What are Money Market Funds?

A money market fund (MMF) is a type of fixed income mutual fund that invests in debt securities. But, before we start with money market funds, it's important to understand what is a fixed income instrument? Well, as the name denotes, a fixed income instrument is something that generates a specified amount of income over a certain period. The investor is given a fixed claim on the assets held by the issuer, fixed income instruments are considered low-risk and low-yield investments. Essentially, fixed income instruments are nothing, but a way of borrowing funds (where the borrowing is done by the issuer).

Fixed Income Vs Stocks

For starters, fixed income gives economic rights to the holder, which includes the right to receive interest payments and the return of all or part of capital invested at a given date. In contrast, the shareholder (stock owner) receives dividends from the issuer, but the company is not bound by any law to pay dividends. Also, another important difference is that the fixed income holder is a creditor of the company that issues the security, while a shareholder is a partner, owning a part of the capital stock. Here it’s important to understand that if the company goes bust, the creditors (bondholders) have priority over shareholders (equity holders).

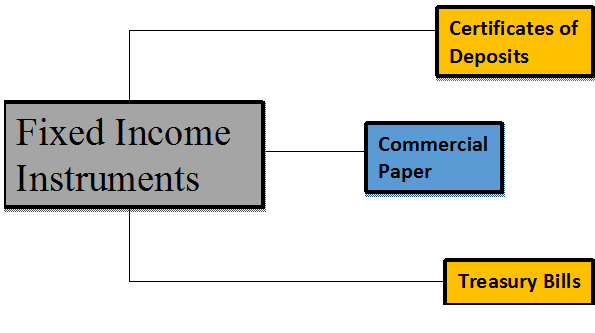

Types of Fixed Income Instruments

There are different fixed income instruments that fall under money market instruments, to name some of them:

Certificates of Deposits (CDs)

Time deposits like term deposits are commonly offered to consumers by banks (scheduled commercial banks) & all India financial institutions. The difference between this and a term deposit in a Bank is that CDs can’t be withdrawn.

Commercial Paper (CPs)

Commercial papers are usually known as promissory notes which are unsecured and are generally issued by companies and financial institutions, at a discounted rate from their face value. The fixed maturity for commercial papers is 1 to 270 days. The purposes for which they are issued are - for inventory financing, accounts receivables, and settling short-term liabilities or loans.

Treasury Bills (T-Bills)

Treasury bills were first issued by the Indian government in 1917. Treasury bills are short-term financial instruments that are issued by the Central Bank of the country. It is one of the safest money market instruments as it is void of market risks (since the risk is sovereign or in this case the Government of India), though the return on investments is not that huge. Treasury bills are circulated by the primary as well as the secondary markets. The maturity periods for treasury bills are respectively 3-month, 6-month, and 1-year.

There are lots of other fixed income instruments such as repurchase agreements (repos), asset-backed securities etc., that also exist in the Indian fixed income market, but the above are the more common ones.

Talk to our investment specialist

Why to Invest in Money Market Mutual Funds?

- Securities in the money market are relatively low risk.

- Money market funds are considered to be the safe and secure of all Mutual Fund investments.

- Considering money market funds, it’s easy to invest in a money market account. Investing through Mutual Funds investors can open an account, make deposits and withdrawals virtually at their convenience.

- Money market funds are considered to be one of the least volatile types of all mutual fund investments.

- The performance of money market funds is closely tied to the interest rates set by the Reserve Bank of India, the Central Bank of India. So, when RBI raises rates in the market, yields increase, and money market funds are able to give good returns.

Money Market Instruments & Bonds: The Difference

Bonds have a maturity period of more than one year which differentiates it from other debt securities like commercial papers, treasury bills and other money market instruments which typically have a maturity period of less than one year.

What is Money Market?

Money market generally refers to a section of the financial market where financial instruments with smaller maturities (less than a year) and high liquidity are traded. India has a very active money market, where a host of instruments are traded. Here you have Mutual Fund companies, government banks and various other large domestic institutions participating. The money market has become a component of the financial market for buying and selling of securities of short-term duration, such as commercial papers and treasury bills.

