+91-22-48913909

+91-22-48913909

Table of Contents

- Why Invest in Top 11 SIP Funds?

- How to Invest in SIP?

- Top 11 SIP Mutual Funds in India FY 24 - 25

- Parameters to Consider While Investing in Best Systematic Investment Plans

- How to Invest in SIP MF Online?

- FAQs

Top 11 Funds

- Invesco India Infrastructure Fund

- Invesco India PSU Equity Fund

- ICICI Prudential Infrastructure Fund

- Nippon India Power and Infra Fund

- Motilal Oswal Midcap 30 Fund

- BOI AXA Manufacturing and Infrastructure Fund

- Kotak Small Cap Fund

- DSP BlackRock India T.I.G.E.R Fund

- ICICI Prudential Smallcap Fund

- TATA Infrastructure Fund

- SBI Infrastructure Fund

11 Best Mutual Funds for SIP 2024

SIP Mutual Funds (or top 11 SIP Mutual Funds) are funds that adhere to the simple formula of periodic investment to avoid nervous selling during the inevitable ups and downs of the stock market.

Typically, SIP or Systematic Investment plan is a mode to invest money in Mutual Funds. Investing in top 11 SIP Mutual Funds brings a systematic and disciplined approach to your investment. It reduces your effort to manage your investment on daily Basis. Moreover, it offers leverage of the Power of Compounding leading to desired returns over time.

There are different Types of Mutual Funds for SIP that include equity, debt, balanced, ultra-short term funds, etc. However, equity Mutual Funds offer maximum returns when invested via a SIP. Financial advisors suggest that, the investors must invest in best mutual funds for SIP basis their investment objectives and the period of SIP investment.

Why Invest in Top 11 SIP Funds?

SIPs give a disciplined approach towards investing in Mutual Funds

Systematic investing helps in financing the future dream and major goals like- retirement, child's career, purchase of a house, car or any other assets

SIPs help in making the most of compounding and are ideal for young investors

Systematic Investment Plans minimize the risk of equity fluctuations

How to Invest in SIP?

Investing money is an art, it can work wonders if done correctly. Now that you know the Top SIP plans you must know how to invest in it. We have mentioned the steps to invest in SIP below.

1. Analyse your financial goals

Choose a SIP investment suiting your Financial goals. For example, if your goal is short-term (if want to buy a car in the next 2 years), you should invest in Debt Mutual Funds. And, if your goal is long-term (like Retirement planning) then prefer investing in Equity Mutual Funds.

2. Choose a timeline of investment

This will ensure that you invest a right amount of money for a right period of time.

3. Decide the amount you wish to invest monthly

As SIP is a monthly investment, you should choose an amount that you will be able to invest monthly without Fail. You can also calculate the suitable amount as per your goal using sip calculator or SIP return calculator.

4. Select the best SIP plan

Make a wise investment choice by consulting a financial advisor or by choosing Best SIP Plans offered by various online investment platforms.

Talk to our investment specialist

Top 11 SIP Mutual Funds in India FY 24 - 25

The Scheme seeks to provide long term capital appreciation by investing in a portfolio that is predominantly constituted of equity and equity related instruments of infrastructure companies. However, there can be no assurance that the investment objective of the Scheme will be achieved. Invesco India Infrastructure Fund is a Equity - Sectoral fund was launched on 21 Nov 07. It is a fund with High risk and has given a Below is the key information for Invesco India Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India PSU Equity Fund is a Equity - Sectoral fund was launched on 18 Nov 09. It is a fund with High risk and has given a Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns BOI AXA Manufacturing and Infrastructure Fund is a Equity - Sectoral fund was launched on 5 Mar 10. It is a fund with High risk and has given a Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on (Erstwhile Kotak Midcap Scheme) The investment objective of the Scheme is to generate capital appreciation from a diversified portfolio of equity and equity related securities. Kotak Small Cap Fund is a Equity - Small Cap fund was launched on 24 Feb 05. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Small Cap Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Indo Asia Equity Fund) ICICI Prudential Indo Asia Equity Fund is an OE equity scheme that seeks to generate long term capital appreciation by investing in equity, equity related securities and or share classes/units of equity funds of companies, which are incorporated or have their area of primary activity, in the Asia Pacific region. Initially the Scheme will invest in share classes of International Opportunities Fund Asian Equity Fund and thereafter the Fund Manager of the Indo Asia Equity Fund may choose to make investment in listed equity shares, securities in the Asia Pacific region. However, there can be no assurance that the investment objective of the Scheme will be realized. ICICI Prudential Smallcap Fund is a Equity - Small Cap fund was launched on 18 Oct 07. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Smallcap Fund Returns up to 1 year are on To provide income distribution and / or medium to long term capital gains by investing predominantly in equity / equity related instruments of the companies in the infrastructure sector. TATA Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Dec 04. It is a fund with High risk and has given a Below is the key information for TATA Infrastructure Fund Returns up to 1 year are on To provide investors with opportunities for long-term growth in capital through an active management of investments in a diversified basket of equity stocks of companies directly or indirectly involved in the infrastructure growth in the Indian economy and in debt & money market instruments. SBI Infrastructure Fund is a Equity - Sectoral fund was launched on 6 Jul 07. It is a fund with High risk and has given a Below is the key information for SBI Infrastructure Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Invesco India Infrastructure Fund Growth ₹57.1

