How to File ITR 6?

There is no denying the fact that when it is the time to file an income tax return, panic seeps in. The rush of collecting required documents and finding a professional CA can even make you go berserk on the filing procedure.

However, as far as the ITR 6 is concerned, this form is completely annexure-less, which means that you would not have to attach any documents with the form. That is a sigh of relief, isn’t it? So, scroll down and find out more basic but essential information about ITR 6 form.

ITR 6 Applicability

The ITR 6 form is specifically for companies, registered under the Companies Act 2013 (or former act) that need to file their Income Tax Returns. However, even the eligibility comes with an exception. Hence, the companies that have to claim an exemption under section 11 of the Income Tax Return have been barred from using this form.

Concept of Claiming Exemption Under Section 11

The companies generating income from such properties that have been held for religious or charitable purposes can claim an exemption under section 11 of Income Tax Return.

Talk to our investment specialist

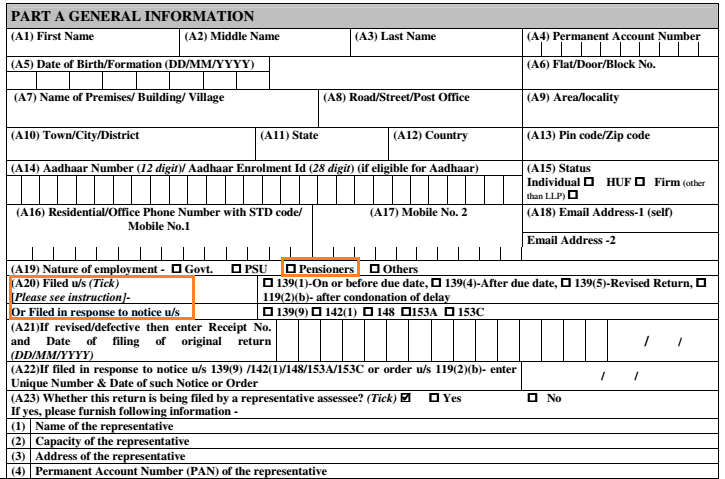

Structure of ITR 6 Income Tax Form

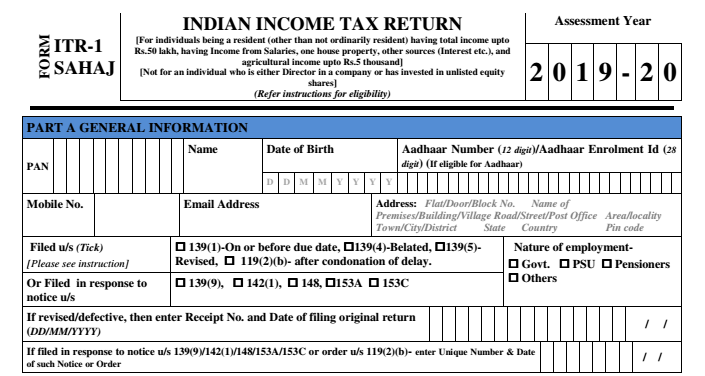

Basically, ITR 6 income tax form has been divided into two significant parts and a handful of schedules. Thus, the sequences must be followed conscientiously by taxpayers while filing up this form.

