+91-22-48913909

+91-22-48913909

Table of Contents

- Why Invest in Balanced Mutual Funds?

- Advantages & Disadvantages of Balanced Funds

- Best Performing Balanced Funds FY 24 - 25

- How to Invest in Balanced Mutual Funds Online?

Top 11 Funds

- ICICI Prudential Equity and Debt Fund

- HDFC Balanced Advantage Fund

- ICICI Prudential Multi-Asset Fund

- BOI AXA Mid and Small Cap Equity and Debt Fund

- JM Equity Hybrid Fund

- Edelweiss Multi Asset Allocation Fund

- UTI Hybrid Equity Fund

- Nippon India Equity Hybrid Fund

- UTI Multi Asset Fund

- BNP Paribas Substantial Equity Hybrid Fund

- Franklin India Equity Hybrid Fund

Best Balanced Mutual Funds 2024

Top Balanced Fund are Mutual Funds that invest their assets in both equities and debt instrument to yield good overall returns. Balanced Mutual Funds are beneficial for investors who are willing to take a Market risk while looking for some fixed returns as well.

The assets invested in equities and stocks offer market-linked returns while the assets invested in debt instruments offer fixed returns. Being a combination of both Equity and Debt, investors should be very careful when Investing in these funds. The investors are advised to look for top Balanced Funds before investing in Balanced Mutual Funds. We have listed top balanced mutual funds below.

Why Invest in Balanced Mutual Funds?

Generally, investors look for ways to diversify their investments within a shorter time period with less risk. Being a combination of both equity and debt instruments, balanced mutual funds offer best of both these worlds. So, these funds reduce the risk of downfall due to the constantly changing market conditions while managing some basic returns due to the debt exposure. This makes balanced funds a highly suitable investment option for investors looking for a mid-path of getting returns with slightly lower risk than investing in 100% Equity Funds.

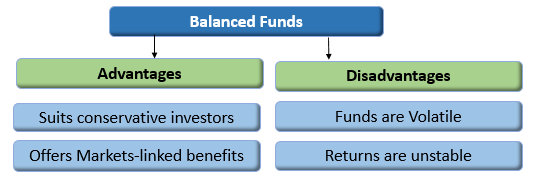

Advantages & Disadvantages of Balanced Funds

Advantages

- Provides stable returns by investing 35-40% of the assets in fixed Income options

- Offers market-linked returns as swell by investing 60-65% of the assets in equities

- Suitable for conservative investors willing to take moderate risk

Disadvantages

- The funds invested in equities are volatile and have a high-risk Factor

- The combined returns (returns of both debt and equity mutual funds) may not yield very good returns in the long run

Talk to our investment specialist

Best Performing Balanced Funds FY 24 - 25

Top Performing Aggressive Hybrid Funds

This fund will invest around 65 to 85 percent of its total assets in equity-related instruments and about 20 to 35 percent of their assets in debt instruments. Mutual Fund Houses can offer either a balanced hybrid or an aggressive hybrid fund, not both.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Equity and Debt Fund Growth ₹341.49

↑ 0.66 ₹33,502 8.2 22.4 41.1 26.6 20.4 28.2 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹34.33

↑ 0.18 ₹665 8.6 26.4 49.6 25.1 21.7 33.7 JM Equity Hybrid Fund Growth ₹111.044

↑ 0.35 ₹223 9.1 28.2 54.2 24.7 18.9 33.8 UTI Hybrid Equity Fund Growth ₹349.676

↑ 1.00 ₹5,306 5.9 17.7 32.7 19.5 15.6 25.5 Nippon India Equity Hybrid Fund Growth ₹92.2391

↑ 0.28 ₹3,435 5.7 17 31.1 18.2 10.9 24.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24

Top Performing Conservative Hybrid Funds

This scheme will majorly invested in debt instruments. About 75 to 90 percent of their total assets will be invest in debt instruments and about 10 to 25 percent in equity-related instruments. This scheme is named as conservative because it is for people who are risk-averse. Investors who don't want to take much risk in their investment can prefer investing in this scheme.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Hybrid Debt Fund Growth ₹74.5264

↑ 0.09 ₹3,103 3 9.5 16.1 11.4 10.4 13.9 Kotak Debt Hybrid Fund Growth ₹52.5696

↑ 0.05 ₹2,331 2.5 10.1 16.1 10.7 11.2 13.9 SBI Debt Hybrid Fund Growth ₹65.1478

↑ 0.09 ₹9,642 3.1 7.4 14.5 10.7 10.5 12.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24

Top Performing Arbitrage Funds

This fund will follow the arbitrage strategy and will invest at least 65 percent of its assets in equity-related instruments. Arbitrage funds are Mutual Funds that leverage the differential price between the cash market and derivative market to generate mutual fund returns. The returns generated by arbitrage funds are dependent on the Volatility of the stock market. Arbitrage mutual funds are hybrid in nature and in times of high or persistent volatility, these funds offer relatively risk-free returns to investors.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Kotak Equity Arbitrage Fund Growth ₹34.5256

↑ 0.00 ₹40,051 2.1 4 8 5.8 5.4 7.4 SBI Arbitrage Opportunities Fund Growth ₹31.1757