Money Market Rates

The money market rates are the interest rates offered by short-term money market instruments. These instruments have a maturity ranging from 1 day to one year. The money market rates vary over many complex instruments such as treasury bills, call money, commercial paper (CP), certificates of deposits (CDs), repos, etc. The Reserve Bank of India (RBI) is largely the governing authority over the money markets.

An example of the money market rates of various instruments as given on the RBI site as of 28th Feb 2017 is below for reference.

| Volume (One Leg) | Weighted Average Rate | Range | |

|---|---|---|---|

| A. Overnight Segment (I+II+III+IV) | 553,584.29 | 6.64 | 4.60-6.86 |

| I. Call Money | 16,300.98 | 6.67 | 4.60-6.85 |

| II. Triparty Repo | 376,743.10 | 6.64 | 6.56-6.80 |

| III. Market Repo | 160,540.21 | 6.65 | 6.00-6.86 |

| IV. Repo in Corporate Bond | 0.00 | - | - |

| B. Term Segment | |||

| I. Notice Money** | 109.00 | 6.27 | 6.00-6.70 |

| II. Term Money@@ | 351.00 | - | 6.40-7.00 |

| III. Triparty Repo | 55.00 | 6.60 | 6.60-6.60 |

| IV. Market Repo | 1,075.00 | 6.76 | 6.75-6.85 |

| V. Repo in Corporate Bond | 0.00 | - | - |

Source: Money Market Operations, RBI Date: 27 Feb 2023

Mutual Fund Companies Offering Money Market Funds

As we have learnt about various types of instruments above, it’s equally important to know how an investor could invest in money market funds. There are 44 AMCs (Asset Managment Companies) in India, most of them offering money market funds (mainly Liquid Funds and ultra-short funds for investors). Investors can also invest via distributors like banks and brokers. Investing in money market funds requires one to follow the respective procedure and the relevant applications. The terms & conditions of debt mutual funds may vary, therefore, it’s important to get an overall knowledge and then choose the one that meets your needs. Moreover, before investing into any money market mutual funds carefully consider its investment objectives, risks, returns, and expenses.

Factors to Consider for Investing in MMFs

Here are some important aspects that you must consider before investing in money market funds in India:

a. Risks and Returns

Money Market Funds are debt funds and hence carry all the risks applicable to debt funds like interest rate risk and credit risk. Additionally, the fund manager might invest in instruments with a slightly higher risk component to increase returns. Usually, money market funds tend to offer better returns than a regular Savings Account. The Net Asset Value or NAV of these funds changes with a change in the interest rate regime.

b. Expense Ratio

Since the returns are not very high, the expense ratio plays an important role in determining your earnings from a money market fund. Expense Ratio is a small percentage of the total assets of the fund charged by the fund house towards fund management services. Ideally, you should look for funds with a lower expense ratio to maximize your returns.

c. Invest according to your Investment Plan

Usually, money market funds are recommended to investors with an investment horizon of 90-365 days. These schemes can help you diversify your Portfolio and help invest surplus cash while maintaining liquidity. Ensure that you invest according to your Investment plan.

d. Taxation

In the case of Money Market Funds, the taxation rules are as follows:

Capital Gains Tax

If you hold the units of the scheme for a period of up to three years, then the Capital Gains earned by you are called short-term capital gains or STCG. STCG is added to your taxable income and taxed as per the applicable income tax slab. If you hold the units of the scheme for more than three years, then the capital gains earned by you are called long-term capital gains or LTCG. It is taxed at 20% with indexation benefits.

Fund Selection Methodology used to find 5 funds

Best Money Market Funds to Invest in FY 26 - 27

Some of the best money market funds in India are as follows-

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Money Market Fund Growth ₹395.548

↑ 0.07 ₹35,025 1.4 3 7.2 7.5 7.4 6.91% 5M 12D 5M 25D UTI Money Market Fund Growth ₹3,214.36

↑ 0.60 ₹20,497 1.4 3 7.2 7.5 7.5 6.96% 4M 26D 4M 26D Franklin India Savings Fund Growth ₹52.2799

