+91-22-48913909

+91-22-48913909

Table of Contents

- म्युच्युअल फंडात गुंतवणूक का करावी?

- सर्वोत्कृष्ट इक्विटी म्युच्युअल फंड 2022 - 2023

- सर्वोत्तम कर्ज निधी 2022 - 2023

- सर्वोत्कृष्ट हायब्रिड फंड 2022 - 2023

- टॉप 5 गोल्ड फंड 2022 - 2023

- 1 महिन्याच्या कामगिरीवर आधारित सर्वोत्तम म्युच्युअल फंड

- सर्वोत्तम म्युच्युअल फंडामध्ये ऑनलाइन गुंतवणूक कशी करावी?

- सर्वोत्तम म्युच्युअल फंडांमध्ये गुंतवणूक करण्यासाठी स्मार्ट टिप्स: एकरकमी आणि एसआयपी गुंतवणूक

Top 5 Funds

सर्वोत्तम कामगिरी करणारे म्युच्युअल फंड 2022 - 2023

म्युच्युअल फंड भारतात वर्षानुवर्षे वाढली आहे. परिणामी, सर्वोत्तम कामगिरी करणाऱ्या फंडांमध्येबाजार बदलत रहा. CRISIL, Morning Star, ICRA सारख्या MF योजनांचा न्याय करण्यासाठी विविध रेटिंग प्रणाली आहेत. या प्रणाली गुणात्मक आणि परिमाणात्मक घटकांवर आधारित निधीचे मूल्यांकन करतात जसे की परतावा, मालमत्तेचा आकार, खर्चाचे प्रमाण,प्रमाणित विचलन, इ.

या सर्व घटकांच्या बेरजेमुळे भारतातील सर्वोत्तम कामगिरी करणाऱ्या म्युच्युअल फंडांचे रेटिंग मिळते. तथापि, प्रक्रिया करण्यासाठीगुंतवणूक गुंतवणूकदारांसाठी सोपे, आम्ही सर्वोत्तम फंड निवडण्यासाठी मार्गदर्शक तत्त्वांसह भारतातील सर्वोत्तम कामगिरी करणारे म्युच्युअल फंड निवडले आहेत.

म्युच्युअल फंडात गुंतवणूक का करावी?

म्युच्युअल फंडातील गुंतवणूक केवळ एकच फायदा घेत नाही, तर ते अनेक फायद्यांसह येते जे गुंतवणूकदारांना त्यांचे पैसे वाढवण्यास मदत करतात. हे अल्प, मध्यम आणि दीर्घकालीन गुंतवणुकीची उद्दिष्टे पूर्ण करते. कमी जोखमीपासून ते कर्जासारख्या उच्च जोखमीच्या योजनांपर्यंत गुंतवणूक करण्यासाठी तुम्ही विविध फंड पर्याय निवडू शकता.इक्विटी फंड.

म्युच्युअल फंडांकडे लोकांचे लक्ष वेधून घेणारे एक महत्त्वाचे वैशिष्ट्य म्हणजे किमान गुंतवणूक रक्कम. तुम्ही ए मध्ये गुंतवणूक सुरू करू शकताSIP फक्त INR 500 मध्ये.

आपण का करावे याची आणखी काही कारणे पाहू याम्युच्युअल फंडात गुंतवणूक करा:

1. तरलता

ओपन-एंडेड योजनांमध्ये, योजना खरेदी करणे आणि बाहेर पडणे सोपे आहे. कोणीही तुमची युनिट्स कधीही विकू शकते (जेव्हा बाजार जास्त असतो तेव्हा हे सुचवले जाते). परंतु, जेव्हा तुम्ही एखाद्या फंडात गुंतवणूक करता तेव्हा तुम्हाला एक्झिट लोडचे शुल्क माहित असले पाहिजे. म्युच्युअल फंडांमध्ये, फंड हाऊसने त्या दिवशीचे निव्वळ मालमत्ता मूल्य (नाही).

2. विविधीकरण

म्युच्युअल फंडामध्ये विविध आर्थिक साधने असतात जसे की स्टॉक, स्थिरउत्पन्न साधने, सोने इ. यामुळे, तुम्ही फक्त एकाच योजनेत गुंतवणूक करून विविधीकरणाचे फायदे घेऊ शकता. याउलट, व्यक्तींनी शेअर्समध्ये थेट गुंतवणूक करण्याचा निर्णय घेतल्यास त्यांना पैसे टाकण्यापूर्वी विविध कंपन्यांच्या स्टॉकचे संशोधन करावे लागेल.

3. चांगले-नियमित

भारतातील म्युच्युअल फंड उद्योग द्वारे व्यवस्थित नियंत्रित आहेसेबी (भारतीय सिक्युरिटीज अँड एक्सचेंज बोर्ड). हे सर्व म्युच्युअल फंडांच्या कामकाजावर नियंत्रण ठेवते. शिवाय, ही फंड हाऊसेसही पारदर्शक आहेत ज्यात; त्यांना त्यांचे कार्यप्रदर्शन अहवाल नियमित अंतराने प्रकाशित करणे आवश्यक आहे.

