund Growth ₹38.0368

↓ -0.06 ₹4,016 2.6 13.6 32.6 18.4 15.9 24 L&T Tax Advantage Fund Growth ₹111.419

↓ -0.09 ₹3,680 6.9 20.7 40.8 18.2 15.5 28.4 DSP BlackRock Tax Saver Fund Growth ₹114.976

↓ -0.16 ₹14,147 3.8 18.8 40.1 20.6 18.7 30 Principal Tax Savings Fund Growth ₹443.396

↓ -1.39 ₹1,222 3.9 14.1 33.6 19.5 15.9 24.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 24

2. Determine Monthly Investment Amount

The next step would be to determine your monthly surplus that you can invest. This should be determined after taking into account your take home salary and expenses. One should also have some funds aside for contingency needs or emergency expenses.

3. Risk Assessment

Risk assessment is an important step and one should determine the same. The ability to take risk depends on many factors such as age, cash flows, ability to tolerate loss etc. One would need to determine basis these if one can take a high risk or moderate risk or low risk.

4. Asset Allocation

This is simply deciding the mix of assets in a portfolio, for e.g. a high risk taking investor can have more equity in the portfolio than a low-risk investor. A basic rule of thumb is 100 minus age of investor to be the equity allocation. Rest to be in debt.

5. Product Selection

After determining allocation, the next step is to ensure we choose the right products to get into. Mutual Funds could be a good route to invest money since they are professionally managed, regulated by SEBI (Securities and Exchange Board of India) and are convenient to enter and exit.

- Ratings of mutual funds published by rating agencies such as CRISIL, MorningStar, ICRA are good starting points for funds that can be selected.

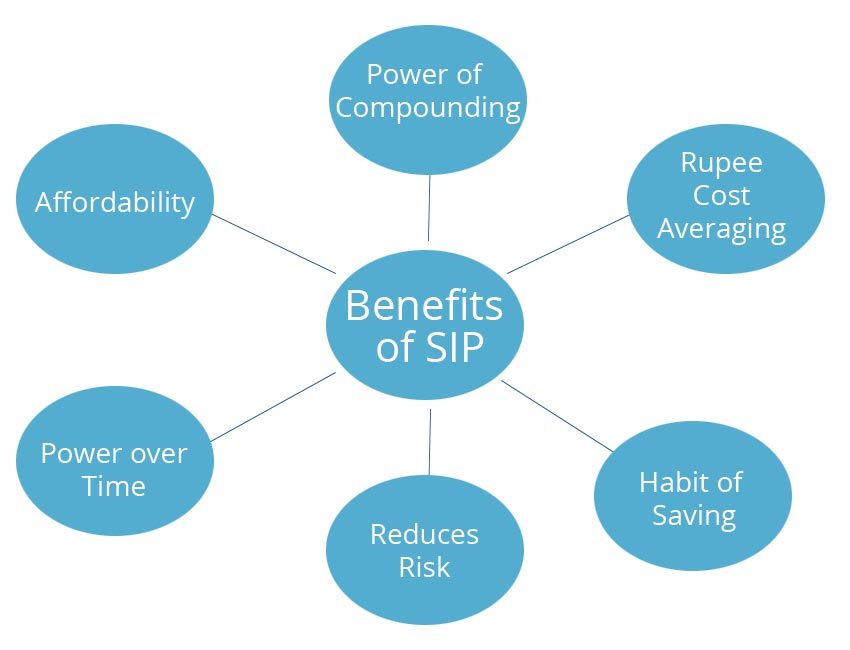

- SIP or Systematic Investment plan could be a good option for salaried employees, which provides convenience to the investor and is a one-time setup while the further investments are automated.

One should choose the final funds to invest into with a careful consideration.

