Income Tax in India FY 26 - 27: Ultimate Guide for Tax Payers!

Union Budget 2023 Update

In the new tax regime, individuals will not have to pay tax on income up to Rs. 7.5 lakhs a year (with the inclusion of standard deduction)

Government has proposed to decrease high surcharge rate to 25% from 37%

No changes have been made to the old tax regime

New tax regime has become the default tax regime but taxpayers can choose the old tax regime

A taxpayer with a yearly income of Rs. 9 lakhs will have to pay Rs. 45,000 in taxes

The tax on income of Rs. 15 lakhs will be Rs. 1.5 lakh, which has been decreased from Rs. 1.87 lakh

Under the new regime, a standard deduction of Rs. 50,000 has been introduced

Tax exemption has been removed from the premium of insurance policies amounting more than Rs. 5 lakhs

For the retirement of non-government employees, the tax exemption has been increased to Rs. 25 lakhs from Rs. 3 lakhs

To co-operative societies, a high TDS limit of Rs. 3 crores is provided on cash withdrawal

To ensure the convenience of tax payers, next-generation Common IT Return Form has been released

The TDS rate has been decreased on a part of EPF withdrawal in non-PAN cases from 30% to 20%

New Income Tax Slabs Under the New Regime 2023 - 24

Finance Minister Nirmala Sitharaman has presented the Union Budget 2023-24 intending to increase income and boost purchasing power. As per the speech, the basic exemption limit has come down to Rs. 2.5 lakhs from Rs. 3 lakhs. Not just that, the rebate under Section 87A has been increased to Rs. 7 lakhs from Rs. 5 lakhs.

Here is the new tax slab rate as per the Union Budget 2023-24:

| Income Range Per Annum | New Tax Range (2023-24) |

|---|---|

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,000 to Rs. 6,00,000 | 5% |

| Rs. 6,00,000 to Rs. 9,00,000 | 10% |

| Rs. 9,00,000 to Rs. 12,00,000 | 15% |

| Rs. 12,00,000 to Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

Those individuals who have an income of Rs. 15.5 lakhs and above will be eligible for the standard deduction of Rs. 52,000. Moreover, the new tax regime has become the default one. Yet, people have the option to retain the old tax regime, which is as follows:

| Income Range Per Annum | Old Tax Range (2021-22) |

|---|---|

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Talk to our investment specialist

Income Tax in India

Income tax in India is what the government levy for the objective of financing several operations. Basically, there are two major Types of Taxes - direct and indirect. In the former category, income tax is covered. And, VAT, excise, service tax, as well as goods and services tax (GST) all come in the indirect taxes.

Along with funding governmental activities, collected taxes are also used as a fiscal stabilizer that helps in the adequate distribution of wealth among the population. There are several aspects that Indian income taxation system comprises. Let's find out more about it.

Types of Income Tax in India

Income tax can be divided into three different categories, based upon the payee and the time of payment, such as:

Tax Deducted at Source (TDS)

Any sort of income tax that is deducted and paid on the taxpayer’s behalf by a second person (who generates the source of income for the taxpayer) is called TDS. This tax is a measurement method that the income tax department uses to ensure timely payment of taxes.

Advance Tax

Throughout the financial year, professionals and businessmen have to pay the income tax in four instalments. Those instalments are known as Advance Tax. There are certain fixed dates for the payment of these taxes, such as:

- Before or on 15th June: 15% of the AD

- Before or on 15th September: 45% of the AD

- Before or on 15th December: 75% of the AD

- Before or on 15th March: 100% of the AD

Self-Assessment Tax

Self-assessment tax means any sort of balance tax that is paid by the taxpayer on the calculated income after taking TDS and advance tax into account.

The Income Source

As per the Indian Income-tax laws, income in India, when generated from the following sources, is meant to be taxable:

- Salaries

- House property income

- Gains and profits of profession or business

- Capital gains

- income from other sources

The income sum from all of these sources is calculated as per the provisions of the Income Tax Act. The tax rates vary based on the earnings of the individual and are called Income Tax slab rates. During the budget, every year, these income tax rates get revised.