↓ 0.00 ₹27,586 2 3.8 7.9 5.8 5.3 7.4 Edelweiss Arbitrage Fund Growth ₹17.8843

↑ 0.00 ₹9,167 2.1 3.9 7.8 5.6 5.4 7.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24

Top Performing Dynamic Asset Allocation Funds

This scheme would dynamically manage their investments in equity and debt instruments. These funds tend to increase the allocation to debt and reduce the weightage to equities when the market becomes costly. Also, these funds focus on providing stability at a low-risk.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) HDFC Balanced Advantage Fund Growth ₹460.605

↑ 1.70 ₹79,875 5.6 21.7 39.5 26 18.3 31.3 BOI AXA Equity Debt Rebalancer Fund Growth ₹23.6692

↑ 0.07 ₹122 5.8 18.1 26 14.9 9.4 18.4 ICICI Prudential Balanced Advantage Fund Growth ₹64.76

↑ 0.12 ₹56,175 4.6 12.6 22.1 13.8 12.8 16.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24

Top Performing Equity Savings Funds

This scheme will invest in equity, arbitrage and debt. Equity savings will invest at least 65 percent of the total assets in stocks and a minimum 10 percent in debt. The scheme would state the minimum hedged and unhedged investments in the scheme information document.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) L&T Equity Savings Fund Growth ₹29.7238

↑ 0.05 ₹230 7.3 14.2 24.1 13.3 10.8 17 Principal Equity Savings Fund Growth ₹63.155

↑ 0.11 ₹742 5.3 11.3 21.5 13.1 12 15.3 HDFC Equity Savings Fund Growth ₹60.295

↑ 0.06 ₹3,994 3.6 11.2 18.4 12.3 10.4 13.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24

Top Performing Multi Asset Allocation Funds

This scheme can invest in three asset classes, which means that they can invest in an extra Asset Class apart from equity and debt. The fund should invest at least 10 percent in each of the asset classes. Foreign securities will not be treated as a separate asset class.

(Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. ICICI Prudential Equity and Debt Fund is a Hybrid - Hybrid Equity fund was launched on 3 Nov 99. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile HDFC Growth Fund and HDFC Prudence Fund) Aims to generate long term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. HDFC Balanced Advantage Fund is a Hybrid - Dynamic Allocation fund was launched on 11 Sep 00. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Balanced Advantage Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. ICICI Prudential Multi-Asset Fund is a Hybrid - Multi Asset fund was launched on 31 Oct 02. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized BOI AXA Mid and Small Cap Equity and Debt Fund is a Hybrid - Hybrid Equity fund was launched on 20 Jul 16. It is a fund with Moderately High risk and has given a Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. JM Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 1 Apr 95. It is a fund with Moderately High risk and has given a Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Edelweiss Multi Asset Allocation Fund is a Hybrid - Multi Asset fund was launched on 12 Aug 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile UTI Balanced Fund) The scheme aims to invest in a portfolio of equity/equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation. UTI Hybrid Equity Fund is a Hybrid - Hybrid Equity fund was launched on 2 Jan 95. It is a fund with Moderately High risk and has given a Below is the key information for UTI Hybrid Equity Fund Returns up to 1 year are on (Erstwhile Reliance Regular Savings Fund - Balanced Plan) The primary investment objective of this option is to generate consistent returns and appreciation of capital by investing in mix of securities comprising of Equity, Equity related instruments & fixed income instruments. Nippon India Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 8 Jun 05. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Equity Hybrid Fund Returns up to 1 year are on (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. UTI Multi Asset Fund is a Hybrid - Multi Asset fund was launched on 21 Oct 08. It is a fund with Moderately High risk and has given a Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile BNP Paribas Balanced Fund) The Scheme seeks to generate income and capital appreciation by investing in a diversified portfolio of equity and equity related instruments and fixed income instruments. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns BNP Paribas Substantial Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 7 Apr 17. It is a fund with Moderately High risk and has given a Below is the key information for BNP Paribas Substantial Equity Hybrid Fund Returns up to 1 year are on (Erstwhile Franklin India Balanced Fund) The fund aims to provide long term capital appreciation and current income by investing in equity and equity related securities and high quality fixed income instruments. Franklin India Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 10 Dec 99. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Equity Hybrid Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Multi-Asset Fund Growth ₹649.526

↑ 0.64 ₹36,843 8.9 18.6 34.3 25.3 19.5 24.1 Edelweiss Multi Asset Allocation Fund Growth ₹54.8

↑ 0.23 ₹1,440 6.3 19.2 34.1 20.2 16.6 25.4 UTI Multi Asset Fund Growth ₹65.7

↑ 0.11 ₹1,394 9.4 24.9 40.7 18.2 14.3 29.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 24 AUM >= 200 Crore & Sorted on 3 Year CAGR Return.

