Best Index Mutual Funds in India for 2026

Index Mutual Funds are no longer a niche investment option in India — they have become one of the fastest-growing segments of the mutual fund industry.

As of 2025, passive funds including Index Funds and ETFs account for over 17% of India’s total mutual fund AUM, compared to less than 4% a decade ago (AMFI data). This sharp rise reflects a simple shift in investor behaviour — more Indians now prefer low-cost, rules-based Investing over expensive active strategies.

Instead of trying to outperform the market, index funds aim to replicate well-known indices such as the Nifty 50 and Sensex, offering diversification, transparency, and long-term compounding at minimal cost.

Over the last 10 years, the Nifty 50 TRI has delivered approximately 13–14% CAGR, proving that passive investing can be an effective wealth-building strategy when followed with discipline.

However, not all index funds are identical.

Funds tracking the same index can deliver noticeably different outcomes due to expense ratio, tracking efficiency, fund size, and tracking error — making proper selection essential for long-term investors.

What is an Index Fund?

An index mutual fund is a type of mutual fund that simply follows the market instead of trying to beat it.

Simple example - Imagine India’s stock market is a cricket team.

The Nifty 50 index is like the best 50 players selected from the country — players such as Reliance, TCS, Infosys, HDFC Bank, ITC, and others.

Now:

- An index mutual fund doesn’t try to choose which player will score the most runs.

- It simply buys all 50 players in the same proportion as the team selection.

So if:

- Reliance has 10% weight in Nifty 50

- TCS has 8%

- Infosys has 6%

The index fund invests in exactly the same ratio.

What happens next?

- If the Nifty 50 rises by 1%,

- the index fund also rises by almost 1% (after small expenses).

If the market falls, the fund falls too.

There is no fund manager guessing stocks, no frequent buying or selling — just automatic tracking of the index.

In simple words - Index fund = “Invest in the entire market at once.”

You don’t need to predict which stock will perform best — you grow your money along with India’s economy.

Talk to our investment specialist

Why Index Funds Are Becoming Popular in India

Low Cost (Expense Ratio) – Since there’s no active management, index funds charge as low as 0.1% – 0.3%, compared to 1% – 2% for active funds.

Market Outperformance by Passive Investing – Many active funds are struggling to beat their benchmarks consistently. Data from SPIVA reports shows over 85% of Large cap funds underperform their benchmarks over 10 years.

Transparency – You always know what you’re investing in.

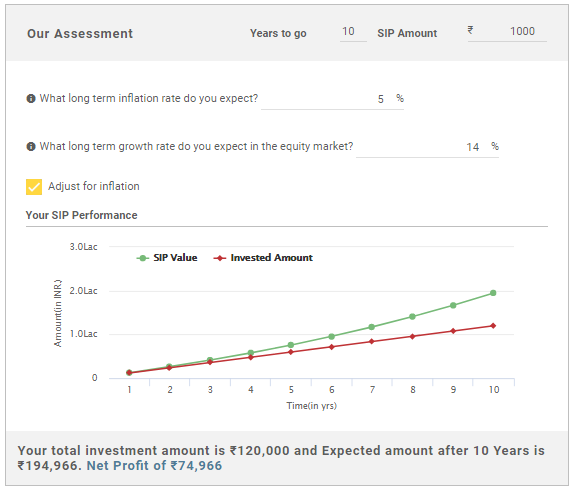

Ideal for Long-Term Wealth Creation – Perfect for SIP investing and Retirement planning.

