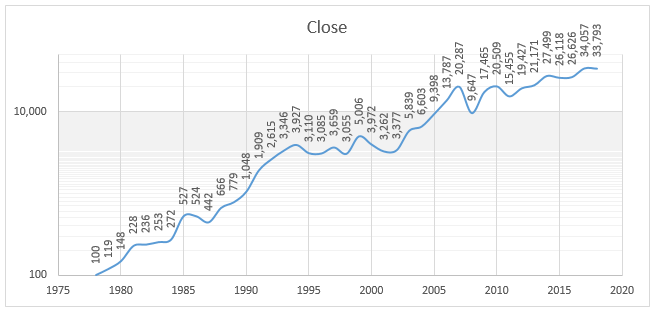

BSE SENSEX Growth Over Years

Why Equities are Good for Long-term?

Whenever we hear about equity investment, the first thing we hear is, equities are good for a long-term investment. However, various people do carry negative views with respect to equity investment. So, let us understand why and how equity is a good investment for long-term, the myths behind equity investment, and parameters to be checked while Investing in equity and the concept of Equity Funds.

Understanding SENSEX Past Performance

Now, let us focus on the performance of Sensex since its inception with the help of the graph given below.

(as on 3rd January, 2018, Source- BSE Limited)

The given graph of Sensex shows that there is an overall increase in since its inception in 1979. The date on which the data taken is as of January 03, 2018. Till date since 1979, the Compounded Annual Growth Rate (CAGR) is approximately 16.39%. However, it does not mean that Sensex has seen only upward movements. However, the biggest growth that Sensex has witnessed is between the period 1979-1994 when the markets grew from 100 to 3,927 points. People who had invested during this period would have earned considerable profits. In addition, these investors also did not face much negative returns as others did. Resultantly, these people would have definitely earned. The second best phase in which investors had earned returns were during 2003-2007, but the increase during this period was not as effective as the first phase.

So, do you think that the market has always witnessed a good pace? It has also witnessed downturns. Some of the worst spells where the Sensex was showing a downturn were during September 1994 - 1999, 2000 - 2003, and 2008 - 2010. Any individual who would have invested during this period would have definitely been negative. However, again, if these investors would have held their investments long, they would have definitely earned profits. As we can see in the map, the downturn period is not much visible.

So, after understanding the myths about equity, let's now see how to select the stocks.

Common Myths Behind Equity Investment

As mentioned earlier, equity investment has a number of myths associated with it. So, let us look at some of the prevalent myths behind equity investment.

1. If a Stock Has Done Well in the Past, it will Do Well in the Future Too

The first myth which people believe while investing in shares is; if a company has done well in the past, it will also do well in the future. Though this thought can give some comfort level yet; it is not completely true. It’s because; a company’s success always depends on the environment in which it performs and whether it is able to adapt itself to the changing business conditions. If it is not able to do so then; the company will not be in a position, to perform in the future.

Therefore, people should conduct a self-analysis before investing in the shares of any company. They should check the company's past performance, its future potentials, the industry conditions in which it performs, and other related parameters.

2. I am not Able to Earn Returns Faster Through Equities as it is Sheer Luck

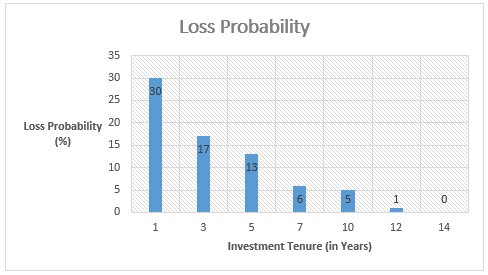

The second presumption people feel is they cannot earn by equity investment as it is based on sheer luck. However, as mentioned in the earlier paragraph, people need to understand that the variation of average returns reduces with the increase in the holding tenure. This is because, in the long-term, the fluctuation of the short-term Volatility reduces and the chances of making losses are also lower. Resultantly, the variations in the earnings start to decrease with the increase in the tenure. This concept is explained with the help of the table given below.