1. ICICI Prudential Equity and Debt Fund

CAGR/Annualized return of 15.5% since its launch. Ranked 7 in Hybrid Equity category. Return for 2023 was 28.2% , 2022 was 11.7% and 2021 was 41.7% . ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (24 Apr 24) ₹341.49 ↑ 0.66 (0.19 %) Net Assets (Cr) ₹33,502 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 3.84 Information Ratio 2.49 Alpha Ratio 12.16 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,882 31 Mar 21 ₹12,623 31 Mar 22 ₹16,807 31 Mar 23 ₹17,757 31 Mar 24 ₹25,057 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 2.6% 3 Month 8.2% 6 Month 22.4% 1 Year 41.1% 3 Year 26.6% 5 Year 20.4% 10 Year 15 Year Since launch 15.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.2% 2022 11.7% 2021 41.7% 2020 9% 2019 9.3% 2018 -1.9% 2017 24.8% 2016 13.7% 2015 2.1% 2014 45.6% Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 8.32 Yr. Manish Banthia 19 Sep 13 10.54 Yr. Mittul Kalawadia 29 Dec 20 3.26 Yr. Akhil Kakkar 22 Jan 24 0.19 Yr. Sri Sharma 30 Apr 21 2.92 Yr. Sharmila D’mello 31 Jul 22 1.67 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 7.93% Equity 73.81% Debt 18.26% Equity Sector Allocation

Sector Value Financial Services 18.86% Consumer Cyclical 12.86% Energy 8.04% Utility 7.56% Communication Services 5.65% Health Care 5.23% Industrials 4.34% Technology 4.2% Basic Materials 2.97% Consumer Defensive 2.26% Real Estate 1.72% Debt Sector Allocation

Sector Value Government 11.6% Cash Equivalent 7.53% Corporate 7.06% Credit Quality

Rating Value A 3.72% AA 26.54% AAA 67.99% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | 5325557% ₹2,362 Cr 70,386,803

↓ -6,546,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK7% ₹2,314 Cr 21,991,832 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 16 | BHARTIARTL5% ₹1,640 Cr 14,595,380 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI4% ₹1,445 Cr 1,280,135 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE4% ₹1,303 Cr 4,459,343 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK4% ₹1,279 Cr 9,116,385

↑ 1,794,215 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA4% ₹1,236 Cr 7,835,635

↓ -137,861 7.18% Govt Stock 2033

Sovereign Bonds | -4% ₹1,215 Cr 120,666,240 8.25% Govt Stock 2033

Sovereign Bonds | -3% ₹1,065 Cr 105,279,550

↑ 20,000,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Apr 17 | 5003123% ₹1,051 Cr 39,721,201

↓ -3,927,000 2. HDFC Balanced Advantage Fund

CAGR/Annualized return of 18.5% since its launch. Ranked 23 in Dynamic Allocation category. Return for 2023 was 31.3% , 2022 was 18.8% and 2021 was 26.4% . HDFC Balanced Advantage Fund

Growth Launch Date 11 Sep 00 NAV (24 Apr 24) ₹460.605 ↑ 1.70 (0.37 %) Net Assets (Cr) ₹79,875 on 31 Mar 24 Category Hybrid - Dynamic Allocation AMC HDFC Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.61 Sharpe Ratio 3.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,472 31 Mar 21 ₹11,728 31 Mar 22 ₹14,196 31 Mar 23 ₹16,080 31 Mar 24 ₹22,455 Returns for HDFC Balanced Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 3% 3 Month 5.6% 6 Month 21.7% 1 Year 39.5% 3 Year 26% 5 Year 18.3% 10 Year 15 Year Since launch 18.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 31.3% 2022 18.8% 2021 26.4% 2020 7.6% 2019 6.9% 2018 -3.1% 2017 27.9% 2016 9.4% 2015 0.3% 2014 51.8% Fund Manager information for HDFC Balanced Advantage Fund

Name Since Tenure Anil Bamboli 29 Jul 22 1.68 Yr. Gopal Agrawal 29 Jul 22 1.68 Yr. Arun Agarwal 6 Oct 22 1.49 Yr. Srinivasan Ramamurthy 29 Jul 22 1.68 Yr. Nirman Morakhia 15 Feb 23 1.13 Yr. Dhruv Muchhal 22 Jun 23 0.78 Yr. Data below for HDFC Balanced Advantage Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 15.85% Equity 58.48% Debt 25.67% Equity Sector Allocation

Sector Value Financial Services 23.42% Industrials 10.46% Energy 8.97% Utility 6.3% Technology 4.01% Consumer Cyclical 4% Health Care 3.78% Consumer Defensive 2.34% Basic Materials 1.82% Communication Services 1.69% Real Estate 1.43% Debt Sector Allocation

Sector Value Government 17.95% Cash Equivalent 15.28% Corporate 8.29% Credit Quality

Rating Value AA 1.29% AAA 97.06% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | HDFCBANK6% ₹4,463 Cr 31,804,751 Coal India Ltd (Energy)

Equity, Since 31 Jan 18 | COALINDIA4% ₹3,218 Cr 73,700,000

↓ -2,000,000 State Bank of India (Financial Services)

Equity, Since 31 May 07 | SBIN4% ₹3,024 Cr 40,426,000

↓ -666,271 7.38% Govt Stock 2027

Sovereign Bonds | -3% ₹2,750 Cr 272,581,800 NTPC Ltd (Utilities)