4. तज्ञ व्यवस्थापन

प्रत्येक MF योजना एका समर्पित निधी व्यवस्थापकाद्वारे व्यवस्थापित केली जाते. गुंतवणूकदारांनी कामगिरीवर सतत लक्ष ठेवून आणि बदलून योजनेतून जास्तीत जास्त परतावा मिळावा हे सुनिश्चित करणे हे फंड व्यवस्थापकाचे उद्दिष्ट आहे.मालमत्ता वाटप बाजाराच्या गरजेनुसार वेळेवर.

Talk to our investment specialist

सर्वोत्कृष्ट इक्विटी म्युच्युअल फंड 2022 - 2023

च्या फरक श्रेणींमधील शीर्ष रँक केलेले फंड खाली दिले आहेतइक्विटी लार्ज-, मिड-, स्मॉल-, मल्टी-कॅप,ELSS आणि क्षेत्रीय निधी.

शीर्ष 5 लार्ज कॅप इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Large Cap Fund Growth ₹79.2171

↑ 0.76 ₹24,378 7.6 21.4 44.4 26.2 17.6 32.1 HDFC Top 100 Fund Growth ₹1,028.71

↑ 8.98 ₹32,355 4 19.1 37.8 22.4 15.8 30 ICICI Prudential Bluechip Fund Growth ₹95.89

↑ 1.02 ₹53,505 6 21.5 41 22.2 17.9 27.4 IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 BNP Paribas Large Cap Fund Growth ₹199.006

↑ 1.51 ₹1,863 8.7 23 40.1 19.8 18 24.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 मिड कॅप इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Motilal Oswal Midcap 30 Fund Growth ₹80.8307

↓ -0.04 ₹8,987 9.4 28.8 60.8 37 26.5 41.7 PGIM India Midcap Opportunities Fund Growth ₹54.53

↑ 0.18 ₹9,924 2.4 13 30.1 20.4 24.8 20.8 Edelweiss Mid Cap Fund Growth ₹78.617

↑ 0.16 ₹5,115 5.8 24.9 52.5 26.6 24.6 38.4 SBI Magnum Mid Cap Fund Growth ₹205.813

↓ -0.35 ₹16,856 4.4 14 40.1 24.6 22.8 34.5 BNP Paribas Mid Cap Fund Growth ₹86.8848

↑ 0.41 ₹1,790 7.2 21.4 47.5 23.7 22.8 32.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 स्मॉल कॅप इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Small Cap Fund Growth ₹148.698

↑ 2.27 ₹45,749 5.6 20 58.3 35.5 30.1 48.9 Kotak Small Cap Fund Growth ₹228.074

↑ 1.56 ₹13,882 2.9 14.4 40.7 24.4 26.3 34.8 ICICI Prudential Smallcap Fund Growth ₹77.55

↑ 0.47 ₹7,173 1.9 13.7 44.4 29.5 25.6 37.9 SBI Small Cap Fund Growth ₹156.614

↑ 1.41 ₹25,435 8.6 15.4 40.1 25.1 25 25.3 DSP BlackRock Small Cap Fund Growth ₹166.53

↑ 2.24 ₹13,039 2.4 13.9 47.1 27.9 24.7 41.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 डायव्हर्सिफाइड/मल्टी-कॅप इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Multi Cap Fund Growth ₹254.329

↑ 2.86 ₹27,746 9.1 21.8 53.9 32.3 21 38.1 JM Multicap Fund Growth ₹88.4757

↑ 0.98 ₹1,774 10.9 27.8 62.1 29 23.2 40 HDFC Equity Fund Growth ₹1,624.53

↑ 12.96 ₹50,840 6.7 22.2 43.6 27.8 19.5 30.6 Mahindra Badhat Yojana Growth ₹30.6893

↑ 0.33 ₹3,165 4.3 21.5 52 26.1 23.4 34.2 ICICI Prudential Multicap Fund Growth ₹687.87

↑ 5.60 ₹11,342 6.8 22.8 50.1 25.3 18.5 35.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 (ELSS) इक्विटी लिंक्ड बचत योजना

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) SBI Magnum Tax Gain Fund Growth ₹380.551

↑ 2.93 ₹21,976 10.7 30.5 59.9 28.3 21.5 40 HDFC Tax Saver Fund Growth ₹1,175

↑ 10.88 ₹13,990 6.4 23.1 45.8 27.1 17.6 33.2 Motilal Oswal Long Term Equity Fund Growth ₹42.9601

↑ 0.61 ₹3,205 10.9 32 58.5 25.7 20.6 37 BOI AXA Tax Advantage Fund Growth ₹154.56

↑ 1.96 ₹1,210 10.9 31.3 54.9 25 25.4 34.8 Franklin India Taxshield Growth ₹1,280.5

↑ 13.48 ₹6,180 5.4 20.6 45.6 23.6 17.7 31.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 सेक्टर इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) SBI PSU Fund Growth ₹29.83

↑ 0.35 ₹1,876 15.7 51.7 93.3 42.7 24.1 54 ICICI Prudential Infrastructure Fund Growth ₹169.77