| Investing Tenure | Average Returns (%) | Deviation of Returns From Average (%) |

|---|---|---|

| 1 Year | 18 | ± 34 |

| 3 Year | 13 | ± 16% |

| 5 Year | 13 | ± 13% |

| 7 Year | 13 | ± 10% |

| 10 Year | 13 | ± 9% |

| 12 Year | 13 | ± 8% |

| 14 Year | 12 | ± 7% |

3. Only a Few are Earning in Share Markets as Equity Markets Are Volatile

It is one of the prevalent myths among individuals. A lot of people feel that they cannot earn by investing in shares. Individuals in a lot of instances feel; though the share markets are showing uptrend; yet I am not able to make my fortune. However, this isn’t true.

*One has to understand equity investing is a zero-sum game. Therefore, one person’s profit is another person’s loss. However, the outcome of whether you made a profit or ended up in a loss is decided upon the time you enter and exit the market. *

It would be again reiterated that, the key to success in equity investments is its long-term holding. One of the world’s renowned investor Warren Buffet built his empire not just because of investing. Instead, he has earned the wealth because of holding the investments for a long-term. In case of long-term investing, even a small sum of money invested gives a larger return. People who remain invested for a very long time can amass a fortune even with a small investment. The following graph shows how the probability of losses decreases with an increase in the investment tenure.

Talk to our investment specialist

How to Invest in Equities

It is the most important step. People while investing in equities need to stick to certain basic rules. Some of these rules are listed below as follows.

Invest in Stocks After its Complete Analysis & Don’t Follow Herd Behavior

The primary rule of investing is; invest in financial instruments that you understand and not the ones which you don’t. Hence, people should do a complete analysis of the shares in which they want to invest. They should go through its annual reports, check its future prospects and so on. Additionally, one should not be biased in their stock selection process.Also, many people do follow a herd behavior when it comes to investing, which should not be the case. It is not a good idea. People forming part of the herd, enter when the market is at its peak and sell when it forms a bottom. Therefore, be careful that you don’t buy the shares when all are entering a buy call and do not sell when everyone goes on a selling spree.

Diversification is the Key to Success

The important role in the case of investing is diversification, which is the key to success as it helps to reduce the level of risk. As rightly quoted that “Don’t hatch all your eggs in one basket;” similarly your investment should be distributed across numerous stocks in a predefined ratio. Diversification, in this context, means that people investing the corpus in different shares of various companies with respect to capitalization, sectors, and other parameters. This is because there are situations where mid-cap shares tend to outperform large-cap shares. So, one needs to have a constant watch on how a share is performing.

Rebalance Your Portfolio Timely

It’s rightly said that, to err is human. Similarly, while investing in stock markets, many people do commit mistakes. The mistake in this context is investing in shares where you have bad deals. However, the most important part is to rectify the wrong investment by rebalancing your Portfolio. It is important to monitor your equity investment in a timely manner. This will help to identify which stocks to sell and which ones to retain. Rebalancing the portfolio always helps to get rid of the bad stocks and thereby people can earn more income.

Thus, from the above pointers, it can be said that whenever you choose to invest in equities, you need to spend a lot of time in share markets rather than the market timing. Also, people should always understand the company before investing in its shares so that their investment money is safe and paves way for wealth creation.

Fund Selection Methodology used to find 10 funds

Top 10 Equity Mutual Funds for Long Term Investments

*List of top funds managing assets for 5 years of above & have returneded best Annualized Returns (CAGR).