↑ 0.67 ₹961 500 13.2 41.8 74.5 36.3 27.6 51.1 Invesco India PSU Equity Fund Growth ₹57.93

↑ 0.75 ₹859 500 17.2 52.7 86.5 39.8 27.5 54.5 ICICI Prudential Infrastructure Fund Growth ₹171.84

↑ 1.20 ₹5,186 100 14.6 39.8 66.4 42.7 27.4 44.6 Nippon India Power and Infra Fund Growth ₹322.65

↑ 2.14 ₹4,529 100 13.8 42.2 80.9 40 26.8 58 Motilal Oswal Midcap 30 Fund Growth ₹81.999

↓ -0.27 ₹8,987 500 10.9 33.7 62.7 37.7 26.6 41.7 BOI AXA Manufacturing and Infrastructure Fund Growth ₹50.69

↑ 0.56 ₹256 1,000 12.4 35.5 65.3 32.6 26.6 44.7 Kotak Small Cap Fund Growth ₹230.323

↑ 1.35 ₹13,882 1,000 4.5 18.9 41.8 24.7 26.5 34.8 DSP BlackRock India T.I.G.E.R Fund Growth ₹286.687

↑ 3.09 ₹3,364 500 15.9 40.4 74.8 38.6 26 49 ICICI Prudential Smallcap Fund Growth ₹78.47

↑ 0.51 ₹7,173 100 4 18.6 45.6 29.9 25.9 37.9 TATA Infrastructure Fund Growth ₹174.205

↑ 1.19 ₹1,885 150 16.8 40.2 71.7 36 25.8 45.1 SBI Infrastructure Fund Growth ₹47.4949

↑ 0.25 ₹2,432 500 12.6 36.8 69.9 36.6 25.6 49.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Apr 24 200 Crore in Equity Category of mutual funds ordered based on 5 year calendar year returns.

1. Invesco India Infrastructure Fund

CAGR/Annualized return of 11.2% since its launch. Ranked 24 in Sectoral category. Return for 2023 was 51.1% , 2022 was 2.3% and 2021 was 55.4% . Invesco India Infrastructure Fund

Growth Launch Date 21 Nov 07 NAV (24 Apr 24) ₹57.1 ↑ 0.67 (1.19 %) Net Assets (Cr) ₹961 on 31 Mar 24 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.49 Sharpe Ratio 3.65 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,905 31 Mar 21 ₹13,511 31 Mar 22 ₹17,789 31 Mar 23 ₹18,787 31 Mar 24 ₹31,730 Returns for Invesco India Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 7.1% 3 Month 13.2% 6 Month 41.8% 1 Year 74.5% 3 Year 36.3% 5 Year 27.6% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 51.1% 2022 2.3% 2021 55.4% 2020 16.2% 2019 6.1% 2018 -15.8% 2017 48.1% 2016 0.8% 2015 -2.6% 2014 83.6% Fund Manager information for Invesco India Infrastructure Fund

Name Since Tenure Amit Nigam 3 Sep 20 3.58 Yr. Data below for Invesco India Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 46.67% Utility 24.3% Basic Materials 9.52% Health Care 4.04% Energy 3.63% Consumer Cyclical 3.1% Financial Services 2.58% Technology 1.65% Communication Services 1.26% Real Estate 1.14% Asset Allocation

Asset Class Value Cash 2.12% Equity 97.88% Top Securities Holdings / Portfolio

Name Holding Value Quantity Power Grid Corp Of India Ltd (Utilities)

Equity, Since 30 Apr 22 | 5328987% ₹63 Cr 2,234,017 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT7% ₹59 Cr 169,760 Gujarat State Petronet Ltd (Utilities)

Equity, Since 30 Nov 22 | 5327024% ₹39 Cr 1,061,584 Tata Power Co Ltd (Utilities)

Equity, Since 31 Jan 21 | 5004004% ₹38 Cr 1,019,084 GAIL (India) Ltd (Utilities)

