Mutual Fund Investment Plans

Mutual Funds in India bring in diverse investment plans to cater the various objectives and the needs of the investors. It offers investment options for all kinds of investors, be it a risk-averse, high-risk or a moderate-risk taker, Mutual Funds have various risks ranging schemes. Its minimum investment amount, i.e., INR 500 monthly, has even attracted youngsters, students, house wife’s to begin their investments in Mutual Funds. So, if you are a new to Mutual Funds, here’s all you need to know about it.

What are Mutual Funds?

A mutual fund is a collective pool of money given by the investors to buy securities. Here the investment is made in various securities like stocks, Bonds, money market instruments, precious metals, commodities, etc. Mutual Funds are managed by professional fund managers who decide how to invest money by keeping a keen eye on the market movements.

The Mutual Fund in India is regulated by the Securities and Exchange Board of India (SEBI). All the Mutual Fund guidelines, rules & regulations, policies are set by SEBI. There are 36 Mutual Fund schemes introduced by SEBI in order to cater to the diverse requirements of the investors.

Types of Mutual Fund Investment Plans

On 6th October 2017, SEBI had passed a notice of re-categorisation of Mutual Funds in India. This is done to bring uniformity in similar schemes launched by the different Mutual Funds. SEBI wants to ensure that investors can find it easier to compare the products and evaluate the different options available before investing in a scheme. So that the investors could invest according to their needs, financial goals and risk appetite.

SEBI has categorised Mutual Fund schemes into 5 broad categories and 36 sub-categories. This mandates Mutual Fund Houses to make the changes in their existing & future schemes. Here, the list of different types of MF schemes in India.

1. Equity Mutual Funds

An equity fund mainly invests in stocks. In other words, the money is invested into shares of different companies. These funds are high-risk, high-return funds, which means that an investor who can tolerate risk should only prefer investing in equities. Let's look at the various types of Equity Funds:

a. Large cap funds

These funds would invest in companies that fall under the 1st to 100th company in terms of full market capitalization. Large cap funds invest in those firms that have the possibility of showing year on year steady growth and profits, which in turn offers stability over a period of time to investors. These stocks give steady returns over long periods of time.

b. Mid cap funds

These funds would invest in companies that fall under the 101st to 250th company in terms of full market capitalization. From a standpoint of the investor, the investing period of mid-caps should be much higher than large-caps due to the higher fluctuations (or volatility) in the prices of the stocks.

c. Large and mid cap funds

SEBI has introduced a combo of large and mid cap funds, which means that these are the schemes that invest in both large & mid cap stocks. Here, the fund will invest a minimum of 35 percent each in mid and large cap stocks.

d. Small cap funds

small cap companies include the startups or firms that are in their early stage of development with small revenues. These funds would invest in companies that fall under the 251st company onwards in terms of full market capitalization. Small-caps have a great potential to discover the value and can generate good returns. However, given the small size, the risks are very high, hence the investing period of small-caps is expected to be the highest.

e. Multi cap funds

Also known as Diversified Funds, these invest across market capitalization, i.e., essentially across large-cap, mid-cap, and small-cap. They typically invest anywhere between 40–60% in large cap stocks, 10–40% in mid-cap stocks and about 10% in small-cap stocks. While diversified equity funds or multi-cap funds invest across market capitalizations the risks of equity still remain in the investment.

f. Equity Linked Saving Schemes (ELSS)

These are equity mutual funds that save your tax as a qualified tax exemption under Section 80C of the Income Tax Act. They offer the twin advantage of capital gains and tax benefits. ELSS schemes come with a lock-in period of three years. A minimum of 80 percent of its total assets has to be invested in equities.

g. Dividend yield funds

dividend yield funds are those where a fund manager deigns the fund portfolios as per dividend yield strategy. This scheme is preferred by investors who like the idea of regular income as well as capital appreciation. This fund invests in companies that provide high dividend yield strategy. This fund aims at buying good underlying businesses that pay regular dividends at attractive valuations. This scheme will invest a minimum 65 percent of its total assets in equities, but in dividend yielding stocks.

h.Value funds

value funds invest in those companies that have fallen out of favour but have good principles. The idea behind this is to select a stock that appears to be underpriced by the market. A value investor looks out for bargains and chooses investments that have a low price on factors such as earnings, net current assets, and sales.

i. Contra funds

contra funds take a contrarian view on equities. It is against the wind kind of investment style. The fund manager picks underperforming stocks at that point in time, which are likely to perform well in the long run, at cheap valuations. The idea here is to buy assets at a lower cost than its fundamental value in the long term. It is done with a belief that the assets will stabilize and come to its real value in the long term. Value/Contra will invest at least 65 percent of its total assets in equities, but a Mutual Fund house can either offer a value fund or a contra fund, but not both.

j. Focused funds

Focused funds hold a mix of equity funds, i.e., large, mid, small or multi-cap stocks, but has a limited number of stocks. As per SEBI, a focused fund can have a maximum of 30 stocks. These funds are allocated their holdings between a limited number of carefully researched securities. Focused funds can invest at least 65 percent of its total assets in equities.

k. Sector funds and Thematic equity funds

A sector fund is an equity scheme that invests in shares of companies that trade in a particular sector or industry like, for instance, a pharma fund would invest only in pharmaceutical companies. thematic funds can be across a wider sector than just keep a very narrow focus, for example, media and entertainment. In this theme, the fund can invest in various companies across publishing, online, media or broadcasting. The risks with thematic funds are the highest since there is virtually very little diversification. At least 80 percent of the total assets of these schemes will be invested in a particular sector or theme.

Talk to our investment specialist

2. Debt Mutual Funds

A debt fund invests in a fixed income instrument like Government Securities, Treasury Bills, Corporate Bonds, etc. Debt funds are preferred by those who are looking for a steady income with relatively lower risks, as they are comparatively less volatile than equities. Debt fund has 16 broad categories that are as follows:

a. Overnight fund

These are a debt scheme that will invest bonds that mature in a day. In other words, investment is done in overnight securities with a maturity of one day. This is a safe option for investors who want to park money without worrying about risks and returns.

b. Liquid funds

Liquid Funds invest in short-term money market instruments such as treasury bills, commercial papers, term deposits, etc. They invest in securities that have a lower maturity period, usually less than 91 days. Liquid funds provide easy liquidity and are less volatile than the other types of debt instruments. Also, liquid fund's investment returns are better than that of a Savings Account.

c. Ultra short duration funds

Ultra short duration funds invest in fixed income instruments which have a Macaulay duration between three to six months. Ultra short-term funds help investors avoid interest rate risks and also offer better returns compared to liquid debt funds. Macaulay duration measures how long it will take the scheme to recoup the investment

d. Low duration funds

The scheme will invest in debt and money market securities with a Macaulay duration between six to 12 months.

e. Money market funds

The money market fund invests in many markets such as commercial/treasury bills, commercial papers, certificate of deposit and other instruments specified by the Reserve Bank of India (RBI). These investments are a good option for risk-averse investors who want to earn good returns in short duration. This debt scheme will invest in money market instruments having a maturity up to one year.

f. Short duration funds

Short duration funds mainly invest in Commercial Papers, Certificate of Deposits, Money Market Instruments, etc, with a Macaulay duration of one to three years. They may provide a higher level of return than ultra-short-term and liquid funds but will be exposed to higher risks.

g. Medium duration funds

This scheme will invest in debt and money market instruments with a Macaulay duration of three to four years. These funds have an average maturity period that is longer than liquid, ultra-short and short duration debt funds.

h. Medium to long duration funds

This scheme will invest in debt and money market instruments with a Macaulay duration of four to seven years.

i. Long duration funds

This scheme will invest in debt and money market instruments with a Macaulay duration greater than seven years.

j. Dynamic bond funds

Dynamic Bond Funds invest in fixed income securities consisting of varying maturity periods. Here, the fund manager decides on which funds they need to invest based on their perception of the interest rate scenario and future interest rate movements. Based on this decision, they invest in funds across various maturity periods of debt instruments. This mutual fund scheme is suitable for individuals who feel puzzled about the interest rate scenario. Such individuals can rely on the view of the fund managers to earn money through dynamic bond funds.

