How to Invest in Mutual Funds?

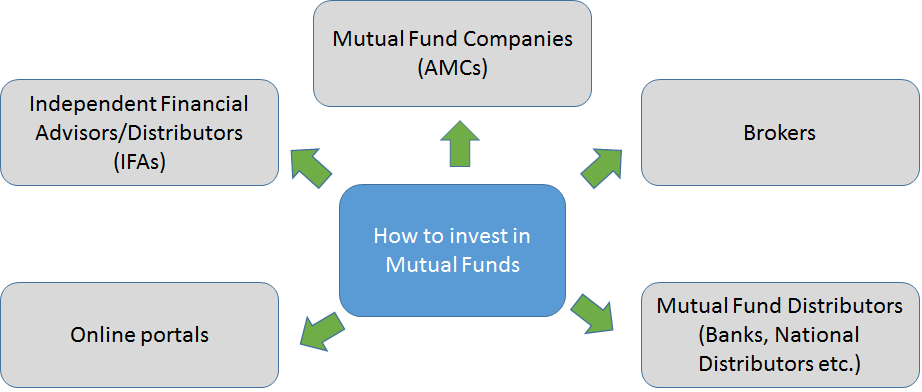

Investing in Mutual Funds in India is gaining popularity. Investors are now asking questions such as "How to Invest in the Stock Market?", "Which are the top Mutual Funds companies in India ?", or "which are the best mutual funds in India ?". Mutual Funds for a layman are still a complex topic, there are various calculators, various Types of Mutual Funds, 44 Mutual Fund companies, etc, however, investors frequently ask the question, "How to invest in Mutual Funds in India ?". Below are some of the commonly available routes to invest in Mutual Funds in India.

Easy Methods to Invest in MF

1. Invest Via AMC Directly

There are 44 Mutual Fund companies( also called Asset Management Companies(AMC)) in India, investors can approach the AMCs directly, go to their website or go to the office of the AMC to invest. The list of 44 AMCs is below for reference:

- Axis Asset Management Company Ltd.

- Baroda Pioneer Asset Management Company Limited

- Birla Sun Life Asset Management Company Limited

- BNP Paribas Asset Management India Private Limited

- BOI AXA Investment Managers Private Limited

- Canara Robeco Asset Management Company Limited

- DHFL Pramerica Asset Managers Private Limited

- DSP BlackRock Investment Managers Private Limited

- Edelweiss Asset Management Limited

- Escorts Asset Management Limited

- Franklin Templeton Asset Management (India) Private Limited

- Goldman Sachs Asset Management (India) Private Limited

- HDFC Asset Management Company Limited

- HSBC Asset Management (India) Private Ltd

- ICICI Prudential Asset Mgmt. Company Limited

- IDBI Asset Management Ltd

- IDFC Asset Management Company Limited

- IIFCL Asset Management Co. Ltd

- IIFL Asset Management Ltd

- IL&FS Infra Asset Management Limited

- Indiabulls Asset Management Company Ltd

- Invesco Asset Management Company Private Limited

- J.M. Financial Asset Management Ltd

- JPMorgan Asset Management (India) Pvt. Ltd

- Kotak Mahindra Asset Management Company Limited

- L&T Investment Management Limited

- LIC Mutual Fund Asset Management Company Limited

- Mahindra Asset Management Company Pvt. Ltd

- Mirae Asset Global Investments (India) Pvt. Ltd

- Motilal Oswal Asset Management Company Limited

- Peerless Funds Management Co. Ltd

- PPFAS Asset Management Pvt. Ltd

- Principal Pnb Asset Management Co.Pvt. Ltd

- Quantum Asset Management Company Private Limited

- Reliance Nippon Life Asset Management Limited

- Sahara Asset Management Company Private Limited

- SBI Funds Management Private Ltd

- Shriram Asset Management Co. Ltd

- SREI Mutual Fund Asset Management Pvt. Ltd

- Sundaram Asset Management Company Limited

- Tata Asset Management Limited

- Taurus Asset Management Company Limited

- Union KBC Asset Management Company Private Limited

- UTI Asset Management Company Ltd

Talk to our investment specialist

2. Invest in Mutual Funds Via Distributors

Investors can also use the services of a distributor. Today distributors such as banks, NBFCs and other entities offer services for distribution of Mutual Funds.There are many such entities in India providing distribution services for Mutual Funds.

3. Invest in Mutual Funds through IFAS

Today there are more than 90,000 IFAs in India. Investors can approach these individual financial advisers and invest in Mutual Funds through these persons. IFAs are spread across the country, to know the IFAs close to a particular vicinity (by inputting PIN code) one can visit the AMFI website and get this information.

