ICICI Bank - History, Revenue, Products, Awards, etc.

Industrial Credit and Investment Corporation of India (ICICI) Bank Limited is an Indian multinational banking and financial services company. It has its corporate office in Mumbai, Maharashtra and a registered office in Vadodara. It was established on 5th January 1994. It provides extensive banking and financial services catering to corporate and retail customers through numerous delivery channels and dedicated subsidiaries in asset management, venture capital, non-life and Life Insurance, and investment banking. The banks have 5275 branches and 15,589 ATMs across India. It has a brand presence in 17 countries worldwide.

Its subsidiaries are present in the UK and Canada and its branches in USA, Bahrain, Singapore, Qatar, Hong Kong, Oman, Dubai International Finance Centre, China and South Africa. ICICI bank also has representative offices in the United Arab Emirates, Malaysia, Indonesia and Bangladesh. It’s UK subsidiary has branches in Germany and Belgium. Furthermore, the bank’s UK subsidiary has branches in Belgium and Germany.

Remarkably, the Reserve Bank of India (RBI) has designated ICICI Bank, along with the State Bank of India and HDFC Bank, as Domestic Systematically Important Banks (D-SIBs), commonly known as banks deemed “too big to fail.” In 1998, ICICI bank launched Internet banking services and in 1999 it became the first Indian company and the first bank to be listed on NYSE. ICICI bank also helped set up the Credit Information Bureau of India Limited (CIBIL).

Key Details About ICICI Bank

Here are some essential details about the ICICI bank:

| Particulars | Description |

|---|---|

| Type | Public |

| Industry | Banking, Financial services |

| Founded | 5 January 1994; 26 years ago |

| Area served | Worldwide |

| Key people | Girish Chandra Chaturvedi (Chairman), Sandeep Bakhshi (MD & CEO) |

| Products | Retail banking, corporate banking, investment banking, mortgage loans, private banking, wealth management, credit cards, finance and insurance |

| Net profit records | Rs. 9,648 crore (Q1FY24) |

| Market Capitalisation | Rs. 7.44 trillion (US $7441.43 billion) (2024) |

| Revenue | Rs. 59,739.72 crore (FY 23-24) |

| Net income | Rs. 34,036.64 crores (US$4.3 billion) (2023) |

| Total assets | Rs. 19.58 lakh crores (US$250 billion) (2023) |

| Number of employees | 1,30,542 (2022) |

History of ICICI Bank

ICICI was established as a government institution on 5 January 1955, with Sir Arcot Ramasamy Mudaliar serving as its Chairman. It was conceived as a joint venture involving India's public-sector Insurance companies, banks, and the World Bank to offer project financing to Indian industry. Initially, ICICI operated solely as a development financial institution.

In 1994, ICICI Bank was founded as a wholly-owned subsidiary of ICICI in Vadodara. Initially named the Industrial Credit and Investment Corporation of India Bank, it later rebranded as ICICI Bank. The Boards of Directors of ICICI and ICICI Bank went ahead with a merger in October 2001 that included two wholly owned retail finance subsidiaries: ICICI Capital Services Limited and ICICI Personal Financial Services Limited. This merger of parent ICICI Ltd. into its subsidiary ICICI Bank led to privatisation.

During the 1990s, ICICI underwent a strategic transformation, diversifying its business from solely offering project finance to becoming a diversified financial services group. ICICI Bank notably launched its Internet Banking operations in 1998. In 1998, the shareholding of ICICI in ICICI Bank was decreased to 46% through an Initial Public Offering (IPO) in India. This followed an equity provided through American depositary receipts on the NYSE in 2000. The acquisition of the Bank of Madura Limited in an all-stock deal took place in 2001.

In 1999, ICICI became the first financial institution, bank, or Indian company from non-Japan Asia to be listed on the NYSE. Subsequently, in 2002, ICICI, ICICI Bank, and its subsidiaries merged in a reverse merger. During the financial crisis of 2007–2008, there were rumours of bank failure, resulting in a rush of customers to ICICI ATMs and branches. The RBI clarified the financial strength of ICICI Bank to dispel these rumours. In 2015, ICICI launched an outward remittance platform called 'Money2World,' allowing fully online outward remittance transactions for both ICICI and non-ICICI customers. In March 2020, the board of ICICI Bank Ltd. approved a Rs. 10 billion (US$130 million) investment in Yes Bank, acquiring a 5% ownership interest in Yes Bank.