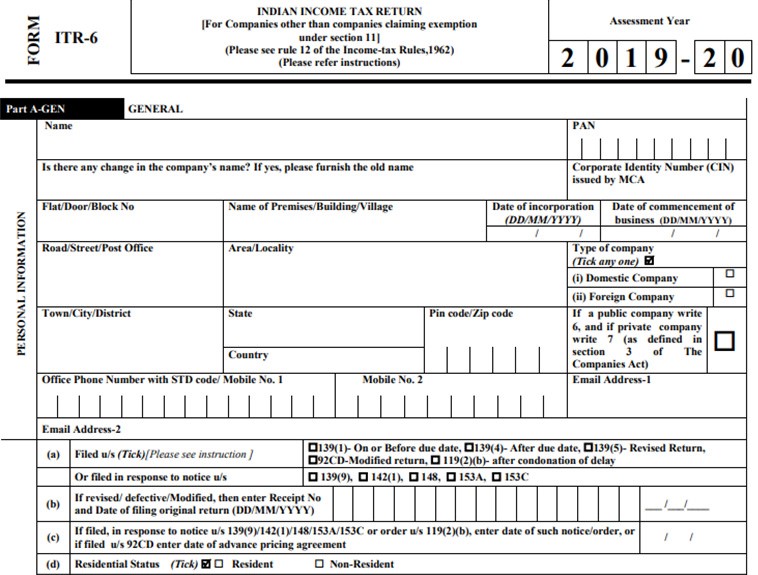

Part A

General Information

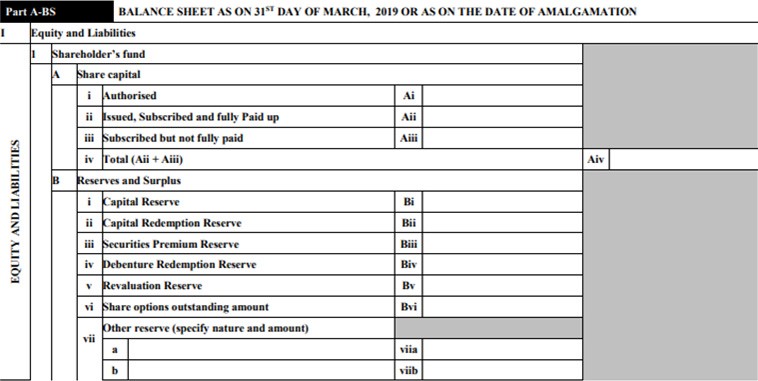

Part A-BS

Balance sheet according to the 31st March or as on the amalgamation date

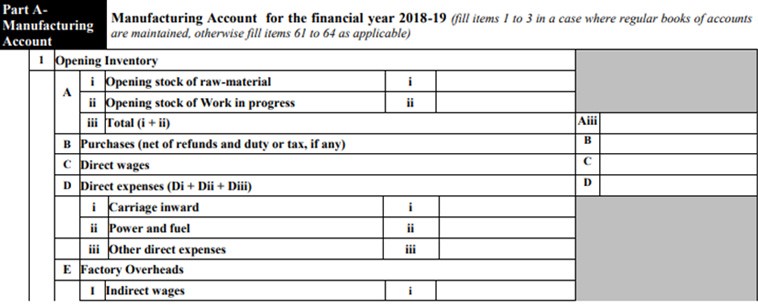

Part A

Details of manufacturing account for the financial year

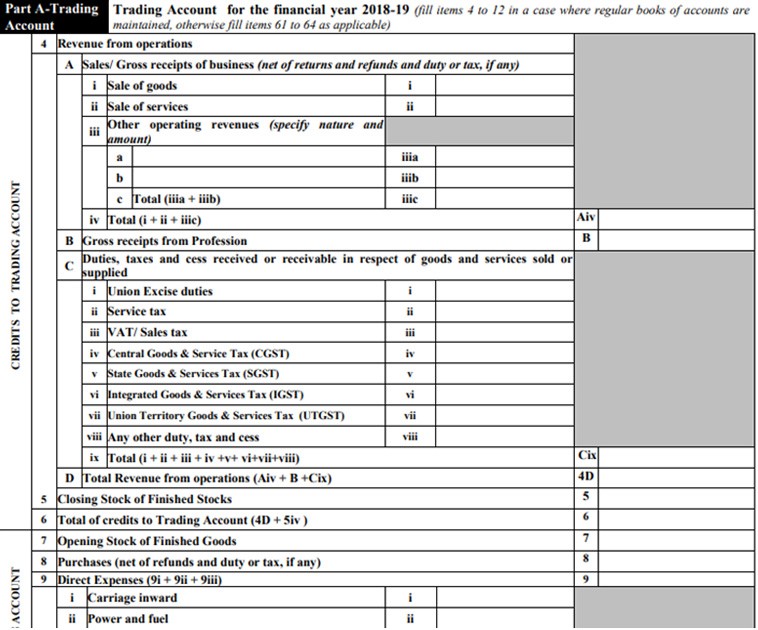

Part A

Details of the Trading Account for that specific financial year

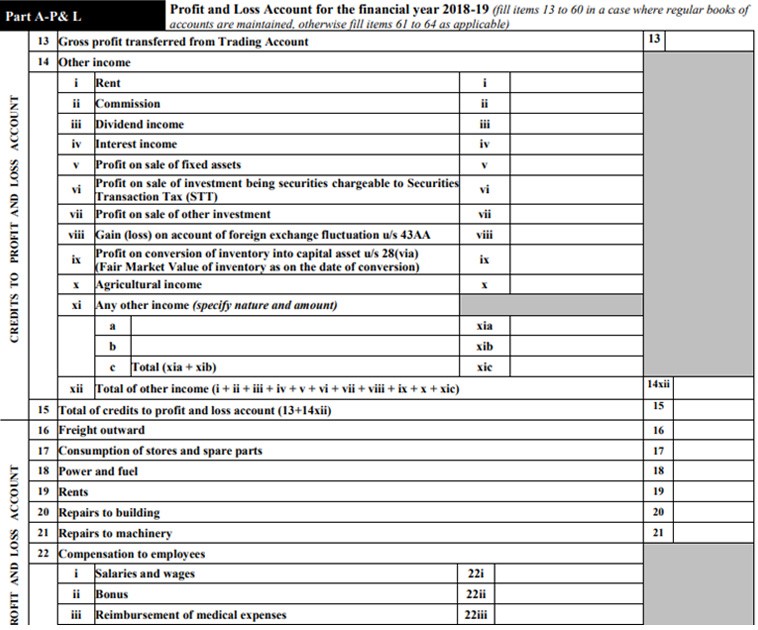

Part A-P&L

Details of profits and losses for that particular financial year

- Part A-OI: Other Information

- Part A-QD: Quantitative details