Fund Selection Methodology used to find 9 funds

Top 9 Best Performing Index Funds FY 26 - 27

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Index Fund - Sensex Plan Growth ₹42.4963

↑ 0.09 ₹992 -1.8 3.5 10.5 11.7 10.7 9.8 LIC MF Index Fund Sensex Growth ₹155.742

↑ 0.32 ₹94 -2 3.2 9.7 11.1 10.2 9.1 Franklin India Index Fund Nifty Plan Growth ₹207.604

↑ 0.34 ₹787 -1.1 4.4 12.6 13.3 11.6 11.3 IDBI Nifty Index Fund Growth ₹36.2111

↓ -0.02 ₹208 9.1 11.9 16.2 20.3 11.7 Nippon India Index Fund - Nifty Plan Growth ₹43.7007

↑ 0.07 ₹3,061 -1.1 4.5 12.7 13.4 11.5 11.4 ICICI Prudential Nifty Next 50 Index Fund Growth ₹61.3189

↑ 0.32 ₹8,190 -0.5 4.9 17.5 21.9 14.6 2.1 IDBI Nifty Junior Index Fund Growth ₹51.7281

↑ 0.27 ₹100 -0.6 4.8 17.4 21.6 14.5 2 LIC MF Index Fund Nifty Growth ₹141.894

↑ 0.23 ₹368 -1.3 4.1 12 12.8 11.1 10.7 Bandhan Nifty Fund Growth ₹55.4112

↑ 0.09 ₹2,268 -1.2 4.4 12.6 13.3 11.7 11.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 9 Funds showcased

Commentary Nippon India Index Fund - Sensex Plan LIC MF Index Fund Sensex Franklin India Index Fund Nifty Plan IDBI Nifty Index Fund Nippon India Index Fund - Nifty Plan ICICI Prudential Nifty Next 50 Index Fund IDBI Nifty Junior Index Fund LIC MF Index Fund Nifty Bandhan Nifty Fund Point 1 Upper mid AUM (₹992 Cr). Bottom quartile AUM (₹94 Cr). Lower mid AUM (₹787 Cr). Bottom quartile AUM (₹208 Cr). Top quartile AUM (₹3,061 Cr). Highest AUM (₹8,190 Cr). Bottom quartile AUM (₹100 Cr). Lower mid AUM (₹368 Cr). Upper mid AUM (₹2,268 Cr). Point 2 Established history (15+ yrs). Established history (23+ yrs). Oldest track record among peers (25 yrs). Established history (15+ yrs). Established history (15+ yrs). Established history (15+ yrs). Established history (15+ yrs). Established history (23+ yrs). Established history (15+ yrs). Point 3 Rating: 2★ (upper mid). Rating: 1★ (lower mid). Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 1★ (bottom quartile). Top rated. Rating: 5★ (top quartile). Rating: 1★ (bottom quartile). Rating: 2★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.68% (bottom quartile). 5Y return: 10.15% (bottom quartile). 5Y return: 11.60% (lower mid). 5Y return: 11.74% (upper mid). 5Y return: 11.54% (lower mid). 5Y return: 14.61% (top quartile). 5Y return: 14.54% (top quartile). 5Y return: 11.13% (bottom quartile). 5Y return: 11.67% (upper mid). Point 6 3Y return: 11.70% (bottom quartile). 3Y return: 11.10% (bottom quartile). 3Y return: 13.30% (lower mid). 3Y return: 20.28% (upper mid). 3Y return: 13.42% (upper mid). 3Y return: 21.93% (top quartile). 3Y return: 21.62% (top quartile). 3Y return: 12.77% (bottom quartile). 3Y return: 13.29% (lower mid). Point 7 1Y return: 10.47% (bottom quartile). 1Y return: 9.73% (bottom quartile). 1Y return: 12.57% (lower mid). 1Y return: 16.16% (upper mid). 1Y return: 12.74% (upper mid). 1Y return: 17.55% (top quartile). 1Y return: 17.44% (top quartile). 1Y return: 12.04% (bottom quartile). 1Y return: 12.57% (lower mid). Point 8 1M return: -0.15% (bottom quartile). 1M return: -0.21% (bottom quartile). 1M return: 0.04% (bottom quartile). 1M return: 3.68% (top quartile). 1M return: 0.12% (upper mid). 1M return: 1.45% (top quartile). 1M return: 1.44% (upper mid). 1M return: 0.06% (lower mid). 1M return: 0.11% (lower mid). Point 9 Alpha: -0.51 (top quartile). Alpha: -1.15 (bottom quartile). Alpha: -0.53 (upper mid). Alpha: -1.03 (bottom quartile). Alpha: -0.47 (top quartile). Alpha: -0.80 (lower mid). Alpha: -0.89 (lower mid). Alpha: -1.06 (bottom quartile). Alpha: -0.63 (upper mid). Point 10 Sharpe: 0.36 (lower mid). Sharpe: 0.30 (bottom quartile). Sharpe: 0.47 (upper mid). Sharpe: 1.04 (top quartile). Sharpe: 0.48 (top quartile). Sharpe: -0.12 (bottom quartile). Sharpe: -0.13 (bottom quartile). Sharpe: 0.42 (lower mid). Sharpe: 0.46 (upper mid). Nippon India Index Fund - Sensex Plan