(Erstwhile Sundaram Select Midcap Fund) To achieve capital appreciation by investing

in diversified stocks that are generally termed

as mid-caps. Below is the key information for Sundaram Mid Cap Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments Research Highlights for HDFC Long Term Advantage Fund Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities. Research Highlights for Aditya Birla Sun Life Equity Fund Below is the key information for Aditya Birla Sun Life Equity Fund Returns up to 1 year are on An Open ended Growth Scheme with the objective to achieve long term growth of capital at controlled level of risk by investing primarily in ‘Mid-Cap’ Stocks. The level of risk is somewhat higher than a fund focused on large and liquid stocks. Concomitantly, the aim is to generate higher returns than a fund focused on large and liquid stocks. Research Highlights for Aditya Birla Sun Life Midcap Fund Below is the key information for Aditya Birla Sun Life Midcap Fund Returns up to 1 year are on The primary objective for Franklin IndiaTaxshield is to provide medium to long term growth of capital along with income tax rebate Research Highlights for Franklin India Taxshield Below is the key information for Franklin India Taxshield Returns up to 1 year are on The primary investment objective of the Scheme is to seek to generate continuous returns by actively investing in equity and equity related securities of

companies in the Banking Sector and companies engaged in allied activities related to Banking Sector. The AMC will have the discretion to completely or

partially invest in any of the type of securities stated above with a view to maximize the returns or on defensive considerations. However, there can be no

assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. Research Highlights for Nippon India Banking Fund Below is the key information for Nippon India Banking Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Research Highlights for Motilal Oswal Midcap 30 Fund Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related or fixed income securities of Pharma and other associated companies. Research Highlights for Nippon India Pharma Fund Below is the key information for Nippon India Pharma Fund Returns up to 1 year are on The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Research Highlights for Nippon India Small Cap Fund Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on To generate returns through a combination of dividend income and capital appreciation by investing primarily in a well-diversified portfolio of value stocks. Value stocks are those, which have attractive valuations in relation to earnings or book value or current and/or future dividends. Research Highlights for ICICI Prudential Value Discovery Fund Below is the key information for ICICI Prudential Value Discovery Fund Returns up to 1 year are on 1. Sundaram Mid Cap Fund

Sundaram Mid Cap Fund

Growth Launch Date 30 Jul 02 NAV (19 Feb 26) ₹1,422.52 ↓ -23.02 (-1.59 %) Net Assets (Cr) ₹13,293 on 31 Dec 25 Category Equity - Mid Cap AMC Sundaram Asset Management Company Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.75 Sharpe Ratio -0.01 Information Ratio 0.13 Alpha Ratio -1.77 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,529 31 Jan 23 ₹13,961 31 Jan 24 ₹20,735 31 Jan 25 ₹24,515 31 Jan 26 ₹26,871 Returns for Sundaram Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 1.7% 3 Month -1.7% 6 Month 2.2% 1 Year 19.8% 3 Year 24.8% 5 Year 20% 10 Year 15 Year Since launch 23.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.1% 2023 32% 2022 40.4% 2021 4.8% 2020 37.5% 2019 11.8% 2018 -0.3% 2017 -15.4% 2016 40.8% 2015 11.3% Fund Manager information for Sundaram Mid Cap Fund

Name Since Tenure S. Bharath 24 Feb 21 4.94 Yr. Ratish Varier 24 Feb 21 4.94 Yr. Data below for Sundaram Mid Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 22.57% Consumer Cyclical 15.22% Industrials 15.04% Health Care 9.97% Basic Materials 9.96% Technology 6.31% Consumer Defensive 6.15% Real Estate 3.7% Utility 2.69% Communication Services 2.55% Energy 2.07% Asset Allocation

Asset Class Value Cash 3.76% Equity 96.23% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cummins India Ltd (Industrials)

Equity, Since 31 Dec 17 | CUMMINSIND4% ₹460 Cr 1,119,311

↓ -37,710 Mahindra & Mahindra Financial Services Ltd (Financial Services)

Equity, Since 31 Jan 24 | M&MFIN3% ₹432 Cr 11,511,504

↓ -32,528 GE Vernova T&D India Ltd (Industrials)

Equity, Since 30 Sep 24 | GVT&D3% ₹385 Cr 1,191,355

↑ 32,779 Coromandel International Ltd (Basic Materials)

Equity, Since 30 Nov 10 | COROMANDEL3% ₹366 Cr 1,601,739

↓ -128,283 IDFC First Bank Ltd (Financial Services)