Equity, Since 31 Aug 16 | 5325553% ₹2,691 Cr 80,175,943

↓ -3,598,464 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK3% ₹2,690 Cr 25,564,524 Infosys Ltd (Technology)

Equity, Since 31 Oct 09 | INFY3% ₹2,003 Cr 11,967,098 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 21 | RELIANCE2% ₹1,949 Cr 6,672,683 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT2% ₹1,932 Cr 5,556,183 Power Finance Corp Ltd (Financial Services)

Equity, Since 30 Apr 17 | 5328102% ₹1,752 Cr 43,712,162 3. ICICI Prudential Multi-Asset Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 53 in Multi Asset category. Return for 2023 was 24.1% , 2022 was 16.8% and 2021 was 34.7% . ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (23 Apr 24) ₹649.526 ↑ 0.64 (0.10 %) Net Assets (Cr) ₹36,843 on 31 Mar 24 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio 3.6 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,873 31 Mar 21 ₹12,356 31 Mar 22 ₹16,198 31 Mar 23 ₹17,881 31 Mar 24 ₹23,704 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 3.3% 3 Month 8.9% 6 Month 18.6% 1 Year 34.3% 3 Year 25.3% 5 Year 19.5% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 24.1% 2022 16.8% 2021 34.7% 2020 9.9% 2019 7.7% 2018 -2.2% 2017 28.2% 2016 12.5% 2015 -1.4% 2014 37% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 12.17 Yr. Manish Banthia 22 Jan 24 0.19 Yr. Ihab Dalwai 3 Jun 17 6.83 Yr. Akhil Kakkar 22 Jan 24 0.19 Yr. Sri Sharma 30 Apr 21 2.92 Yr. Gaurav Chikane 2 Aug 21 2.66 Yr. Sharmila D’mello 31 Jul 22 1.67 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 19.11% Equity 67.25% Debt 8.8% Other 4.84% Equity Sector Allocation

Sector Value Financial Services 20.87% Consumer Cyclical 7.59% Energy 7.4% Utility 5.84% Basic Materials 5.07% Health Care 4.92% Technology 4.59% Industrials 3.74% Consumer Defensive 3.22% Communication Services 2.95% Real Estate 1.06% Debt Sector Allocation

Sector Value Cash Equivalent 18.07% Government 5.63% Corporate 4.21% Credit Quality

Rating Value A 2.72% AA 9.35% AAA 85.49% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK6% ₹1,981 Cr 18,829,681

↓ -308,700 NTPC Ltd (Utilities)

Equity, Since 31 Mar 17 | 5325555% ₹1,646 Cr 49,047,163

↓ -4,467,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK4% ₹1,552 Cr 11,057,759

↑ 3,218,650 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI4% ₹1,306 Cr 1,157,159

↓ -23,500 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹1,118 Cr 3,827,758

↑ 450,000 ICICI Pru Gold ETF

- | -3% ₹971 Cr 179,088,851

↑ 15,175,925 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | SBICARD3% ₹882 Cr 12,250,556

↑ 247,558 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY2% ₹819 Cr 4,891,022

↑ 216,800 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 16 | BHARTIARTL2% ₹794 Cr 7,066,516

↑ 506,878 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIGI2% ₹787 Cr 4,600,295

↓ -101,900 4. BOI AXA Mid and Small Cap Equity and Debt Fund

CAGR/Annualized return of 17.2% since its launch. Return for 2023 was 33.7% , 2022 was -4.8% and 2021 was 54.5% . BOI AXA Mid and Small Cap Equity and Debt Fund

Growth Launch Date 20 Jul 16 NAV (24 Apr 24) ₹34.33 ↑ 0.18 (0.53 %) Net Assets (Cr) ₹665 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.58 Sharpe Ratio 3.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,855 31 Mar 21 ₹13,318 31 Mar 22 ₹17,901 31 Mar 23 ₹17,253 31 Mar 24 ₹25,193 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.3% 3 Month 8.6% 6 Month 26.4% 1 Year 49.6% 3 Year 25.1% 5 Year 21.7% 10 Year 15 Year Since launch 17.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 33.7% 2022 -4.8% 2021 54.5% 2020 31.1% 2019 -4.7% 2018 -14.2% 2017 47.1% 2016 2015 2014 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 7.13 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 16.76% Equity 71.24% Debt 12% Equity Sector Allocation

Sector Value Basic Materials 13.98% Financial Services 13.14% Consumer Cyclical 11.06% Health Care 9.2% Industrials 6.99% Energy 5.34% Technology 3.82% Consumer Defensive 3.21% Communication Services 2.41% Utility 2.09% Debt Sector Allocation

Sector Value Government 12.45% Corporate 10.42% Cash Equivalent 5.88% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Oil India Ltd (Energy)

Equity, Since 31 Mar 23 | OIL3% ₹22 Cr 406,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL3% ₹20 Cr 305,000

↓ -55,000 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348162% ₹16 Cr 625,000 Power Grid Corporation Of India Limited

Debentures | -2% ₹15 Cr 150,000,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA2% ₹15 Cr 220,000

↓ -40,000 JK Cement Ltd (Basic Materials)

Equity, Since 31 Aug 22 | JKCEMENT2% ₹14 Cr 31,900 CRISIL Ltd (Financial Services)

Equity, Since 29 Feb 24 | CRISIL2% ₹14 Cr 27,000

↑ 27,000 7.26% Govt Stock 2033

Sovereign Bonds | -2% ₹13 Cr 1,300,000 Astral Ltd (Industrials)

Equity, Since 30 Jun 17 | ASTRAL2% ₹13 Cr 63,000

↓ -9,000 Kotak Mahindra Bank Ltd.