LIC MF Index Fund Sensex

Franklin India Index Fund Nifty Plan

IDBI Nifty Index Fund

Nippon India Index Fund - Nifty Plan

ICICI Prudential Nifty Next 50 Index Fund

IDBI Nifty Junior Index Fund

LIC MF Index Fund Nifty

Bandhan Nifty Fund

All the funds mentioned above are ideal, we are giving you detailed analysis of 5 funds.

The primary investment objective of the scheme is to replicate the composition of the Sensex, with a view to generate returns that are commensurate with the performance of the Sensex, subject to tracking errors. Research Highlights for Nippon India Index Fund - Sensex Plan Below is the key information for Nippon India Index Fund - Sensex Plan Returns up to 1 year are on The main investment objective of the fund is to generate returns commensurate with the performance of the index either Nifty / Sensex based on the plans by investing in the respective index stocks subject to tracking errors. Research Highlights for LIC MF Index Fund Sensex Below is the key information for LIC MF Index Fund Sensex Returns up to 1 year are on The Investment Objective of the Scheme is to invest in companies whose securities are included in the Nifty and subject to tracking errors, endeavouring to attain results commensurate with the Nifty 50 under NSENifty Plan Research Highlights for Franklin India Index Fund Nifty Plan Below is the key information for Franklin India Index Fund Nifty Plan Returns up to 1 year are on The investment objective of the scheme is to invest in the stocks and equity related instruments comprising the S&P CNX Nifty Index in the same weights as these stocks represented in the Index with the intent to replicate the performance of the Total Returns Index of S&P CNX Nifty index. The scheme will adopt a passive investment strategy and will seek to achieve the investment objective by minimizing the tracking error between the S&P CNX Nifty index (Total Returns Index) and the scheme. Research Highlights for IDBI Nifty Index Fund Below is the key information for IDBI Nifty Index Fund Returns up to 1 year are on The primary investment objective of the scheme is to replicate the composition of the Nifty 50, with a view to generate returns that are commensurate with the

performance of the Nifty 50, subject to tracking errors. Research Highlights for Nippon India Index Fund - Nifty Plan Below is the key information for Nippon India Index Fund - Nifty Plan Returns up to 1 year are on 1. Nippon India Index Fund - Sensex Plan

Nippon India Index Fund - Sensex Plan

Growth Launch Date 28 Sep 10 NAV (17 Feb 26) ₹42.4963 ↑ 0.09 (0.21 %) Net Assets (Cr) ₹992 on 31 Dec 25 Category Others - Index Fund AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.49 Sharpe Ratio 0.36 Information Ratio -10.92 Alpha Ratio -0.51 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,580 31 Jan 23 ₹12,981 31 Jan 24 ₹15,738 31 Jan 25 ₹17,111 31 Jan 26 ₹18,287 Returns for Nippon India Index Fund - Sensex Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month -0.1% 3 Month -1.8% 6 Month 3.5% 1 Year 10.5% 3 Year 11.7% 5 Year 10.7% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.8% 2023 8.9% 2022 19.5% 2021 5% 2020 22.4% 2019 16.6% 2018 14.2% 2017 6.2% 2016 27.9% 2015 2% Fund Manager information for Nippon India Index Fund - Sensex Plan