Equity, Since 30 Jun 25 | IDFCFIRSTB2% ₹317 Cr 37,978,844 The Federal Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | FEDERALBNK2% ₹305 Cr 10,582,426

↓ -1,283,544 Jindal Steel Ltd (Basic Materials)

Equity, Since 30 Nov 20 | JINDALSTEL2% ₹269 Cr 2,380,218 Hindustan Petroleum Corp Ltd (Energy)

Equity, Since 31 Oct 21 | HINDPETRO2% ₹267 Cr 6,264,200

↑ 119,818 BSE Ltd (Financial Services)

Equity, Since 31 May 24 | BSE2% ₹264 Cr 945,165 Indian Bank (Financial Services)

Equity, Since 31 Jul 23 | INDIANB2% ₹261 Cr 2,859,289

↓ -150,834 2. HDFC Long Term Advantage Fund

HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. Aditya Birla Sun Life Equity Fund

Aditya Birla Sun Life Equity Fund

Growth Launch Date 27 Aug 98 NAV (19 Feb 26) ₹1,857.55 ↓ -25.88 (-1.37 %) Net Assets (Cr) ₹25,098 on 31 Dec 25 Category Equity - Multi Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.68 Sharpe Ratio 0.41 Information Ratio 0.82 Alpha Ratio 3.22 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,998 31 Jan 23 ₹12,764 31 Jan 24 ₹16,795 31 Jan 25 ₹18,861 31 Jan 26 ₹21,115 Returns for Aditya Birla Sun Life Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month -0.1% 3 Month -1.3% 6 Month 3.5% 1 Year 16.7% 3 Year 18.2% 5 Year 14.5% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.2% 2023 18.5% 2022 26% 2021 -1.1% 2020 30.3% 2019 16.1% 2018 8.5% 2017 -4.1% 2016 33.5% 2015 15.2% Fund Manager information for Aditya Birla Sun Life Equity Fund

Name Since Tenure Harish Krishnan 3 Nov 23 2.25 Yr. Dhaval Joshi 21 Nov 22 3.2 Yr. Data below for Aditya Birla Sun Life Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 31.61% Consumer Cyclical 14.05% Technology 11.05% Basic Materials 10.11% Industrials 9.91% Consumer Defensive 7.22% Health Care 7.08% Energy 4.42% Communication Services 2.49% Real Estate 0.57% Asset Allocation

Asset Class Value Cash 1.49% Equity 98.51% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 16 | ICICIBANK7% ₹1,606 Cr 11,849,171 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK4% ₹1,027 Cr 11,055,796 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY4% ₹1,011 Cr 6,161,817 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | KOTAKBANK4% ₹942 Cr 23,096,430 Reliance Industries Ltd (Energy)

Equity, Since 31 May 19 | RELIANCE3% ₹796 Cr 5,706,067 HCL Technologies Ltd (Technology)

Equity, Since 30 Nov 11 | HCLTECH3% ₹696 Cr 4,103,703 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN3% ₹679 Cr 6,300,000 Hindalco Industries Ltd (Basic Materials)

Equity, Since 31 Mar 17 | HINDALCO2% ₹542 Cr 5,628,825

↓ -517,357 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 17 | BHARTIARTL2% ₹540 Cr 2,741,033 Tech Mahindra Ltd (Technology)

Equity, Since 29 Feb 24 | TECHM2% ₹492 Cr 2,820,504 4. Aditya Birla Sun Life Midcap Fund

Aditya Birla Sun Life Midcap Fund

Growth Launch Date 3 Oct 02 NAV (19 Feb 26) ₹787.35 ↓ -11.20 (-1.40 %) Net Assets (Cr) ₹6,301 on 31 Dec 25 Category Equity - Mid Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.89 Sharpe Ratio -0.02 Information Ratio -0.6 Alpha Ratio -1.66 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,034 31 Jan 23 ₹14,161 31 Jan 24 ₹20,298 31 Jan 25 ₹22,871 31 Jan 26 ₹24,546 Returns for Aditya Birla Sun Life Midcap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 0.2% 3 Month -2.5% 6 Month -0.1% 1 Year 15.9% 3 Year 20.4% 5 Year 18.1% 10 Year 15 Year Since launch 20.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 4.4% 2023 22% 2022 39.9% 2021 -5.3% 2020 50.4% 2019 15.5% 2018 -3.7% 2017 -16% 2016 44.8% 2015 5.7% Fund Manager information for Aditya Birla Sun Life Midcap Fund