Equity, Since 31 Jan 23 | 5321554% ₹35 Cr 1,946,687 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Nov 17 | BEL4% ₹33 Cr 1,623,224 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Jan 23 | 5005474% ₹33 Cr 543,643

↑ 35,819 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Mar 17 | CONCOR3% ₹31 Cr 312,742

↑ 48,027 Thermax Ltd (Industrials)

Equity, Since 30 Jun 21 | THERMAX3% ₹28 Cr 76,244

↑ 507 NHPC Ltd (Utilities)

Equity, Since 30 Jun 23 | NHPC3% ₹27 Cr 3,039,056 2. Invesco India PSU Equity Fund

CAGR/Annualized return of 12.9% since its launch. Ranked 33 in Sectoral category. Return for 2023 was 54.5% , 2022 was 20.5% and 2021 was 31.1% . Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (24 Apr 24) ₹57.93 ↑ 0.75 (1.31 %) Net Assets (Cr) ₹859 on 31 Mar 24 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.46 Sharpe Ratio 3.07 Information Ratio -1.18 Alpha Ratio -0.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹8,584 31 Mar 21 ₹12,144 31 Mar 22 ₹14,910 31 Mar 23 ₹16,919 31 Mar 24 ₹31,021 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 7.5% 3 Month 17.2% 6 Month 52.7% 1 Year 86.5% 3 Year 39.8% 5 Year 27.5% 10 Year 15 Year Since launch 12.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 54.5% 2022 20.5% 2021 31.1% 2020 6.1% 2019 10.1% 2018 -16.9% 2017 24.3% 2016 17.9% 2015 2.5% 2014 54.5% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Dhimant Kothari 19 May 20 3.87 Yr. Data below for Invesco India PSU Equity Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Utility 27.18% Industrials 25.7% Financial Services 25.62% Energy 19.79% Asset Allocation

Asset Class Value Cash 1.71% Equity 98.29% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹78 Cr 3,801,222

↑ 62,232 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325559% ₹76 Cr 2,254,157

↑ 16,754 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹73 Cr 975,626

↓ -5,256 Coal India Ltd (Energy)

Equity, Since 31 Aug 23 | COALINDIA8% ₹67 Cr 1,526,429

↓ -106,386 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 22 | 5328987% ₹60 Cr 2,126,667

↑ 477,183 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005476% ₹50 Cr 833,087 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹49 Cr 157,644 NHPC Ltd (Utilities)

Equity, Since 31 Oct 22 | NHPC6% ₹48 Cr 5,435,618

↑ 144,875 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | 5321345% ₹38 Cr 1,431,527 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Mar 17 | CONCOR4% ₹38 Cr 386,333 3. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 16.5% since its launch. Ranked 27 in Sectoral category. Return for 2023 was 44.6% , 2022 was 28.8% and 2021 was 50.1% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (24 Apr 24) ₹171.84 ↑ 1.20 (0.70 %) Net Assets (Cr) ₹5,186 on 31 Mar 24 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 3.64 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹6,301 31 Mar 21 ₹11,765 31 Mar 22 ₹15,945 31 Mar 23 ₹19,470 31 Mar 24 ₹31,799 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.1% 3 Month 14.6% 6 Month 39.8% 1 Year 66.4% 3 Year 42.7% 5 Year 27.4% 10 Year 15 Year Since launch 16.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% 2014 56.2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 6.83 Yr. Sharmila D’mello 30 Jun 22 1.76 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 29.05% Financial Services 17.86% Basic Materials 16.1% Utility 14.25% Energy 8.84% Communication Services 2.24% Real Estate 2.05% Consumer Cyclical 1.86% Asset Allocation

Asset Class Value Cash 6.85% Equity 92.26% Debt 0.89% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325557% ₹359 Cr 10,712,000

↓ -600,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT5% ₹264 Cr 760,393

↑ 39,900 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK5% ₹241 Cr 2,290,000

↑ 100,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK5% ₹239 Cr 1,699,500

↑ 760,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL4% ₹178 Cr 1,844,988

↓ -18,016 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹170 Cr 6,900,000

↓ -758,244 Grasim Industries Ltd (Basic Materials)

Equity, Since 31 Aug 23 | GRASIM3% ₹162 Cr 739,601 Gujarat Gas Ltd (Utilities)

Equity, Since 31 Jan 23 | GUJGASLTD3% ₹161 Cr 2,844,446 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004802% ₹114 Cr 415,782 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 17 | 5003122% ₹113 Cr 4,257,800

