Compare Mutual Funds Before Investing

Under the Mutual Fund umbrella, there are a number of schemes with various objectives and benefits. At first instance, when you look at a particular Mutual Fund category, all schemes might look similar to you. But, when you understand some terms and basic parameters it would be easy for you to compare funds before Investing. Comparison helps in bettering investment decision. So, let’s understand how can an investor can compare the two Best Performing Mutual Funds before investing.

Tips for Mutual Fund Comparison

Compare Mutual Funds within Same Category

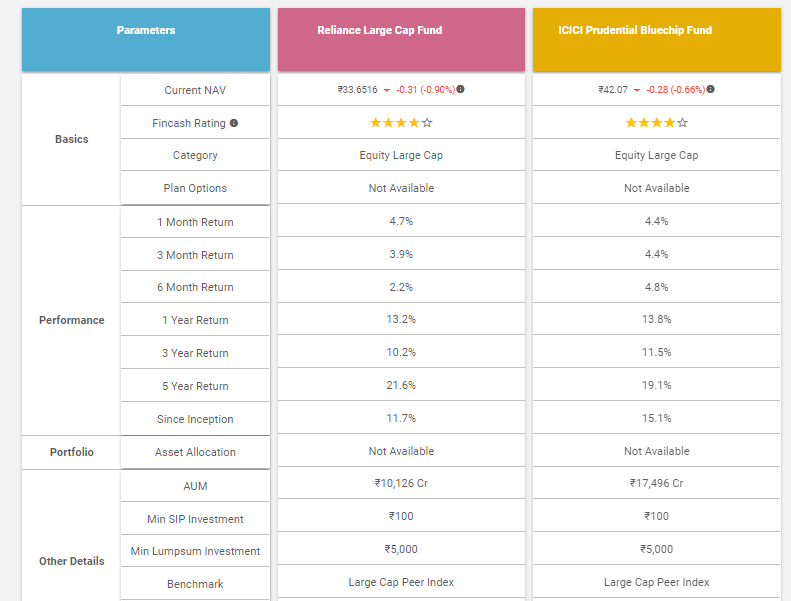

It is called apple to apple comparison. A comparison of Mutual Fund will only make sense when you do it within the same category. For instance, if you want to invest in Large cap funds, you can two large-cap schemes and compare it with each other. Look at the fund’s inception date, AUM i.e, Asset Under Management. For better understanding, let’s take ICICI Prudential Bluechip Fund and Reliance Large Cap Fund, one of the two top performing schemes under large-cap category. The AUM of ICICI Prudential Bluechip Fund as on 30th June 2018 was INR 17,496 crores, whereas the AUM of Reliance Large Cap Fund was INR 10,126 crores. Similarly, if we look at the fund age, ICICI’s scheme was launched in the year 2008 and the inception year of Reliance’s scheme was 2007.

Talk to our investment specialist

Benchmark

Benchmark is one of the important indicators of the fund’s performance. Benchmark indicates how much returns the fund or scheme has generated as aganist how much it should have delivered. It is mandated by Securities and Exchange Board of India (SEBI) to declare a benchmark. If a fund surpasses its benchmark, it is indicated that the fund has performed well.

Track Returns

Returns can be one of the easiest ways to measure and compare funds. Returns can also be one of the parameters to judge a fund’s stability. However, one should note that the time period that you should consider for comparison may vary from category to category. If you are planning to invest in Equity Funds, you need to sort returns on the Basis of past five returns, whereas if you want to invest in Debt fund with short maturities like Liquid Funds or ultra short term funds, then you can consider past one-year returns for comparison.

Illustrator of how Mutual Fund comparison can be done at Fincash- Explore page

Risk Factors

There is a risk attached to every fund. There are better parameters like Alpha and Beta that measures the risk Factor in a scheme. Alpha is a measure of the success of your investment or rather outperformance against the benchmark. It measures on how much the fund or stock has performed in the general Market. A positive alpha of 1 means that the fund has outperformed its benchmark index by 1%, while a negative alpha of -1 would indicate that the fund has produced 1% lower returns than its market benchmark. So, basically, an investor’s strategy should be to buy securities with positive alpha.

Whereas, beta measure the Volatility in a stock’s price or fund relative to a benchmark and is denoted in positive or negative figures. A beta of 1 signifies that the stock’s price moves in line with the market, beta of a greater than 1 designates that the stock is riskier than the market, and a beta of less than 1 means that the stock is less risky than the market. So, lower beta is better in a falling market. In a rising market, high-beta is better.

Minimum Investment

The minimum investment includes SIP and lump sum, it depends which investment route you wish to take Mutual Funds. Minimum SIP investment and minimum lump sum investment may vary fund to fund. In the case of the above illustration, both SIP and lump sum amount is the same. While in most cases, the minimum lump sum amount may be the same, i.e., INR 5000, SIP amount may vary from INR 500 or INR 1000.

Additional Quick Points to Compare Mutual Funds

Compare two funds with similar investment options. Don't compare a growth plan option with a dividend plan. While comparing fund with a growth plan, choose another fund with growth plan option.

When you compare the returns of two schemes, make sure that you compare of the same year. Compare the five-year return of one fund with the five-year return of the other fund. Don’t compare the five-year return of one fund with the three-year return of another.

Make sure the benchmark of the two funds is similar. For example, in the above two funds- ICICI Prudential BlueChip Fund and Reliance Large Cap Fund, the benchmark of both is the same i.e., Large Cap Peer Index.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.