4. Investing in Mutual Funds Via Brokers

Mutual funds are offered through the offline and online mode by many brokers (e.g ICICI Direct, Kotak Securities etc). The offline mode(also called physical mode) is where the customer fills a paper form. Some brokers use the "demat mode" for investing, in the demat mode the units of the mutual funds get credited into the Demat account of the investor.

5. Mutual Funds through Online Portals

There are many online portals today that offer paperless services where investors can sit at home or office and invest their hard earned money. These portals are also called "robo-advisors" and offer many services other than just transaction services.

Fund Selection Methodology used to find 5 funds

Best Performing Mutual Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) PGIM India Low Duration Fund Growth ₹26.0337

↑ 0.01 ₹104 1.5 3.3 6.3 4.5 1.3 Sundaram Rural and Consumption Fund Growth ₹92.4376

↑ 0.21 ₹1,461 -7.6 -7.3 3.5 15.5 13 Baroda Pioneer Treasury Advantage Fund Growth ₹1,600.39

↑ 0.30 ₹28 0.7 1.2 3.7 -9.5 -3.2 UTI Dynamic Bond Fund Growth ₹31.7095

↑ 0.03 ₹421 0.8 2.8 5.9 7 8.6 Franklin Asian Equity Fund Growth ₹39.5966

↑ 0.21 ₹372 16.9 24.5 37.5 16.1 3.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 29 Sep 23 Research Highlights & Commentary of 5 Funds showcased

Commentary PGIM India Low Duration Fund Sundaram Rural and Consumption Fund Baroda Pioneer Treasury Advantage Fund UTI Dynamic Bond Fund Franklin Asian Equity Fund Point 1 Bottom quartile AUM (₹104 Cr). Highest AUM (₹1,461 Cr). Bottom quartile AUM (₹28 Cr). Upper mid AUM (₹421 Cr). Lower mid AUM (₹372 Cr). Point 2 Established history (18+ yrs). Oldest track record among peers (19 yrs). Established history (16+ yrs). Established history (15+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: High. Point 5 1Y return: 6.30% (upper mid). 5Y return: 13.03% (top quartile). 1Y return: 3.74% (bottom quartile). 1Y return: 5.94% (lower mid). 5Y return: 3.44% (lower mid). Point 6 1M return: 0.47% (bottom quartile). 3Y return: 15.52% (upper mid). 1M return: 0.21% (bottom quartile). 1M return: 0.78% (lower mid). 3Y return: 16.10% (top quartile). Point 7 Sharpe: -1.66 (bottom quartile). 1Y return: 3.50% (bottom quartile). Sharpe: 0.37 (upper mid). Sharpe: -0.18 (lower mid). 1Y return: 37.52% (top quartile). Point 8 Information ratio: 0.00 (top quartile). Alpha: -7.86 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.34% (top quartile). Sharpe: -0.56 (bottom quartile). Yield to maturity (debt): 4.07% (lower mid). Yield to maturity (debt): 7.29% (upper mid). Sharpe: 2.24 (top quartile). Point 10 Modified duration: 0.53 yrs (lower mid). Information ratio: -0.54 (bottom quartile). Modified duration: 0.63 yrs (bottom quartile). Modified duration: 3.87 yrs (bottom quartile). Information ratio: 0.00 (bottom quartile). PGIM India Low Duration Fund

Sundaram Rural and Consumption Fund

Baroda Pioneer Treasury Advantage Fund

UTI Dynamic Bond Fund

Franklin Asian Equity Fund

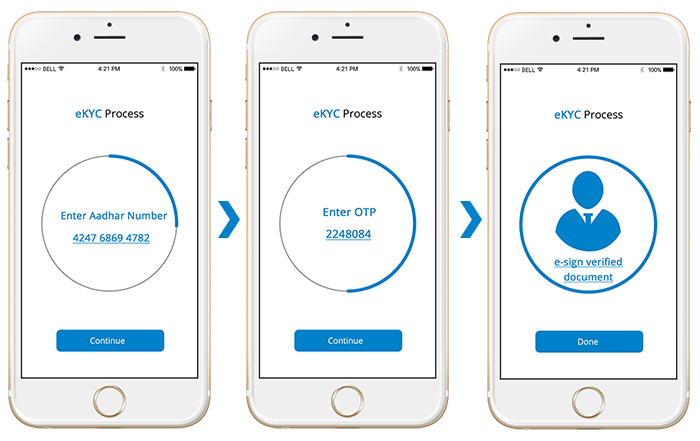

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Hence there are many routes available for customers to invest in Mutual Funds. As an investor, one should choose a route that seems most convenient but also allows the investor to make a correct decision. While investors may choose any route that is convenient to invest, it is important to consider the goal, risk appetite and Asset Allocation while making investments. Additionally, one needs to check that those offering the services are carrying the relevant license/registrations etc to ensure that the entity/person being used for these services is able to provide sound and quality inputs.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.