↑ 1.22 ₹5,186 12.8 35.2 65.5 42.1 27.2 44.6 HDFC Infrastructure Fund Growth ₹43.175

↑ 0.59 ₹1,663 12.2 31.5 82.9 41.1 20.9 55.4 Invesco India PSU Equity Fund Growth ₹56.93

↑ 0.24 ₹859 15.2 46.5 84.8 39.6 27.2 54.5 Nippon India Power and Infra Fund Growth ₹317.396

↑ 2.05 ₹4,529 12.3 36.7 78.9 39.4 26.5 58 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 व्हॅल्यू इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) JM Value Fund Growth ₹88.8521

↑ 1.19 ₹581 4.1 24.4 63.3 29.7 22.6 47.7 Templeton India Value Fund Growth ₹647.672

↑ 1.97 ₹1,820 6.7 21.7 44.4 28.7 20.3 33.7 L&T India Value Fund Growth ₹93.3098

↑ 0.90 ₹11,431 6.7 24.3 53.7 27.4 21.3 39.4 Nippon India Value Fund Growth ₹196.09

↑ 2.66 ₹7,107 6.4 28.1 58.8 27.4 21.7 42.4 ICICI Prudential Value Discovery Fund Growth ₹394.94

↑ 1.73 ₹41,282 5.5 20.3 42.4 27.1 21.8 31.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 केंद्रित इक्विटी फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Focused 30 Fund Growth ₹187.688

↑ 1.61 ₹10,433 7.1 21.7 41.3 29.5 19.4 29.6 ICICI Prudential Focused Equity Fund Growth ₹74.68

↑ 0.93 ₹7,583 8.9 24.8 46.4 24.3 19.7 28.3 Franklin India Focused Equity Fund Growth ₹95.2125

↑ 1.00 ₹11,160 7 19.5 40.3 22.9 18.1 23.5 IIFL Focused Equity Fund Growth ₹42.171

↑ 0.26 ₹6,794 6.5 17.7 38 21.8 21.8 29.8 Nippon India Focused Equity Fund Growth ₹103.758

↑ 1.03 ₹7,608 0.8 11.9 32.8 18.6 17 27.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

सर्वोत्तम कर्ज निधी 2022 - 2023

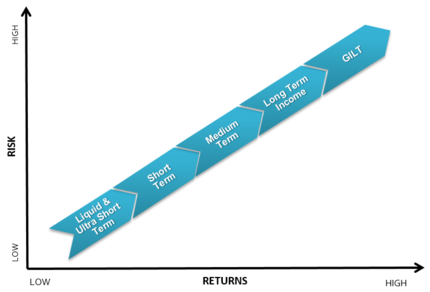

खाली भिन्न श्रेणींमधील शीर्ष रँक केलेले फंड आहेत. लिक्विड, अल्ट्रा शॉर्ट, शॉर्ट टर्म, GILT, क्रेडिट रिस्क आणि कॉर्पोरेट कर्जकर्ज.

शीर्ष 5 अल्ट्रा शॉर्ट टर्म डेट फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹501.329

↑ 0.29 ₹10,748 2.1 3.9 7.5 5.8 7.2 7.95% 5M 12D 6M 4D SBI Magnum Ultra Short Duration Fund Growth ₹5,487.36

↑ 2.67 ₹9,018 2 3.7 7.2 5.4 7 7.68% 4M 28D 5M 8D ICICI Prudential Ultra Short Term Fund Growth ₹25.4391

↑ 0.01 ₹12,180 2.1 3.8 7.2 5.6 6.9 8.02% 4M 24D 5M 8D Kotak Savings Fund Growth ₹39.4572

↑ 0.02 ₹12,372 2 3.6 7 5.3 6.8 7.8% 6M 4D 8M 8D UTI Ultra Short Term Fund Growth ₹3,903.66

↑ 1.91 ₹2,093 1.9 3.6 7 6.1 6.7 7.91% 6M 1D 6M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 शॉर्ट टर्म डेट फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Franklin India Short Term Income Plan - Retail Plan Growth ₹5,149.41 ₹13 0 0 3.5 8.4 6.9 0% IDBI Short Term Bond Fund Growth ₹23.8418

↓ 0.00 ₹26 1.4 3.2 6.2 7.2 6.43% 3M 3M 14D UTI Short Term Income Fund Growth ₹28.8222

↑ 0.01 ₹2,689 1.9 4 7.1 7 6.9 7.51% 2Y 5M 8D 3Y 8M 5D BNP Paribas Short Term Fund Growth ₹25.4771

↓ -0.01 ₹258 0.6 1.3 4.6 6.5 5.16% 1Y 11M 26D 2Y 3M ICICI Prudential Short Term Fund Growth ₹54.5371

↑ 0.07 ₹16,876 1.8 3.8 7.3 5.8 7.4 8.02% 2Y 7M 2D 4Y 9M 4D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 लिक्विड फंड

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,677.11

↑ 0.46 ₹22,169 0.7 1.9 3.7 7.3 7.1 7.41% 1M 13D 1M 14D Aditya Birla Sun Life Liquid Fund Growth ₹387.544

