Types of Mutual Funds in India

The Mutual Fund industry has been in India since 1963. Today, there are more than 10,000 schemes that exist in India, and growth of the industry has been massive. The AUM of the Indian MF Industry has grown from ₹7.66 trillion as on August 31, 2013 to ₹46.63 trillion as on August 31, 2023 more than 6 fold increase in a span of 10 years. To add, the total number of folios as per MF parlance as on April 30, 20213 stood at 15.42 crore (154.2 million)

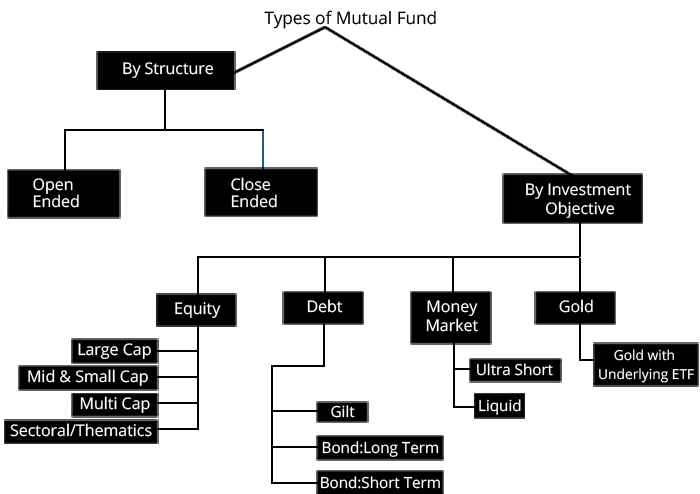

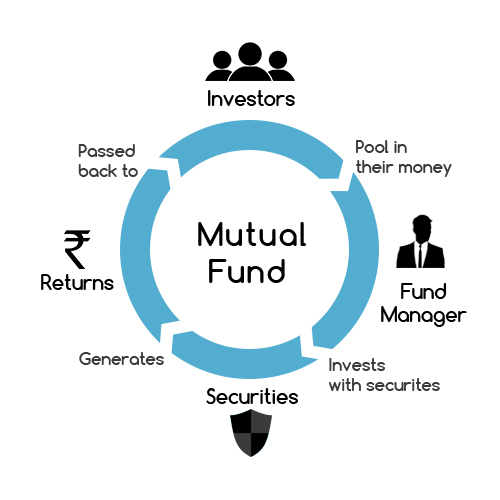

Looking at such eye-tempting growth, many people are attracted to invest, which is a great step for securing the future. Before you start, ensure your research well. It is important to know the basics of MFs such as types of Mutual Funds, risk & return, diversification, etc. MFs deploy money by Investing in the stock market for equities, they also take exposure to debt instruments. Likewise, they also invest in gold, hybrid, FOFs, etc. The basics classification is by maturity period, where there are two broad categories of mutual funds - open-ended and closed-ended.

Open-ended Mutual Funds

The majority of mutual funds in India are open-ended in nature. These funds are open for subscription (or in simple terms purchase) by investors at any time. They issue new units to investors who want to get into the fund. After the initial offering period (NFO), the units of these funds can be purchased. In a rare scenario, the Asset Management Company (AMC) can stop further purchase by investors if the AMC feels that there are not enough and good opportunities to deploy the fresh monies. However, for redemption, the AMC has to buy back the units.

Talk to our investment specialist

Closed-ended Mutual Funds

These are funds that are closed for further subscription (or purchase) by investors after the initial offering period (NFO). Unlike, Open-ended funds, investors cannot buy fresh units of these types of mutual funds after the NFO period. Hence, investing in closed-ended funds is possible only during the NFO period. Also, one thing to note is that investors cannot exit via redemption in the closed-ended fund. The redemption takes place once the period matures. Additionally, to provide an opportunity to exit, Mutual Fund Houses list the closed-ended funds on the stock exchange. Hence, investors would need to trade the closed-ended funds on the exchange to exit them before the maturity period.