Debentures | -2% ₹13 Cr 1,350,000 5. JM Equity Hybrid Fund

CAGR/Annualized return of 12.8% since its launch. Ranked 35 in Hybrid Equity category. Return for 2023 was 33.8% , 2022 was 8.1% and 2021 was 22.9% . JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (24 Apr 24) ₹111.044 ↑ 0.35 (0.32 %) Net Assets (Cr) ₹223 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.46 Sharpe Ratio 3.58 Information Ratio 1.33 Alpha Ratio 20.88 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹6,954 31 Mar 21 ₹12,368 31 Mar 22 ₹14,221 31 Mar 23 ₹15,051 31 Mar 24 ₹22,422 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 5.6% 3 Month 9.1% 6 Month 28.2% 1 Year 54.2% 3 Year 24.7% 5 Year 18.9% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 33.8% 2022 8.1% 2021 22.9% 2020 30.5% 2019 -8.1% 2018 1.7% 2017 18.5% 2016 3% 2015 -0.2% 2014 33.4% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Asit Bhandarkar 31 Dec 21 2.25 Yr. Gurvinder Wasan 1 Dec 22 1.33 Yr. Chaitanya Choksi 20 Aug 21 2.61 Yr. Data below for JM Equity Hybrid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 6.67% Equity 75.15% Debt 18.18% Equity Sector Allocation

Sector Value Consumer Cyclical 15.84% Financial Services 14.04% Industrials 12.77% Technology 10.67% Health Care 7.66% Real Estate 4.05% Basic Materials 3.64% Utility 1.98% Energy 1.76% Consumer Defensive 1.46% Communication Services 1.28% Debt Sector Allocation

Sector Value Corporate 10.51% Government 7.68% Cash Equivalent 6.67% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Govt Stock 2037

Sovereign Bonds | -4% ₹9 Cr 900,000 Infosys Ltd (Technology)

Equity, Since 30 Nov 20 | INFY4% ₹7 Cr 44,050

↑ 12,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIBANK3% ₹7 Cr 64,100

↑ 20,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | M&M3% ₹6 Cr 33,000

↑ 33,000 Sobha Ltd (Real Estate)

Equity, Since 30 Sep 23 | SOBHA3% ₹6 Cr 38,239 REC Ltd (Financial Services)

Equity, Since 30 Nov 22 | 5329553% ₹6 Cr 134,000

↑ 40,000 GE T&D India Ltd (Industrials)

Equity, Since 30 Nov 23 | 5222753% ₹6 Cr 64,050

↑ 6,500 Tata Motors Ltd Class A (Consumer Cyclical)

Equity, Since 31 Jul 23 | TATAMTRDVR3% ₹6 Cr 91,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS3% ₹5 Cr 13,000

↑ 13,000 Voltas Ltd (Industrials)

Equity, Since 31 Oct 23 | VOLTAS2% ₹5 Cr 45,000 6. Edelweiss Multi Asset Allocation Fund

CAGR/Annualized return of since its launch. Ranked 71 in Multi Asset category. Return for 2023 was 25.4% , 2022 was 5.3% and 2021 was 27.1% . Edelweiss Multi Asset Allocation Fund

Growth Launch Date 12 Aug 09 NAV (24 Apr 24) ₹54.8 ↑ 0.23 (0.42 %) Net Assets (Cr) ₹1,440 on 31 Mar 24 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.5 Sharpe Ratio 3.14 Information Ratio 1.86 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹8,441 31 Mar 21 ₹12,687 31 Mar 22 ₹15,192 31 Mar 23 ₹15,920 31 Mar 24 ₹21,401 Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 2.7% 3 Month 6.3% 6 Month 19.2% 1 Year 34.1% 3 Year 20.2% 5 Year 16.6% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2023 25.4% 2022 5.3% 2021 27.1% 2020 12.7% 2019 10.4% 2018 -0.1% 2017 26.1% 2016 0.2% 2015 2.2% 2014 38.4% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Dhawal Dalal 23 Nov 21 2.35 Yr. Bhavesh Jain 14 Oct 15 8.47 Yr. Bharat Lahoti 1 Oct 21 2.5 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 4.71% Equity 75.43% Debt 19.86% Other 0% Equity Sector Allocation

Sector Value Financial Services 21.31% Consumer Cyclical 9.55% Health Care 7.5% Energy 6.64% Technology 6.62% Industrials 5.55% Consumer Defensive 4.68% Utility 3.81% Basic Materials 3.38% Communication Services 2.21% Real Estate 1.49% Debt Sector Allocation