↑ 0.01 ₹3,898 1.4 3 7.2 7.4 7.4 6.89% 5M 8D 5M 19D Nippon India Money Market Fund Growth ₹4,324.44

↑ 0.77 ₹21,699 1.4 2.9 7.2 7.5 7.4 6.48% 4M 23D 5M 3D Tata Money Market Fund Growth ₹4,919.19

↑ 0.72 ₹37,939 1.4 2.9 7.1 7.5 7.4 6.35% 5D 5D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Money Market Fund UTI Money Market Fund Franklin India Savings Fund Nippon India Money Market Fund Tata Money Market Fund Point 1 Upper mid AUM (₹35,025 Cr). Bottom quartile AUM (₹20,497 Cr). Bottom quartile AUM (₹3,898 Cr). Lower mid AUM (₹21,699 Cr). Highest AUM (₹37,939 Cr). Point 2 Established history (19+ yrs). Established history (16+ yrs). Oldest track record among peers (24 yrs). Established history (20+ yrs). Established history (22+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Moderately Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 7.22% (top quartile). 1Y return: 7.22% (upper mid). 1Y return: 7.20% (lower mid). 1Y return: 7.17% (bottom quartile). 1Y return: 7.14% (bottom quartile). Point 6 1M return: 0.62% (lower mid). 1M return: 0.61% (bottom quartile). 1M return: 0.60% (bottom quartile). 1M return: 0.63% (top quartile). 1M return: 0.62% (upper mid). Point 7 Sharpe: 2.31 (top quartile). Sharpe: 2.26 (upper mid). Sharpe: 2.24 (lower mid). Sharpe: 2.08 (bottom quartile). Sharpe: 2.11 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.91% (upper mid). Yield to maturity (debt): 6.96% (top quartile). Yield to maturity (debt): 6.89% (lower mid). Yield to maturity (debt): 6.48% (bottom quartile). Yield to maturity (debt): 6.35% (bottom quartile). Point 10 Modified duration: 0.45 yrs (bottom quartile). Modified duration: 0.41 yrs (lower mid). Modified duration: 0.44 yrs (bottom quartile). Modified duration: 0.40 yrs (upper mid). Modified duration: 0.01 yrs (top quartile). ICICI Prudential Money Market Fund

UTI Money Market Fund

Franklin India Savings Fund

Nippon India Money Market Fund

Tata Money Market Fund

The objective of the Plan will be to seek to provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through investments made primarily in money market and debt securities. Below is the key information for ICICI Prudential Money Market Fund Returns up to 1 year are on To provide highest possible current income consistent with preservation of capital and providing liquidity from investing in a diversified portfolio of short term money market securities. Research Highlights for UTI Money Market Fund Below is the key information for UTI Money Market Fund Returns up to 1 year are on (Erstwhile Franklin India Savings Plus Fund Retail Option) Aims to provide income consistent with the prudent risk from a portfolio comprising substantially of floating rate debt instruments, fixed rate debt instruments swapped for floating rate returns, and also fixed rate instruments and money market instruments. Research Highlights for Franklin India Savings Fund Below is the key information for Franklin India Savings Fund Returns up to 1 year are on (Erstwhile Reliance Liquidity Fund) The investment objective of the Scheme is to generate optimal returns consistent with moderate levels of risk and high liquidity. Accordingly, investments shall predominantly be made in Debt and Money Market Instruments. Research Highlights for Nippon India Money Market Fund Below is the key information for Nippon India Money Market Fund Returns up to 1 year are on (Erstwhile Tata Liquid Fund) To create a highly liquid portfolio of good quality debt as well as money market instruments so as to provide reasonable returns and high liquidity to the unitholders. Research Highlights for Tata Money Market Fund Below is the key information for Tata Money Market Fund Returns up to 1 year are on 1. ICICI Prudential Money Market Fund

