Facing Credit Card Debt? 6 Smart Tips To Get Out of It!

How to Get Out of Credit Card Debt? - An Overview

Did the overuse of credit cards at shopping stores wipe away your earnings and landed you in debt? Well, you are not the only one. Read the story of Taani, who shares the similar story -

Taani is an educated, employed woman whose favourite hobby is shopping. Being a fashion freak, Taani used to buy everything trending in the market. Sujata, her mother, was highly concerned about Taani's chronic spending habits. Seeing all this, one day, she finally confronted her and said, "Taani, you need to learn to spend your money wisely; not every new thing in the market needs to make it to your wardrobe." Taani didn't take her mother's words as advice.

She was left with regret and a piled-up Credit Card Bill that had to be paid up in a specific timeline, which was not long enough anyway. If you can relate to Taani or are nearing her situation, this post is undoubtedly for you.

Talk to our investment specialist

What is Credit Card Debt?

It can be referred to as revolving debt. It is the money you owe to the creditors for every purchase you made using the credit card. Credit card debt in India is an unsecured, short-term liability that must be paid within a standard operating cycle. If you fail to pay your dues as per the terms of the credit card agreement, the creditor may demand full repayment at a high-interest rate. Hence, to manage your credit card debt successfully, make sure to pay your monthly bills and, most importantly, take control of your expenses.

How to Calculate Credit Card Debt?

A credit card debt calculator can help you break down the lump sum and calculate how much time you may need to repay the total amount. Here's how you can make the calculations with a calculator:

- Firstly, enter your outstanding loan amount, i.e., your overdue credit card payment

- Next, enter the monthly interest rate charged by the credit card supplier

- Hereafter, write down the amount that you can pay every month

- Once done, select the 'submit' option to get a clearer picture of the respective figures

How to Clear Credit Card Debt?

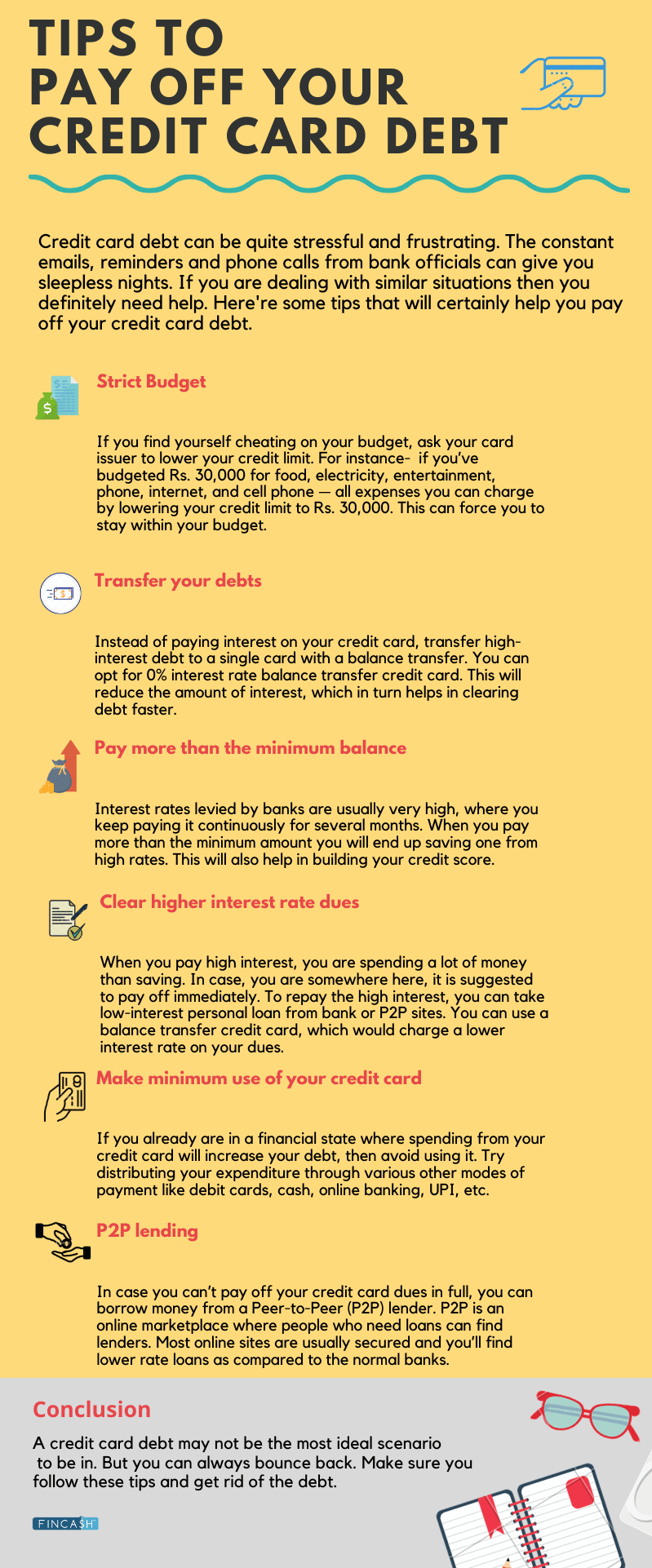

If your credit card is adding on to your monthly bills, it's time to take action before things get worse. You can start by assessing your finances and listing all your dues, calculating the Annual Percentage Rate (APR) and checking your current available balance for repayments. Here, make sure to sort your debt in order of the highest to the lowest APR and start with paying debts with the highest APR first. This is what is known as the debt avalanche method, which saves you from paying a large sum of money that comes with accumulated interest. Besides this, here are some more ways to help you go debt-free:

1. Select the Right Payment Strategy

To tackle your credit card debt, it's essential to have a solid repayment strategy. This is to ensure that everything goes following your predetermined goal. Following are some methods to help pay off your debt -

Debt Snowball

With the snowball method, you prioritize your smallest loans first. Once they've been paid, you roll that amount into your next payment to clear the next smallest loan - similar to rolling a snowball rolling down the hill. This way, you gradually knock out more significant payments until all your credit card debt loan is eliminated.

Automate Your Payment

Automating your payments is a smart and easy way to timely pay your credit bills and avoid racking extra costs in terms of late fees. It not only helps save time but also reduces stress and increases your financial security. Moreover, automating your finances allow you to live without the fear of missing payments or a poor credit score.

Try Paying More than Minimum

Your minimum payment amount is calculated based on the amount you owe, which is usually 2% or 3% of your balance. This is usually a very small amount of your debt which may seem convenient to pay. However, know that creditors charge interest on a daily basis, which means the longer you'll take to repay your debt, the higher will be the interest rate. Hence, if you want to get out of the debt, it is advised to pay more than the minimum payment amount if possible.

2. Reach Out to Your Creditors

Have a word with your creditors, explaining your entire situation and what landed you in the crisis. If you're a loyal customer with a good credit score, chances are your credit card issuer will agree to negotiate payment terms or offer you a credit card hardship program.

Now, what's a credit card hardship program?

It's a payment plan that is negotiated via your credit card issuer that can help you with affordable interest rates or waived fees. Whether you negotiate the payment terms or sign up for a hardship program, both options can provide you with a sense of relief amidst the unfavourable circumstances impacting your ability to manage finances.

Besides, you can also request your creditor for debt settlement. Under debt settlement, a creditor accepts an amount less than your total debt. Well, this may sound like the best option, but debt settlement can be risky and severely affect your credit. Hence, the best is to hire a debt settlement company that can negotiate with the creditors on your behalf and guide you with all the associated risks and benefits.

3. Take a Loan to Pay your Debts

Have you got huge credit card debt and finding it hard to pay off? No worries!

If you're someone with a good credit score of 730 or higher, you can consider taking a personal loan to settle all your debt at once. Now, if you're thinking, why take a loan when you're already in debt? This is because personal loans come at much lesser interest rates compared to credit card interest rates. Hence, they can not only help you go debt-free but also let you save a big amount of money on interest.

4. Focus on One Card Payment At-a-Time

If you're holding bills on multiple credit cards, it might take longer than usual to wipe off those debts. However, to make significant progress on debt reduction, you can either pay off the card with the lowest debt or clear payments of the card with the highest interest rate first. No matter what option you choose, the thing is to target just one card at a time to simplify the entire repayment process.

5. Pay Your Bills Regularly

This is not a debt reduction method to help you clear off your debt but rather a bit of advice for the future. Always set a budget for your credit card and limit your expenses as per that budget. This ensures that you timely pay your bills without getting stuck in a debt cycle. If you are planning a vacation, want to buy a new product or make any big investments, sort your finances accordingly.

Conclusion

Credit card debt can badly affect your credit score and report. Hence, clear it as soon as possible to avoid high-interest costs. You can opt for an automatic payment facility to never miss out on paying your credit card bills on time.

Frequently Asked Questions (FAQs)

1. How long will it take to pay off my credit card debt?

A. The total amount of time to pay off credit card debts may vary depending upon how much debt you have, the interest rate on that debt, the amount you can afford to pay monthly, and the debt payment method you choose.

2. What is credit card debt consolidation?

A. Credit card debt consolidation is where you consolidate all your credit card debt payments into one account. You'll only be making one payment every month to clear off the balance.

3. Which is the best debt repayment plan?

A. There's no right or best plan for debt repayment. For some, the debt snowball method can help give a psychological boost to their repayment plan. For others, taking a personal loan may help get a hold of their finances.

If you can't make minimum monthly payments, a debt management plan can be the best option. Here, a credit counsellor can help you negotiate lower interest rates on your debt resulting in a reduced payable amount. Rest, explore all the debt repayment options considering your circumstances and budget.

4. When should I pay my credit card bills?

A. You should always pay your credit card bills on time. If you're unable to pay it in full, try paying at least the minimum amount by the due date. This will help maintain your account and build a high credit score.

5. Is there any such thing as credit card debt forgiveness?

A. Although credit card companies rarely forgive all your credit card debt, they might settle the debt for less and forgive the remaining portion. This is what is generally termed credit card debt forgiveness.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.