Difference Between Financial Year and Assessment Year

A financial year is that year in which you have earned your income. Assessment year, on the other hand, is the succeeding year in which you have to file the Income Tax Return for the previous year. So, for instance, you have earned your income in 2019, it will be considered as your Financial Year. And, since you are going to file the return for 2019 in 2020, it will be considered as your Assessment Year.

Documents Required to File ITR in India

When it comes to filing the ITR online, you would require a certain set of documents. These documents vary as per the source of income.

Below-mentioned is the detail regarding the same:

| Income Source | Required Documents |

|---|---|

| Salaried Individuals | Form 16, 16A, 26AS. Receipt of Rent for HRA. Payslips. Investment done under Section 80C, 80D, 80E, and 80G |

| Capital Gains | SIPs, ELSS, Mutual Fund statement, debt funds, sale and purchase of Equity Funds. Purchase/selling price, details of capital gains, details of registration if any house property is sold. Statement of capital gains via selling shares and stock trading (if available) |

| House Property | Certificate of Home Loan interest. Property address. Details of the co-owner, including capital share and PAN card details |

| Other Sources | Bank details, if receiving interest on Savings Account. Income received from an account in a post office. Details of interest received from tax-saving and/or corporate Bonds |

Apart from the ones mentioned above, there are certain mandatory documents as well, like bank account details, and PAN card.

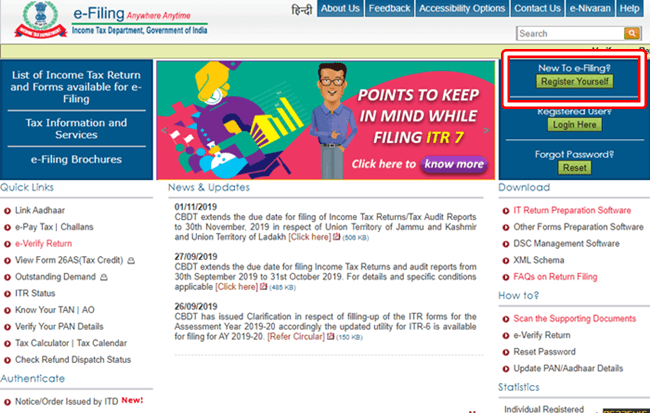

Income Tax Forms

Income tax forms are the approved forms from the income tax department. These are the ones used by taxpayers to furnish information regarding the earned income and paid taxes for that financial year. In total, there are seven different forms, and each of them belongs to a set category of taxpayers.

So, for instance, a form that is approved for income tax for professionals in India cannot be used by salaried individuals and vice versa.

| Income Tax Return Form | Taxpayer Income Eligibility |

|---|---|

| ITR 1 (SAHAJ) | ✔Pension or Salary ✔One residential property ✔Other sources (except lottery, horse race, etc.) ✔Total income up to Rs. 50 lakhs |

| ITR 2 | hindu undivided family (HUFs) and individuals with no income from gains and profits of a profession or a business |

| ITR 3 | Hindu Undivided Family (HUFs) and individuals earning income from a profession or a business, including partnership companies |

| ITR 4 (SUGAM) | Anybody with income for presumptive tax |

| ITR 5 | Everybody apart from: ✔Individuals ✔HUFs ✔Companies ✔Those who are eligible to File ITR 7 |

| ITR 6 | For companies apart from the ones that claim an exemption under section 11 |

| ITR 7 | People, including companies, need to furnish returns under Section 139 (4A)/ 139 (4B)/ 139 (4C)/ 139 (4D)/ 139 (4E)/ 139 (4F) |

Conclusion

With the introduction of e-filing, the process to file ITR and claim deductions has become an easier one. Being a young earning individual, you would no longer have to undergo a strenuous process of filing. Now that this post covers almost every aspect of income tax in India, don’t miss out on your responsibilities.

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head! You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.