Different Types of Mutual Funds

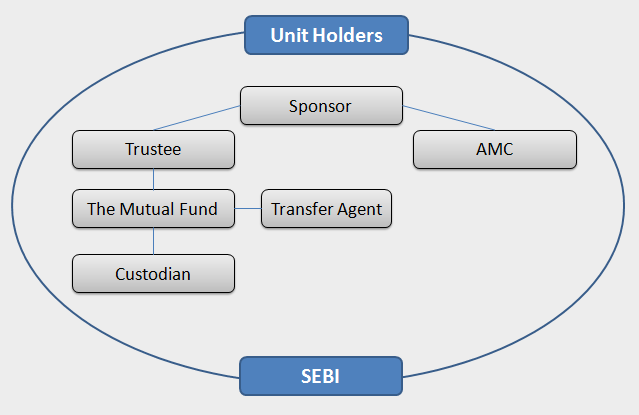

Guided by Securities and Exchange Board of India (SEBI) norms, there are five main broad categories and 36 sub-categories in Mutual Funds.

Fund Selection Methodology used to find 5 funds

1. Equity Mutual Funds

Equity Funds make money for investors by investing in the equity stock market. This option is suitable for investors looking for long-term returns. Some of the types of equity mutual funds are-

- Large cap funds

- mid cap funds

- Small cap funds

- Sector/thematic funds

- ELSS

- dividend yield funds

- focused fund

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹66.5931

↑ 2.21 ₹1,975 52.1 92.7 172.7 62.5 31 167.1 SBI PSU Fund Growth ₹36.9616

↑ 0.09 ₹5,980 10.5 18.9 33.4 35.8 27.9 11.3 ICICI Prudential Infrastructure Fund Growth ₹197.15

↓ -1.16 ₹8,077 0.5 1.6 17.1 25.7 26.2 6.7 Invesco India PSU Equity Fund Growth ₹68.22

↓ -0.17 ₹1,492 4.9 10.9 31 32.5 25.9 10.3 DSP India T.I.G.E.R Fund Growth ₹326.847

↓ -0.22 ₹5,184 4.1 4.2 21.3 26.8 24.5 -2.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹5,184 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 31.02% (top quartile). 5Y return: 27.86% (upper mid). 5Y return: 26.15% (lower mid). 5Y return: 25.88% (bottom quartile). 5Y return: 24.53% (bottom quartile). Point 6 3Y return: 62.48% (top quartile). 3Y return: 35.81% (upper mid). 3Y return: 25.69% (bottom quartile). 3Y return: 32.54% (lower mid). 3Y return: 26.79% (bottom quartile). Point 7 1Y return: 172.70% (top quartile). 1Y return: 33.44% (upper mid). 1Y return: 17.05% (bottom quartile). 1Y return: 31.04% (lower mid). 1Y return: 21.26% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (bottom quartile). Sharpe: 0.53 (lower mid). Sharpe: 0.08 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Large-cap funds invest in companies which have a large market capitalization (hence the name large-), usually, these are very large companies and are established players, e.g Unilever, Reliance, ITC etc. Mid-cap and small-cap funds invest in smaller companies, these companies by being smaller can show extraordinary growth and provide good returns. However, since they are small they can give losses and are riskier.

Thematic funds invest into a particular sector like infrastructure, power, media & entertainment etc. Not all mutual funds provide thematic funds, for e.g Reliance Mutual Fund provides exposure to thematic funds via its Power Sector Fund, Media and Entertainment Fund etc. ICICI Prudential Mutual Fund provides exposure to Banking & financial services sector via its ICICI Prudential Banking & Financial Services Fund, technology via the ICICI Prudential Technology Fund.

2. Debt Mutual Funds

Debt funds invest in fixed income instruments, also known as Bonds & gilts. Bonds funds are classified by their maturity period (hence the name, long term or short term). As per tenure, the risk also varies. The broad categories of debt mutual funds, such as:

- Overnight funds

- Liquid Funds

- Ultra short term funds

- Money market funds

- Dynamic bonds

- Corporate bonds

- Gilt Funds

- Credit risk funds

- Floater fund

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Credit Risk Fund Growth ₹50.3642

↑ 0.02 ₹217 -0.5 1 17.9 14.1 10.8 21 Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 8.7 Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3282

↓ 0.00 ₹1,138 4.7 7.4 13.2 12 9.9 13.4 Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 5.6 Sundaram Low Duration Fund Growth ₹28.8391