k. Corporate bond funds

Corporate bond funds are essentially a certificate of debt issued by major companies. These are issued as a way of raising money for businesses. This debt scheme mainly invests in the highest rated corporate bonds. The fund can invest a minimum 80 percent of its total assets in the highest-rated corporate bonds. Corporate bond funds are a great option when it comes to good return and low-risk type investment. Investors can earn a regular income which is usually higher than that of interest on your Fixed Deposits (FDs).

l. Credit risk funds

This scheme will invest in below the high-rated corporate bonds. The credit risk fund should invest at least 65 percent of its assets below the highest-rated instruments.

m. Banking and PSU funds

This scheme predominantly invests in debt and money market instruments consisting of securities issued by entities such as Banks, Public Financial Institutions, Public Sector Undertakings. This option is considered to maintain an optimum balance of liquidity, safety, and yield.

n. Gilt fund

This scheme invests in government securities issued by RBI. Government-backed securities include G-secs, treasury bills, etc. As the papers are backed by the government these schemes are relatively safer. Depending on their maturity profile, long-term Gilt Funds carry interest rate risks. For instance, the higher the maturity of the scheme the higher would be the interest rate risk. Gilt Funds will invest a minimum 80 percent of its total assets in government securities.

o. Gilt fund with 10-year constant duration

This scheme will invest in government securities with a maturity of 10 years. 15. Gilt Fund with a 10-year Constant Duration will invest a minimum 80 percent in government securities.

p. Floater funds

This debt scheme mainly invests in floating rate instruments, where the interest paid changes in order with the changing interest rate scenario in the debt market. Floater Fund will invest a minimum of 65 percent of its total assets in floating rate instruments.

3. Hybrid Mutual Funds

Hybrid Funds act as a combination of equity and debt fund. This fund allows an investor to invest in both equity and debt markets in certain proportions.

a. Conservative hybrid funds

This scheme will majorly invested in debt instruments. About 75 to 90 percent of their total assets will be invest in debt instruments and about 10 to 25 percent in equity-related instruments. This scheme is named as conservative because it is for people who are risk-averse. Investors who don't want to take much risk in their investment can prefer investing in this scheme.

b. Balanced hybrid funds

This fund will invest around 40-60 percent of its total assets in both debt and equity instruments. The beneficial factor of a Balanced Fund is that they provide equity comparable returns with a lower risk factor.

c. Aggressive hybrid funds

This fund will invest around 65 to 85 percent of its total assets in equity-related instruments and about 20 to 35 percent of their assets in debt instruments. Mutual Fund Houses can offer either a balanced hybrid or an aggressive hybrid fund, not both.

d. Dynamic asset allocation or Balanced advantage funds

This scheme would dynamically manage their investments in equity and debt instruments. These funds tend to increase the allocation to debt and reduce the weightage to equities when the market becomes costly. Also, these funds focus on providing stability at a low-risk.

e. Multi asset allocation

This scheme can invest in three asset classes, which means that they can invest in an extra asset class apart from equity and debt. The fund should invest at least 10 percent in each of the asset classes. Foreign securities will not be treated as a separate asset class.

f. Arbitrage funds

This fund will follow the arbitrage strategy and will invest at least 65 percent of its assets in equity-related instruments. Arbitrage funds are Mutual Funds that leverage the differential price between the cash market and derivative market to generate mutual fund returns. The returns generated by arbitrage funds are dependent on the volatility of the stock market. Arbitrage mutual funds are hybrid in nature and in times of high or persistent volatility, these funds offer relatively risk-free returns to investors.

g. Equity savings

This scheme will invest in equity, arbitrage and debt. Equity savings will invest at least 65 percent of the total assets in stocks and a minimum 10 percent in debt. The scheme would state the minimum hedged and unhedged investments in the scheme information document.

4. Solution Oriented Schemes

a. Retirement fund

This is a retirement solution oriented scheme that will have a lock-in of five years or till the age of retirement.

b. Children’s fund

This is children oriented scheme having a lock-on for five years or until the child attains the age of majority, whichever is earlier.

5. Other Schemes

a. Index Fund/ETF

These funds invest their corpus in shares that constitute a part of a particular index. In other words, these schemes mimic the performance of an index. These schemes are designed to track the returns of a particular market index. These schemes can be purchased either as Mutual Funds or as Exchange Traded Fund (ETFs). Also known as Index Tracker Funds, the corpus of these schemes is invested in the exact proportion as they are in the index. As a consequence, whenever, individuals purchase units of Index Funds, they indirectly own a share in the portfolio that has instruments of a particular index. This fund can invest at least 95 percent of its total asset in securities of a particular index.

b. FoFs (Overseas Domestic)

A Mutual Fund Investing its collected pool of money in another mutual fund (one or maybe more) is referred to as fund of funds. Investors in their portfolios take exposure to different funds and keep track of them separately. However, by investing in multi-manager mutual funds this process gets more simplified as investors need to track only one fund, which in turn holds numerous mutual funds within it. This fund can invest a minimum of 95 percent of its total assets in the underlying fund.

Fund Selection Methodology used to find 15 funds

15 Best Mutual Funds Across Categories

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 5,000 16.5 26.1 41.2 16.8 4.1 23.7 Global DSP Natural Resources and New Energy Fund Growth ₹110.438

↑ 0.34 ₹1,765 1,000 15.2 25.4 38.8 25.1 21.5 17.5 Sectoral DSP US Flexible Equity Fund Growth ₹78.698

↓ -0.52 ₹1,119 1,000 5.4 16.9 34.3 23.6 17.2 33.8 Global Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 5,000 2.1 6.6 24.2 28.6 24 3.7 Sectoral Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.89

↓ -1.06 ₹3,641 1,000 -1.2 8 22.1 18.2 13.4 17.5 Sectoral Kotak Equity Opportunities Fund Growth ₹355.699

↓ -4.19 ₹29,991 5,000 0.3 5.8 20.6 20.5 17.4 5.6 Large & Mid Cap Kotak Standard Multicap Fund Growth ₹87.09

↓ -1.07 ₹56,479 5,000 -0.8 4.2 19.3 18.2 14.4 9.5 Multi Cap Invesco India Growth Opportunities Fund Growth ₹98.19

↓ -1.00 ₹8,959 5,000 -5.6 -3.3 18.9 24.8 17.5 4.7 Large & Mid Cap Aditya Birla Sun Life Small Cap Fund Growth ₹84.0292

↓ -1.02 ₹4,778 1,000 -2.8 0.5 18.9 18.8 15 -3.7 Small Cap ICICI Prudential Nifty Next 50 Index Fund Growth ₹61.2116

↓ -0.81 ₹8,103 5,000 0.9 4.2 18.7 23.2 15.2 2.1 Index Fund IDBI Nifty Junior Index Fund Growth ₹51.6352

↓ -0.68 ₹98 5,000 0.8 4.1 18.6 22.9 15.1 2 Index Fund Tata India Tax Savings Fund Growth ₹45.8014

↓ -0.43 ₹4,566 500 -1.3 5.6 17.6 17.1 14.5 4.9 ELSS ICICI Prudential Banking and Financial Services Fund Growth ₹136.55

↓ -2.28 ₹10,951 5,000 -2.6 3.6 16.9 16.6 12.9 15.9 Sectoral DSP Equity Opportunities Fund Growth ₹633.892

↓ -6.57 ₹17,434 1,000 -1 4.6 16.3 21.4 16.8 7.1 Large & Mid Cap Tata Equity PE Fund Growth ₹352.434