↓ -577,500 4. Nippon India Power and Infra Fund

CAGR/Annualized return of 19% since its launch. Ranked 13 in Sectoral category. Return for 2023 was 58% , 2022 was 10.9% and 2021 was 48.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (24 Apr 24) ₹322.65 ↑ 2.14 (0.67 %) Net Assets (Cr) ₹4,529 on 31 Mar 24 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.23 Sharpe Ratio 3.98 Information Ratio 1.48 Alpha Ratio 11.98 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹6,580 31 Mar 21 ₹12,215 31 Mar 22 ₹15,256 31 Mar 23 ₹17,694 31 Mar 24 ₹31,288 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.6% 3 Month 13.8% 6 Month 42.2% 1 Year 80.9% 3 Year 40% 5 Year 26.8% 10 Year 15 Year Since launch 19% Historical performance (Yearly) on absolute basis

Year Returns 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% 2014 50.8% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Sanjay Doshi 2 Jan 17 7.25 Yr. Kinjal Desai 25 May 18 5.86 Yr. Data below for Nippon India Power and Infra Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 37.72% Utility 14.4% Basic Materials 9.78% Energy 8.03% Communication Services 6.62% Consumer Cyclical 6.41% Technology 5.2% Real Estate 4.25% Health Care 1.82% Asset Allocation

Asset Class Value Cash 5.78% Equity 94.22% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE6% ₹270 Cr 925,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT6% ₹261 Cr 750,000

↑ 110,663 Bosch Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | 5005306% ₹239 Cr 83,500 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325556% ₹235 Cr 7,000,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | ULTRACEMCO5% ₹208 Cr 210,000

↑ 10,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES5% ₹198 Cr 670,000

↑ 92,352 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL4% ₹169 Cr 1,500,000

↑ 150,000 Cyient DLM Ltd (Technology)

Equity, Since 31 Jul 23 | 5439333% ₹137 Cr 1,708,669

↑ 158,099 Honeywell Automation India Ltd (Industrials)

Equity, Since 31 Jan 24 | HONAUT3% ₹137 Cr 36,000

↑ 13,882 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Aug 22 | CONCOR3% ₹125 Cr 1,274,151 5. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 23% since its launch. Ranked 27 in Mid Cap category. Return for 2023 was 41.7% , 2022 was 10.7% and 2021 was 55.8% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (24 Apr 24) ₹81.999 ↓ -0.27 (-0.33 %) Net Assets (Cr) ₹8,987 on 31 Mar 24 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.45 Sharpe Ratio 3.98 Information Ratio 1.03 Alpha Ratio 18.76 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,580 31 Mar 21 ₹12,801 31 Mar 22 ₹17,693 31 Mar 23 ₹19,463 31 Mar 24 ₹31,209 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.8% 3 Month 10.9% 6 Month 33.7% 1 Year 62.7% 3 Year 37.7% 5 Year 26.6% 10 Year 15 Year Since launch 23% Historical performance (Yearly) on absolute basis

Year Returns 2023 41.7% 2022 10.7% 2021 55.8% 2020 9.3% 2019 9.7% 2018 -12.7% 2017 30.8% 2016 5.2% 2015 16.5% 2014 Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Niket Shah 1 Jul 20 3.75 Yr. Ankush Sood 11 Nov 22 1.39 Yr. Rakesh Shetty 22 Nov 22 1.36 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Technology 21.43% Industrials 20.27% Consumer Cyclical 18.03% Financial Services 10.97% Real Estate 7.82% Basic Materials 4.24% Communication Services 1.86% Health Care 0.7% Asset Allocation

Asset Class Value Cash 14.68% Equity 85.32% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jio Financial Services Ltd (Financial Services)

Equity, Since 31 Aug 23 | 54394011% ₹930 Cr 30,000,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹841 Cr 975,000 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL10% ₹814 Cr 20,500,000

↑ 20,500,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 20 | TIINDIA8% ₹706 Cr 2,025,000

↑ 50,000 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 31 Jul 23 | PRESTIGE6% ₹525 Cr 4,500,000 Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE6% ₹524 Cr 800,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 31 Mar 21 | 5000935% ₹443 Cr 10,000,000 Balkrishna Industries Ltd (Consumer Cyclical)

Equity, Since 28 Feb 23 | BALKRISIND5% ₹384 Cr 1,725,000 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 30 Sep 22 | DEEPAKNTR4% ₹360 Cr 1,625,000

↓ -200,000 Zomato Ltd (Consumer Cyclical)