↑ 0.07 ₹29,764 0.7 1.9 3.7 7.2 7.1 7.47% 1M 17D 1M 17D UTI Liquid Cash Plan Growth ₹3,945.58

↑ 0.69 ₹18,736 0.7 1.9 3.7 7.2 7 7.58% 1M 29D 1M 29D Mirae Asset Cash Management Fund Growth ₹2,522.35

↑ 0.46 ₹6,872 0.7 1.9 3.7 7.3 7 7.34% 1M 6D 1M 7D Baroda Pioneer Liquid Fund Growth ₹2,767.67

↑ 0.48 ₹5,368 0.7 1.9 3.7 7.2 7 7.62% 1M 26D 2M Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 बँकिंग आणि PSU डेट फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Banking and PSU Debt Fund Growth ₹29.7009

↑ 0.03 ₹8,837 1.9 3.6 7.3 5.8 7.3 7.79% 2Y 11M 26D 5Y 4M 2D Kotak Banking and PSU Debt fund Growth ₹59.1762

↑ 0.05 ₹5,992 1.8 3.8 6.8 5.4 6.8 7.74% 4Y 1M 10D 8Y 9M 22D Aditya Birla Sun Life Banking & PSU Debt Fund Growth ₹332.089

↑ 0.30 ₹10,060 1.7 3.7 6.7 5.3 6.9 7.65% 3Y 3M 25D 5Y 9M 18D HDFC Banking and PSU Debt Fund Growth ₹20.8489

↑ 0.02 ₹6,267 1.8 3.7 6.8 5.2 6.8 7.57% 2Y 10M 27D 4Y 17D Nippon India Banking & PSU Debt Fund Growth ₹18.7964

↑ 0.02 ₹5,466 1.8 3.8 6.6 5.1 6.8 7.59% 3Y 3M 25D 4Y 6M 7D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 क्रेडिट रिस्क फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity BOI AXA Credit Risk Fund Growth ₹11.4438

↑ 0.00 ₹142 2.5 3.9 6.7 40.4 5.6 6.95% 7M 13D 9M Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 2.9 5 7.5 11 0% UTI Credit Risk Fund Growth ₹15.5041

↑ 0.01 ₹396 1.7 3.4 6.4 10.7 6.6 8.25% 2Y 11D 2Y 9M 29D DSP BlackRock Credit Risk Fund Growth ₹39.7956

↑ 0.04 ₹195 1.8 3.7 15.1 9.5 15.6 8.34% 2Y 4M 6D 3Y 2M 1D Baroda Pioneer Credit Risk Fund Growth ₹20.057

↑ 0.02 ₹154 1.7 3.7 7.2 8.7 7.4 8.7% 2Y 3M 14D 3Y 4M 20D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 कॉर्पोरेट बाँड फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Corporate Bond Fund Growth ₹27.013

↑ 0.03 ₹26,230 1.9 3.7 7.5 5.9 7.6 7.92% 2Y 3M 14D 4Y 2M 23D Nippon India Prime Debt Fund Growth ₹54.0247

↑ 0.07 ₹2,818 1.9 4 7.1 5.8 7.1 7.74% 3Y 1M 20D 4Y 1M 13D Aditya Birla Sun Life Corporate Bond Fund Growth ₹101.803

↑ 0.13 ₹21,135 1.9 4 7.2 5.7 7.3 7.68% 3Y 7M 2D 5Y 6M 14D HDFC Corporate Bond Fund Growth ₹29.3884

↑ 0.03 ₹28,499 2.1 3.9 7.4 5.5 7.2 7.73% 3Y 8D 5Y 2M Kotak Corporate Bond Fund Standard Growth ₹3,404.78

↑ 3.66 ₹11,584 1.9 3.9 6.9 5.4 6.9 7.77% 3Y 4M 10D 5Y 6M 18D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 गिल्ट फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Gilt Fund Growth ₹92.3461

↑ 0.20 ₹4,865 1.5 3.5 7.4 5.8 8.3 7.51% 4Y 11M 5D 9Y 6M 11D SBI Magnum Gilt Fund Growth ₹59.5183

↑ 0.11 ₹7,884 1.8 4.2 6.8 5.6 7.6 7.26% 8Y 15Y 5M 19D DSP BlackRock Government Securities Fund Growth ₹86.0738

↑ 0.20 ₹755 2.3 5.2 7.1 5.3 7.1 7.27% 10Y 1M 24D 22Y 9M 4D Edelweiss Government Securities Fund Growth ₹22.2315

↑ 0.05 ₹139 2.5 5.6 6.6 5 6.2 7.21% 8Y 9M 4D 15Y 11M 6D Aditya Birla Sun Life Government Securities Fund Growth ₹73.4891

↑ 0.18 ₹1,369 1.8 4.9 6.6 5 7.1 7.24% 8Y 5M 1D 15Y 11M 5D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