- Part A-OL: Receipt and payment account of the company under liquidation

Schedule

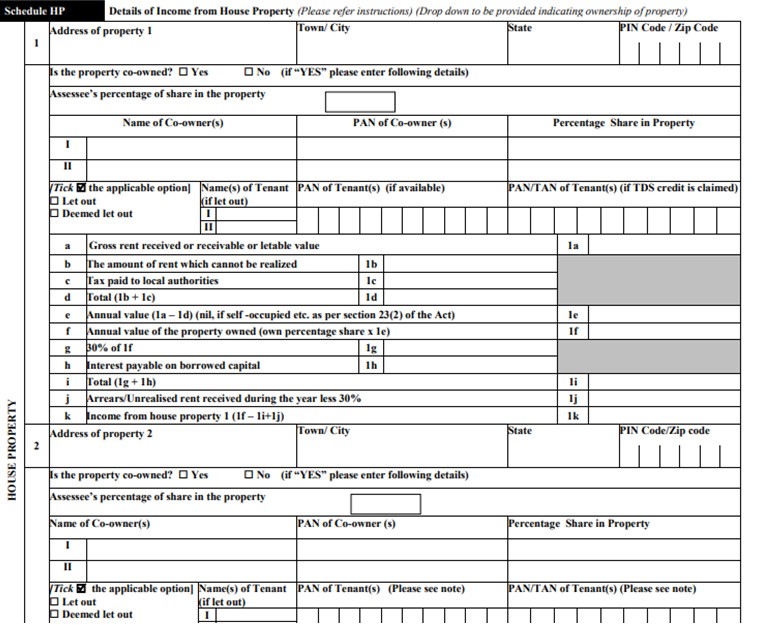

- Schedule-HP: Information regarding income from residential property

- Schedule-BP: Details of income under the head profits and gains from profession or business

- Schedule-DPM: Details of depreciation on machinery and plant under the Income-tax Act

- Schedule DOA: Details of depreciation on other assets under the Income-tax Act

- Schedule DEP: Summary of depreciation on assets under the Income-tax Act

- Schedule DCG: Information regarding deemed Capital Gains on depreciable assets sale