↓ -4.10 ₹8,819 5,000 -2.8 4.2 14.9 20.1 16.7 3.7 Value Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 15 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund Kotak Equity Opportunities Fund Kotak Standard Multicap Fund Invesco India Growth Opportunities Fund Aditya Birla Sun Life Small Cap Fund ICICI Prudential Nifty Next 50 Index Fund IDBI Nifty Junior Index Fund Tata India Tax Savings Fund ICICI Prudential Banking and Financial Services Fund DSP Equity Opportunities Fund Tata Equity PE Fund Point 1 Bottom quartile AUM (₹372 Cr). Bottom quartile AUM (₹1,765 Cr). Bottom quartile AUM (₹1,119 Cr). Lower mid AUM (₹3,003 Cr). Lower mid AUM (₹3,641 Cr). Top quartile AUM (₹29,991 Cr). Highest AUM (₹56,479 Cr). Upper mid AUM (₹8,959 Cr). Lower mid AUM (₹4,778 Cr). Upper mid AUM (₹8,103 Cr). Bottom quartile AUM (₹98 Cr). Lower mid AUM (₹4,566 Cr). Upper mid AUM (₹10,951 Cr). Top quartile AUM (₹17,434 Cr). Upper mid AUM (₹8,819 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (16+ yrs). Established history (12+ yrs). Established history (21+ yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (18+ yrs). Established history (15+ yrs). Established history (15+ yrs). Established history (11+ yrs). Established history (17+ yrs). Oldest track record among peers (25 yrs). Established history (21+ yrs). Point 3 Rating: 5★ (top quartile). Rating: 5★ (lower mid). Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Top rated. Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 4.12% (bottom quartile). 5Y return: 21.46% (top quartile). 5Y return: 17.18% (upper mid). 5Y return: 24.04% (top quartile). 5Y return: 13.43% (bottom quartile). 5Y return: 17.37% (upper mid). 5Y return: 14.36% (bottom quartile). 5Y return: 17.54% (top quartile). 5Y return: 14.99% (lower mid). 5Y return: 15.22% (lower mid). 5Y return: 15.15% (lower mid). 5Y return: 14.45% (lower mid). 5Y return: 12.88% (bottom quartile). 5Y return: 16.81% (upper mid). 5Y return: 16.67% (upper mid). Point 6 3Y return: 16.78% (bottom quartile). 3Y return: 25.07% (top quartile). 3Y return: 23.63% (upper mid). 3Y return: 28.56% (top quartile). 3Y return: 18.25% (lower mid). 3Y return: 20.48% (lower mid). 3Y return: 18.18% (bottom quartile). 3Y return: 24.82% (top quartile). 3Y return: 18.80% (lower mid). 3Y return: 23.24% (upper mid). 3Y return: 22.92% (upper mid). 3Y return: 17.14% (bottom quartile). 3Y return: 16.65% (bottom quartile). 3Y return: 21.39% (upper mid). 3Y return: 20.14% (lower mid). Point 7 1Y return: 41.22% (top quartile). 1Y return: 38.81% (top quartile). 1Y return: 34.28% (top quartile). 1Y return: 24.24% (upper mid). 1Y return: 22.11% (upper mid). 1Y return: 20.63% (upper mid). 1Y return: 19.26% (upper mid). 1Y return: 18.90% (lower mid). 1Y return: 18.90% (lower mid). 1Y return: 18.68% (lower mid). 1Y return: 18.58% (lower mid). 1Y return: 17.64% (bottom quartile). 1Y return: 16.95% (bottom quartile). 1Y return: 16.34% (bottom quartile). 1Y return: 14.89% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 2.18 (top quartile). Alpha: 0.00 (lower mid). Alpha: 0.61 (upper mid). Alpha: 2.61 (top quartile). Alpha: 3.74 (top quartile). Alpha: -0.94 (bottom quartile). Alpha: 0.00 (lower mid). 1M return: 4.56% (upper mid). 1M return: 4.54% (upper mid). Alpha: -0.76 (lower mid). Alpha: -2.00 (bottom quartile). Alpha: 1.22 (upper mid). Alpha: 0.27 (upper mid). Point 9 Sharpe: 2.24 (top quartile). Sharpe: 1.32 (top quartile). Sharpe: 1.15 (top quartile). Sharpe: 0.21 (lower mid). Sharpe: 1.03 (upper mid). Sharpe: 0.44 (upper mid). Sharpe: 0.46 (upper mid). Sharpe: 0.19 (lower mid). Sharpe: 0.01 (bottom quartile). Alpha: -0.79 (bottom quartile). Alpha: -0.88 (bottom quartile). Sharpe: 0.14 (bottom quartile). Sharpe: 0.78 (upper mid). Sharpe: 0.34 (lower mid). Sharpe: 0.22 (lower mid). Point 10 Information ratio: 0.00 (lower mid). Information ratio: 0.00 (lower mid). Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.25 (upper mid). Information ratio: 0.08 (upper mid). Information ratio: 0.19 (upper mid). Information ratio: 0.56 (top quartile). Information ratio: 0.00 (upper mid). Sharpe: 0.17 (bottom quartile). Sharpe: 0.16 (bottom quartile). Information ratio: -0.35 (bottom quartile). Information ratio: -0.01 (lower mid). Information ratio: 0.30 (top quartile). Information ratio: 0.89 (top quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Kotak Equity Opportunities Fund

Kotak Standard Multicap Fund

Invesco India Growth Opportunities Fund

Aditya Birla Sun Life Small Cap Fund

ICICI Prudential Nifty Next 50 Index Fund

IDBI Nifty Junior Index Fund

Tata India Tax Savings Fund

ICICI Prudential Banking and Financial Services Fund

DSP Equity Opportunities Fund

Tata Equity PE Fund

An open-end diversified equity fund that seeks to provide medium to long term appreciation through investments primarily in Asian Companies / sectors (excluding Japan) with long term potential across market capitalisation. Below is the key information for Franklin Asian Equity Fund Returns up to 1 year are on To seek to generate capital appreciation and provide long term growth opportunities by investing in equity and equity related securities of companies domiciled in India whose predominant economic activity is in the (a) discovery, development, production, or distribution of natural resources, viz., energy, mining etc; (b) alternative energy and energy technology sectors, with emphasis given to renewable energy, automotive and on-site power generation, energy storage and enabling energy technologies. also invest a certain portion of its corpus in the equity and equity related securities of companies domiciled overseas, which are principally engaged in the discovery, development, production or distribution of natural resources and alternative energy and/or the units shares of Merrill Lynch international Investment Funds New Energy Fund, Merrill Lynch International Investment Funds World Energy Fund and similar other overseas mutual fund schemes. Research Highlights for DSP Natural Resources and New Energy Fund Below is the key information for DSP Natural Resources and New Energy Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of BGF – USFEF. The Scheme may, at the discretion of the Investment Manager also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized. It shall be noted ‘similar overseas mutual fund schemes’ shall have investment objective, investment strategy and risk profile/consideration similar to those of BGF – USFEF. Research Highlights for DSP US Flexible Equity Fund Below is the key information for DSP US Flexible Equity Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Research Highlights for Aditya Birla Sun Life Banking And Financial Services Fund Below is the key information for Aditya Birla Sun Life Banking And Financial Services Fund Returns up to 1 year are on (Erstwhile Kotak Opportunities Scheme) To generate capital appreciation from a diversified portfolio of equity and equity