Sector Value Government 16.58% Cash Equivalent 4.61% Corporate 3.36% Securitized 0.02% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.06% Govt Stock 2028

Sovereign Bonds | -11% ₹150 Cr 15,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK5% ₹66 Cr 628,995

↑ 149,709 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 20 | RELIANCE4% ₹49 Cr 166,486

↑ 43,736 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK3% ₹39 Cr 280,000

↑ 29,255 7.18% Govt Stock 2033

Sovereign Bonds | -3% ₹39 Cr 3,850,000

↑ 3,850,000 7.1% Govt Stock 2029

Sovereign Bonds | -3% ₹35 Cr 3,500,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 16 | LT3% ₹34 Cr 98,194 ITC Ltd (Consumer Defensive)

Equity, Since 30 Sep 16 | ITC3% ₹34 Cr 839,944 State Bank of India (Financial Services)

Equity, Since 30 Jun 15 | SBIN2% ₹33 Cr 439,145

↑ 95,703 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | 5325552% ₹32 Cr 960,772

↑ 110,158 7. UTI Hybrid Equity Fund

CAGR/Annualized return of 15.2% since its launch. Ranked 12 in Hybrid Equity category. Return for 2023 was 25.5% , 2022 was 5.6% and 2021 was 30.5% . UTI Hybrid Equity Fund

Growth Launch Date 2 Jan 95 NAV (24 Apr 24) ₹349.676 ↑ 1.00 (0.29 %) Net Assets (Cr) ₹5,306 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.95 Sharpe Ratio 2.99 Information Ratio 1.4 Alpha Ratio 4.68 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,508 31 Mar 21 ₹12,119 31 Mar 22 ₹14,529 31 Mar 23 ₹15,145 31 Mar 24 ₹20,211 Returns for UTI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 3.1% 3 Month 5.9% 6 Month 17.7% 1 Year 32.7% 3 Year 19.5% 5 Year 15.6% 10 Year 15 Year Since launch 15.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.5% 2022 5.6% 2021 30.5% 2020 13.2% 2019 2.5% 2018 -5.6% 2017 25.7% 2016 8.8% 2015 2.4% 2014 32.8% Fund Manager information for UTI Hybrid Equity Fund

Name Since Tenure V Srivatsa 24 Sep 09 14.53 Yr. Sunil Patil 5 Feb 18 6.16 Yr. Data below for UTI Hybrid Equity Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 3.58% Equity 70.29% Debt 26.14% Equity Sector Allocation

Sector Value Financial Services 23.13% Consumer Cyclical 10.48% Technology 7.08% Industrials 6.19% Health Care 6.16% Energy 5.07% Basic Materials 3.74% Consumer Defensive 3.28% Communication Services 2.18% Utility 1.98% Real Estate 1% Debt Sector Allocation

Sector Value Government 17.82% Corporate 8.32% Cash Equivalent 3.58% Credit Quality

Rating Value AA 10.02% AAA 89.98% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK7% ₹350 Cr 2,495,825

↑ 105,971 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 10 | ICICIBANK6% ₹302 Cr 2,867,404

↑ 85,278 7.18% Govt Stock 2037

Sovereign Bonds | -5% ₹276 Cr 2,750,000,000

↑ 250,000,000 7.26% Govt Stock 2033

Sovereign Bonds | -5% ₹253 Cr 2,500,000,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 19 | RELIANCE4% ₹225 Cr 770,258

↓ -131,541 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹211 Cr 1,260,664

↓ -127,428 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 12 | LT3% ₹165 Cr 473,882

↓ -32,267 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Mar 21 | M&M3% ₹145 Cr 748,614 ITC Ltd (Consumer Defensive)

Equity, Since 31 Aug 06 | ITC3% ₹132 Cr 3,254,420 7.41% Govt Stock 2036

Sovereign Bonds | -2% ₹128 Cr 1,250,000,000 8. Nippon India Equity Hybrid Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 8 in Hybrid Equity category. Return for 2023 was 24.1% , 2022 was 6.6% and 2021 was 27.8% . Nippon India Equity Hybrid Fund

Growth Launch Date 8 Jun 05 NAV (24 Apr 24) ₹92.2391 ↑ 0.28 (0.31 %) Net Assets (Cr) ₹3,435 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.06 Sharpe Ratio 2.94 Information Ratio 1.22 Alpha Ratio 3.86 Min Investment 500 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹6,418 31 Mar 21 ₹10,243 31 Mar 22 ₹12,041 31 Mar 23 ₹12,577 31 Mar 24 ₹16,526 Returns for Nippon India Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 2.4% 3 Month 5.7% 6 Month 17% 1 Year 31.1% 3 Year 18.2% 5 Year 10.9% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 24.1% 2022 6.6% 2021 27.8% 2020 -5.3% 2019 3% 2018 -4.9% 2017 29.5% 2016 4.2% 2015 8.7% 2014 43.2% Fund Manager information for Nippon India Equity Hybrid Fund

