Table of Contents

Gold Monetisation Scheme: Things to Know

The Gold Monetisation Scheme (GMS) is launched by the Prime Minister of India with an aim to help investors earn interest on their gold lying idle in Bank lockers. Gold Monetisation Scheme works like a gold Savings Account which will earn interest on the gold that you deposit, based on the weight along with the appreciation in the value of gold.

Investors can deposit gold in any physical form – jewellery, bars or coins. This new gold scheme is a modification of the existing Gold Metal Loan Scheme (GML), Gold Deposit Scheme (GDS) and it would replace the existing Gold Deposit Scheme (GDS), 1999.

Gold Monetisation Scheme Details

Gold Monetisation Scheme is launched with an idea to ensure mobilisation of the gold owned by the families and Indian institutions. It is expected that the Gold Monetisation Scheme would turn gold into a productive asset in India.

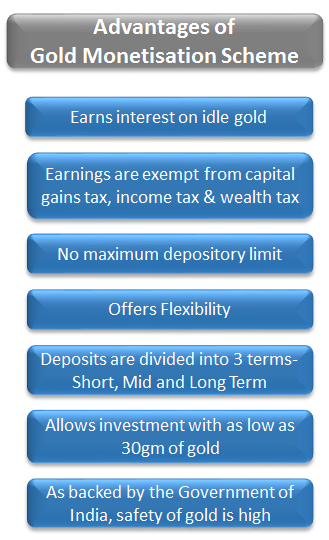

Generally, gold lying in bank lockers appreciates in value if the gold price goes up, but it doesn't pay a regular interest or dividend. On the contrary, you incur carrying costs on it (bank locker charges). The Gold Monetisation Scheme allows individuals to earn certain regular interest on their gold and also saves carrying costs. The minimum quantity of gold that a customer can bring is proposed to be set at 30 grams.

Under the Gold Monetisation Scheme, an investor can deposit gold for a short, medium and long-term period. The tenure for each term is as follows- Short Term Bank Deposits (SRBD) is of 1-3 years, Mid-term is between 5-7 years of tenure and Long Term Government Deposit (LTGD) comes under a tenure of 12-15 years.

Features of this Gold Scheme

- Gold Monetisation Scheme accepts a minimum deposit of 30 grams in the form of a coin, bar or jewellery.

- There is no maximum limit of investment under this scheme.

- All designated commercial banks would be able to implement the Gold Monetisation Scheme in India.

- Gold Monetisation Scheme allows premature withdrawal after a minimum lock-in period. However, it charges a penalty for such withdrawals.

- The short-term deposits offered by this scheme can be redeemed either in gold or in rupees at current rates applicable at the time of Redemption.

- Investor's gold will be securely maintained by the bank.

Talk to our investment specialist

How is Interest Rate Calculated?

Both principal deposit and interest will be valued in gold. For instance, if a customer deposits 100 grams of gold and gets 2% interest, then, on maturity he has a credit of 102 grams.

Benefits of Investing in Gold Monetisation Scheme

- Investors would earn interest on their idle gold, which would add value to their savings too.

- The Gold Monetisation Scheme offers flexibility. Investors can withdraw their investment/gold as and when they need it.

- Investors can start their investment with as low as 30gm of gold.

- Coins and bars can earn interest apart from the appreciation of the value

- Earnings are exempt from Capital gains tax, income tax and wealth tax. There will be no Capital Gains tax on the appreciation in the value of gold deposited, or on the interest, you make from it.

- As the Gold Monetisation Scheme is backed by the Government of India, the safety and security of the gold invested are high.

How to Open Gold Savings Account?

Individuals willing to open an account can do so with a scheduled bank listed under the Reserve Bank of India. The documents which are required to open the account are same as those required for any savings bank account opening, for example, Know Your Customer (KYC) form along with valid ID proof, address proof and passport size photograph.

Eligibility

All residents Indians along with trusts, including Mutual Funds/ETF (Exchange Traded Fund), registered under SEBI can make deposits under the Gold Monetisation Scheme.