related securities. However, there is no assurance that the objective of the scheme will be realized. Research Highlights for Kotak Equity Opportunities Fund Below is the key information for Kotak Equity Opportunities Fund Returns up to 1 year are on (Erstwhile Kotak Select Focus Fund) The investment objective of the scheme is to generate long term appreciation from the portfolio of equity and equity related sectors, generally focussed on few selected sectors. Research Highlights for Kotak Standard Multicap Fund Below is the key information for Kotak Standard Multicap Fund Returns up to 1 year are on (Erstwhile Invesco India Growth Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversified portfolio of predominantly equity and equity-related securities. However, there can be no assurance that the objectives of the scheme will be achieved. Research Highlights for Invesco India Growth Opportunities Fund Below is the key information for Invesco India Growth Opportunities Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Small & Midcap Fund) An Open ended Small and Mid Cap Equity Scheme with an objective to generate consistent long-term capital appreciation by investing predominantly in equity and equity related securities of companies considered to be small and midcap. The Scheme may also invest a certain portion of its corpus in fixed income securities including money market instruments, in order to meet liquidity requirements from time to time. Research Highlights for Aditya Birla Sun Life Small Cap Fund Below is the key information for Aditya Birla Sun Life Small Cap Fund Returns up to 1 year are on The fund's objective is to invest in companies whose securities are included in Nifty Junior Index and to endeavor to achieve the returns of the above index as closely as possible, though subject to tracking error. The fund intends to track only 90-95% of the Index i.e. it will always keep cash balance between 5-10% of the Net Asset to meet the redemption and other liquidity requirements. However, as and when the liquidity in the Index improves the fund intends to track up to 100% of the Index. The fund will not seek to outperform the CNX Nifty Junior. The objective is that the performance of the NAV of the fund should closely track the performance of the CNX Nifty Junior over the same period subject to tracking error. Research Highlights for ICICI Prudential Nifty Next 50 Index Fund Below is the key information for ICICI Prudential Nifty Next 50 Index Fund Returns up to 1 year are on The investment objective of the scheme is to invest in the stocks and equity related instruments comprising the CNX Nifty Junior Index in the same weights as these stocks represented in the Index with the intent to replicate the performance of the Total Returns Index of CNX Nifty Junior Index. The scheme will adopt a passive investment strategy and will seek to achieve the investment objective by minimizing the tracking error between the CNX Nifty Junior Index (Total Returns Index) and the scheme. Research Highlights for IDBI Nifty Junior Index Fund Below is the key information for IDBI Nifty Junior Index Fund Returns up to 1 year are on To provide medium to long term capital gains along with income tax relief to its Unitholders, while at all times emphasising the importance of capital appreciation.. Research Highlights for Tata India Tax Savings Fund Below is the key information for Tata India Tax Savings Fund Returns up to 1 year are on ICICI Prudential Banking and Financial Services Fund is an Open-ended equity scheme that seeks to generate long-term capital appreciation to unitholders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for ICICI Prudential Banking and Financial Services Fund Below is the key information for ICICI Prudential Banking and Financial Services Fund Returns up to 1 year are on (Erstwhile DSP BlackRock Opportunities Fund) The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of large and midcap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized Research Highlights for DSP Equity Opportunities Fund Below is the key information for DSP Equity Opportunities Fund Returns up to 1 year are on To provide reasonable and regular income and/ or possible capital appreciation to its Unitholder. Research Highlights for Tata Equity PE Fund Below is the key information for Tata Equity PE Fund Returns up to 1 year are on 1. Franklin Asian Equity Fund

Franklin Asian Equity Fund

Growth Launch Date 16 Jan 08 NAV (26 Feb 26) ₹40.288 ↑ 0.27 (0.68 %) Net Assets (Cr) ₹372 on 31 Jan 26 Category Equity - Global AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.54 Sharpe Ratio 2.24 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-3 Years (1%),3 Years and above(NIL) Sub Cat. Global Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹8,504 28 Feb 23 ₹7,614 29 Feb 24 ₹7,584 28 Feb 25 ₹8,556 28 Feb 26 ₹12,188 Returns for Franklin Asian Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 6.8% 3 Month 16.5% 6 Month 26.1% 1 Year 41.2% 3 Year 16.8% 5 Year 4.1% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 23.7% 2023 14.4% 2022 0.7% 2021 -14.5% 2020 -5.9% 2019 25.8% 2018 28.2% 2017 -13.6% 2016 35.5% 2015 7.2% Fund Manager information for Franklin Asian Equity Fund

Name Since Tenure Sandeep Manam 18 Oct 21 4.29 Yr. Shyam Sriram 26 Sep 24 1.35 Yr. Data below for Franklin Asian Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Technology 30.83% Consumer Cyclical 22.8% Financial Services 17.15% Industrials 8.16% Communication Services 5.67% Health Care 4.72% Basic Materials 2.87% Real Estate 2.54% Utility 0.92% Asset Allocation

Asset Class Value Cash 4.34% Equity 95.66% Top Securities Holdings / Portfolio

Name Holding Value Quantity Taiwan Semiconductor Manufacturing Co Ltd (Technology)

Equity, Since 31 Mar 09 | 233010% ₹36 Cr 70,000 Samsung Electronics Co Ltd (Technology)

Equity, Since 31 Mar 08 | 0059306% ₹21 Cr 20,911 SK Hynix Inc (Technology)

Equity, Since 30 Jun 20 | 0006606% ₹21 Cr 3,567 Tencent Holdings Ltd (Communication Services)

Equity, Since 31 Jul 14 | 007005% ₹18 Cr 25,200 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 25 | HDFCBANK5% ₹17 Cr 187,442 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 25 | ICICIBANK3% ₹13 Cr 93,555

↑ 6,860 Hyundai Motor Co (Consumer Cyclical)

Equity, Since 31 Aug 22 | 0053803% ₹10 Cr 3,275

↓ -839 Alibaba Group Holding Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Dec 20 | 099883% ₹10 Cr 52,104 MediaTek Inc (Technology)

Equity, Since 31 Aug 20 | 24543% ₹10 Cr 19,000

↓ -2,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 24 | LT3% ₹10 Cr 24,471

↑ 7,009 2. DSP Natural Resources and New Energy Fund

DSP Natural Resources and New Energy Fund

Growth Launch Date 25 Apr 08 NAV (26 Feb 26) ₹110.438 ↑ 0.34 (0.31 %) Net Assets (Cr) ₹1,765 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio 1.32 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Sub Cat. Sectoral Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,942 28 Feb 23 ₹13,335 29 Feb 24 ₹19,096 28 Feb 25 ₹18,712 28 Feb 26 ₹26,378 Returns for DSP Natural Resources and New Energy Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 8.6% 3 Month 15.2% 6 Month 25.4% 1 Year 38.8% 3 Year 25.1% 5 Year 21.5% 10 Year 15 Year Since launch 14.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.5% 2023 13.9% 2022 31.2% 2021 9.8% 2020 42.8% 2019 11.5% 2018 4.4% 2017 -15.3% 2016 43.1% 2015 43.1% Fund Manager information for DSP Natural Resources and New Energy Fund

Name Since Tenure Rohit Singhania 1 Jul 12 13.6 Yr. Data below for DSP Natural Resources and New Energy Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Energy 42.96% Basic Materials 36.91% Utility 7.36% Industrials 1.62% Technology 1.28% Consumer Cyclical 0.11% Asset Allocation

Asset Class Value Cash 9.76% Equity 90.24% Debt 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Energy I2

Investment Fund | -11% ₹192 Cr 602,478

↑ 214,175 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 May 20 | ONGC9% ₹159 Cr 5,905,732

↑ 107,567 Jindal Steel Ltd (Basic Materials)

Equity, Since 31 Mar 20 | JINDALSTEL9% ₹154 Cr 1,356,666 Tata Steel Ltd (Basic Materials)

Equity, Since 31 Aug 16 | TATASTEEL9% ₹153 Cr 7,896,586 Oil India Ltd (Energy)

Equity, Since 29 Feb 24 | OIL6% ₹100 Cr 1,954,429

↑ 363,081 National Aluminium Co Ltd (Basic Materials)

Equity, Since 28 Feb 22 | NATIONALUM5% ₹94 Cr 2,439,055 BGF Sustainable Energy I2

Investment Fund | -5% ₹80 Cr 330,203 Coal India Ltd (Energy)

Equity, Since 31 Mar 22 | COALINDIA4% ₹68 Cr 1,533,115 Hindalco Industries Ltd (Basic Materials)

Equity, Since 31 Oct 15 | HINDALCO4% ₹67 Cr 691,612

↓ -127,079 Petronet LNG Ltd (Energy)