ICICI Bank Awards

In 2018, ICICI bank won the Celent Model Bank Awards in the Emerging Innovation category. It also won the Best Retail Bank award for India at the Asian Banker Excellence in Retail Financial Services International Awards for the 5th consecutive time. It also won the maximum awards in the same year and the Indian Banks’ Association (IBA) awards.

ICICI Offerings

ICICI Bank provides diverse products and services catering to various financial needs. These offerings include:

- Savings and current accounts

- Trade and forex services

- Fixed and recurring deposits

- Gold loans

- Auto loans

- Personal loans

- Business loans

- NRI banking services

- Remittances

- Card services

- Lockers

- Agri and rural services

The bank also offers a suite of digital platforms to enhance customer experience, including:

- iMobile Pay

- InstaBiz

- Digital Rupee App

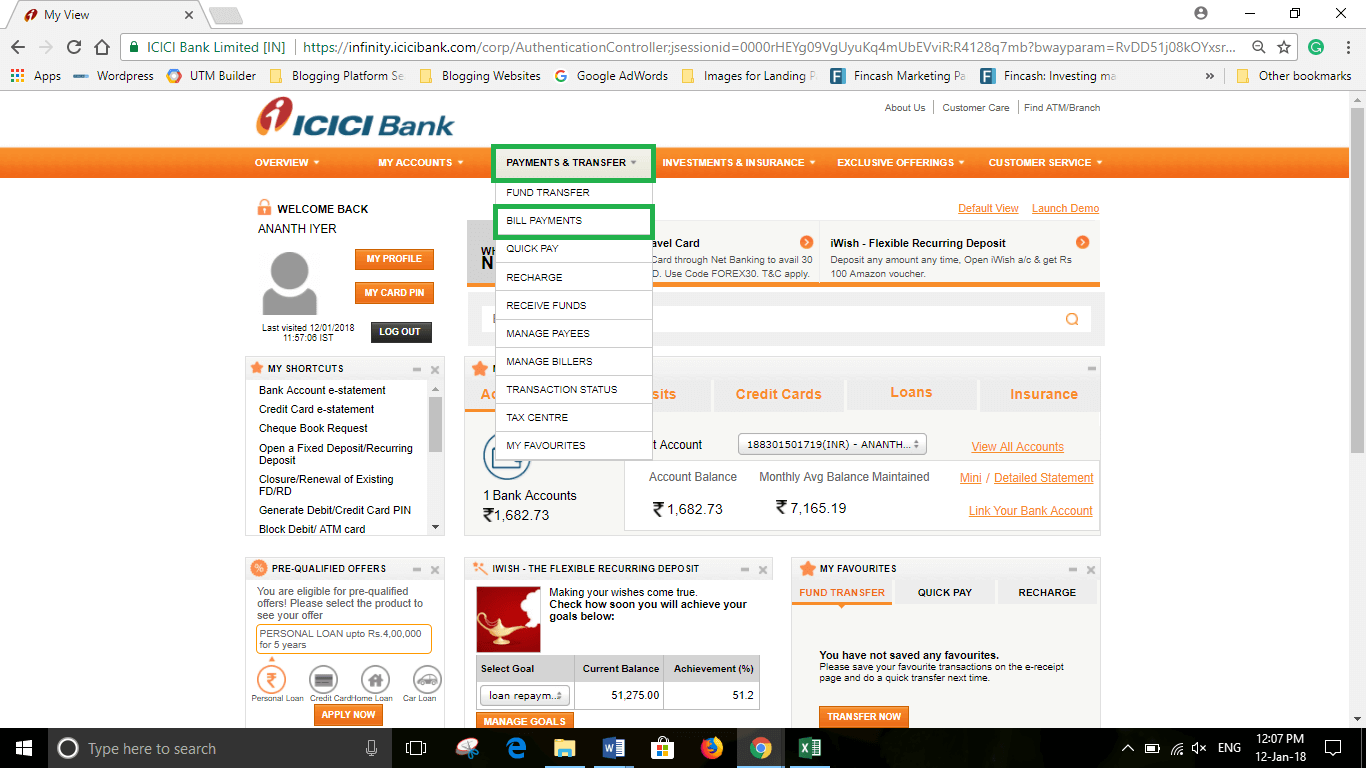

- Retail Internet Banking

- Corporate Internet Banking

- Money2India

- Money2World

- Digital wallet Pockets by ICICI Bank

In March 2020, ICICI Bank introduced ICICI STACK, a comprehensive digital banking suite catering to individuals, merchants, and corporations. This suite offers various online services, such as:

- Payments

- Digital accounts

- Instant loans

- Insurance

- Investments

In December 2020, ICICI Bank launched 'iMobile Pay,' an interoperable app providing payment and banking services to customers across multiple banking institutions. Initially launched as iMobile in 2008, iMobile Pay offers over 350 services and has garnered over 10 million sign-ups from non-ICICI Bank account holders by September 2023.

In July 2019, ICICI Bank unveiled the InstaBIZ app, designed to offer enhanced banking and value-added services to micro, small, and medium (MSME) customers and customers of any bank. InstaBIZ facilitates interoperability, allowing merchants to instantly collect payments using UPI IDs and QR codes. The app has approximately 1.5 million active users and has experienced a year-on-year throughput growth of over 70%. As of September 2022, the platform has amassed around 195,000 non-ICICI Bank account holders registrations.

ICICI Prudential Life Insurance

This is a joint venture between ICICI bank and Prudential Corporation Holdings Limited. It was established in 2001 and has been one of the most successful services in the private life insurance sector. It was ranked #1 four times in the most valuable Life Insurance brands in India as per the BrandZ Top 50 Most Valuable Indian Brands 2014, 2015, 2016 and 2017.

ICICI Securities Ltd

It offers a wide range of financial services, investment banking, retail broking, institution broking, private wealth management, product distribution. It has also registered with the Monetary Authority of Singapore and has a branch office there. It is headquartered in Mumbai and has subsidiaries in New York too.

Talk to our investment specialist

ICICI Lombard General Insurance Company

ICICI Lombard is the largest private-sector non-life insurer in India. Customers get services regarding motor, health, crop-/weather, institutional broking, retail broking, private health management and many more. ICICI Lombard won the ATD (Association of Talent Development) Award for the 5th time in 2017. Among the top 2 companies that maintained their positions in Top 10 that year was ICICI Lombard. It was also awarded the Golden Peacock National Training Award in the same year.

ICICI Securities Primary Dealership Limited

It is the largest dealer in government securities in India. It deals in institutional sales and trading, resource mobilisation, Portfolio management services and research. ICICI Securities Primary Dealership was awarded as Top Bank Arranger Investors’ Choices for Government Primary Issues in India by Triple A Asset.

Acquisitions of ICICI

Here are some businesses acquired by ICICI:

| Year | Acquisition | Details |

|---|---|---|

| 1996 | ICICI Ltd. | A diversified financial institution headquartered in Mumbai. |

| 1997 | ITC Classic Finance | Incorporated in 1986, ITC Classic was a non-bank financial firm engaged in hire, purchase, and leasing operations. It had eight offices, 26 outlets, and 700 brokers. |

| 1997 | Shipping Credit and Investment Corporation of India (SCICI) | - |

| 1998 | Anagram (ENAGRAM) Finance | Anagram operated a network of approximately 50 branches in Gujarat, Rajasthan, and Maharashtra, primarily focusing on retail financing of cars and trucks. |

| 2001 | Bank of Madura | - |

| 2002 | The Darjeeling and Shimla branches of Grindlays Bank | - |

| 2005 | Investitsionno-Kreditny Bank (IKB) | A Russian bank |

| 2007 | Sangli Bank | Sangli Bank, founded in 1916, was a private sector unlisted bank with headquarters in Sangli, Maharashtra, and 198 branches spread across multiple states in India. |

| 2010 | The Bank of Rajasthan (BOR) | Acquired for Rs. 30 billion (US$380 million), it was criticized by the Reserve Bank of India for its promoters' failure to reduce their holdings. It has since been merged with ICICI Bank. |

Conclusion

ICICI bank is one among the top 4 banks in India providing leading financial solutions and banking services. Along with other ICICI products, it has established itself as one of the leading banks globally.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.