Equity, Since 30 Apr 23 | 5433204% ₹331 Cr 20,000,000

↓ -20,000,000 6. BOI AXA Manufacturing and Infrastructure Fund

CAGR/Annualized return of 12.2% since its launch. Return for 2023 was 44.7% , 2022 was 3.3% and 2021 was 52.5% . BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (24 Apr 24) ₹50.69 ↑ 0.56 (1.12 %) Net Assets (Cr) ₹256 on 31 Mar 24 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.55 Sharpe Ratio 3.79 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,753 31 Mar 21 ₹14,264 31 Mar 22 ₹18,195 31 Mar 23 ₹19,232 31 Mar 24 ₹30,627 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 8% 3 Month 12.4% 6 Month 35.5% 1 Year 65.3% 3 Year 32.6% 5 Year 26.6% 10 Year 15 Year Since launch 12.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 44.7% 2022 3.3% 2021 52.5% 2020 28.1% 2019 2.5% 2018 -22.8% 2017 56% 2016 1% 2015 0.3% 2014 54.1% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 1.51 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 23.22% Consumer Cyclical 15.67% Basic Materials 14.41% Energy 14.05% Health Care 10.1% Utility 6.75% Communication Services 4.31% Real Estate 3.52% Consumer Defensive 2.07% Technology 0.76% Asset Allocation

Asset Class Value Cash 5.1% Equity 94.86% Debt 0.04% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE8% ₹20 Cr 69,156

↑ 5,968 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT7% ₹17 Cr 50,207

↑ 11,302 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹12 Cr 370,539 Hero MotoCorp Ltd (Consumer Cyclical)

Equity, Since 30 Nov 23 | HEROMOTOCO4% ₹10 Cr 22,106 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Aug 22 | SUNPHARMA3% ₹8 Cr 47,707

↑ 2,885 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348163% ₹7 Cr 275,782

↑ 50,969 ITD Cementation India Ltd (Industrials)

Equity, Since 31 Dec 22 | 5094962% ₹6 Cr 180,560 Ashok Leyland Ltd (Industrials)

Equity, Since 31 Dec 22 | 5004772% ₹5 Cr 320,461

↑ 20,336 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 23 | MARUTI2% ₹5 Cr 4,816

↓ -1,707 Oil India Ltd (Energy)

Equity, Since 31 Dec 23 | OIL2% ₹5 Cr 99,102

↓ -10,140 7. Kotak Small Cap Fund

CAGR/Annualized return of 17.8% since its launch. Ranked 23 in Small Cap category. Return for 2023 was 34.8% , 2022 was -3.1% and 2021 was 70.9% . Kotak Small Cap Fund

Growth Launch Date 24 Feb 05 NAV (24 Apr 24) ₹230.323 ↑ 1.35 (0.59 %) Net Assets (Cr) ₹13,882 on 31 Mar 24 Category Equity - Small Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.48 Sharpe Ratio 2.13 Information Ratio -0.79 Alpha Ratio -6.19 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,291 31 Mar 21 ₹16,607 31 Mar 22 ₹22,660 31 Mar 23 ₹21,802 31 Mar 24 ₹30,166 Returns for Kotak Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.9% 3 Month 4.5% 6 Month 18.9% 1 Year 41.8% 3 Year 24.7% 5 Year 26.5% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 34.8% 2022 -3.1% 2021 70.9% 2020 34.2% 2019 5% 2018 -17.3% 2017 44% 2016 8.9% 2015 7.4% 2014 74% Fund Manager information for Kotak Small Cap Fund

Name Since Tenure Arjun Khanna 30 Apr 22 1.92 Yr. Harish Bihani 20 Oct 23 0.45 Yr. Data below for Kotak Small Cap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 36.44% Consumer Cyclical 21.46% Basic Materials 17.38% Health Care 7.4% Financial Services 3.54% Consumer Defensive 3.35% Technology 2.9% Real Estate 1.74% Communication Services 0.93% Asset Allocation

Asset Class Value Cash 4.44% Equity 95.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cyient Ltd (Industrials)

Equity, Since 31 Dec 19 | CYIENT4% ₹610 Cr 3,013,563

↑ 6,319 Century Plyboards (India) Ltd (Basic Materials)

Equity, Since 31 Oct 18 | 5325483% ₹448 Cr 6,337,762 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Jun 18 | CARBORUNIV3% ₹428 Cr 4,000,051 Blue Star Ltd (Industrials)

Equity, Since 31 May 18 | BLUESTARCO3% ₹427 Cr 3,364,838

↓ -511,312 Ratnamani Metals & Tubes Ltd (Basic Materials)

Equity, Since 31 Jan 18 | RATNAMANI3% ₹382 Cr 1,258,764 Alembic Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Jan 22 | APLLTD2% ₹351 Cr 3,441,355

↓ -432,661 Garware Technical Fibres Ltd (Consumer Cyclical)