Equity, Since 31 Jan 18 | PETRONET4% ₹63 Cr 2,180,366

↓ -116,682 3. DSP US Flexible Equity Fund

DSP US Flexible Equity Fund

Growth Launch Date 3 Aug 12 NAV (26 Feb 26) ₹78.698 ↓ -0.52 (-0.65 %) Net Assets (Cr) ₹1,119 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆☆ Risk High Expense Ratio 1.55 Sharpe Ratio 1.15 Information Ratio -0.16 Alpha Ratio 2.18 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Sub Cat. Global Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,278 28 Feb 23 ₹11,792 29 Feb 24 ₹14,474 28 Feb 25 ₹16,363 28 Feb 26 ₹21,901 Returns for DSP US Flexible Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month -1% 3 Month 5.4% 6 Month 16.9% 1 Year 34.3% 3 Year 23.6% 5 Year 17.2% 10 Year 15 Year Since launch 16.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 33.8% 2023 17.8% 2022 22% 2021 -5.9% 2020 24.2% 2019 22.6% 2018 27.5% 2017 -1.1% 2016 15.5% 2015 9.8% Fund Manager information for DSP US Flexible Equity Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP US Flexible Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Technology 33.69% Communication Services 14.82% Financial Services 14.37% Health Care 10.6% Industrials 9.72% Consumer Cyclical 9.62% Basic Materials 2.33% Energy 2.21% Asset Allocation

Asset Class Value Cash 2.63% Equity 97.36% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF US Flexible Equity I2

Investment Fund | -99% ₹1,106 Cr 1,881,749 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹15 Cr Net Receivables/Payables

Net Current Assets | -0% -₹2 Cr 4. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (27 Feb 26) ₹148.681 ↓ -1.28 (-0.86 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Sub Cat. Sectoral Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,098 28 Feb 23 ₹13,800 29 Feb 24 ₹23,698 28 Feb 25 ₹23,292 28 Feb 26 ₹29,368 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 8.1% 3 Month 2.1% 6 Month 6.6% 1 Year 24.2% 3 Year 28.6% 5 Year 24% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000 5. Aditya Birla Sun Life Banking And Financial Services Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Growth Launch Date 14 Dec 13 NAV (27 Feb 26) ₹63.89 ↓ -1.06 (-1.63 %) Net Assets (Cr) ₹3,641 on 31 Jan 26 Category Equity - Sectoral AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio 1.03 Information Ratio 0.25 Alpha Ratio 0.61 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Sub Cat. Sectoral Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,667 28 Feb 23 ₹11,358 29 Feb 24 ₹14,691 28 Feb 25 ₹15,262 28 Feb 26 ₹18,780 Returns for Aditya Birla Sun Life Banking And Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.9% 3 Month -1.2% 6 Month 8% 1 Year 22.1% 3 Year 18.2% 5 Year 13.4% 10 Year 15 Year Since launch 16.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.5% 2023 8.7% 2022 21.7% 2021 11.5% 2020 16.8% 2019 1.1% 2018 14.9% 2017 -2.4% 2016 47.6% 2015 15.7% Fund Manager information for Aditya Birla Sun Life Banking And Financial Services Fund

Name Since Tenure Dhaval Gala 26 Aug 15 10.44 Yr. Data below for Aditya Birla Sun Life Banking And Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 94.64% Technology 1% Asset Allocation

Asset Class Value Cash 4.36% Equity 95.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | ICICIBANK14% ₹504 Cr 3,717,929

↓ -960,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | HDFCBANK14% ₹503 Cr 5,408,496 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | AXISBANK9% ₹315 Cr 2,302,100 State Bank of India (Financial Services)

Equity, Since 31 Oct 17 | SBIN6% ₹207 Cr 1,918,689 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | BAJFINANCE5% ₹199 Cr 2,137,250 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 19 | KOTAKBANK4% ₹145 Cr 3,546,665 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | AUBANK4% ₹132 Cr 1,346,861 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹122 Cr 1,198,382 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹103 Cr 565,076 Billionbrains Garage Ventures Ltd (Financial Services)

Equity, Since 30 Nov 25 | GROWW2% ₹91 Cr 5,134,395 6. Kotak Equity Opportunities Fund

Kotak Equity Opportunities Fund

Growth Launch Date 9 Sep 04 NAV (27 Feb 26) ₹355.699 ↓ -4.19 (-1.17 %) Net Assets (Cr) ₹29,991 on 31 Jan 26 Category Equity - Large & Mid Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.6 Sharpe Ratio 0.44 Information Ratio 0.08 Alpha Ratio 2.61 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Sub Cat. Large & Mid Cap Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,757 28 Feb 23 ₹12,693 29 Feb 24 ₹17,596 28 Feb 25 ₹18,065 28 Feb 26 ₹22,274 Returns for Kotak Equity Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.9% 3 Month 0.3% 6 Month 5.8% 1 Year 20.6% 3 Year 20.5% 5 Year 17.4% 10 Year 15 Year Since launch 18.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 5.6% 2023 24.2% 2022 29.3% 2021 7% 2020 30.4% 2019 16.5% 2018 13.2% 2017 -5.6% 2016 34.9% 2015 9.6% Fund Manager information for Kotak Equity Opportunities Fund

Name Since Tenure Harsha Upadhyaya 4 Aug 12 13.5 Yr. Data below for Kotak Equity Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 29.59% Industrials 16.54% Consumer Cyclical 12.56% Basic Materials 11.94% Technology 7.29% Health Care 7.15% Energy 5.31% Communication Services 2.92% Utility 2.4% Consumer Defensive 1.48% Real Estate 0.8% Asset Allocation

Asset Class Value Cash 0.99% Equity 99.01% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | HDFCBANK6% ₹1,812 Cr 19,500,000 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN4% ₹1,346 Cr 12,500,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 18 | BEL4% ₹1,257 Cr 28,000,000 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹958 Cr 35,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | ICICIBANK3% ₹949 Cr 7,000,000 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY3% ₹875 Cr 5,330,405 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | AXISBANK3% ₹850 Cr 6,200,000 Coromandel International Ltd (Basic Materials)

Equity, Since 30 Nov 16 | COROMANDEL2% ₹742 Cr 3,250,001 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 13 | LT2% ₹727 Cr 1,850,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 28 Feb 21 | BHARTIARTL2% ₹719 Cr 3,650,000 7. Kotak Standard Multicap Fund

Kotak Standard Multicap Fund

Growth Launch Date 11 Sep 09 NAV (27 Feb 26) ₹87.09 ↓ -1.07 (-1.21 %) Net Assets (Cr) ₹56,479 on 31 Jan 26 Category Equity - Multi Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 0.46 Information Ratio 0.19 Alpha Ratio 3.74 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Sub Cat. Multi Cap Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,238 28 Feb 23 ₹11,798 29 Feb 24 ₹15,664 28 Feb 25 ₹16,077 28 Feb 26 ₹19,559 Returns for Kotak Standard Multicap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 2.2% 3 Month -0.8% 6 Month 4.2% 1 Year 19.3% 3 Year 18.2% 5 Year 14.4% 10 Year 15 Year Since launch 14.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.5% 2023 16.5% 2022 24.2% 2021 5% 2020 25.4% 2019 11.8% 2018 12.3% 2017 -0.9% 2016 34.3% 2015 9.4% Fund Manager information for Kotak Standard Multicap Fund

Name Since Tenure Harsha Upadhyaya 4 Aug 12 13.5 Yr. Data below for Kotak Standard Multicap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 29.69% Industrials 18.37% Basic Materials 14.81% Consumer Cyclical 11.1% Technology 7.13% Energy 5.9% Utility 3.15% Communication Services 3% Health Care 2.65% Consumer Defensive 2.14% Asset Allocation

Asset Class Value Cash 2.05% Equity 97.95% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK6% ₹3,671 Cr 39,500,000 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Aug 14 | BEL6% ₹3,592 Cr 80,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 10 | ICICIBANK5% ₹2,981 Cr 22,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jan 12 | SBIN5% ₹2,564 Cr 23,800,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 May 12 | AXISBANK4% ₹2,193 Cr 16,000,000 Jindal Steel Ltd (Basic Materials)

Equity, Since 31 Mar 18 | JINDALSTEL4% ₹2,151 Cr 19,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 13 | LT4% ₹2,084 Cr 5,300,000 SRF Ltd (Industrials)