↑ 0.01 ₹550 1 10.2 11.8 5 5.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Credit Risk Fund Sundaram Short Term Debt Fund Sundaram Low Duration Fund Point 1 Bottom quartile AUM (₹217 Cr). Bottom quartile AUM (₹297 Cr). Highest AUM (₹1,138 Cr). Lower mid AUM (₹362 Cr). Upper mid AUM (₹550 Cr). Point 2 Established history (22+ yrs). Established history (18+ yrs). Established history (10+ yrs). Oldest track record among peers (23 yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Not Rated. Rating: 2★ (upper mid). Rating: 2★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 17.92% (top quartile). 1Y return: 13.69% (upper mid). 1Y return: 13.15% (lower mid). 1Y return: 12.83% (bottom quartile). 1Y return: 11.79% (bottom quartile). Point 6 1M return: -0.97% (bottom quartile). 1M return: 0.59% (upper mid). 1M return: 0.96% (top quartile). 1M return: 0.20% (bottom quartile). 1M return: 0.28% (lower mid). Point 7 Sharpe: 1.48 (lower mid). Sharpe: 2.57 (top quartile). Sharpe: 2.38 (upper mid). Sharpe: 0.98 (bottom quartile). Sharpe: 0.99 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.67% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 4.52% (lower mid). Yield to maturity (debt): 4.19% (bottom quartile). Point 10 Modified duration: 2.43 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). Modified duration: 2.41 yrs (bottom quartile). Modified duration: 1.20 yrs (lower mid). Modified duration: 0.47 yrs (upper mid). DSP Credit Risk Fund

Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Credit Risk Fund

Sundaram Short Term Debt Fund

Sundaram Low Duration Fund

3. Hybrid Mutual Funds

Hybrid funds are a type of mutual fund that invests both in equity and debt. They can be Balanced Fund or Monthly Income Plan (MIPs). The portion of investment is higher in equities. Some of the types of hybrid funds are:

- Arbitrage funds

- Dynamic Asset Allocation

- Conservative hybrid funds

- Balanced hybrid funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.6541

↓ -0.39 ₹6,848 1.8 7.3 16.3 20.8 14.6 11.1 SBI Multi Asset Allocation Fund Growth ₹67.1464

↓ -0.12 ₹14,944 6.2 13 23.7 20.2 15 18.6 ICICI Prudential Multi-Asset Fund Growth ₹826.395

↑ 3.78 ₹80,768 2.6 8.6 17.6 20.2 19.8 18.6 ICICI Prudential Equity and Debt Fund Growth ₹408.59

↓ -2.02 ₹49,257 -0.1 3 15.7 19.4 18.8 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.19

↓ -0.12 ₹1,329 1.4 0.6 14.3 19.4 18.4 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Multi Asset Fund SBI Multi Asset Allocation Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Bottom quartile AUM (₹6,848 Cr). Lower mid AUM (₹14,944 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (17+ yrs). Established history (20+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.58% (bottom quartile). 5Y return: 15.02% (bottom quartile). 5Y return: 19.78% (top quartile). 5Y return: 18.79% (upper mid). 5Y return: 18.43% (lower mid). Point 6 3Y return: 20.76% (top quartile). 3Y return: 20.25% (upper mid). 3Y return: 20.19% (lower mid). 3Y return: 19.37% (bottom quartile). 3Y return: 19.36% (bottom quartile). Point 7 1Y return: 16.26% (lower mid). 1Y return: 23.72% (top quartile). 1Y return: 17.61% (upper mid). 1Y return: 15.68% (bottom quartile). 1Y return: 14.27% (bottom quartile). Point 8 1M return: 0.79% (bottom quartile). 1M return: 1.52% (bottom quartile). 1M return: 2.18% (lower mid). 1M return: 2.69% (upper mid). 1M return: 4.54% (top quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.76 (lower mid). Sharpe: 2.05 (top quartile). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). UTI Multi Asset Fund

SBI Multi Asset Allocation Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

4. Solution Oriented Schemes

Solution oriented schemes are helpful for those investors who wish to create long-term wealth that mainly includes Retirement planning and a child’s future education by investing in Mutual Funds. Earlier, these plans were a part of equity or balanced schemes, but as per SEBI’s new circulation, these funds are separately categorised under solution oriented schemes. Also these schemes used to have a lock-in for three years, but now these funds have a mandatory lock-in of five years.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Retirement Savings Fund - Equity Plan Growth ₹50.656

↓ -0.52 ₹6,941 -2.1 0.2 11.3 17.4 17.6 5.2 ICICI Prudential Child Care Plan (Gift) Growth ₹326.19

↓ -1.66 ₹1,378 -1.5 -2 13.6 19 14.3 8.3 HDFC Retirement Savings Fund - Hybrid - Equity Plan Growth ₹38.743