- Schedule ESR: Deduction under section 35

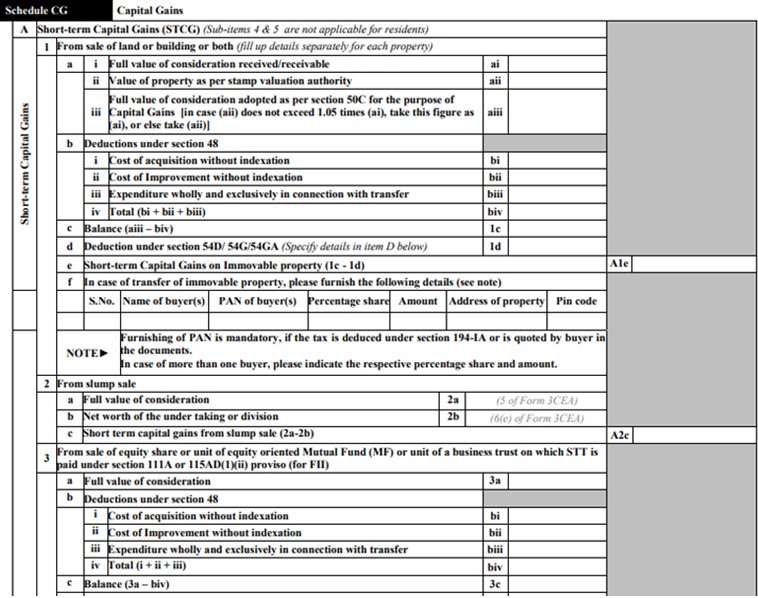

- Schedule-CG: Details of income under the head capital gains

Schedule-OS: Details of income under the head income from other sources

Schedule-CYLA: statement of income after setting the current year’s losses

Schedule-BFLA: Statement of income after setting unabsorbed loss brought forward from previous years

Schedule- CFL: Details of losses that need to be carried forward

Schedule –UD: Computation of unabsorbed depreciation as well as allowance

Schedule ICDS: Impact of Income details on profit

Schedule- 10AA: Information regarding deductions under section 10AA of the Income Tax

Schedule- 80G: Details of donation for deduction under Section 80G

Schedule 80GGA: Computation of donations for rural development or scientific research

Schedule RA: Details of donations done for research associations and more.

Schedule- 80IA: Information regarding deductions under section 80IA of the Income Tax

Schedule- 80IB: Information regarding deductions under section 80IB of the Income Tax

Schedule- 80IC or 80IE: Details of deduction under section 80IC or 80 IE

Schedule-VIA: Statement of deductions under Chapter VIA

Schedule-SI: Details of income charged to tax at special rates

Schedule PTI: Income details from business trust or investment fund

Schedule-EI: Details of income not disclosed in total income

Schedule-MAT: Details of Minimum Alternate Tax payable under section 115JB

Schedule-MATC: Details of tax credit under section 115JAA

Schedule-DDT: Dividend distribution tax payment details

Schedule BBS: Details of tax on distributed income of domestic company on buyback of shares, not listed on the stock exchange

Schedule ESI: Income from abroad and tax relief details

Schedule-IT: Payment statement of tax on self-assessment and advance-tax

Schedule-TDS: Details of TDS on income (except salary)

Schedule-TCS: TDS details

Schedule FSI: Income details accruing abroad

Schedule TR: Details of claimed tax relief for taxes paid outside India

Schedule FA: Foreign income and assets information

Schedule SH-1: Shareholding of an unlisted company

Schedule SH-2: Shareholding of Start-ups

Schedule AL-1: Details of assets and liabilities as per the end of the year

Schedule AL-2: Details of assets and liabilities as per the end of the year (applicable for start-ups)

Schedule GST: Calculation of turnover or gross receipts for GST

Schedule FD: Payments or receipts breakup in a different currency

Part B-TI: Details of total income

Part B-TTI: Details of tax liability on total income

How to File ITR 6 Online?

Since filing ITR 6 offline is not an option, online filing becomes the only way to do so. To do so, follow these simple steps:

- Visit the Income Tax Department website

- Log into your account and open the dashboard

- Choose Form 6 if it is applicable for you

- Fill up the required details

- Digitally sign the verification form

And you are done.

Final Words

Filing ITR 6 is surely not a tough task, given that you are familiar with the procedure of filing Income Tax online. However, if you are a novice in this stream, it is recommended to take professional help so as to stay clear of unnecessary mistakes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.