Name Since Tenure Himanshu Mange 23 Dec 23 2.11 Yr. Data below for Nippon India Index Fund - Sensex Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 0.04% Equity 99.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | 50018015% ₹139 Cr 1,497,490

↑ 1,030 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | 53217410% ₹95 Cr 702,968

↑ 484 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 10 | 50032510% ₹93 Cr 665,599

↑ 457 Infosys Ltd (Technology)

Equity, Since 31 Oct 10 | 5002096% ₹58 Cr 351,457

↑ 241 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 10 | 5324546% ₹54 Cr 274,851

↑ 189 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | 5005105% ₹45 Cr 115,019

↑ 79 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | 5001125% ₹44 Cr 408,610

↑ 281 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5322154% ₹38 Cr 280,871

↑ 193 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 10 | 5325403% ₹31 Cr 99,656

↑ 69 ITC Ltd (Consumer Defensive)

Equity, Since 29 Feb 12 | 5008753% ₹31 Cr 948,927

↑ 653 2. LIC MF Index Fund Sensex

LIC MF Index Fund Sensex

Growth Launch Date 14 Nov 02 NAV (17 Feb 26) ₹155.742 ↑ 0.32 (0.21 %) Net Assets (Cr) ₹94 on 31 Dec 25 Category Others - Index Fund AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating ☆ Risk Moderately High Expense Ratio 0.98 Sharpe Ratio 0.3 Information Ratio -18.24 Alpha Ratio -1.15 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Months (1%),1 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,524 31 Jan 23 ₹12,877 31 Jan 24 ₹15,554 31 Jan 25 ₹16,814 31 Jan 26 ₹17,851 Returns for LIC MF Index Fund Sensex

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month -0.2% 3 Month -2% 6 Month 3.2% 1 Year 9.7% 3 Year 11.1% 5 Year 10.2% 10 Year 15 Year Since launch 13% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.1% 2023 8.2% 2022 19% 2021 4.6% 2020 21.9% 2019 15.9% 2018 14.6% 2017 5.6% 2016 27.4% 2015 1.6% Fund Manager information for LIC MF Index Fund Sensex

Name Since Tenure Sumit Bhatnagar 3 Oct 23 2.33 Yr. Data below for LIC MF Index Fund Sensex as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 0.3% Equity 99.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 09 | 50018015% ₹13 Cr 141,805

↓ -292 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 09 | 53217410% ₹9 Cr 66,645

↓ -15 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 09 | 50032510% ₹9 Cr 63,128

↑ 12 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | 5002096% ₹5 Cr 33,237

↓ -47 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 09 | 5324546% ₹5 Cr 25,987

↓ -52 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 09 | 5005105% ₹4 Cr 10,898

↓ -09 State Bank of India (Financial Services)

Equity, Since 31 Mar 09 | 5001125% ₹4 Cr 38,736

↓ -11 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | 5322154% ₹4 Cr 26,687

↑ 53 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Mar 09 | 5325403% ₹3 Cr 9,448

↑ 16 ITC Ltd (Consumer Defensive)

Equity, Since 30 Sep 11 | 5008753% ₹3 Cr 89,867

↑ 77 3. Franklin India Index Fund Nifty Plan

Franklin India Index Fund Nifty Plan

Growth Launch Date 4 Aug 00 NAV (17 Feb 26) ₹207.604 ↑ 0.34 (0.16 %) Net Assets (Cr) ₹787 on 31 Dec 25 Category Others - Index Fund AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆ Risk Moderately High Expense Ratio 0.63 Sharpe Ratio 0.47 Information Ratio -3.74 Alpha Ratio -0.53 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-30 Days (1%),30 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,734 31 Jan 23 ₹13,048 31 Jan 24 ₹16,092 31 Jan 25 ₹17,531 31 Jan 26 ₹19,001 Returns for Franklin India Index Fund Nifty Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0% 3 Month -1.1% 6 Month 4.4% 1 Year 12.6% 3 Year 13.3% 5 Year 11.6% 10 Year 15 Year Since launch 12.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 9.5% 2022 20.2% 2021 4.9% 2020 24.3% 2019 14.7% 2018 12% 2017 3.2% 2016 28.3% 2015 3.3% Fund Manager information for Franklin India Index Fund Nifty Plan

