Index Funds: An Overview

Index Funds are the schemes whose Portfolio resembles that of an index’s portfolio. These schemes invest their corpus in shares that form part of a particular index. Index funds, similar to other funds, also have their own set of advantages.

So, let us understand what is an Index Fund, the top and best Index Fund, features of Index Fund, and the concept of Exchange Traded Fund (ETF) through this article.

What is an Index Fund?

Index Funds are the Mutual Fund schemes who invest their corpus in shares that constitute a part of a particular index. In other words, these schemes mimic the performance of an index. These schemes are designed to track the returns of a particular market index. These schemes can be purchased either as Mutual Funds or as Exchange Traded Funds (ETFs). Also known as Index Tracker Funds, the corpus of these schemes is invested in the exact proportion as they are in the index. As a consequence, whenever, individuals purchase units of Index Funds, they indirectly own a share in the portfolio that has instruments of a particular index.

The performance of Index Fund is dependent on the underlying index’s performance. Resultantly, if the index moves up, the Index Fund’s value also moves up and vice versa. In India, the two major indexes that are used to formulate index funds are Sensex and Nifty. Sensex is the index of Bombay Stock Exchange (BSE) while Nifty is of National Stock Exchange (NSE).

As the name implies, the index fund refers to the mutual fund that looks similar to the index portfolio. Portfolio diversification has become quite a popular option for investors. People are familiar with the benefits of diversifying their portfolios across different industries. While there are plenty of options for novices and experienced investors, Index Funds often draw most of the attention for being the funds associated with Nifty and Sensex.

Index funds must not be confused with actively managed funds, which is one of the reasons why they involve considerably low cost. The funds are not designed to perform better than other funds in the market, but the only purpose of the Index funds is to maintain a high level of uniformity in the market. As the main reason for Investing in index funds is portfolio diversification, these funds help investors manage their risks efficiently.

Talk to our investment specialist

Why Should you Invest in Index Funds?

Likewise, many Mutual Fund schemes, Index Fund too has its own advantages. So, let us look at some of the benefits of investing in Index Fund.

1. Less Expenses as Compared to other Funds

One of the primary advantages of Index Fund lower operating expenses as compared to other schemes. Here, the fund managers need not have a separate team of research analysts to carry out an in-depth research of the companies against which a significant amount is spent. In Index Funds, the manager just needs to replicate the index. Therefore, the expense ratio is lower in case of Index Funds as compared to other schemes.

2. Diversification

An index is a collection of different stocks and securities. They offer diversification to the investor which is the main motive of Asset Allocation. This ensures that the investor does not have all his eggs in one basket.

3. Less Managerial Influence

Since the funds simply follow the movements of the particular index, the manager doesn’t have to choose what stocks to invest in. This is a plus point since the manager’s own style of investing (which may not be in sync with the market at times) does not creep in.

How Does Index Funds Work?

Unlike the actively managed funds, the main goal of the index funds is not to outperform the market, but to ensure that their performance level complements its index. When you invest in the index funds, you could expect returns that either match or is somewhat below or above their benchmark.

There are times when there could be some difference between the performance of the fund and the index. It commonly occurs when there is a tracking error. It is the responsibility of the fund manager to control the tracking error.

As these funds are associated with the index, they are less likely to cause equity-related Volatility issues. Before we discuss whether the index fund is the best option for you, note that these funds might lose their value if the economy faces a downturn.

Fund Selection Methodology used to find 5 funds

Top & Best Index Funds to Invest 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Index Fund - Sensex Plan Growth ₹40.8553

↓ -0.53 ₹957 -5.8 0.1 10.3 11.5 10.4 9.8 LIC MF Index Fund Sensex Growth ₹149.693

↓ -1.97 ₹91 -6 -0.3 9.5 10.9 9.9 9.1 Franklin India Index Fund Nifty Plan Growth ₹200.658

↓ -2.53 ₹766 -4.5 1.2 12.9 13.4 11.3 11.3 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Nippon India Index Fund - Nifty Plan Growth ₹42.2396

↓ -0.53 ₹3,078 -4.5 1.2 13.1 13.5 11.2 11.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex Franklin India Index Fund Nifty Plan IDBI Nifty Index Fund Nippon India Index Fund - Nifty Plan Point 1 Upper mid AUM (₹957 Cr). Bottom quartile AUM (₹91 Cr). Lower mid AUM (₹766 Cr). Bottom quartile AUM (₹208 Cr). Highest AUM (₹3,078 Cr). Point 2 Established history (15+ yrs). Established history (23+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 1★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.41% (bottom quartile). 5Y return: 9.88% (bottom quartile). 5Y return: 11.26% (upper mid). 5Y return: 11.74% (top quartile). 5Y return: 11.21% (lower mid). Point 6 3Y return: 11.55% (bottom quartile). 3Y return: 10.93% (bottom quartile). 3Y return: 13.35% (lower mid). 3Y return: 20.28% (top quartile). 3Y return: 13.47% (upper mid). Point 7 1Y return: 10.28% (bottom quartile). 1Y return: 9.53% (bottom quartile). 1Y return: 12.92% (lower mid). 1Y return: 16.16% (top quartile). 1Y return: 13.09% (upper mid). Point 8 1M return: -1.75% (bottom quartile). 1M return: -1.80% (bottom quartile). 1M return: -0.96% (lower mid). 1M return: 3.68% (top quartile). 1M return: -0.88% (upper mid). Point 9 Alpha: -0.51 (upper mid). Alpha: -1.17 (bottom quartile). Alpha: -0.53 (lower mid). Alpha: -1.03 (bottom quartile). Alpha: -0.47 (top quartile). Point 10 Sharpe: 0.13 (bottom quartile). Sharpe: 0.07 (bottom quartile). Sharpe: 0.25 (lower mid). Sharpe: 1.04 (top quartile). Sharpe: 0.25 (upper mid). Nippon India Index Fund - Sensex Plan

