A Comprehensive Guide to Income Tax Return (ITR)

ITR 2021 Budget Update

Finance Minister Nirmala Sitharaman announced no filing of Income Tax Return by senior citizens (above 75 years of age) who have only pension and interest income.

Pension from the ex-employer is taxed under the income tax head of Salary while family pension is taxed as ‘income from other sources’.

Interest income received from SCSS, Bank FD etc., is taxed as per one’s income slab under the head ‘income from other sources’.

Budget 2021 has extended the ITR filing due dates for a certain category of taxpayers whose accounts need to be audited. The timeline for filing revised returns has also been proposed to be reduced from April 1, 2021.

ITR filing is made easy. Details of Capital Gains, income from list securities, dividend income, income from interest on bank deposits will come pre-filled in ITR.

Paying an Income Tax Return (ITR) is definitely a milestone of the year, whether it is for the first time or 100th. However, for those who aren’t aware of it profoundly, the entire process can turn out to be tedious and daunting.

Sure, being a legal concept, you may come across such terms that may just go over your head, leaving you even more baffled. Don’t worry, now that you have come here, this post comprises a comprehensive guide to Income Tax Returns.

Scroll down and know more about what is ITR and all about the different aspects associated with it.

What is Income Tax Return?

Income tax returns is a form that is used to claim tax deductions, account the total taxable income and proclaim the gross tax liability. Till date, the government department has brought seven different forms into the attention of taxpayers.

These forms are known as ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7. The applicability of these forms is based upon the income sources of the taxpayer.

Individuals who earn, irrespective of the amount, are liable for ITR filing. Basically, the government has made it mandatory for Hindu Undivided Families (HUFs), salaried or self-employed individuals, and companies or firms to file the Income Tax Return to the Income Tax Department.

Income Tax Filing Eligibility in India

As per the rules and regulations set by the government, those who match any of the following criteria are responsible for income tax filing:

If the ones who are less than 60 years of age are earning a gross total annual income of Rs. 2,50,000 (before the deduction under 80C to 80U)

If the ones who are more than 60 years, but less than 80 years are earning a gross total annual income of Rs. 3,00,000

If the ones who are 80 years and above of age are earning a gross total annual income of Rs. 5,00,000

If it is a firm or a company, regardless of the loss or profit made in a financial year

If a tax return has to be claimed

If an Indian resident has a financial interest or asset situated abroad

If a loss under income head requires to take forward

If an individual is applying for a visa or a loan

If an individual is gaining income from religious purposes, research association, medical or educational institute, any authority, property held under a trust for charity, infrastructure debt fund, news agency, or a trade union

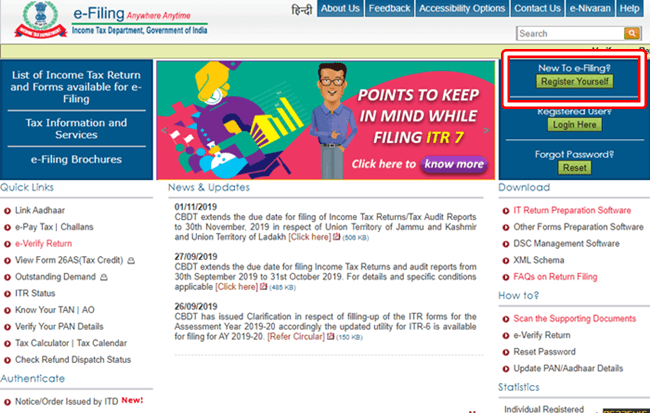

Further, now that the efiling of income tax has been implemented, the following cases would be required to file the tax online:

ITR 3, 4, 5, 6, 7 are mandatory to file online

If a refund has to be claimed

If an Income Tax Refund has to be claimed

If the gross total annual income is more than Rs. 5,00,000

Talk to our investment specialist

Income Tax Slab FY 2021-22

The ones who are eligible for income tax return filing would have to determine their tax slabs under which they would be falling. Basically, the lower the income, the lesser will be the tax liability. These are the latest income tax slabs for FY 2021-22:

You can find more information below:

| Income Tax Slab | Tax Rate |

|---|---|

| Up to Rs. 2.5 lakh | Exempted |

| Between Rs. 2.5 lakh and Rs. 5 lakh | 5% of the amount more than Rs. 2.5 lakh + 4% cess |

| Between Rs. 5 lakh and Rs. 10 lakh | Rs. 12,500 + 20% of the amount more than Rs. 5 lakh + 4% cess |

| More than Rs. 10 lakh | Rs. 1,12,500 + 30% of the amount more than Rs. 10 lakh + 4% cess |