Name Since Tenure Sandeep Manam 18 Oct 21 4.29 Yr. Shyam Sriram 26 Sep 24 1.35 Yr. Data below for Franklin India Index Fund Nifty Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 0.36% Equity 99.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 03 | HDFCBANK12% ₹94 Cr 1,010,405

↑ 4,206 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | ICICIBANK8% ₹64 Cr 471,797

↑ 1,673 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 03 | RELIANCE8% ₹62 Cr 445,990 Infosys Ltd (Technology)

Equity, Since 29 Feb 12 | INFY5% ₹38 Cr 231,373

↓ -5,973 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 04 | BHARTIARTL5% ₹36 Cr 184,054

↑ 4,494 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT4% ₹31 Cr 77,573

↑ 205 State Bank of India (Financial Services)

Equity, Since 31 Jan 03 | SBIN4% ₹30 Cr 274,059

↑ 717 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 09 | AXISBANK3% ₹26 Cr 189,309

↑ 642 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 05 | TCS3% ₹21 Cr 67,451

↑ 167 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 11 | ITC3% ₹21 Cr 636,552

↑ 1,810 4. IDBI Nifty Index Fund

IDBI Nifty Index Fund

Growth Launch Date 25 Jun 10 NAV (28 Jul 23) ₹36.2111 ↓ -0.02 (-0.06 %) Net Assets (Cr) ₹208 on 30 Jun 23 Category Others - Index Fund AMC IDBI Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 0.9 Sharpe Ratio 1.04 Information Ratio -3.93 Alpha Ratio -1.03 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,652 31 Jan 23 ₹12,934 Returns for IDBI Nifty Index Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 3.7% 3 Month 9.1% 6 Month 11.9% 1 Year 16.2% 3 Year 20.3% 5 Year 11.7% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for IDBI Nifty Index Fund

Name Since Tenure Data below for IDBI Nifty Index Fund as on 30 Jun 23

Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. Nippon India Index Fund - Nifty Plan

Nippon India Index Fund - Nifty Plan

Growth Launch Date 28 Sep 10 NAV (17 Feb 26) ₹43.7007 ↑ 0.07 (0.16 %) Net Assets (Cr) ₹3,061 on 31 Dec 25 Category Others - Index Fund AMC Nippon Life Asset Management Ltd. Rating ☆ Risk Moderately High Expense Ratio 0.49 Sharpe Ratio 0.48 Information Ratio -12.07 Alpha Ratio -0.47 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,705 31 Jan 23 ₹12,984 31 Jan 24 ₹16,044 31 Jan 25 ₹17,471 31 Jan 26 ₹18,949 Returns for Nippon India Index Fund - Nifty Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.1% 3 Month -1.1% 6 Month 4.5% 1 Year 12.7% 3 Year 13.4% 5 Year 11.5% 10 Year 15 Year Since launch 10.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.4% 2023 9.4% 2022 20.5% 2021 4.6% 2020 24% 2019 14.3% 2018 12.3% 2017 3.5% 2016 29% 2015 2.5% Fund Manager information for Nippon India Index Fund - Nifty Plan

Name Since Tenure Himanshu Mange 23 Dec 23 2.11 Yr. Data below for Nippon India Index Fund - Nifty Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 0.06% Equity 99.94% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | HDFCBANK12% ₹378 Cr 4,072,348

↑ 140,539 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | ICICIBANK8% ₹258 Cr 1,901,536

↑ 65,623 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 10 | RELIANCE8% ₹251 Cr 1,797,523

↑ 62,034 Infosys Ltd (Technology)

Equity, Since 31 Oct 10 | INFY5% ₹153 Cr 932,529

↑ 32,182 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 10 | BHARTIARTL5% ₹146 Cr 741,814