LIC MF Index Fund Sensex

Franklin India Index Fund Nifty Plan

IDBI Nifty Index Fund

Nippon India Index Fund - Nifty Plan

Should you Invest in the Index Funds?

Whether or not you should invest in index funds depends largely on your individual risk preference. If you don’t want to invest in risky commodities and financial instruments, then index funds will be your best bet. The funds are designed specifically for those who expect a predictable and stable return for their investments. You do not need to engage in an extensive level of tracking. These funds make a great choice for those who are interested in investing in equities but aren’t certain about taking the risks that come with the actively managed funds. For those who are on the lookout for funds that could help them earn market-beating returns, the actively managed fund is your best option.

The returns generated from the index fund may or may not be equal to the returns you earn from the actively managed funds. While both perform pretty well, the actively managed funds tend to deliver a better performance in the long run. Not only because of its high return potential but these funds are made for investors that are looking for long-term investment opportunities. However, actively managed funds are not recommended for short-term investors, as they come with market risks. It is a suitable option for only those who are willing to bear the risk.

Index Mutual Funds Vs Index Exchange Traded Funds (ETFs)

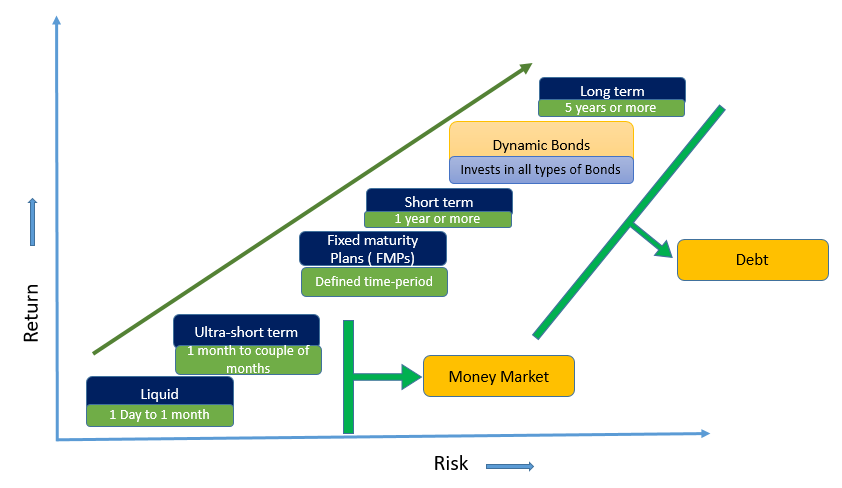

Individuals can invest in Index Tracker Funds either through index funds or through index Exchange Traded Funds or ETFs though there is not much difference between both of them. Individuals investing in Mutual Funds route can purchase the units of the scheme as per the NAV or Net Asset Value at the end of the day. On the contrary, people investing in ETF mode can purchase it throughout the day till the markets are functioning. Also, the cost of both the funds is low. Though the level of flexibility is high in case of ETFs, yet for people whose objective is long-term investing can choose to invest in Index Tracker Funds through Mutual Funds channel.

Index Funds: Passive Investing Strategy

Index Funds follow a passive investing strategy rather than an active investing strategy. This is because, in this scheme, the fund manager replicates the index instead of choosing and trading the shares as per their choice. In this case, the fund manager need not follow a lot of rules. This is because the underlying portfolio of the Index Fund does not change frequently and it changes only when there is a change in the constituents of the index itself.

On the contrary, while adopting active investment strategy, the fund managers need to be careful when they choose and pick instruments. Here, their motto is to outperform the index and not follow the index. In addition, the expense rate in case of actively managed funds is higher as compared to expense ratio of passively managed funds.

The table given below summarizes the differences between active investing and passive investing strategy.

| Active Investing | Passive Investing |

|---|---|

| Analyses and chooses which stocks to pick | Stocks are selected based on the index |

| Goal is to outperform the index | Goal is to follow the index |

| High Transaction fees due to constant research | Low expenses due to less research |

Conclusion

Thus, from the various pointers, it can be said that Index Funds are one of the good investment options. However, individuals should always be careful about investing in any such fund. They should understand thoroughly the modalities of the schemes and check whether the scheme’s methodology is in-line with the scheme’s objectives or not. People can also consult a financial advisor if required. This will help them to ensure that their money is safe and objectives are accomplished on time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.