Name Since Tenure Vishal Gajwani 31 Oct 24 1.25 Yr. Data below for Aditya Birla Sun Life Midcap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 23.39% Basic Materials 17.15% Consumer Cyclical 15.51% Industrials 13.12% Technology 11.41% Health Care 6.85% Real Estate 5.31% Utility 2.53% Consumer Defensive 1.76% Communication Services 1.04% Asset Allocation

Asset Class Value Cash 1.92% Equity 98.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity The Federal Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | FEDERALBNK3% ₹203 Cr 7,043,431

↓ -431,422 Max Financial Services Ltd (Financial Services)

Equity, Since 28 Feb 17 | MFSL3% ₹198 Cr 1,225,565 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 19 | AUBANK3% ₹198 Cr 2,011,167

↓ -189,524 JK Cement Ltd (Basic Materials)

Equity, Since 31 Jan 24 | JKCEMENT3% ₹189 Cr 342,940

↑ 71,955 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Aug 24 | APLAPOLLO3% ₹179 Cr 873,080

↓ -81,900 Thermax Ltd (Industrials)

Equity, Since 31 Oct 19 | THERMAX3% ₹155 Cr 539,138 Torrent Power Ltd (Utilities)

Equity, Since 31 Oct 19 | TORNTPOWER3% ₹153 Cr 1,100,000 Prestige Estates Projects Ltd (Real Estate)

Equity, Since 30 Nov 24 | PRESTIGE2% ₹134 Cr 916,888 Mphasis Ltd (Technology)

Equity, Since 31 Mar 20 | MPHASIS2% ₹134 Cr 484,677 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 31 Aug 20 | KPRMILL2% ₹130 Cr 1,500,000 5. Franklin India Taxshield

Franklin India Taxshield

Growth Launch Date 10 Apr 99 NAV (19 Feb 26) ₹1,463.74 ↓ -21.59 (-1.45 %) Net Assets (Cr) ₹6,693 on 31 Dec 25 Category Equity - ELSS AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆ Risk Moderately High Expense Ratio 1.81 Sharpe Ratio -0.22 Information Ratio 0.45 Alpha Ratio -5.39 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,755 31 Jan 23 ₹13,866 31 Jan 24 ₹19,216 31 Jan 25 ₹21,774 31 Jan 26 ₹22,785 Returns for Franklin India Taxshield

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month -0.2% 3 Month -3.6% 6 Month -0.6% 1 Year 8.6% 3 Year 18% 5 Year 15.6% 10 Year 15 Year Since launch 20.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 2.1% 2023 22.4% 2022 31.2% 2021 5.4% 2020 36.7% 2019 9.8% 2018 5.1% 2017 -3% 2016 29.1% 2015 4.7% Fund Manager information for Franklin India Taxshield

Name Since Tenure R. Janakiraman 2 May 16 9.76 Yr. Rajasa Kakulavarapu 1 Dec 23 2.17 Yr. Data below for Franklin India Taxshield as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.36% Industrials 13.55% Technology 10% Consumer Cyclical 9.37% Basic Materials 6.18% Consumer Defensive 6.08% Utility 5.05% Health Care 4.42% Communication Services 4.35% Energy 3.19% Real Estate 1.28% Asset Allocation

Asset Class Value Cash 3.17% Equity 96.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 07 | HDFCBANK9% ₹606 Cr 6,520,834 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK7% ₹447 Cr 3,297,903 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 19 | LT5% ₹348 Cr 883,853 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 14 | AXISBANK5% ₹340 Cr 2,477,634 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹308 Cr 1,876,441 State Bank of India (Financial Services)

