Table of Contents

Role of a Tax Consultant

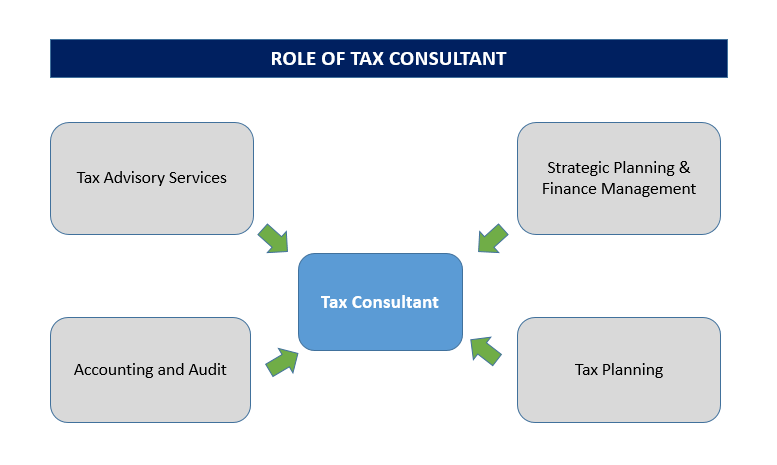

A tax consultant acts as an advisor to all those paying Taxes in a country. They study and understand the myriad rules & regulations of the government to provide sound financial advice and tax-related services to their clients, in accordance with the central and state tax regulations.

These tax experts help their clients to file income tax and help them in Tax Planning. A tax Accountant plays multiple roles within the finance sector for the Industry. A tax consultant is well-versed with all financial literature, including updated central and state tax laws, statutory compliance, and associated tax procedures. This extensive knowledge is put to use while reducing the tax liabilities of companies or even individuals and devising options for financial investments to legally reduce taxes.

Tax Advisory Services

The first and foremost responsibility of a tax consultant is to provide logical financial advice to clients, designing various strategies that help mitigate the client’s financial dues, within the framework of the law. The tax advisor assists in reducing liabilities and educating the client about the options available while computing taxes. A strong background in financial management is necessary for the same, as is a strong knowledge base of the country’s taxation rules and regulations.

Strategic Planning and Finance Management

The tax consultant is accountable for the strategic planning and finance management of the company and is expected to develop, plan, and execute these strategies for tax reduction in accordance with legal compliance. The consultant coordinates across various departments to chalk out a comprehensive strategy for the company that aligns with the objectives of the company while satisfying all tax service requirements.

Talk to our investment specialist

Accounting and Tax Planning

Tax consultant often functions as an accountant and auditor for a client, provided they have the necessary qualifications. They help the clients in tax planning. In these instances, the consultant prepares and files Income Tax Returns, balance sheets, accounts, and audit reports for the company, and is also the signatory authority. The tax accountant provides professional guidance regarding management of wealth and property, assets, tax management, and international taxation including transfer pricing.

Use of Comprehensive Taxation Software

Accounting and auditing require the use of diverse software solutions for quick and easy computation of taxes. The various Types of Taxes, such as Sales Tax, Income tax, international tax, accounting, and more, each have their designated software for calculation. The tax consultant is familiar with the functions of these income tax and sales tax software and prepares the complete Financial Structure with the help of the same.

Functioning as a Tax Pro

Taxation and financial management is a huge spectrum. Although all general practitioners in the industry offer insights into tax management, some tax consultants avail of exclusive taxation courses to function as tax specialists within a particular branch of taxation. These individuals have years of expertise within their chosen fields and are invaluable in case of tax assessments.

The overall taxation and financial management structure make a tax consultant indispensable for every individual and business. These individuals can act as independent entrepreneurs or work for a specific company, utilising their acumen and expertise for assisting with comprehensive tax management solutions.