ICICI Prudential Money Market Fund

Growth Launch Date 9 Mar 06 NAV (27 Feb 26) ₹395.548 ↑ 0.07 (0.02 %) Net Assets (Cr) ₹35,025 on 31 Jan 26 Category Debt - Money Market AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.32 Sharpe Ratio 2.31 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 100 Exit Load NIL Yield to Maturity 6.91% Effective Maturity 5 Months 25 Days Modified Duration 5 Months 12 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,379 28 Feb 23 ₹10,915 29 Feb 24 ₹11,748 28 Feb 25 ₹12,642 28 Feb 26 ₹13,552 Returns for ICICI Prudential Money Market Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 3% 1 Year 7.2% 3 Year 7.5% 5 Year 6.3% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.7% 2022 7.4% 2021 4.7% 2020 3.7% 2019 6.2% 2018 7.9% 2017 7.7% 2016 6.7% 2015 7.7% Fund Manager information for ICICI Prudential Money Market Fund

Name Since Tenure Manish Banthia 12 Jun 23 2.64 Yr. Nikhil Kabra 3 Aug 16 9.5 Yr. Data below for ICICI Prudential Money Market Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 78.74% Debt 21.01% Other 0.26% Debt Sector Allocation

Sector Value Corporate 47.46% Cash Equivalent 44.27% Government 8.01% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 19/03/2026 Maturing 182 DTB

Sovereign Bonds | -7% ₹2,320 Cr 233,500,000

↑ 233,500,000 Axis Bank Ltd.

Debentures | -4% ₹1,406 Cr 30,000 12/03/2026 Maturing 364 DTB

Sovereign Bonds | -4% ₹1,308 Cr 131,500,000 Union Bank of India

Domestic Bonds | -3% ₹983 Cr 21,000

↑ 21,000 Small Industries Development Bank of India

Debentures | -2% ₹796 Cr 17,000 Indusind Bank Ltd.

Debentures | -2% ₹699 Cr 15,000

↑ 15,000 Bank of Baroda

Debentures | -2% ₹657 Cr 14,000 National Bank for Agriculture and Rural Development

Domestic Bonds | -2% ₹655 Cr 14,000 Canara Bank

Domestic Bonds | -1% ₹375 Cr 8,000 National Bank for Agriculture and Rural Development

Domestic Bonds | -1% ₹373 Cr 8,000

↑ 8,000 2. UTI Money Market Fund

UTI Money Market Fund

Growth Launch Date 13 Jul 09 NAV (27 Feb 26) ₹3,214.36 ↑ 0.60 (0.02 %) Net Assets (Cr) ₹20,497 on 15 Feb 26 Category Debt - Money Market AMC UTI Asset Management Company Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.25 Sharpe Ratio 2.26 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.96% Effective Maturity 4 Months 26 Days Modified Duration 4 Months 26 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,388 28 Feb 23 ₹10,942 29 Feb 24 ₹11,779 28 Feb 25 ₹12,678 28 Feb 26 ₹13,591 Returns for UTI Money Market Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 3% 1 Year 7.2% 3 Year 7.5% 5 Year 6.3% 10 Year 15 Year Since launch 7.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 7.7% 2022 7.4% 2021 4.9% 2020 3.7% 2019 6% 2018 8% 2017 7.8% 2016 6.7% 2015 7.7% Fund Manager information for UTI Money Market Fund

Name Since Tenure Anurag Mittal 1 Dec 21 4.17 Yr. Amit Sharma 7 Jul 17 8.58 Yr. Data below for UTI Money Market Fund as on 15 Feb 26

Asset Allocation

Asset Class Value Cash 68.52% Debt 31.21% Other 0.28% Debt Sector Allocation

Sector Value Corporate 43.56% Cash Equivalent 35.9% Government 20.26% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Canara Bank

Domestic Bonds | -3% ₹684 Cr 7,000,000,000 Indusind Bank Ltd.