Equity, Since 31 Dec 18 | SRF3% ₹1,760 Cr 6,250,000 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 Aug 23 | 5433203% ₹1,751 Cr 64,000,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | ULTRACEMCO3% ₹1,745 Cr 1,375,000 8. Invesco India Growth Opportunities Fund

Invesco India Growth Opportunities Fund

Growth Launch Date 9 Aug 07 NAV (27 Feb 26) ₹98.19 ↓ -1.00 (-1.01 %) Net Assets (Cr) ₹8,959 on 31 Jan 26 Category Equity - Large & Mid Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.82 Sharpe Ratio 0.19 Information Ratio 0.56 Alpha Ratio -0.94 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Sub Cat. Large & Mid Cap Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,243 28 Feb 23 ₹11,536 29 Feb 24 ₹17,100 28 Feb 25 ₹18,501 28 Feb 26 ₹22,438 Returns for Invesco India Growth Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 4.6% 3 Month -5.6% 6 Month -3.3% 1 Year 18.9% 3 Year 24.8% 5 Year 17.5% 10 Year 15 Year Since launch 13.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.7% 2023 37.5% 2022 31.6% 2021 -0.4% 2020 29.7% 2019 13.3% 2018 10.7% 2017 -0.2% 2016 39.6% 2015 3.3% Fund Manager information for Invesco India Growth Opportunities Fund

Name Since Tenure Aditya Khemani 9 Nov 23 2.23 Yr. Data below for Invesco India Growth Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 31.05% Consumer Cyclical 19.34% Health Care 19.06% Industrials 12.07% Real Estate 6.75% Technology 4.98% Basic Materials 4.61% Communication Services 1.66% Asset Allocation

Asset Class Value Cash 0.46% Equity 99.52% Top Securities Holdings / Portfolio

Name Holding Value Quantity Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 30 Nov 22 | MAXHEALTH7% ₹591 Cr 6,175,405

↑ 1,293,178 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Mar 24 | INDIGO6% ₹520 Cr 1,130,285

↑ 37,299 Eternal Ltd (Consumer Cyclical)

Equity, Since 30 Jun 23 | 5433205% ₹451 Cr 16,475,309 BSE Ltd (Financial Services)

Equity, Since 31 Oct 23 | BSE5% ₹442 Cr 1,580,775 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 28 Feb 23 | CHOLAFIN4% ₹400 Cr 2,449,413 L&T Finance Ltd (Financial Services)

Equity, Since 30 Apr 24 | LTF4% ₹384 Cr 13,404,597 Trent Ltd (Consumer Cyclical)

Equity, Since 28 Feb 22 | TRENT4% ₹372 Cr 983,522 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | FEDERALBNK4% ₹358 Cr 12,449,121

↓ -1,486,959 Sai Life Sciences Ltd (Healthcare)

Equity, Since 31 Dec 24 | SAILIFE4% ₹358 Cr 4,283,799 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 15 | ICICIBANK4% ₹347 Cr 2,562,012

↑ 1,450,274 9. Aditya Birla Sun Life Small Cap Fund

Aditya Birla Sun Life Small Cap Fund

Growth Launch Date 31 May 07 NAV (27 Feb 26) ₹84.0292 ↓ -1.02 (-1.20 %) Net Assets (Cr) ₹4,778 on 31 Jan 26 Category Equity - Small Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio 0.01 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Sub Cat. Small Cap Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,988 28 Feb 23 ₹12,024 29 Feb 24 ₹17,652 28 Feb 25 ₹16,665 28 Feb 26 ₹20,103 Returns for Aditya Birla Sun Life Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5% 3 Month -2.8% 6 Month 0.5% 1 Year 18.9% 3 Year 18.8% 5 Year 15% 10 Year 15 Year Since launch 12% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 21.5% 2022 39.4% 2021 -6.5% 2020 51.4% 2019 19.8% 2018 -11.5% 2017 -22.6% 2016 56.7% 2015 9.7% Fund Manager information for Aditya Birla Sun Life Small Cap Fund

Name Since Tenure Abhinav Khandelwal 31 Oct 24 1.25 Yr. Dhaval Joshi 21 Nov 22 3.2 Yr. Data below for Aditya Birla Sun Life Small Cap Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 23.97% Consumer Cyclical 15.76% Industrials 14.94% Health Care 13.54% Basic Materials 12.16% Consumer Defensive 7.28% Real Estate 4.39% Technology 2.1% Utility 1.38% Asset Allocation

Asset Class Value Cash 4.48% Equity 95.52% Top Securities Holdings / Portfolio

Name Holding Value Quantity Navin Fluorine International Ltd (Basic Materials)

Equity, Since 31 Jul 20 | NAVINFLUOR3% ₹146 Cr 240,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 Dec 24 | MCX3% ₹143 Cr 566,000

↓ -75,000 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Nov 24 | 5900033% ₹123 Cr 4,072,155

↑ 263,819 TD Power Systems Ltd (Industrials)

Equity, Since 30 Jun 23 | TDPOWERSYS2% ₹107 Cr 1,462,004

↓ -37,996 CCL Products (India) Ltd (Consumer Defensive)

Equity, Since 31 May 20 | CCL2% ₹105 Cr 1,078,825 Sai Life Sciences Ltd (Healthcare)

Equity, Since 30 Jun 25 | SAILIFE2% ₹104 Cr 1,245,785

↑ 20,000 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Mar 25 | UJJIVANSFB2% ₹97 Cr 14,830,393

↑ 3,000,000 Ramco Cements Ltd (Basic Materials)

Equity, Since 28 Feb 25 | RAMCOCEM2% ₹96 Cr 858,998

↑ 61,414 PNB Housing Finance Ltd (Financial Services)

Equity, Since 31 Aug 24 | PNBHOUSING2% ₹89 Cr 1,081,130

↑ 25,000 Manappuram Finance Ltd (Financial Services)

Equity, Since 31 Jul 25 | MANAPPURAM2% ₹83 Cr 2,931,940

↑ 200,000 10. ICICI Prudential Nifty Next 50 Index Fund

ICICI Prudential Nifty Next 50 Index Fund

Growth Launch Date 25 Jun 10 NAV (27 Feb 26) ₹61.2116 ↓ -0.81 (-1.30 %) Net Assets (Cr) ₹8,103 on 31 Jan 26 Category Others - Index Fund AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.17 Information Ratio -6.81 Alpha Ratio -0.79 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Sub Cat. Index Fund Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,675 28 Feb 23 ₹10,881 29 Feb 24 ₹17,215 28 Feb 25 ₹16,621 28 Feb 26 ₹20,311 Returns for ICICI Prudential Nifty Next 50 Index Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 4.6% 3 Month 0.9% 6 Month 4.2% 1 Year 18.7% 3 Year 23.2% 5 Year 15.2% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2.1% 2023 27.2% 2022 26.3% 2021 0.1% 2020 29.5% 2019 14.3% 2018 0.6% 2017 -8.8% 2016 45.7% 2015 7.6% Fund Manager information for ICICI Prudential Nifty Next 50 Index Fund

Name Since Tenure Nishit Patel 18 Jan 21 5.04 Yr. Ajaykumar Solanki 1 Feb 24 2 Yr. Ashwini Shinde 18 Dec 24 1.12 Yr. Data below for ICICI Prudential Nifty Next 50 Index Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 0.08% Equity 99.88% Top Securities Holdings / Portfolio

Name Holding Value Quantity Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 21 | VEDL5% ₹413 Cr 6,063,111

↑ 66,403 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 30 Sep 22 | HAL4% ₹313 Cr 678,121

↑ 7,419 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TVSMOTOR4% ₹309 Cr 839,152

↑ 9,183 Divi's Laboratories Ltd (Healthcare)

Equity, Since 30 Sep 24 | DIVISLAB3% ₹275 Cr 454,113

↑ 4,968 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Mar 25 | BPCL3% ₹253 Cr 6,927,526

↑ 75,869 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Mar 25 | BRITANNIA3% ₹247 Cr 421,515

↑ 4,611 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 30 Sep 21 | CHOLAFIN3% ₹247 Cr 1,511,537