↓ -0.32 ₹1,703 -1.7 0.5 9.7 13.8 12.4 5.4 SBI Magnum Children's Benefit Plan Growth ₹111.161

↑ 0.19 ₹132 0.2 1.6 7.2 12.5 11.3 3.2 Tata Retirement Savings Fund - Progressive Growth ₹63.066

↓ -0.41 ₹2,041 -3.6 -3.3 8.7 15.8 11.1 -1.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Retirement Savings Fund - Equity Plan ICICI Prudential Child Care Plan (Gift) HDFC Retirement Savings Fund - Hybrid - Equity Plan SBI Magnum Children's Benefit Plan Tata Retirement Savings Fund - Progressive Point 1 Highest AUM (₹6,941 Cr). Bottom quartile AUM (₹1,378 Cr). Lower mid AUM (₹1,703 Cr). Bottom quartile AUM (₹132 Cr). Upper mid AUM (₹2,041 Cr). Point 2 Established history (10+ yrs). Oldest track record among peers (24 yrs). Established history (10+ yrs). Established history (24+ yrs). Established history (14+ yrs). Point 3 Not Rated. Rating: 2★ (lower mid). Not Rated. Top rated. Rating: 5★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.61% (top quartile). 5Y return: 14.33% (upper mid). 5Y return: 12.35% (lower mid). 5Y return: 11.30% (bottom quartile). 5Y return: 11.13% (bottom quartile). Point 6 3Y return: 17.36% (upper mid). 3Y return: 19.05% (top quartile). 3Y return: 13.85% (bottom quartile). 3Y return: 12.51% (bottom quartile). 3Y return: 15.79% (lower mid). Point 7 1Y return: 11.28% (upper mid). 1Y return: 13.60% (top quartile). 1Y return: 9.69% (lower mid). 1Y return: 7.21% (bottom quartile). 1Y return: 8.66% (bottom quartile). Point 8 1M return: 1.82% (upper mid). 1M return: 3.55% (top quartile). 1M return: 1.42% (lower mid). 1M return: 1.13% (bottom quartile). 1M return: 1.39% (bottom quartile). Point 9 Alpha: -1.32 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -5.02 (bottom quartile). Point 10 Sharpe: 0.09 (upper mid). Sharpe: 0.12 (top quartile). Sharpe: 0.02 (lower mid). Sharpe: -0.32 (bottom quartile). Sharpe: -0.13 (bottom quartile). HDFC Retirement Savings Fund - Equity Plan

ICICI Prudential Child Care Plan (Gift)

HDFC Retirement Savings Fund - Hybrid - Equity Plan

SBI Magnum Children's Benefit Plan

Tata Retirement Savings Fund - Progressive

5. Gold Funds

The Gold mutual funds invest in gold ETFs (exchange-traded funds). Ideally suitable for investor who wants to take exposure in gold. Unlike physical gold, they are easy to purchase and redeem (buying and selling). Also, they offer transparency of price for investors for buying and selling.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹46.2901

↑ 0.47 ₹15,024 28.5 58.9 80.7 39.8 26.2 71.5 Axis Gold Fund Growth ₹46.0175

↑ 0.44 ₹2,835 28.7 58.7 79.7 39.7 26.1 69.8 ICICI Prudential Regular Gold Savings Fund Growth ₹48.8424

↑ 0.36 ₹6,338 28.1 58.3 80.1 39.6 26 72 Nippon India Gold Savings Fund Growth ₹60.4268

