What is SENSEX?

Investors use indexes to assess a firm's performance or a Mutual Fund scheme. This, in turn, can be used to assess the status of the economy and financial markets. The SENSEX issued by the Bombay Stock Exchange (BSE) and Nifty issued by the National Stock Exchange (NSE) are the most popular financial products.

For quite some time now, almost every news channel has been reporting that the SENSEX has reached an all-time high and that the comeback from the March low is historic.

But what exactly is the SENSEX, and how can you invest in it? This article decrypts the complexities of the SENSEX for novice investors and explains how it is computed in layman's terms.

SENSEX Meaning

The term SENSEX stands for the Stock Exchange Sensitive Index. It represents the total value of the stocks of 30 BSE-listed firms. These are the most actively traded equities and represent some of the world's largest companies.

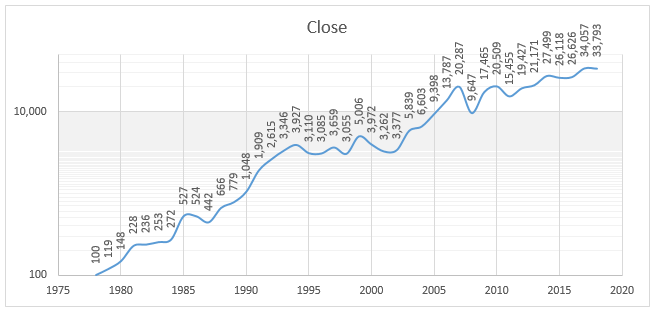

The BSE can revise this list of 30 stocks at any moment. The SENSEX is India's first stock index that was launched by Standard & Poor's (S&P) on January 1, 1986. When the SENSEX is stated to be rising, investors want to purchase equities since it indicates that the economy is expanding.

On the other hand, when it falls, individuals are hesitant to invest in the economy, owing to a lack of faith in the economy's future. Market research experts primarily monitor the SENSEX's movements to better understand the index's overall growth, industry-specific development, national stock market trends, and so on.

Talk to our investment specialist

Eligibility Criteria for Selection

After thorough research, every stock in the SENSEX is only included, ensuring that only high-quality stocks get a place in the index. The 30 stocks are selected based on a number of factors, including-

BSE Listing

The firm must be listed on the BSE; if it is not, it will not be included in the SENSEX index.

Market Capitalisation

To be listed on SENSEX, a company's market capitalisation must be in the large-to-mid range. Companies with a market capitalisation of Rs. 7,000 to 20,000 crores are classified as Large-Caps, whereas companies with a market capitalisation of more than Rs. 20,000 crores are referred to as Mega-Caps.

High Liquidity

Stock must be highly liquid, which indicates the ease of buying and selling that particular stock. As liquidity is a result of the underlying business's quality, it also serves as a screening criterion.

Industry Representation

Another crucial criterion is sector balance. Every sector has a weight assigned to it, which reflects the economy for any given index. Parallel to the Indian equity market, the firm should have a well-balanced and varied sector concentration.

Revenue

The company's core business activity should generate a significant amount of revenue. There are many firms that have been categorised into several sectors based on their basic operations and the type of business they operate in

SENSEX Calculation

Previously, the SENSEX was computed using a method called weighted market capitalisation. However, from September 1, 2003, the Free Float Market Capitalization technique has been used to compute the BSE SENSEX value. Under this method:

A selection is made of 30 firms constituting the index. The formula used is: Free Float Market Capitalisation = Market Capitalisation x FreeFloat Factor The market capitalisation is computed as follows:

Market Capitalisation = share price per share x the number of shares issued by the firm

The free float factor is the % of a company's total shares that are easily available to sell to the general public. This is also a measure of a company's total outstanding shares. This component excludes shares granted to promoters, the government, and others that are not accessible for public trading on the market.

The value of the BSE SENSEX is derived after determining the free-float market capitalisation with the below-mentioned method:

SENSEX Value = (Total free float market capitalization / Base market capitalization) x Base period index value

Note: The base period (year) for this analysis is 1978-79, with a base value of 100 index points

Trading on BSE SENSEX

A DEMAT and a Trading Account are required for investors who intend to trade (buy or sell securities) on the BSE SENSEX. For trading, an investor needs a Bank account and a PAN Card in addition to a trading and Demat account.