↑ 16,549 Varun Beverages Ltd (Consumer Defensive)

Equity, Since 31 Mar 23 | VBL3% ₹230 Cr 4,891,051

↑ 53,565 Tata Power Co Ltd (Utilities)

Equity, Since 31 Aug 22 | TATAPOWER3% ₹220 Cr 6,001,759

↑ 65,730 Indian Oil Corp Ltd (Energy)

Equity, Since 31 Mar 22 | IOC3% ₹218 Cr 13,354,177

↑ 146,260 11. IDBI Nifty Junior Index Fund

IDBI Nifty Junior Index Fund

Growth Launch Date 20 Sep 10 NAV (27 Feb 26) ₹51.6352 ↓ -0.68 (-1.29 %) Net Assets (Cr) ₹98 on 31 Jan 26 Category Others - Index Fund AMC IDBI Asset Management Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 0.86 Sharpe Ratio 0.16 Information Ratio -7.59 Alpha Ratio -0.88 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Sub Cat. Index Fund Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,697 28 Feb 23 ₹10,928 29 Feb 24 ₹17,191 28 Feb 25 ₹16,582 28 Feb 26 ₹20,243 Returns for IDBI Nifty Junior Index Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 4.5% 3 Month 0.8% 6 Month 4.1% 1 Year 18.6% 3 Year 22.9% 5 Year 15.1% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 2% 2023 26.9% 2022 25.7% 2021 0.4% 2020 29.6% 2019 13.7% 2018 0.5% 2017 -9.3% 2016 43.6% 2015 6.9% Fund Manager information for IDBI Nifty Junior Index Fund

Name Since Tenure Sumit Bhatnagar 3 Oct 23 2.33 Yr. Data below for IDBI Nifty Junior Index Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 0.2% Equity 99.76% Top Securities Holdings / Portfolio

Name Holding Value Quantity Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 21 | VEDL5% ₹5 Cr 73,349

↑ 323 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 30 Sep 22 | HAL4% ₹4 Cr 8,220

↑ 28 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | TVSMOTOR4% ₹4 Cr 10,179

↑ 78 Divi's Laboratories Ltd (Healthcare)

Equity, Since 30 Sep 24 | DIVISLAB3% ₹3 Cr 5,483

↓ -10 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Mar 25 | BPCL3% ₹3 Cr 83,789

↑ 583 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 30 Sep 21 | CHOLAFIN3% ₹3 Cr 18,293

↑ 139 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Mar 25 | BRITANNIA3% ₹3 Cr 5,086

↓ -10 Varun Beverages Ltd (Consumer Defensive)

Equity, Since 31 Mar 23 | VBL3% ₹3 Cr 59,223

↑ 921 Tata Power Co Ltd (Utilities)

Equity, Since 31 Aug 22 | TATAPOWER3% ₹3 Cr 72,891

↑ 465 Indian Oil Corp Ltd (Energy)

Equity, Since 31 Mar 22 | IOC3% ₹3 Cr 161,388

↑ 1,060 12. Tata India Tax Savings Fund

Tata India Tax Savings Fund

Growth Launch Date 13 Oct 14 NAV (27 Feb 26) ₹45.8014 ↓ -0.43 (-0.94 %) Net Assets (Cr) ₹4,566 on 31 Jan 26 Category Equity - ELSS AMC Tata Asset Management Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio 0.14 Information Ratio -0.35 Alpha Ratio -0.76 Min Investment 500 Min SIP Investment 500 Exit Load NIL Sub Cat. ELSS Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,546 28 Feb 23 ₹12,189 29 Feb 24 ₹16,029 28 Feb 25 ₹16,422 28 Feb 26 ₹19,638 Returns for Tata India Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 4% 3 Month -1.3% 6 Month 5.6% 1 Year 17.6% 3 Year 17.1% 5 Year 14.5% 10 Year 15 Year Since launch 14.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.9% 2023 19.5% 2022 24% 2021 5.9% 2020 30.4% 2019 11.9% 2018 13.6% 2017 -8.4% 2016 46% 2015 2.1% Fund Manager information for Tata India Tax Savings Fund

Name Since Tenure Sailesh Jain 16 Dec 21 4.13 Yr. Data below for Tata India Tax Savings Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.01% Industrials 13.51% Consumer Cyclical 12.82% Basic Materials 7.07% Technology 6.29% Energy 5.29% Health Care 5.2% Communication Services 4.89% Utility 2.69% Real Estate 1.99% Consumer Defensive 1.05% Asset Allocation

Asset Class Value Cash 5.2% Equity 94.8% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | HDFCBANK7% ₹318 Cr 3,425,000

↓ -25,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK6% ₹285 Cr 2,100,000

↓ -25,000 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 30 Nov 21 | 8901575% ₹223 Cr 1,426,428

↑ 1,330,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 18 | SBIN5% ₹220 Cr 2,040,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 18 | RELIANCE4% ₹188 Cr 1,350,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 18 | INFY3% ₹146 Cr 891,081

↓ -175,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 16 | LT3% ₹138 Cr 352,147 NTPC Ltd (Utilities)

Equity, Since 30 Jun 21 | NTPC3% ₹123 Cr 3,451,000 Samvardhana Motherson International Ltd (Consumer Cyclical)

Equity, Since 30 Nov 22 | MOTHERSON3% ₹115 Cr 10,200,000 City Union Bank Ltd (Financial Services)

Equity, Since 31 Aug 21 | CUB2% ₹100 Cr 3,300,000 13. ICICI Prudential Banking and Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Growth Launch Date 22 Aug 08 NAV (27 Feb 26) ₹136.55 ↓ -2.28 (-1.64 %) Net Assets (Cr) ₹10,951 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 1.83 Sharpe Ratio 0.78 Information Ratio -0.01 Alpha Ratio -2 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Sub Cat. Sectoral Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,687 28 Feb 23 ₹11,553 29 Feb 24 ₹14,160 28 Feb 25 ₹15,531 28 Feb 26 ₹18,324 Returns for ICICI Prudential Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.1% 3 Month -2.6% 6 Month 3.6% 1 Year 16.9% 3 Year 16.6% 5 Year 12.9% 10 Year 15 Year Since launch 16.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.9% 2023 11.6% 2022 17.9% 2021 11.9% 2020 23.5% 2019 -5.5% 2018 14.5% 2017 -0.4% 2016 45.1% 2015 21.1% Fund Manager information for ICICI Prudential Banking and Financial Services Fund

Name Since Tenure Roshan Chutkey 29 Jan 18 8.01 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Banking and Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 94.04% Health Care 1.07% Technology 0.37% Industrials 0.29% Asset Allocation

Asset Class Value Cash 4.18% Equity 95.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK18% ₹1,921 Cr 20,674,867

↓ -1,418,863 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | ICICIBANK14% ₹1,530 Cr 11,290,200

↓ -2,749,373 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | AXISBANK10% ₹1,067 Cr 7,783,679

↑ 1,208,406 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN6% ₹683 Cr 6,340,456

↓ -2,310,000 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE6% ₹647 Cr 3,236,415

↑ 220,210 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 23 | KOTAKBANK5% ₹508 Cr 12,443,955 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 25 | SBICARD4% ₹392 Cr 5,202,910

↑ 2,680,350 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | HDFCLIFE3% ₹383 Cr 5,241,538 LIC Housing Finance Ltd (Financial Services)

Equity, Since 30 Nov 24 | LICHSGFIN3% ₹358 Cr 6,799,870

↑ 2,797,160 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹327 Cr 1,800,328

↑ 253,640 14. DSP Equity Opportunities Fund

DSP Equity Opportunities Fund

Growth Launch Date 16 May 00 NAV (27 Feb 26) ₹633.892 ↓ -6.57 (-1.03 %) Net Assets (Cr) ₹17,434 on 31 Jan 26 Category Equity - Large & Mid Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.72 Sharpe Ratio 0.34 Information Ratio 0.3 Alpha Ratio 1.22 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Sub Cat. Large & Mid Cap Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,453 28 Feb 23 ₹12,144 29 Feb 24 ₹17,384 28 Feb 25 ₹18,389 28 Feb 26 ₹21,747 Returns for DSP Equity Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.6% 3 Month -1% 6 Month 4.6% 1 Year 16.3% 3 Year 21.4% 5 Year 16.8% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.1% 2023 23.9% 2022 32.5% 2021 4.4% 2020 31.2% 2019 14.2% 2018 11.4% 2017 -9.2% 2016 40.1% 2015 11.2% Fund Manager information for DSP Equity Opportunities Fund