↑ 0.56 ₹7,160 28.2 58.4 80 39.5 26 71.2 HDFC Gold Fund Growth ₹47.1738

↑ 0.43 ₹11,458 28.2 58.5 80.1 39.5 26 71.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Gold Fund Axis Gold Fund ICICI Prudential Regular Gold Savings Fund Nippon India Gold Savings Fund HDFC Gold Fund Point 1 Highest AUM (₹15,024 Cr). Bottom quartile AUM (₹2,835 Cr). Bottom quartile AUM (₹6,338 Cr). Lower mid AUM (₹7,160 Cr). Upper mid AUM (₹11,458 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 1★ (lower mid). Rating: 1★ (bottom quartile). Rating: 2★ (upper mid). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 26.19% (top quartile). 5Y return: 26.08% (upper mid). 5Y return: 25.96% (bottom quartile). 5Y return: 25.95% (bottom quartile). 5Y return: 25.98% (lower mid). Point 6 3Y return: 39.84% (top quartile). 3Y return: 39.66% (upper mid). 3Y return: 39.56% (lower mid). 3Y return: 39.53% (bottom quartile). 3Y return: 39.49% (bottom quartile). Point 7 1Y return: 80.73% (top quartile). 1Y return: 79.66% (bottom quartile). 1Y return: 80.11% (lower mid). 1Y return: 80.02% (bottom quartile). 1Y return: 80.12% (upper mid). Point 8 1M return: 3.00% (upper mid). 1M return: 3.08% (top quartile). 1M return: 2.54% (bottom quartile). 1M return: 2.99% (lower mid). 1M return: 2.67% (bottom quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.25 (lower mid). Sharpe: 3.44 (top quartile). Sharpe: 3.10 (bottom quartile). Sharpe: 3.01 (bottom quartile). Sharpe: 3.29 (upper mid). SBI Gold Fund

Axis Gold Fund

ICICI Prudential Regular Gold Savings Fund

Nippon India Gold Savings Fund

HDFC Gold Fund

Other Mutual Fund Schemes

Index Fund/Exchange Traded Fund (ETF) and fund of funds (FoFs) are categorised under other schemes.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Nifty Next 50 Index Fund Growth ₹61.2741

↑ 0.05 ₹8,103 2.6 3.2 16.8 22.9 14.9 2.1 IDBI Nifty Junior Index Fund Growth ₹51.689

↑ 0.04 ₹98 2.5 3.1 16.7 22.6 14.8 2 Kotak Asset Allocator Fund - FOF Growth ₹263.223

↑ 2.67 ₹2,398 4.9 12 23.2 21.1 18.4 15.4 Bandhan Asset Allocation Fund of Funds - Moderate Plan Growth ₹42.6704

↓ -0.12 ₹20 3.2 5.2 14 13.7 10.1 6.3 ICICI Prudential Advisor Series - Debt Management Fund Growth ₹46.4946

↑ 0.04 ₹108 1 2.9 7.1 7.7 6.3 7.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Nifty Next 50 Index Fund IDBI Nifty Junior Index Fund Kotak Asset Allocator Fund - FOF Bandhan Asset Allocation Fund of Funds - Moderate Plan ICICI Prudential Advisor Series - Debt Management Fund Point 1 Highest AUM (₹8,103 Cr). Bottom quartile AUM (₹98 Cr). Upper mid AUM (₹2,398 Cr). Bottom quartile AUM (₹20 Cr). Lower mid AUM (₹108 Cr). Point 2 Established history (15+ yrs). Established history (15+ yrs). Established history (21+ yrs). Established history (16+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 14.89% (upper mid). 5Y return: 14.81% (lower mid). 5Y return: 18.45% (top quartile). 5Y return: 10.11% (bottom quartile). 5Y return: 6.34% (bottom quartile). Point 6 3Y return: 22.89% (top quartile). 3Y return: 22.58% (upper mid). 3Y return: 21.13% (lower mid). 3Y return: 13.66% (bottom quartile). 3Y return: 7.65% (bottom quartile). Point 7 1Y return: 16.84% (upper mid). 1Y return: 16.74% (lower mid). 1Y return: 23.25% (top quartile). 1Y return: 14.00% (bottom quartile). 1Y return: 7.05% (bottom quartile). Point 8 1M return: 5.36% (top quartile). 1M return: 5.33% (upper mid). 1M return: 0.38% (bottom quartile). 1M return: 1.13% (lower mid). 1M return: 0.61% (bottom quartile). Point 9 Alpha: -0.79 (bottom quartile). Alpha: -0.88 (bottom quartile). Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 10 Sharpe: 0.17 (bottom quartile). Sharpe: 0.16 (bottom quartile). Sharpe: 1.38 (top quartile). Sharpe: 0.90 (upper mid). Sharpe: 0.65 (lower mid). ICICI Prudential Nifty Next 50 Index Fund

IDBI Nifty Junior Index Fund

Kotak Asset Allocator Fund - FOF

Bandhan Asset Allocation Fund of Funds - Moderate Plan

ICICI Prudential Advisor Series - Debt Management Fund

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

What is the future of mutual funds now after Covid 19, approximately how long it will take for the Sensex and Nifty to recover in January-February 2020 ?