Debentures | -3% ₹538 Cr 5,500,000,000 19/03/2026 Maturing 364 DTB

Sovereign Bonds | -2% ₹497 Cr 5,000,000,000 18/06/2026 Maturing 182 DTB

Sovereign Bonds | -2% ₹490 Cr 5,000,000,000

↑ 5,000,000,000 Union Bank of India

Domestic Bonds | -2% ₹392 Cr 4,000,000,000 National Bank for Agriculture and Rural Development

Domestic Bonds | -2% ₹373 Cr 4,000,000,000

↑ 4,000,000,000 08/05/2026 Maturing 182 DTB

Sovereign Bonds | -2% ₹345 Cr 3,500,000,000

↑ 3,500,000,000 21/05/2026 Maturing 182 DTB

Sovereign Bonds | -2% ₹344 Cr 3,500,000,000 Export-Import Bank of India

Domestic Bonds | -1% ₹280 Cr 3,000,000,000

↑ 3,000,000,000 Bank Of Maharashtra

Domestic Bonds | -1% ₹211 Cr 2,250,000,000

↓ -250,000,000 3. Franklin India Savings Fund

Franklin India Savings Fund

Growth Launch Date 11 Feb 02 NAV (27 Feb 26) ₹52.2799 ↑ 0.01 (0.02 %) Net Assets (Cr) ₹3,898 on 31 Jan 26 Category Debt - Money Market AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately Low Expense Ratio 0.3 Sharpe Ratio 2.24 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.89% Effective Maturity 5 Months 19 Days Modified Duration 5 Months 8 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,370 28 Feb 23 ₹10,874 29 Feb 24 ₹11,692 28 Feb 25 ₹12,576 28 Feb 26 ₹13,480 Returns for Franklin India Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 3% 1 Year 7.2% 3 Year 7.4% 5 Year 6.2% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.7% 2022 7.3% 2021 4.4% 2020 3.6% 2019 6% 2018 8.5% 2017 7.5% 2016 7.2% 2015 8.1% Fund Manager information for Franklin India Savings Fund

Name Since Tenure Rahul Goswami 6 Oct 23 2.33 Yr. Rohan Maru 10 Oct 24 1.31 Yr. Chandni Gupta 30 Apr 24 1.76 Yr. Data below for Franklin India Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 99.6% Debt 0.13% Other 0.27% Debt Sector Allocation

Sector Value Cash Equivalent 42.08% Corporate 41.4% Government 16.25% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 05/03/2026 Maturing 364 DTB

Sovereign Bonds | -6% ₹224 Cr 22,500,000 Punjab National Bank

Domestic Bonds | -3% ₹104 Cr 2,100 Kotak Mahindra Bank Ltd.

Debentures | -2% ₹74 Cr 1,500 12/03/2026 Maturing 364 DTB

Sovereign Bonds | -1% ₹50 Cr 5,000,000 Indian Bank

Domestic Bonds | -1% ₹50 Cr 1,000 08.39 RJ UDAY 2026

Domestic Bonds | -1% ₹30 Cr 2,860,000 HDFC Bank Ltd.

Debentures | -1% ₹25 Cr 500 Corporate Debt Market Development Fund Class A2

- | -0% ₹10 Cr 8,992

↑ 8,992 6.88% Westbengal Sdl 2026

Sovereign Bonds | -0% ₹5 Cr 500,000 Call, Cash & Other Assets

CBLO | -9% ₹352 Cr 4. Nippon India Money Market Fund

Nippon India Money Market Fund

Growth Launch Date 16 Jun 05 NAV (27 Feb 26) ₹4,324.44 ↑ 0.77 (0.02 %) Net Assets (Cr) ₹21,699 on 31 Jan 26 Category Debt - Money Market AMC Nippon Life Asset Management Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.39 Sharpe Ratio 2.08 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load NIL Yield to Maturity 6.48% Effective Maturity 5 Months 3 Days Modified Duration 4 Months 23 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,392 28 Feb 23 ₹10,951 29 Feb 24 ₹11,783 28 Feb 25 ₹12,680 28 Feb 26 ₹13,586 Returns for Nippon India Money Market Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 2.9% 1 Year 7.2% 3 Year 7.5% 5 Year 6.3% 10 Year 15 Year Since launch 7.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.8% 2022 7.4% 2021 5% 2020 3.8% 2019 6% 2018 8.1% 2017 7.9% 2016 6.6% 2015 7.6% Fund Manager information for Nippon India Money Market Fund

Name Since Tenure Kinjal Desai 16 Jul 18 7.55 Yr. Vikash Agarwal 14 Sep 24 1.38 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Money Market Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 79.21% Debt 20.52% Other 0.27% Debt Sector Allocation

Sector Value Cash Equivalent 47.71% Corporate 43.47% Government 8.56% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Indusind Bank Ltd.