सर्वोत्कृष्ट हायब्रिड फंड 2022 - 2023

खाली भिन्न श्रेणींमधील शीर्ष रँक केलेले फंड आहेत. आक्रमक, पुराणमतवादी, आर्बिट्रेज, डायनॅमिक ऍलोकेशन, मल्टी अॅसेट, इक्विटी सेव्हिंग्स आणि सोल्युशन ओरिएंटेडसंकरित योजना

शीर्ष 5 बॅलन्स्ड फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Equity and Debt Fund Growth ₹339.79

↑ 1.87 ₹33,502 7.8 20.5 41 26.3 20.5 28.2 HDFC Balanced Advantage Fund Growth ₹457.928

↑ 2.64 ₹79,875 5.1 19.4 39.4 25.8 18.4 31.3 ICICI Prudential Multi-Asset Fund Growth ₹648.063

↑ 2.14 ₹36,843 7.7 17.4 33.8 25.3 19.4 24.1 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹33.86

↑ 0.34 ₹665 6.4 21.1 47.6 24.6 21.4 33.7 JM Equity Hybrid Fund Growth ₹109.554

↑ 1.42 ₹223 7.1 23.6 52.8 24.1 18.8 33.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 आक्रमक हायब्रिड फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Equity and Debt Fund Growth ₹339.79

↑ 1.87 ₹33,502 7.8 20.5 41 26.3 20.5 28.2 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹33.86

↑ 0.34 ₹665 6.4 21.1 47.6 24.6 21.4 33.7 JM Equity Hybrid Fund Growth ₹109.554

↑ 1.42 ₹223 7.1 23.6 52.8 24.1 18.8 33.8 UTI Hybrid Equity Fund Growth ₹347.796

↑ 2.13 ₹5,306 4.5 15.5 32.6 19.2 15.6 25.5 Nippon India Equity Hybrid Fund Growth ₹91.8303

↑ 0.78 ₹3,435 4.5 15.2 31.1 17.9 11 24.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 कंझर्व्हेटिव्ह हायब्रिड फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Equity and Debt Fund Growth ₹339.79

↑ 1.87 ₹33,502 7.8 20.5 41 26.3 20.5 28.2 HDFC Balanced Advantage Fund Growth ₹457.928

↑ 2.64 ₹79,875 5.1 19.4 39.4 25.8 18.4 31.3 ICICI Prudential Multi-Asset Fund Growth ₹648.063

↑ 2.14 ₹36,843 7.7 17.4 33.8 25.3 19.4 24.1 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹33.86

↑ 0.34 ₹665 6.4 21.1 47.6 24.6 21.4 33.7 JM Equity Hybrid Fund Growth ₹109.554

↑ 1.42 ₹223 7.1 23.6 52.8 24.1 18.8 33.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 आर्बिट्राज फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) SBI Arbitrage Opportunities Fund Growth ₹31.1633

↓ -0.02 ₹27,586 2.1 3.8 7.9 5.8 5.3 7.4 Invesco India Arbitrage Fund Growth ₹29.4064

↓ -0.02 ₹14,611 2 3.8 7.8 5.8 5.4 7.4 Kotak Equity Arbitrage Fund Growth ₹34.5073

↓ -0.03 ₹40,051 2.2 3.9 8 5.8 5.4 7.4 Edelweiss Arbitrage Fund Growth ₹17.8744

↓ -0.02 ₹9,167 2.1 3.8 7.8 5.6 5.4 7.1 ICICI Prudential Equity Arbitrage Fund Growth ₹31.6126

↓ -0.03 ₹17,729 2 3.7 7.7 5.5 5.2 7.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 डायनॅमिक ऍलोकेशन फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Balanced Advantage Fund Growth ₹457.928

↑ 2.64 ₹79,875 5.1 19.4 39.4 25.8 18.4 31.3 BOI AXA Equity Debt Rebalancer Fund Growth ₹23.5805

↑ 0.16 ₹122 4.5 16 26.2 14.8 9.3 18.4 ICICI Prudential Balanced Advantage Fund Growth ₹64.5

↑ 0.30 ₹56,175 3.9 11.6 21.9 13.6 12.7 16.5 Edelweiss Balanced Advantage Fund Growth ₹45.86

↑ 0.26 ₹10,738 4.9 14.3 26 13.5 14.4 18.8 Nippon India Balanced Advantage Fund Growth ₹157.051

↑ 0.70 ₹7,719 4.1 13.5 24.6 13.2 11.6 17.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

शीर्ष 5 मल्टी अॅसेट ऍलोकेशन फंड

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Multi-Asset Fund Growth ₹648.063

↑ 2.14 ₹36,843 7.7 17.4 33.8 25.3 19.4 24.1 Edelweiss Multi Asset Allocation Fund Growth ₹54.34

↑ 0.35 ₹1,440 5 16.8 33.5 19.7 16.5 25.4 UTI Multi Asset Fund Growth ₹65.673

↑ 0.28 ₹1,394 8.7 23.4 41.4 18.1 14.3 29.1 SBI Multi Asset Allocation Fund Growth ₹51.6776

↑ 0.11 ₹4,230 5 14.4 28.6 15.9 14.3 24.4 HDFC Multi-Asset Fund Growth ₹62.296

↑ 0.19 ₹2,642 5.2 13.7 23.4 14.7 14.2 18 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 19 Apr 24