Types of Income Tax Return Forms

As mentioned above, seven different types of income tax return forms have been introduced. But, how can you figure out which one is suited for your tax slab? Have a look at the table below:

| ITR Form | Applicability |

|---|---|

| ITR 1 | Used by those who have an annual income of less than Rs. 50 lakh through salary, one house property or pension |

| ITR 2 | Used by the ones with an income of more than Rs. 50 lakh; the list includes private companies, shareholders, non-resident Indians (NRIs), directors of companies, and individuals who gain income through two or more residential properties, capital gains, and foreign sources |

| ITR 3 | Used by professionals and those who have a proprietorship |

| ITR 4 | Used by those who come under the Presumptive Taxation.scheme and have an income of less than Rs. 50 lakh from professions and less than Rs. 2 crores from business |

| ITR 5 | Used by partnership firms, limited liability partnerships (LLPs), individuals and associations for either tax computation or reporting income |

| ITR 6 | Used by companies registered in India |

| ITR 7 | Used by scientific research institutes, religious or charitable trusts, political parties, and universities or colleges |

Documents required to register for Income Tax

- Form -16

- Interest certification from the Post Office or a bank

- Form 16-A/16-B/16-C

- Form 26 AS

- Investment proofs for tax saving

- Proofs of documentary to claim deduction under sections 80D to 80U

- Home Loan statement (if available)

- Capital gains

- Aadhar card

- Pre-validation of bank account for the purpose of ECS refund

- Information about investments in unlisted shares

- Salary slips

- Bank or post office Savings Account

- Bank account details

Conclusion

Now that you have a basic idea of IT return, don’t step back from fulfilling your responsibilities. If you fall under any categories mentioned above, file your ITR well before the due date to gain maximum returns and to avoid penalties.

FAQs

1. Who pays income tax in India?

A: Income tax in India is paid by the following categories of people and institutions:

- Individuals who earn above Rs.2.5 lakhs

- hindu undivided family (HUF)

- Association of Persons(AOP)

- Body of Individuals (BOI)

- Business enterprises

2. What is the tax slab for individuals and HUF?

A: The tax slab for individuals and HUF are as follows:

- Up to Rs. 2,50,000 there is no tax

- There is 5% tax for individuals earning Rs. 2,50,001 to Rs. 5,00,000

- Individuals earning Rs. 5,00,001 to Rs. 7,50,000 have to pay 20% in old scheme and 10% tax in new scheme

- Individuals earning Rs. 7,50,001 to Rs. 10,00,000 have to pay 20% income tax iunder the old scheme and 15% tax in new scheme

- Individuals earning Rs. 10,00,001 to Rs. 12,50,000 have to pay 30% tax in old scheme and 20% tax in new scheme

- Individuals earning Rs. 12,50,001 to Rs. 15,00,000 have to pay 30% tax in old scheme 25% in old scheme

- Individuals who are earning above Rs. 15,00,000 have to pay income tax of 30% both under the existing scheme and the new one

3. What is income tax under capital gains?

A: This is a part of your IT returns: surplus income that you earn from the sale of assets such as property, Mutual Funds, shares, or other similar assets. However, this will not be a part of your IT returns that you file every year. It can be a taxable earning for the particular year in which you have made the capital gains.

4. Do senior citizens have to file ITR?

A: Yes, senior citizens whose earnings are above Rs. 2,50,000 have to File ITR-1. Pensioner above 75 years of age, their interest earnings are exempt from filing income tax returns.

5. Is there any exemption available under the new tax regime?

A: Under the new tax regime, transport allowances are made for specially-abled individuals. The conveyance allowance you have incurred as a part of previous employment is exempt from taxation. The compensation that you get as a part of the tour or transfer is exempt from taxation.

6. Do individuals who fall below the taxation limit need to file ITR-1?

A: It is not necessary to file income tax returns if you do not fall under the tax slab. But you can file ITR-1 if you want to.

7. What are the documents that I need to provide while filing my income tax return?

A: The documents that you require for income tax filing are as follows:

- bank statement for interest on the savings account.

- Interest Income Statement for fixed deposits.

- TDS certificate issued by banks.

- Form 16

- Permanent Account Number or PAN

- Month wise salary slip

8. Is it necessary to disclose all my income in my ITR?

A: Yes, you must disclose all your income in your ITR even if it is exempt under Section 80C.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.