Equity, Since 30 Jun 21 | GARFIBRES2% ₹322 Cr 885,547 Galaxy Surfactants Ltd (Basic Materials)

Equity, Since 31 Jan 18 | GALAXYSURF2% ₹322 Cr 1,268,161 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Dec 18 | TECHNOE2% ₹296 Cr 4,184,629 Great Eastern Shipping Co Ltd (Industrials)

Equity, Since 31 Aug 18 | GESHIP2% ₹287 Cr 2,851,787 8. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 18.4% since its launch. Ranked 12 in Sectoral category. Return for 2023 was 49% , 2022 was 13.9% and 2021 was 51.6% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (24 Apr 24) ₹286.687 ↑ 3.09 (1.09 %) Net Assets (Cr) ₹3,364 on 31 Mar 24 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio 3.25 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹6,593 31 Mar 21 ₹12,010 31 Mar 22 ₹15,471 31 Mar 23 ₹17,444 31 Mar 24 ₹28,755 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 10.2% 3 Month 15.9% 6 Month 40.4% 1 Year 74.8% 3 Year 38.6% 5 Year 26% 10 Year 15 Year Since launch 18.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 49% 2022 13.9% 2021 51.6% 2020 2.7% 2019 6.7% 2018 -17.2% 2017 47% 2016 4.1% 2015 0.7% 2014 61.3% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 13.79 Yr. Jay Kothari 16 Mar 18 6.05 Yr. Charanjit Singh 1 Jan 21 3.25 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 46.79% Basic Materials 20.22% Technology 6.76% Utility 6.35% Energy 6.09% Consumer Cyclical 4.85% Communication Services 2.9% Real Estate 1.2% Consumer Defensive 0.77% Asset Allocation

Asset Class Value Cash 4.06% Equity 95.94% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG4% ₹132 Cr 1,447,045

↑ 39,608 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325554% ₹126 Cr 3,745,599

↓ -398,819 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹119 Cr 341,272 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005503% ₹110 Cr 234,753 Apar Industries Ltd (Industrials)

Equity, Since 31 Dec 22 | APARINDS3% ₹107 Cr 171,817

↓ -352 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Mar 22 | HAL3% ₹102 Cr 329,889 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE3% ₹99 Cr 339,790 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 22 | KPIL3% ₹97 Cr 1,001,987

↓ -191,971 Cyient DLM Ltd (Technology)

Equity, Since 30 Jun 23 | 5439332% ₹78 Cr 965,297

↓ -55,148 KFin Technologies Ltd (Technology)

Equity, Since 31 Jan 24 | KFINTECH2% ₹76 Cr 1,103,354 9. ICICI Prudential Smallcap Fund

CAGR/Annualized return of 13.3% since its launch. Ranked 26 in Small Cap category. Return for 2023 was 37.9% , 2022 was 5.7% and 2021 was 61% . ICICI Prudential Smallcap Fund

Growth Launch Date 18 Oct 07 NAV (24 Apr 24) ₹78.47 ↑ 0.51 (0.65 %) Net Assets (Cr) ₹7,173 on 31 Mar 24 Category Equity - Small Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.04 Sharpe Ratio 2.37 Information Ratio -0.18 Alpha Ratio -4.4 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,173 31 Mar 21 ₹14,647 31 Mar 22 ₹20,462 31 Mar 23 ₹21,137 31 Mar 24 ₹29,912 Returns for ICICI Prudential Smallcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 5.4% 3 Month 4% 6 Month 18.6% 1 Year 45.6% 3 Year 29.9% 5 Year 25.9% 10 Year 15 Year Since launch 13.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 37.9% 2022 5.7% 2021 61% 2020 22.8% 2019 10% 2018 -22.4% 2017 42.7% 2016 6% 2015 0.5% 2014 50.6% Fund Manager information for ICICI Prudential Smallcap Fund

Name Since Tenure Anish Tawakley 18 Sep 23 0.54 Yr. Sri Sharma 18 Sep 23 0.54 Yr. Sharmila D’mello 30 Jun 22 1.76 Yr. Data below for ICICI Prudential Smallcap Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 26.81% Consumer Cyclical 18.78% Basic Materials 14.86% Financial Services 8.42% Health Care 8.03% Consumer Defensive 4.9% Real Estate 3.35% Technology 2.43% Utility 2.37% Communication Services 2.25% Energy 1.73% Asset Allocation

Asset Class Value Cash 5.52% Equity 94.48% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon Life India Asset Management Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 23 | NAM-INDIA3% ₹256 Cr 4,970,796

↓ -270,143 Cummins India Ltd (Industrials)

Equity, Since 30 Sep 23 | 5004803% ₹229 Cr 835,817 Cyient Ltd (Industrials)

