Implied Rate

What is the Implied Rate?

The implied rate is the difference between the interest rate for the futures or forward delivery date and the spot interest rate. For instance, suppose if the current deposit rate for the spot is 1% and it will be 1.5% in one year, the implied rate will be the difference of 0.5%.

Or, if the spot price is 1.050 for a specific currency, and 1.110 is the price of the futures contract, the 5.71% difference will be regarded as the implied interest rate. In both of the examples, the implied rate has turned out to be positive.

This signifies that the market is anticipating the rates of future borrowing to be higher in the upcoming days.

Understanding Implied Rate

With the implied interest rate, investors get a way to compare returns of different investments and assess the return and risk characteristics of that specific security. An implied interest rate can easily be evaluated for any security type that also has a futures or options contract.

To evaluate the implied rate, the forward price ratio will be taken over the spot price. Elevate that ratio to 1 power, divided by the time length, until the forward contract expires. And them, subtract 1.

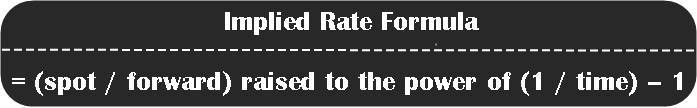

In simple words, here is the implied rate formula:

Implied rate = (spot / forward) raised to the power of (1 / time) – 1

Here, time is equal to the forward contract’s length in years.

Talk to our investment specialist

Examples of Implied Rate

Commodities Example

Suppose that the spot price for one oil barrel is Rs. 68. And, its one-year futures contract is Rs. 71. Now, the implied interest rate can be calculated by dividing the futures price of Rs. 71 with the spot price of Rs. 68.

Considering that the length of the contract is 1 year, the ratio will be raised to the power of 1. And then, minus 1 from the ratio and you will get the implied interest rate.

71/68 – 1= 4.41%

Stocks Example

Take up a stock that is trading at a price of Rs. 30. And, there is a forward contract of 2-years, which is trading at Rs. 39. To get the implied rate, simply divide Rs. 39 by Rs. 30. The ratio will be raised to the power of 1/2 since this one is a 2-years futures contract. Minus 1 from the number you got to find the implied interest rate, which will be:

39/30 raised to the power of (1/2) – 1 = 14.02%

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.