शीर्ष 5 इक्विटी बचत निधी

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Principal Equity Savings Fund Growth ₹62.8921

↑ 0.46 ₹742 4.5 9.7 21.2 13 11.9 15.3 L&T Equity Savings Fund Growth ₹29.4984

↑ 0.13 ₹230 6.7 12 23.6 12.9 10.7 17 HDFC Equity Savings Fund Growth ₹60.158

↑ 0.15 ₹3,994 3.5 10.2 18.5 12.2 10.4 13.8 Kotak Equity Savings Fund Growth ₹23.5602

↑ 0.02 ₹4,813 3.3 10.5 19.4 12.1 10.6 15.7 SBI Equity Savings Fund Growth ₹21.3283

↑ 0.00 ₹4,544 1.7 5.9 19.6 10.9 10.3 17.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 सोल्युशन ओरिएंटेड योजना

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Retirement Savings Fund - Equity Plan Growth ₹44.405

↑ 0.39 ₹4,830 4.5 18.1 38.7 25.9 21.2 32.6 HDFC Retirement Savings Fund - Hybrid - Equity Plan Growth ₹34.38

↑ 0.18 ₹1,352 3.1 13.3 28.7 17.3 15.5 24.9 ICICI Prudential Child Care Plan (Gift) Growth ₹284.86

↑ 3.54 ₹1,205 7.6 24.1 43.5 20.2 15 29.2 Tata Retirement Savings Fund - Progressive Growth ₹56.6799

↑ 0.48 ₹1,750 4.6 15.7 38.1 16 14.5 29 Tata Retirement Savings Fund-Moderate Growth ₹55.6445

↑ 0.42 ₹1,918 4.1 13.1 32 14.7 13.2 25.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

टॉप 5 गोल्ड फंड 2022 - 2023

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDBI Gold Fund Growth ₹19.892

↑ 0.20 ₹49 19.6 22.4 21.8 15.2 17.2 14.8 SBI Gold Fund Growth ₹21.7857

↓ -0.26 ₹1,604 16.3 19.3 19.8 13.9 17 14.1 HDFC Gold Fund Growth ₹22.3891

↓ -0.14 ₹1,811 17.2 19.9 19.9 13.9 16.9 14.1 Invesco India Gold Fund Growth ₹21.229

↓ -0.16 ₹68 16.7 20.1 20.2 13.9 17 14.5 Axis Gold Fund Growth ₹21.8127

↓ -0.13 ₹410 16.4 19.6 20 13.9 17.1 14.7 Aditya Birla Sun Life Gold Fund Growth ₹21.8864

↑ 0.08 ₹316 17.3 22.7 21.4 13.8 17.2 14.5 Nippon India Gold Savings Fund Growth ₹28.6352

↓ -0.23 ₹1,709 16.7 19.5 20 13.8 16.7 14.3 ICICI Prudential Regular Gold Savings Fund Growth ₹23.0982

↓ -0.16 ₹851 16.7 19.4 19.9 13.7 16.6 13.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 22 Apr 24

1 महिन्याच्या कामगिरीवर आधारित सर्वोत्तम म्युच्युअल फंड

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." DSP BlackRock World Gold Fund is a Equity - Global fund was launched on 14 Sep 07. It is a fund with High risk and has given a Below is the key information for DSP BlackRock World Gold Fund Returns up to 1 year are on The investment objective of the Scheme will be to generate returns that correspond closely to the returns generated by IDBI Gold Exchange Traded Fund (IDBI GOLD ETF). IDBI Gold Fund is a Gold - Gold fund was launched on 14 Aug 12. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Gold Fund Returns up to 1 year are on An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Aditya Birla Sun Life Gold Fund is a Gold - Gold fund was launched on 20 Mar 12. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on To seek capital appreciation by investing in units of HDFC Gold Exchange Traded Fund (HGETF). HDFC Gold Fund is a Gold - Gold fund was launched on 24 Oct 11. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Gold Fund Returns up to 1 year are on To provide returns that closely corresponds to returns provided by Invesco India Gold Exchange Traded Fund. Invesco India Gold Fund is a Gold - Gold fund was launched on 5 Dec 11. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Gold Fund Returns up to 1 year are on 1. DSP BlackRock World Gold Fund

CAGR/Annualized return of 3.9% since its launch. Ranked 11 in Global category. Return for 2023 was 7% , 2022 was -7.7% and 2021 was -9% . DSP BlackRock World Gold Fund

Growth Launch Date 14 Sep 07 NAV (19 Apr 24) ₹18.8104 ↑ 0.13 (0.68 %) Net Assets (Cr) ₹797 on 31 Mar 24 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.31 Sharpe Ratio -0.2 Information Ratio -0.31 Alpha Ratio -4.39 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹10,868 31 Mar 21 ₹14,785 31 Mar 22 ₹16,468 31 Mar 23 ₹15,505 31 Mar 24 ₹15,128 Returns for DSP BlackRock World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Apr 24 Duration Returns 1 Month 15.5% 3 Month 22.8% 6 Month 14.4% 1 Year -0.4% 3 Year -1.2% 5 Year 11.1% 10 Year 15 Year Since launch 3.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 7% 2022 -7.7% 2021 -9% 2020 31.4% 2019 35.1% 2018 -10.7% 2017 -4% 2016 52.7% 2015 -18.5% 2014 -3% Fund Manager information for DSP BlackRock World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 11.09 Yr. Data below for DSP BlackRock World Gold Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Basic Materials 90.82% Asset Allocation