Equity, Since 31 Aug 18 | CYIENT3% ₹226 Cr 1,113,643 Rolex Rings Ltd (Industrials)

Equity, Since 31 Jul 21 | 5433252% ₹177 Cr 862,662

↑ 8,357 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 19 | KPIL2% ₹170 Cr 1,762,604

↓ -24,540 Grindwell Norton Ltd (Industrials)

Equity, Since 30 Sep 23 | 5060762% ₹161 Cr 772,468

↑ 497,762 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Oct 23 | LT2% ₹157 Cr 452,798

↑ 44,600 Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Sep 16 | 5329292% ₹157 Cr 1,570,577 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | MARUTI2% ₹154 Cr 136,687

↑ 13,800 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 23 | ULTRACEMCO2% ₹145 Cr 146,215

↑ 11,215 10. TATA Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 15 in Sectoral category. Return for 2023 was 45.1% , 2022 was 7.6% and 2021 was 53.5% . TATA Infrastructure Fund

Growth Launch Date 31 Dec 04 NAV (24 Apr 24) ₹174.205 ↑ 1.19 (0.69 %) Net Assets (Cr) ₹1,885 on 31 Mar 24 Category Equity - Sectoral AMC Tata Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 2.36 Sharpe Ratio 4.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 150 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,125 31 Mar 21 ₹12,994 31 Mar 22 ₹16,283 31 Mar 23 ₹17,969 31 Mar 24 ₹29,647 Returns for TATA Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 8.2% 3 Month 16.8% 6 Month 40.2% 1 Year 71.7% 3 Year 36% 5 Year 25.8% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 45.1% 2022 7.6% 2021 53.5% 2020 11.1% 2019 2.8% 2018 -15.7% 2017 42.2% 2016 5.3% 2015 -0.2% 2014 63.1% Fund Manager information for TATA Infrastructure Fund

Name Since Tenure Abhinav Sharma 9 Mar 21 3.07 Yr. Data below for TATA Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 55.38% Utility 12.23% Basic Materials 11.46% Real Estate 8.54% Technology 2.84% Consumer Cyclical 2.72% Communication Services 1.34% Energy 0.69% Asset Allocation

Asset Class Value Cash 3.99% Equity 95.2% Debt 0.81% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 05 | LT7% ₹122 Cr 349,889 NTPC Ltd (Utilities)

Equity, Since 30 Jun 21 | 5325554% ₹80 Cr 2,395,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Jan 21 | ADANIPORTS3% ₹61 Cr 460,000

↑ 40,000 DLF Ltd (Real Estate)

Equity, Since 30 Sep 20 | 5328683% ₹58 Cr 640,000

↓ -50,000 Cummins India Ltd (Industrials)

Equity, Since 30 Nov 20 | 5004803% ₹53 Cr 192,668

↓ -9,332 Torrent Power Ltd (Utilities)

Equity, Since 31 Jan 22 | 5327793% ₹47 Cr 435,000 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 31 Jul 22 | 5001033% ₹47 Cr 2,050,000 Thermax Ltd (Industrials)

Equity, Since 30 Apr 21 | THERMAX2% ₹43 Cr 117,920 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005502% ₹42 Cr 90,575 ACC Ltd (Basic Materials)

Equity, Since 30 Sep 20 | 5004102% ₹42 Cr 158,000 11. SBI Infrastructure Fund

CAGR/Annualized return of 9.7% since its launch. Ranked 18 in Sectoral category. Return for 2023 was 49.7% , 2022 was 9.3% and 2021 was 48.3% . SBI Infrastructure Fund

Growth Launch Date 6 Jul 07 NAV (24 Apr 24) ₹47.4949 ↑ 0.25 (0.52 %) Net Assets (Cr) ₹2,432 on 31 Mar 24 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk High Expense Ratio 2.39 Sharpe Ratio 4.42 Information Ratio 0.67 Alpha Ratio 16.5 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 19 ₹10,000 31 Mar 20 ₹7,377 31 Mar 21 ₹12,805 31 Mar 22 ₹16,615 31 Mar 23 ₹18,443 31 Mar 24 ₹30,017 Returns for SBI Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 24 Duration Returns 1 Month 6.1% 3 Month 12.6% 6 Month 36.8% 1 Year 69.9% 3 Year 36.6% 5 Year 25.6% 10 Year 15 Year Since launch 9.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 49.7% 2022 9.3% 2021 48.3% 2020 8.2% 2019 10.2% 2018 -18.1% 2017 41.7% 2016 9.3% 2015 2.7% 2014 48.1% Fund Manager information for SBI Infrastructure Fund