Best SIP Plans for 2024

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDFC Infrastructure Fund Growth ₹45.079

↑ 0.27 ₹1,009 100 16 36.6 77.3 34.9 24.1 50.3 Franklin Build India Fund Growth ₹124.018

↑ 0.19 ₹2,149 500 10.6 31.2 72.3 36.5 23.6 51.1 Motilal Oswal Multicap 35 Fund Growth ₹48.753

↓ -0.18 ₹9,424 500 6.7 23.1 52.6 15.9 13.3 31 L&T India Value Fund Growth ₹92.5954

↓ -0.22 ₹11,536 500 5.6 22.6 51.1 26.5 20.6 39.4 DSP BlackRock Natural Resources and New Energy Fund Growth ₹86.126

↓ -0.08 ₹957 500 13.6 31.3 49.4 24 21.2 31.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 24

6. Monitoring and Rebalancing

After making investments, it is not over by a big margin. To make sure that you get good returns it is required to monitor the portfolio at least once in 3 months and ensure you rebalance once a year at a minimum. One would need to see scheme performance and also that good performer exists in the portfolio. Else changes need to be made to the holdings and replace laggards with good performers.

These are the basic steps to be followed to make an effective and efficient plan. If one does this and monitors the holdings over time, it should yield good results. Best of luck!

FAQs

1. What is Sec 80C?

A: Section 80C of the Income Tax Act of 1961 allows individuals, mostly salaried individuals, to receive tax benefits. Individuals can claim deductions up to Rs. 1.5 lakh on the total income earned in a year.

2. What is TDS?

A: TDS is the acronym for Tax Deducted at Source. It is the tax collected at the source where the income of the individual is generated.

3. How is TDS connected to 80C?

A: TDS is connected with 80C because for individual incomes, but note that TDS cannot be deducted under Section 80C. Say, for instance, you have a PPF account with a Bank with a maximum deposit limit of Rs.1.5 lakh per year. This account is then exempt from TDS under Section 80C; similarly, if interest income earned from the various other tax-saving methods are eligible to be exempt from TDS under Section 80C.

4. What are the other sections that can help you gain tax benefits other than 80C?

A: There are fourteen more methods by which you can save on taxes other than 80C, and these are as follows:

- Section 80CCD: National Pension Scheme

- Section 80D: Payment of health insurance premium

- Section 80E: Repayment of an education loan

- Section 24: Interest payment of a Home Loan

- Section 80EE: Interest payment of the home loan for first-time buyers

- Section 80EEA: Interest payment of the home loan for first-time buyers

- Section 80EEB: Interest paid on loan taken for the purchase of an electric vehicle

- Section 80G: Donations to charitable institutions

- Section 80GG: Rent paid for accommodation

- Section 80TTA: Interest from Saving Bank Account

- Section 80TTB: Interest from deposits in case of senior citizens

- Section 54: Long-term Capital Gain on the sale of the residential house

- Section 54EC: long-term capital gain on the sale of land, building or both

- Section 54F: long-term capital gain on the sale of a capital asset other than a residential house

5. What are the tax benefits under 80D?

A: Individuals can claim tax deductions on the payment of health insurance premiums. For individuals below 60 years and paying for themselves, they can claim deductions up to Rs. 25,000. If you are below sixty, but live with parents above the age of 60 and are paying premiums for them, then you can claim deductions up to Rs. 75,000.

Finally, for senior citizens living with senior citizens' parents, paying premiums for themselves and their parents, they can claim deductions up to Rs. 1,00,000.

6. What is the tax benefit under 80E?

A: Suppose you are repaying the education loan you have taken for yourself or repaying it on behalf of your child, spouse, or an individual whose legal guardian you are. In that case, you can claim tax deductions under section 80E.

7. Should asset allocation be a part of your investment planning?

A: Yes, Asset Allocation should be a part of investment planning. Because a diversified portfolio is essential to ensure that you have enough investments so that your overall investments are not adversely affected if one does not perform.

8. Who manages the various products in which you can invest?

A: You can have a wealth manager from your bank, helping you create your portfolio of investments. Otherwise, if you feel you can manage it, you, too, can identify the suitable products to invest.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.