Name Since Tenure Rohit Singhania 1 Jun 15 10.68 Yr. Nilesh Aiya 1 Sep 25 0.42 Yr. Data below for DSP Equity Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 37.7% Consumer Cyclical 12.1% Technology 10.24% Health Care 9.3% Basic Materials 8.61% Energy 6.15% Communication Services 3.32% Industrials 3.25% Utility 3.03% Consumer Defensive 2.65% Real Estate 1.59% Asset Allocation

Asset Class Value Cash 1.96% Equity 98.04% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK6% ₹995 Cr 10,703,186

↑ 2,237,872 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 20 | AXISBANK5% ₹863 Cr 6,295,083

↓ -1,578,029 State Bank of India (Financial Services)

Equity, Since 30 Jun 20 | SBIN5% ₹832 Cr 7,727,309 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 16 | ICICIBANK5% ₹798 Cr 5,892,412

↑ 1,155,886 Infosys Ltd (Technology)

Equity, Since 28 Feb 18 | INFY3% ₹589 Cr 3,591,527

↓ -503,563 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 25 | TCS3% ₹447 Cr 1,431,705 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹446 Cr 4,368,288

↑ 256,014 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | KOTAKBANK2% ₹386 Cr 9,472,585 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | M&M2% ₹366 Cr 1,065,842 Coforge Ltd (Technology)

Equity, Since 31 Mar 22 | COFORGE2% ₹364 Cr 2,203,203 15. Tata Equity PE Fund

Tata Equity PE Fund

Growth Launch Date 29 Jun 04 NAV (27 Feb 26) ₹352.434 ↓ -4.10 (-1.15 %) Net Assets (Cr) ₹8,819 on 31 Jan 26 Category Equity - Value AMC Tata Asset Management Limited Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.22 Information Ratio 0.89 Alpha Ratio 0.27 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-18 Months (1%),18 Months and above(NIL) Sub Cat. Value Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹11,489 28 Feb 23 ₹12,484 29 Feb 24 ₹18,382 28 Feb 25 ₹18,497 28 Feb 26 ₹21,614 Returns for Tata Equity PE Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 1.1% 3 Month -2.8% 6 Month 4.2% 1 Year 14.9% 3 Year 20.1% 5 Year 16.7% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 21.7% 2022 37% 2021 5.9% 2020 28% 2019 12.5% 2018 5.3% 2017 -7.1% 2016 39.4% 2015 16.2% Fund Manager information for Tata Equity PE Fund

Name Since Tenure Sonam Udasi 1 Apr 16 9.84 Yr. Data below for Tata Equity PE Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 39.1% Energy 12.12% Consumer Cyclical 9.17% Consumer Defensive 6.46% Communication Services 6.12% Technology 5.81% Utility 4.99% Basic Materials 4.73% Industrials 2.85% Health Care 0.78% Asset Allocation

Asset Class Value Cash 7.87% Equity 92.13% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | ICICIBANK7% ₹659 Cr 4,860,000

↑ 360,000 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 24 | SHRIRAMFIN6% ₹502 Cr 4,923,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | HDFCBANK6% ₹490 Cr 5,274,000

↓ -720,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Dec 23 | BPCL6% ₹489 Cr 13,410,000 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 30 Apr 24 | INDUSTOWER5% ₹431 Cr 9,708,707 Muthoot Finance Ltd (Financial Services)

Equity, Since 30 Apr 23 | MUTHOOTFIN5% ₹420 Cr 1,098,000

↓ -45,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | KOTAKBANK5% ₹408 Cr 9,990,000 Coal India Ltd (Energy)

Equity, Since 31 Mar 22 | COALINDIA4% ₹369 Cr 8,370,000

↑ 1,049,381 Motilal Oswal Financial Services Ltd (Financial Services)

Equity, Since 31 Oct 24 | MOTILALOFS4% ₹313 Cr 4,158,000

↑ 225,000 Wipro Ltd (Technology)

Equity, Since 31 Dec 23 | WIPRO3% ₹297 Cr 12,555,000

↑ 450,000

Mutual Fund Investment Options

Ideally, there are two options to invest in Mutual Funds— SIP and lump sum. In a SIP, an investor can invest periodically, i.e., monthly, quarterly, etc. Whereas, in a lump sum, investors have to make one-time payment as an investment. Here, the deposit does not take place at multiple times.

In a SIP, investors can start their monthly investment with just INR 500, and in a lump sum, one can start investing with INR 5000. If you are a first-time investor, you can either use a sip calculator or a lump sum calculator to pre-determine your investments before investing.

SIP Calculator

When using a SIP calculator, one has to fill certain variables, that include-

- The desired investment duration

- The estimated monthly SIP amount

- Expected inflation rate (annual) for the years to come

- Long-term growth rate on investments

Once you feed all the above-mentioned information, the calculator will end up giving you the amount you will receive (your SIP returns) after the number of years mentioned. Your net profit will be highlighted as well so that you can estimate your goal fulfilment accordingly.

Lump Sum Calculator

Individuals who are new to investment, find it difficult to understand the concept of lumpsum calculator and its functioning. Therefore, to ease out the complexities, the detailed information about the calculation is given. Go through this information to understand the process. The input data that needs to be fed in the lumpsum calculator includes:

- The tenure of lumpsum investment

- The amount of money is being invested through lumpsum mode

- Expected rate of returns in the long-term from equity markets

- Expected annual inflation rate

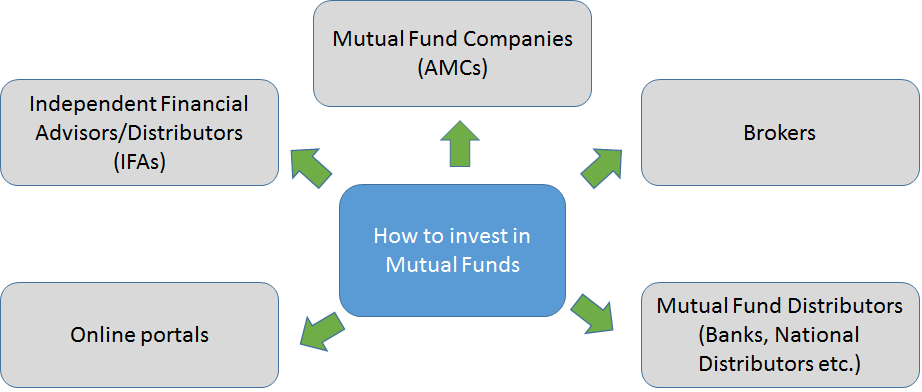

How to Invest in Mutual Funds Online?

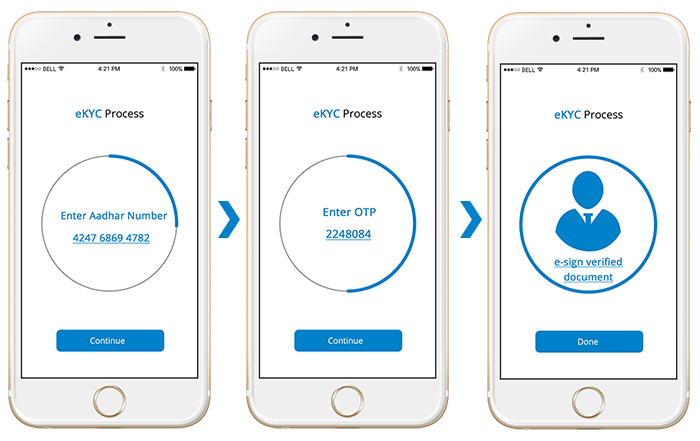

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for Franklin Asian Equity Fund