Equity, Since 31 Aug 15 | SBIN5% ₹305 Cr 2,833,344 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 07 | BHARTIARTL4% ₹280 Cr 1,421,571

↓ -50,000 HCL Technologies Ltd (Technology)

Equity, Since 31 Oct 21 | HCLTECH4% ₹248 Cr 1,462,587 Reliance Industries Ltd (Energy)

Equity, Since 31 May 22 | RELIANCE3% ₹206 Cr 1,472,922 Eternal Ltd (Consumer Cyclical)

Equity, Since 30 Nov 21 | 5433203% ₹205 Cr 7,500,000 6. Nippon India Banking Fund

Nippon India Banking Fund

Growth Launch Date 26 May 03 NAV (19 Feb 26) ₹669.776 ↓ -7.73 (-1.14 %) Net Assets (Cr) ₹7,778 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.85 Information Ratio 0.56 Alpha Ratio -0.93 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,022 31 Jan 23 ₹14,954 31 Jan 24 ₹19,137 31 Jan 25 ₹21,060 31 Jan 26 ₹25,027 Returns for Nippon India Banking Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 6.9% 1 Year 21.6% 3 Year 19.8% 5 Year 16.6% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.4% 2023 10.3% 2022 24.2% 2021 20.7% 2020 29.7% 2019 -10.6% 2018 10.7% 2017 -1.2% 2016 44.1% 2015 11.5% Fund Manager information for Nippon India Banking Fund

Name Since Tenure Vinay Sharma 9 Apr 18 7.82 Yr. Kinjal Desai 25 May 18 7.7 Yr. Bhavik Dave 18 Jun 21 4.63 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Banking Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 95.82% Technology 2.67% Asset Allocation

Asset Class Value Cash 1.51% Equity 98.49% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK15% ₹1,173 Cr 12,619,320

↑ 550,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK13% ₹1,008 Cr 7,438,887

↓ -800,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 17 | AXISBANK10% ₹764 Cr 5,571,983 State Bank of India (Financial Services)

Equity, Since 31 Mar 14 | SBIN8% ₹599 Cr 5,565,352 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Nov 20 | SBILIFE4% ₹294 Cr 1,470,199 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jul 20 | SBICARD4% ₹293 Cr 3,893,792 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Nov 04 | FEDERALBNK3% ₹271 Cr 9,405,824 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Oct 23 | BAJAJFINSV3% ₹249 Cr 1,275,773 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | KOTAKBANK3% ₹207 Cr 5,072,870 Bank of Baroda (Financial Services)

Equity, Since 30 Apr 25 | BANKBARODA3% ₹203 Cr 6,793,554 7. Motilal Oswal Midcap 30 Fund

Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (19 Feb 26) ₹91.571 ↓ -1.91 (-2.04 %) Net Assets (Cr) ₹36,880 on 31 Dec 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.56 Sharpe Ratio -0.79 Information Ratio 0.1 Alpha Ratio -18.12 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,611 31 Jan 23 ₹17,167 31 Jan 24 ₹25,382 31 Jan 25 ₹32,939 31 Jan 26 ₹31,530 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month -5.8% 3 Month -11.9% 6 Month -11.5% 1 Year -1% 3 Year 22.3% 5 Year 23.3% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -12.1% 2023 57.1% 2022 41.7% 2021 10.7% 2020 55.8% 2019 9.3% 2018 9.7% 2017 -12.7% 2016 30.8% 2015 5.2% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Varun Sharma 21 Jan 26 0.03 Yr. Swapnil Mayekar 18 Nov 25 0.2 Yr. Ajay Khandelwal 1 Oct 24 1.33 Yr. Ankit Agarwal 21 Jan 26 0.03 Yr. Rakesh Shetty 22 Nov 22 3.19 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Technology 32.1% Financial Services 19.54% Consumer Cyclical 13.52% Industrials 9.23% Communication Services 8.81% Real Estate 2.56% Health Care 0.83% Asset Allocation