Considering that the SENSEX is made up of India's best firms. If you buy one, you become a part-owner of these incredible businesses. Investing in SENSEX can be done in the following ways:

- You can invest directly in the elements of the SENSEX and the weightage they have in that index. This implies you can acquire equities in the same number as their weightage

- You can invest in Index mutual Funds rather than SENSEX. These funds follow the index's Portfolio perfectly as they have the same holdings as the index. As a result, a SENSEX index fund will own the same 30 equities as the SENSEX index

Difference Between SENSEX and Nifty

The SENSEX is the BSE's benchmark index, constituting 30 well-known equities from different industries that are traded on the stock exchange regularly. The NIFTY is a benchmark-based index representing the top 50 equities traded on the NSE out of 1600 businesses.

Nifty, like SENSEX, select equities from a variety of industries. Here is the key difference between Sensex and Nifty:

| Basis | SENSEX | Nifty |

|---|---|---|

| Full form | Sensitive and Index | National and fifty |

| Ownership | BSE | NSE Subsidiary Index and Services and Products Limited (IISL) |

| Base Number | 100 | 1000 |

| Base Period | 1978-79 | November 3rd 1995 |

| Number of Stocks | 30 | 50 |

| Foreign Exchanges | EUREX and stock exchanges of BRCS nations | Singapore Stock Exchange (SGX) and Chicago Mercantile Exchange (SME) |

| Number of Sectors | 13 | 24 |

| Base Capital | NA | 2.06 trillion |

| Former Names | S&P BSE SENSEX | CNX FIFTY |

| Volume and Liquidity | Low | High |

The SENSEX and the Nifty are stock market indexes and benchmarks. They are representative of the whole stock market; therefore, any movement in these two indexes has an impact on the entire market.

The sole distinction is that the SENSEX contains 30 equities while the Nifty has 50. In a bull market, leading companies drive the SENSEX index upward. On the other hand, Nifty's value rises less than the value of SENSEX.

As a result, the value of the Nifty is lower than the value of the SENSEX. The SENSEX and Nifty are two separate stock market indexes. Therefore, neither one is superior to the other.

List of 30 Stocks of BSE SENSEX

Below is the most recent list of firms used to compute the SENSEX, also known as the SENSEX 30 or BSE 30 or just the SENSEX, and information such as the company's name, sector and weightage.

| S.No. | Company | Sector | Weightage |

|---|---|---|---|

| 1 | Reliance Industries Ltd. | Oil & Gas | 11.99% |

| 2 | HDFC Bank | Banking | 11.84% |

| 3 | Infosys Ltd. | IT | 9.06% |

| 4 | HDFC | Financial Services | 8.30% |

| 5 | ICICI Bank | Banking | 7.37% |

| 6 | TCS | IT | 5.76% |

| 7 | Kotak Mahindra Bank Ltd. | Banking | 4.88% |

| 8 | Hindustan Unilever Ltd. | Consumer Goods | 3.75% |

| 9 | ITC | Consumer Goods | 3.49% |

| 10 | Axis Bank | Banking | 3.35% |

| 11 | Larsen & Toubro | Construction | 3.13% |

| 12 | Bajaj Finance | Financial Services | 2.63% |

| 13 | State Bank of India | Banking | 2.59% |

| 14 | Bharti Airtel | Telecommunication | 2.31% |

| 15 | Asian Paints | Consumer Goods | 1.97% |

| 16 | HCL Tech | IT | 1.89% |

| 17 | Maruti Suzuki | Automobile | 1.72% |

| 18 | Mahindra & Mahindra Ltd. | Automobile | 1.48% |

| 19 | UltraTech Cement Ltd. | Cement | 1.40% |

| 20 | Sun Pharmaceutical Industries Ltd. | Pharmaceuticals | 1.16% |

| 21 | Tech Mahindra | IT | 1.11% |

| 22 | Titan Company Ltd. | Consumer Goods | 1.11% |

| 23 | Nestle India Ltd. | Consumer Goods | 1.07% |

| 24 | Bajaj Finserv | Financial Services | 1.04% |

| 25 | IndusInd Bank | Banking | 1.03% |

| 26 | Power Grid Corporation of India Ltd. | Energy – Power | 1.03% |

| 27 | Tata Steel Ltd. | Metals | 1.01% |

| 28 | NTPC Ltd. | Energy – Power | 0.94% |

| 29 | Bajaj Auto | Automobile | 0.86% |

| 30 | Oil & Natural Gas Corporation Ltd. | Oil & Gas | 0.73% |

The Bottom Line

With so many publicly traded firms in India, it can be tough for investors to keep track of all available stocks before deciding. When a market index is used to reflect the whole market, it becomes very useful.

As it is a crucial indication of market activity, every investor should understand the basics of SENSEX. BSE and S&P Dow Jones Indices, a global index manager, collaborate to administer and run the SENSEX.

The SENSEX's composition is recast or changed regularly to reflect the true market composition.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.