Name Since Tenure Meenakshi Dawar 10 Sep 21 2.56 Yr. Kinjal Desai 25 May 18 5.85 Yr. Sushil Budhia 1 Feb 20 4.16 Yr. Akshay Sharma 1 Dec 22 1.33 Yr. Data below for Nippon India Equity Hybrid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 2.45% Equity 73.4% Debt 23.7% Other 0.44% Equity Sector Allocation

Sector Value Financial Services 22.4% Industrials 8.98% Consumer Cyclical 8.13% Health Care 7.6% Technology 6.63% Energy 5.63% Utility 3.83% Consumer Defensive 3.8% Basic Materials 2.88% Communication Services 2.57% Real Estate 0.95% Debt Sector Allocation

Sector Value Corporate 18.18% Government 5.52% Cash Equivalent 2.45% Credit Quality

Rating Value A 2.49% AA 41.39% AAA 56.12% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 10 | HDFCBANK5% ₹166 Cr 1,182,356 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 12 | ICICIBANK5% ₹165 Cr 1,570,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 14 | RELIANCE4% ₹147 Cr 503,000

↓ -45,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 13 | LT4% ₹123 Cr 354,838

↓ -56,000 Infosys Ltd (Technology)

Equity, Since 28 Feb 11 | INFY4% ₹122 Cr 730,000

↓ -150,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 11 | SUNPHARMA3% ₹110 Cr 700,000

↓ -50,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | 5322153% ₹100 Cr 933,200 NTPC Ltd (Utilities)

Equity, Since 31 Aug 20 | 5325553% ₹99 Cr 2,950,620 State Bank of India (Financial Services)

Equity, Since 31 Jul 16 | SBIN2% ₹82 Cr 1,100,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 19 | BHARTIARTL2% ₹77 Cr 685,000 9. UTI Multi Asset Fund

CAGR/Annualized return of 12.9% since its launch. Ranked 34 in Multi Asset category. Return for 2023 was 29.1% , 2022 was 4.4% and 2021 was 11.8% . UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (24 Apr 24) ₹65.7 ↑ 0.11 (0.17 %) Net Assets (Cr) ₹1,394 on 31 Mar 24 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.61 Sharpe Ratio 3.9 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹8,630 31 Mar 21 ₹11,823 31 Mar 22 ₹13,004 31 Mar 23 ₹13,630 31 Mar 24 ₹19,045 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 3.4% 3 Month 9.4% 6 Month 24.9% 1 Year 40.7% 3 Year 18.2% 5 Year 14.3% 10 Year 15 Year Since launch 12.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 29.1% 2022 4.4% 2021 11.8% 2020 13.1% 2019 3.9% 2018 -0.5% 2017 17.1% 2016 7.3% 2015 -3.7% 2014 22.7% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sunil Patil 1 Sep 21 2.58 Yr. Sharwan Kumar Goyal 12 Nov 21 2.38 Yr. Data below for UTI Multi Asset Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 11.61% Equity 56.39% Debt 10.67% Other 21.33% Equity Sector Allocation

Sector Value Financial Services 14.43% Consumer Cyclical 14.09% Industrials 10.54% Consumer Defensive 6.53% Health Care 6.24% Energy 4.28% Technology 3.99% Utility 3.09% Real Estate 1.75% Basic Materials 1.23% Debt Sector Allocation

Sector Value Cash Equivalent 11.61% Government 9.89% Corporate 0.78% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -21% ₹275 Cr 51,807,715

↑ 10,012,999 7.41% Govt Stock 2036

Sovereign Bonds | -4% ₹51 Cr 500,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 23 | LT4% ₹47 Cr 135,740

↑ 5,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 23 | 5322153% ₹36 Cr 332,408

↑ 4,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC3% ₹33 Cr 824,415

↑ 10,000 ICICI Bank Ltd (Financial Services)

Equity, Since 29 Feb 24 | ICICIBANK2% ₹31 Cr 299,132

↑ 299,132 7.18% Govt Stock 2037

Sovereign Bonds | -2% ₹30 Cr 300,000,000

↓ -200,000,000 NTPC Ltd (Utilities)

Equity, Since 31 Oct 22 | 5325552% ₹28 Cr 841,623

↓ -452,074 Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Jul 23 | TATAMOTORS2% ₹26 Cr 271,486

↓ -146,841 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5002512% ₹25 Cr 63,408 10. BNP Paribas Substantial Equity Hybrid Fund

CAGR/Annualized return of 14% since its launch. Return for 2023 was 21% , 2022 was 4.3% and 2021 was 22.2% . BNP Paribas Substantial Equity Hybrid Fund

Growth Launch Date 7 Apr 17 NAV (24 Apr 24) ₹25.1329 ↑ 0.03 (0.12 %) Net Assets (Cr) ₹997 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating Risk Moderately High Expense Ratio 2.29 Sharpe Ratio 3.54 Information Ratio 0.72 Alpha Ratio 7.68 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹9,342 31 Mar 21 ₹13,443 31 Mar 22 ₹15,734 31 Mar 23 ₹15,880 31 Mar 24 ₹21,206 Returns for BNP Paribas Substantial Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 2.6% 3 Month 8.4% 6 Month 20.2% 1 Year 33.8% 3 Year 17.2% 5 Year 16.6% 10 Year 15 Year Since launch 14% Historical performance (Yearly) on absolute basis