Asset Class Value Cash 6.54% Equity 93.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹3,391 Cr 5,618,243

↓ -351,597 Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹3,308 Cr 20,000,000

↑ 250,000 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433968% ₹2,650 Cr 23,299,158

↑ 798,031 Nifty February 2026 Future

- | -7% ₹2,450 Cr 964,015

↑ 964,015 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 Aug 25 | 5433207% ₹2,359 Cr 86,225,827

↑ 9,724,827 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL6% ₹2,220 Cr 61,385,972

↑ 1,342,732 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Nov 25 | BHARTIARTL5% ₹1,874 Cr 9,517,664 Aditya Birla Capital Ltd (Financial Services)

Equity, Since 30 Jun 25 | ABCAPITAL5% ₹1,747 Cr 51,423,983

↑ 3,923,983 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI5% ₹1,642 Cr 4,084,550

↑ 84,550 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON5% ₹1,565 Cr 1,497,807

↓ -602,193 8. Nippon India Pharma Fund

Nippon India Pharma Fund

Growth Launch Date 5 Jun 04 NAV (19 Feb 26) ₹506.023 ↓ -2.74 (-0.54 %) Net Assets (Cr) ₹8,265 on 31 Dec 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk High Expense Ratio 1.81 Sharpe Ratio -0.52 Information Ratio -0.79 Alpha Ratio -1.59 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,758 31 Jan 23 ₹11,307 31 Jan 24 ₹17,103 31 Jan 25 ₹19,714 31 Jan 26 ₹20,002 Returns for Nippon India Pharma Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 1.8% 3 Month -2.4% 6 Month -3% 1 Year 7.5% 3 Year 22.8% 5 Year 15.3% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.3% 2023 34% 2022 39.2% 2021 -9.9% 2020 23.9% 2019 66.4% 2018 1.7% 2017 3.6% 2016 7.6% 2015 -10.6% Fund Manager information for Nippon India Pharma Fund

Name Since Tenure Sailesh Raj Bhan 1 Apr 05 20.85 Yr. Kinjal Desai 25 May 18 7.69 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Pharma Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Health Care 98.97% Asset Allocation

Asset Class Value Cash 1.03% Equity 98.97% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 09 | SUNPHARMA13% ₹998 Cr 6,256,349 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 08 | LUPIN8% ₹621 Cr 2,883,991 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB7% ₹515 Cr 850,754 Dr Reddy's Laboratories Ltd (Healthcare)

Equity, Since 30 Jun 11 | DRREDDY6% ₹477 Cr 3,916,074 Cipla Ltd (Healthcare)

Equity, Since 31 May 08 | CIPLA6% ₹463 Cr 3,495,054 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Sep 20 | APOLLOHOSP6% ₹452 Cr 648,795 Medplus Health Services Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5434274% ₹290 Cr 3,627,277 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 30 Sep 21 | 5433504% ₹277 Cr 2,886,684 Ajanta Pharma Ltd (Healthcare)

Equity, Since 30 Apr 22 | AJANTPHARM3% ₹267 Cr 959,323 GlaxoSmithKline Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Aug 22 | GLAXO3% ₹219 Cr 913,226 9. Nippon India Small Cap Fund

Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (19 Feb 26) ₹162.57 ↓ -1.89 (-1.15 %) Net Assets (Cr) ₹68,287 on 31 Dec 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.44 Sharpe Ratio -0.42 Information Ratio -0.02 Alpha Ratio -1.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹17,257 31 Jan 23 ₹18,306 31 Jan 24 ₹28,687 31 Jan 25 ₹31,667 31 Jan 26 ₹31,833 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month 1.7% 3 Month -4.5% 6 Month -3.9% 1 Year 11.4% 3 Year 20.7% 5 Year 23.5% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 -4.7% 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 9.09 Yr. Kinjal Desai 25 May 18 7.7 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Small Cap Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 19.87% Financial Services 17.63% Consumer Cyclical 13.65% Consumer Defensive 11.02% Basic Materials 11% Health Care 9.06% Technology 6.72% Utility 3.16% Energy 1.39% Communication Services 1.17% Real Estate 1.08% Asset Allocation