Name Since Tenure Mohit Jain 30 Nov 17 6.34 Yr. Bhavin Vithlani 1 Jan 22 2.25 Yr. Data below for SBI Infrastructure Fund as on 31 Mar 24

Equity Sector Allocation

Sector Value Industrials 27.73% Basic Materials 17.04% Financial Services 11.25% Energy 11.16% Consumer Cyclical 8.3% Utility 8.23% Communication Services 5.45% Real Estate 3.45% Asset Allocation

Asset Class Value Cash 7.39% Equity 92.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Sep 19 | RELIANCE9% ₹205 Cr 700,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 07 | BHARTIARTL5% ₹124 Cr 1,100,000

↑ 400,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT5% ₹111 Cr 320,000 Torrent Power Ltd (Utilities)

Equity, Since 31 May 22 | 5327794% ₹97 Cr 900,000 Shree Cement Ltd (Basic Materials)

Equity, Since 31 Jul 22 | 5003874% ₹92 Cr 36,000 Sobha Ltd (Real Estate)

Equity, Since 31 Jul 23 | SOBHA3% ₹78 Cr 500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 22 | 5322153% ₹75 Cr 700,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Dec 19 | ULTRACEMCO3% ₹69 Cr 70,000

↑ 20,000 Grasim Industries Ltd (Basic Materials)

Equity, Since 31 Jan 24 | GRASIM3% ₹66 Cr 300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 Dec 20 | 5321553% ₹66 Cr 3,600,000

The investors are suggested to invest in the SIP plans of their choice. The above-mentioned top 11 Mutual Funds are suitable for investors of all kind. So, either you are a high-risk investor or a relatively lower one, these SIP funds are the Best Mutual Funds to Invest. So, don’t wait, invest now!

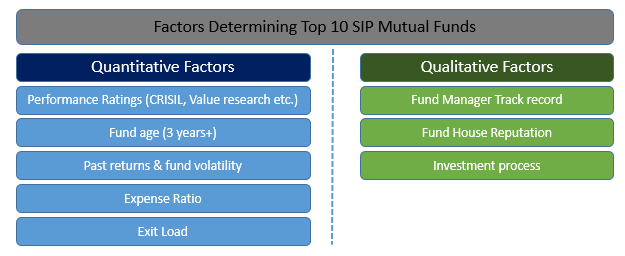

Parameters to Consider While Investing in Best Systematic Investment Plans

To evaluate best performing SIP Funds, let’s know the factors that one must consider before investing.

Quantitative Factors to Invest in Top SIP

The quantitative factors one must consider before investing via SIP include performance rating (as per CRISIL, Value Research etc.), fund age, past returns and fund volatility, expense ratio and exit load.

Qualitative Factors to Invest in Top SIP

Qualitative key statistics to analyse include the track record of the fund manager, reputation of the fund house and the investment process of the SIP fund.

How to Invest in SIP MF Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Begin your investment journey with SIP today!

FAQs

1. What are mutual funds?

A: Mutual funds are a part of the Systematic Investment Plan or SIPs that usually produce excellent returns later. When you invest in Mutual Funds, you diversify your investment portfolio. A mutual fund can be considered an investment tool developed by an Asset Management Company by pooling in multiple investors and companies' investments.

2. What are the different types of mutual funds?

A: Mutual funds can be broadly classified into the following types:

- Equity or growth funds

- Fixed income funds or Debt fund

- Tax saving funds

- Liquid Funds

- Balanced Fund

- Gilt Funds

- Exchange-Traded Funds or ETFs

3. What are growth equity funds?

A: The growth Equity Funds are the most common mutual funds. However, this portfolio will consist of volatile investments. Nevertheless, investors often prefer the growth equity funds as these have higher returns and can be invested for a shorter period.

4. Why should you invest in a debt fund?

A: These investments are ideal for individuals who are looking for fixed returns on investment. The fixed income can be earned from debentures, debt securities, commercial papers, and government securities. Mutual funds would create a portfolio of various types of investments and dissipate the risk.

5. Why should you invest in SIPs?

A: SIPs can provide the investor with assured income. If you are interested in earning passive income and want to ensure that your investment produces regular income, then you can consider investing in SIPs. .

6. Why invest in a tax saving mutual fund?

A: If you are looking to grow your Capital and at the same time want to enjoy tax exemptions, then you could invest in a tax saving mutual fund. Under Section 80C of the income tax Act of 1861, if you invest in equity-linked tax saving mutual funds, you can enjoy tax exemptions on your investment.

7. Do I need a broker to invest in mutual funds?

A: You will need the support of a broker or a financial institute to help you with the investment. You will need the support to identify the suitable SIPs and ensure that the investments have been made correctly.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.