↑ 25,601 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹123 Cr 312,650

↑ 10,790 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN4% ₹119 Cr 1,104,571

↑ 38,119 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 10 | AXISBANK3% ₹105 Cr 762,993

↑ 26,331 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 10 | TCS3% ₹85 Cr 271,856

↑ 9,382 ITC Ltd (Consumer Defensive)

Equity, Since 29 Feb 12 | ITC3% ₹83 Cr 2,565,568

↑ 88,540

Popular Indices Tracked by Index Mutual Funds in India

Index mutual funds do not have official sub-categories under SEBI. However, fund houses offer index funds that track different market benchmarks.

Some commonly tracked indices include:

- Nifty 50 and Sensex – represent India’s largest and most stable companies

- Nifty Next 50 – companies just below the top 50, offering higher growth but more Volatility

- Sectoral indices – such as banking, IT, pharma or PSU indices

- International indices – like Nasdaq 100 or S&P 500 for global exposure

- Debt indices – government bond or PSU bond indices such as Bharat Bond

All these funds follow the same principle —they replicate an index, not pick stocks.

Index Funds vs ETFs (Exchange Traded Funds)

| Parameter | Index Funds | ETFs |

|---|---|---|

| Investment method | SIP or lump sum | Exchange traded |

| Demat account | Not required | Required |

| Pricing | End-of-day NAV | Real-time price |

| Suitable for | SIP investors | Traders & long-term investors |

Expense Ratio and Tracking Error: Why They Matter

Two funds tracking the same index can give different returns.

Always check:

- Expense ratio → lower is better

- Tracking error → closer to index = better replication

Even a 0.3% annual difference can reduce returns by lakhs over 20 years.

Why to Invest in Index Funds in India?

Some of the benefits of investing in Index Funds are:

1. Diversification

An index is a collection of different stocks and securities. They offer diversification to the investor which is the main motive of Asset Allocation. This ensures that the investor does not have all their eggs in one basket.

2. Less Expenses

Index funds have lower operating expenses compared to other mutual fund schemes. Here, the fund managers do not require a separate team of research analysts to carry out in-depth research of the companies, which usually involves significant costs. In index funds, the manager just needs to replicate the index. Therefore, the expense ratio is lower in the case of index funds.

3. Less Managerial Influence

Since the fund simply follows the movement of a particular index, the manager doesn’t have to choose what stocks to invest in. This is a plus point since the manager’s own style of investing (which may not always align with market trends) does not influence the fund.

Risks of Investing in Index Funds

While index funds are cost-efficient, they are not risk-free.

Market Risk: Returns depend entirely on index performance. If the market falls, so does the NAV.

No Flexibility: Since funds can’t deviate from the index, they may miss opportunities outside of it.

Tracking Error: Slight deviations from the index due to expenses or fund structure.

Experts suggest allocating 5–10% of your Portfolio to index funds for long-term wealth creation while balancing risks.

Who Should Invest in Index Funds?

- Long-term SIP investors

- Retirement planners

- Investors who prefer low cost and simplicity

- Those who don’t want fund manager risk

How to Invest in Index Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

FAQs

1. Are index mutual funds good for long-term investment?

A: Yes. Index funds are ideal for long-term investing due to low cost, diversification and consistent market-linked returns.

2. Can index funds beat active funds?

A: Over long periods, many index funds outperform most active funds after adjusting for expenses.

3. Are index funds safe?

A: They are subject to market risk but safer than individual stocks due to diversification.

4. Is SIP better than lump sum in index funds?

A: SIP is better for most investors as it reduces market timing risk and builds discipline.

Conclusion

Index mutual funds have transformed the way Indians invest. With minimal costs, transparent portfolios and consistent performance, they offer one of the most efficient paths to long-term wealth creation. Rather than chasing short-term outperformers, index investing allows you to participate in India’s economic growth in a simple and disciplined manner. For investors seeking stability, low expenses and stress-free investing, index mutual funds remain one of the smartest choices.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Quite detailed review which helps in deciding which is a better performing index fund