Asset Class Value Cash 5.55% Equity 90.88% Debt 0.01% Other 3.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -82% ₹597 Cr 2,147,242

↑ 40,339 VanEck Gold Miners ETF

- | GDX15% ₹108 Cr 492,658 Treps / Reverse Repo Investments / Corporate Debt Repo

CBLO/Reverse Repo | -4% ₹27 Cr Net Receivables/Payables

Net Current Assets | -0% -₹2 Cr 2. IDBI Gold Fund

CAGR/Annualized return of 6.1% since its launch. Return for 2023 was 14.8% , 2022 was 12% and 2021 was -4% . IDBI Gold Fund

Growth Launch Date 14 Aug 12 NAV (22 Apr 24) ₹19.892 ↑ 0.20 (1.02 %) Net Assets (Cr) ₹49 on 31 Mar 24 Category Gold - Gold AMC IDBI Asset Management Limited Rating Risk Moderately High Expense Ratio 0.55 Sharpe Ratio 0.35 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹13,572 31 Mar 21 ₹13,572 31 Mar 22 ₹15,372 31 Mar 23 ₹17,849 31 Mar 24 ₹19,736 Returns for IDBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Apr 24 Duration Returns 1 Month 13.2% 3 Month 19.6% 6 Month 22.4% 1 Year 21.8% 3 Year 15.2% 5 Year 17.2% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.8% 2022 12% 2021 -4% 2020 24.2% 2019 21.6% 2018 5.8% 2017 1.4% 2016 8.3% 2015 -8.7% 2014 0.2% Fund Manager information for IDBI Gold Fund

Name Since Tenure Yash Dhoot 31 Jul 23 0.67 Yr. Data below for IDBI Gold Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 0.57% Other 99.43% Top Securities Holdings / Portfolio

Name Holding Value Quantity LIC MF Gold ETF

- | -100% ₹45 Cr 79,936

↓ -816 Treps

CBLO/Reverse Repo | -0% ₹0 Cr Net Receivables / (Payables)

Net Current Assets | -0% ₹0 Cr 3. Aditya Birla Sun Life Gold Fund

CAGR/Annualized return of 6.7% since its launch. Return for 2023 was 14.5% , 2022 was 12.3% and 2021 was -5% . Aditya Birla Sun Life Gold Fund

Growth Launch Date 20 Mar 12 NAV (19 Apr 24) ₹21.8864 ↑ 0.08 (0.38 %) Net Assets (Cr) ₹316 on 31 Mar 24 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.49 Sharpe Ratio 0.36 Information Ratio 0 Alpha Ratio 0 Min Investment 100 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹13,554 31 Mar 21 ₹13,472 31 Mar 22 ₹15,412 31 Mar 23 ₹17,654 31 Mar 24 ₹19,539 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Apr 24 Duration Returns 1 Month 11.9% 3 Month 17.3% 6 Month 22.7% 1 Year 21.4% 3 Year 13.8% 5 Year 17.2% 10 Year 15 Year Since launch 6.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.5% 2022 12.3% 2021 -5% 2020 26% 2019 21.3% 2018 6.8% 2017 1.6% 2016 11.5% 2015 -7.2% 2014 -9.4% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Pranav Gupta 31 Mar 23 1.01 Yr. Haresh Mehta 28 Apr 23 0.93 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 3.05% Other 96.95% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -99% ₹291 Cr 52,257,587

↑ 225,000 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -1% ₹3 Cr Net Receivables / (Payables)

Net Current Assets | -0% ₹0 Cr 4. HDFC Gold Fund

CAGR/Annualized return of 6.7% since its launch. Return for 2023 was 14.1% , 2022 was 12.7% and 2021 was -5.5% . HDFC Gold Fund

Growth Launch Date 24 Oct 11 NAV (22 Apr 24) ₹22.3891 ↓ -0.14 (-0.63 %) Net Assets (Cr) ₹1,811 on 31 Mar 24 Category Gold - Gold AMC HDFC Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.54 Sharpe Ratio 0.35 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹13,720 31 Mar 21 ₹13,691 31 Mar 22 ₹15,629 31 Mar 23 ₹18,022 31 Mar 24 ₹19,935 Returns for HDFC Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Apr 24 Duration Returns 1 Month 10.3% 3 Month 17.2% 6 Month 19.9% 1 Year 19.9% 3 Year 13.9% 5 Year 16.9% 10 Year 15 Year Since launch 6.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.1% 2022 12.7% 2021 -5.5% 2020 27.5% 2019 21.7% 2018 6.6% 2017 2.8% 2016 10.1% 2015 -7.3% 2014 -9.8% Fund Manager information for HDFC Gold Fund