Asset Class Value Cash 4.26% Equity 95.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX3% ₹2,219 Cr 8,778,789

↓ -476,261 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,422 Cr 15,300,000

↑ 2,000,000 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN2% ₹1,115 Cr 10,347,848 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900032% ₹1,082 Cr 35,913,511

↓ -2,227,363 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | AXISBANK1% ₹819 Cr 5,977,976 eClerx Services Ltd (Technology)

Equity, Since 31 Jul 20 | ECLERX1% ₹797 Cr 1,712,794 Bharat Heavy Electricals Ltd (Industrials)

Equity, Since 30 Sep 22 | BHEL1% ₹775 Cr 29,507,422 Emami Ltd (Consumer Defensive)

Equity, Since 31 Jul 23 | EMAMILTD1% ₹772 Cr 15,948,302

↑ 150,000 Zydus Wellness Ltd (Consumer Defensive)

Equity, Since 31 Aug 16 | ZYDUSWELL1% ₹764 Cr 17,048,030 TD Power Systems Ltd (Industrials)

Equity, Since 31 Dec 15 | TDPOWERSYS1% ₹743 Cr 10,178,244 10. ICICI Prudential Value Discovery Fund

ICICI Prudential Value Discovery Fund

Growth Launch Date 16 Aug 04 NAV (19 Feb 26) ₹486.75 ↓ -5.25 (-1.07 %) Net Assets (Cr) ₹61,272 on 31 Dec 25 Category Equity - Value AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio 0.74 Information Ratio 0.97 Alpha Ratio 5.8 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,414 31 Jan 23 ₹15,803 31 Jan 24 ₹21,604 31 Jan 25 ₹24,758 31 Jan 26 ₹27,568 Returns for ICICI Prudential Value Discovery Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 19 Feb 26 Duration Returns 1 Month -0.5% 3 Month -1.7% 6 Month 3.2% 1 Year 14.2% 3 Year 20.2% 5 Year 20.2% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.8% 2023 20% 2022 31.4% 2021 15% 2020 38.5% 2019 22.9% 2018 0.6% 2017 -4.2% 2016 23.8% 2015 4.6% Fund Manager information for ICICI Prudential Value Discovery Fund

Name Since Tenure Sankaran Naren 18 Jan 21 5.04 Yr. Dharmesh Kakkad 18 Jan 21 5.04 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Masoomi Jhurmarvala 4 Nov 24 1.24 Yr. Data below for ICICI Prudential Value Discovery Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 33.64% Technology 13.02% Health Care 11.54% Consumer Defensive 8.93% Energy 8.76% Consumer Cyclical 6.55% Utility 5.28% Industrials 3.3% Basic Materials 3.21% Communication Services 1.64% Asset Allocation

Asset Class Value Cash 4.66% Equity 95.33% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 28 Feb 21 | ICICIBANK9% ₹5,187 Cr 38,278,164 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 21 | HDFCBANK8% ₹4,543 Cr 48,892,327

↑ 7,250,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 23 | RELIANCE6% ₹3,720 Cr 26,657,283 Infosys Ltd (Technology)

Equity, Since 30 Sep 14 | INFY6% ₹3,680 Cr 22,426,207 ITC Ltd (Consumer Defensive)

Equity, Since 30 Sep 17 | ITC5% ₹3,133 Cr 97,252,019

↑ 18,350,688 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA5% ₹2,884 Cr 18,077,448

↑ 1,778,972 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 25 | TCS5% ₹2,754 Cr 8,815,008 NTPC Ltd (Utilities)

Equity, Since 30 Sep 14 | NTPC4% ₹2,493 Cr 70,040,641 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 20 | AXISBANK3% ₹1,974 Cr 14,404,841

↓ -5,601,250 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 31 May 21 | SBILIFE3% ₹1,915 Cr 9,583,134

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for Sundaram Mid Cap Fund