Year Returns 2023 21% 2022 4.3% 2021 22.2% 2020 14.9% 2019 16.3% 2018 0.4% 2017 2016 2015 2014 Fund Manager information for BNP Paribas Substantial Equity Hybrid Fund

Name Since Tenure Jitendra Sriram 16 Jun 22 1.79 Yr. Mayank Prakash 7 Apr 17 6.99 Yr. Pratish Krishnan 14 Mar 22 2.05 Yr. Miten Vora 1 Dec 22 1.33 Yr. Data below for BNP Paribas Substantial Equity Hybrid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 0.6% Equity 77.13% Debt 22.28% Equity Sector Allocation

Sector Value Financial Services 19.22% Consumer Cyclical 13.69% Industrials 11.65% Technology 9.71% Energy 9.15% Consumer Defensive 3.55% Basic Materials 2.56% Health Care 2.08% Communication Services 1.46% Utility 1.14% Debt Sector Allocation

Sector Value Corporate 11.71% Government 10.05% Cash Equivalent 0.6% Securitized 0.52% Credit Quality

Rating Value AA 24.26% AAA 73.66% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 31 May 21 | RELIANCE6% ₹60 Cr 207,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 17 | HDFCBANK6% ₹54 Cr 387,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 17 | ICICIBANK5% ₹53 Cr 504,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 21 | LT5% ₹50 Cr 144,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Mar 20 | TCS4% ₹37 Cr 90,000

↓ -6,639 ITC Ltd (Consumer Defensive)

Equity, Since 30 Sep 21 | ITC3% ₹29 Cr 702,000 Stock Futures Total

Derivatives, Since 29 Feb 24 | -3% ₹28 Cr Tata Motors Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TATAMOTORS3% ₹26 Cr 270,000

↓ -45,000 Infosys Ltd (Technology)

Equity, Since 30 Apr 17 | INFY2% ₹24 Cr 144,000 Bosch Ltd (Consumer Cyclical)

Equity, Since 31 Jul 22 | 5005302% ₹21 Cr 7,200 11. Franklin India Equity Hybrid Fund

CAGR/Annualized return of 13.9% since its launch. Ranked 16 in Hybrid Equity category. Return for 2023 was 22.5% , 2022 was 4.7% and 2021 was 23.8% . Franklin India Equity Hybrid Fund

Growth Launch Date 10 Dec 99 NAV (24 Apr 24) ₹239.209 ↑ 0.75 (0.32 %) Net Assets (Cr) ₹1,714 on 31 Mar 24 Category Hybrid - Hybrid Equity AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.22 Sharpe Ratio 2.72 Information Ratio 0.56 Alpha Ratio 3.45 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹8,083 31 Mar 21 ₹12,586 31 Mar 22 ₹14,279 31 Mar 23 ₹14,841 31 Mar 24 ₹19,464 Returns for Franklin India Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 2.5% 3 Month 5.9% 6 Month 18% 1 Year 32.5% 3 Year 16.8% 5 Year 14.8% 10 Year 15 Year Since launch 13.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 22.5% 2022 4.7% 2021 23.8% 2020 13.7% 2019 7.9% 2018 -1.6% 2017 21% 2016 7.6% 2015 4.8% 2014 47% Fund Manager information for Franklin India Equity Hybrid Fund

Name Since Tenure Anuj Tagra 7 Mar 24 0.07 Yr. Chandni Gupta 7 Mar 24 0.07 Yr. Varun Sharma 1 Sep 23 0.58 Yr. Sandeep Manam 18 Oct 21 2.45 Yr. Rajasa Kakulavarapu 6 Sep 21 2.57 Yr. Data below for Franklin India Equity Hybrid Fund as on 31 Mar 24

Asset Allocation

Asset Class Value Cash 11.64% Equity 69.48% Debt 18.87% Equity Sector Allocation

Sector Value Financial Services 18.44% Industrials 11.44% Consumer Cyclical 10.67% Technology 7.09% Health Care 4.98% Utility 4.31% Energy 3.49% Basic Materials 3.18% Consumer Defensive 3.13% Communication Services 2.74% Debt Sector Allocation

Sector Value Government 15.66% Corporate 7.61% Cash Equivalent 7.25% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK5% ₹88 Cr 839,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK4% ₹71 Cr 506,400 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT4% ₹67 Cr 191,263 5.63% Govt Stock 2026

Sovereign Bonds | -4% ₹65 Cr 6,500,000 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY4% ₹60 Cr 356,567 5.74% Govt Stock 2026

Sovereign Bonds | -3% ₹49 Cr 5,000,000 Tata Motors Ltd (Consumer Cyclical)

Equity, Since 30 Sep 14 | TATAMOTORS3% ₹47 Cr 492,000 HCL Technologies Ltd (Technology)

Equity, Since 30 Nov 21 | HCLTECH3% ₹45 Cr 269,300 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | 5322153% ₹43 Cr 403,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Sep 22 | SUNPHARMA2% ₹42 Cr 265,500

How to Invest in Balanced Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.