Name Since Tenure Arun Agarwal 15 Feb 23 1.13 Yr. Nirman Morakhia 15 Feb 23 1.13 Yr. Data below for HDFC Gold Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 1.8% Other 98.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Gold ETF

- | -100% ₹1,682 Cr 310,440,388

↑ 321,300 Treps - Tri-Party Repo

CBLO/Reverse Repo | -0% ₹1 Cr Net Current Assets

Net Current Assets | -0% -₹1 Cr 5. Invesco India Gold Fund

CAGR/Annualized return of 6.3% since its launch. Return for 2023 was 14.5% , 2022 was 12.8% and 2021 was -5.5% . Invesco India Gold Fund

Growth Launch Date 5 Dec 11 NAV (22 Apr 24) ₹21.229 ↓ -0.16 (-0.73 %) Net Assets (Cr) ₹68 on 31 Mar 24 Category Gold - Gold AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.47 Sharpe Ratio 0.35 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-6 Months (2%),6-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹13,450 31 Mar 21 ₹13,745 31 Mar 22 ₹15,550 31 Mar 23 ₹18,151 31 Mar 24 ₹20,081 Returns for Invesco India Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Apr 24 Duration Returns 1 Month 10.3% 3 Month 16.7% 6 Month 20.1% 1 Year 20.2% 3 Year 13.9% 5 Year 17% 10 Year 15 Year Since launch 6.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 14.5% 2022 12.8% 2021 -5.5% 2020 27.2% 2019 21.4% 2018 6.6% 2017 1.3% 2016 21.6% 2015 -15.1% 2014 -9% Fund Manager information for Invesco India Gold Fund

Name Since Tenure Krishna Cheemalapati 4 Jan 20 4.24 Yr. Data below for Invesco India Gold Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 2.13% Other 97.87% Top Securities Holdings / Portfolio

Name Holding Value Quantity Invesco India Gold ETF

- | -100% ₹62 Cr 113,043 Triparty Repo

CBLO/Reverse Repo | -1% ₹0 Cr Net Receivables / (Payables)

Net Current Assets | -0% ₹0 Cr

सर्वोत्तम म्युच्युअल फंडामध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

सर्वोत्तम म्युच्युअल फंडांमध्ये गुंतवणूक करण्यासाठी स्मार्ट टिप्स: एकरकमी आणि एसआयपी गुंतवणूक

सर्वोत्कृष्ट कामगिरी करणाऱ्या म्युच्युअल फंडामध्ये गुंतवणूक करण्याचा एक उत्तम मार्ग म्हणजे त्याचे गुणात्मक आणि परिमाणात्मक दोन्ही उपाय पाहणे, जसे की:

1. योजना मालमत्तेचा आकार

गुंतवणुकदारांनी नेहमी अशा फंडासाठी जावे जे फार मोठे किंवा आकाराने लहान नाही. फंडाच्या आकारामध्ये कोणतीही परिपूर्ण व्याख्या आणि संबंध नसताना, असे म्हटले जाते की खूप लहान किंवा खूप मोठे दोन्ही, फंडाच्या कार्यक्षमतेत अडथळा आणू शकतात. कोणत्याही योजनेत कमी मालमत्ता व्यवस्थापन (एयूएम) खूप जोखमीचे असते कारण तुम्हाला माहित नसते की गुंतवणूकदार कोण आहेत आणि त्यांनी विशिष्ट योजनेत किती गुंतवणूक केली आहे. अशा प्रकारे, फंड निवडताना, ज्याची AUM अंदाजे श्रेणी सारखीच आहे अशासाठी जाण्याचा सल्ला दिला जातो.

2. निधी कामगिरी

सर्वोत्तम कामगिरी करणाऱ्या म्युच्युअल फंडामध्ये गुंतवणूक करण्यासाठी, गुंतवणूकदारांनी ठराविक कालावधीसाठी फंडाच्या कामगिरीचे योग्य मूल्यांकन केले पाहिजे. तसेच, 4-5 वर्षांमध्ये सातत्याने त्याच्या बेंचमार्कला मागे टाकणाऱ्या योजनेसाठी जाण्यास सुचवले आहे, त्याव्यतिरिक्त, फंड बेंचमार्कला मागे टाकण्यास सक्षम आहे की नाही हे तपासण्यासाठी प्रत्येक कालावधी पाहावा.

3. एकूण खर्चाचे प्रमाण

म्युच्युअल फंडात गुंतवणूक करू इच्छिणाऱ्या गुंतवणूकदारांना मालमत्ता व्यवस्थापन कंपनी (AMC). बर्याच वेळा, गुंतवणूकदार अशा फंडासाठी जातात ज्यात कमी खर्चाचे प्रमाण असते, परंतु ही अशी गोष्ट आहे जी फंडाची कामगिरी इत्यादीसारख्या इतर महत्त्वाच्या घटकांना मागे टाकू नये.

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Excellent Very helpful for seclecting top most mutual funds for Investment

Very in-depth and unbiased analysis useful for evaluation of MF performance and prospects.

very helpful

Want to know about MF