Debentures | -3% ₹699 Cr 15,000

↑ 15,000 21/05/2026 Maturing 182 DTB

Sovereign Bonds | -2% ₹443 Cr 45,000,000 Small Industries Development Bank of India

Debentures | -2% ₹398 Cr 8,500 Bank of Baroda

Debentures | -2% ₹367 Cr 7,500 National Bank for Agriculture and Rural Development

Domestic Bonds | -1% ₹303 Cr 6,500

↑ 6,500 Small Industries Development Bank of India

Debentures | -1% ₹286 Cr 6,000 Union Bank of India

Domestic Bonds | -1% ₹258 Cr 5,500

↑ 5,500 05/03/2026 Maturing 364 DTB

Sovereign Bonds | -1% ₹249 Cr 25,000,000 Canara Bank

Domestic Bonds | -1% ₹234 Cr 5,000 IDFC First Bank Ltd.

Debentures | -1% ₹233 Cr 5,000

↑ 5,000 5. Tata Money Market Fund

Tata Money Market Fund

Growth Launch Date 22 May 03 NAV (27 Feb 26) ₹4,919.19 ↑ 0.72 (0.01 %) Net Assets (Cr) ₹37,939 on 15 Feb 26 Category Debt - Money Market AMC Tata Asset Management Limited Rating ☆☆☆ Risk Low Expense Ratio 0.44 Sharpe Ratio 2.11 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.35% Effective Maturity 5 Days Modified Duration 5 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,404 28 Feb 23 ₹10,945 29 Feb 24 ₹11,780 28 Feb 25 ₹12,675 28 Feb 26 ₹13,580 Returns for Tata Money Market Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 27 Feb 26 Duration Returns 1 Month 0.6% 3 Month 1.4% 6 Month 2.9% 1 Year 7.1% 3 Year 7.5% 5 Year 6.3% 10 Year 15 Year Since launch 6.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.7% 2022 7.4% 2021 4.8% 2020 3.9% 2019 6.4% 2018 8.1% 2017 -0.1% 2016 6.7% 2015 7.6% Fund Manager information for Tata Money Market Fund

Name Since Tenure Amit Somani 16 Oct 13 12.3 Yr. Data below for Tata Money Market Fund as on 15 Feb 26

Asset Allocation

Asset Class Value Cash 88.99% Debt 10.72% Other 0.3% Debt Sector Allocation

Sector Value Corporate 50.92% Cash Equivalent 42.92% Government 5.86% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tbill

Sovereign Bonds | -4% ₹1,204 Cr 122,000,000

↑ 122,000,000 Indian Bank

Domestic Bonds | -3% ₹957 Cr 20,000 Indusind Bank Ltd.

Debentures | -2% ₹746 Cr 16,000

↑ 16,000 Indusind Bank Ltd.

Debentures | -2% ₹586 Cr 12,000 Tbill

Sovereign Bonds | -2% ₹583 Cr 59,000,000

↑ 59,000,000 26/03/2026 Maturing 182 DTB

Sovereign Bonds | -1% ₹496 Cr 50,000,000

↑ 50,000,000 26/03/2026 Maturing 364 DTB

Sovereign Bonds | -1% ₹377 Cr 38,000,000

↑ 38,000,000 30/04/2026 Maturing 182 DTB

Sovereign Bonds | -1% ₹331 Cr 33,500,000

↑ 33,500,000 Indusind Bank Ltd.

Debentures | -1% ₹293 Cr 6,000 16/04/2026 Maturing 182 DTB

Sovereign Bonds | -1% ₹198 Cr 20,000,000

Conclusion

While we have learnt about money market instruments it's also important to know about debt mutual funds, their types, and classifications. Well, debt mutual funds are classified into general broad categories such as Liquid Funds, Ultra short term funds, Short Term Funds, Long Term Income Funds and Gilt Funds.

However, to invest in money market funds, it’s very important to understand the situation of the economy, the direction of interest rates, and the expected direction of movement of yields in corporate debt as well as government debt when investing.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for ICICI Prudential Money Market Fund