4 Important Benefits of Filing Income Tax Return

Many-a-times, Millennials live with a perception that until or unless their Income doesn’t reach the benchmark amount, they don’t have to file the ITR. However, this point of view may backfire in several situations. One thing that you must understand is as soon as you get into working infrastructure, whether a job or a business- you must start filing your Income Tax Return.

Basically, there are various benefits of income tax Return and this can quickly be done online from the convenience of one’s home or office. However, this is not a standard form for every taxpayer; several forms cover different individuals according to their sources of income as well as the properties they own.

Types of ITR

Fundamentally, there are seven ITR Forms, each covering a different type of taxpayer. Following is the brief about each one of them:

ITR 1

Also known as Sahaj, this form is specifically for those residents who have a total gross income of maximum Rs. 50 lakhs. However, NRIs and RNORs cannot go for this form.

ITR 2

This income Tax Return form is used by those Hindu Undivided Families (HUF) and Individuals who have a gross total income of more than Rs. 50 lakhs. However, in case individuals are making this income from a profession or a business, they cannot use ITR 2.

Talk to our investment specialist

ITR 3

On the contrary, to ITR 2, this form is used by those HUFs and individuals who make their income from a profession or a business and have a turnover of more than Rs. 2 crores.

ITR 4

This form is also known as Sugam and is for those individuals, HUFs, and partnership firms who generate their incomes from professions or businesses and have selected presumptive income scheme as per the Section 44AD, 44ADA, and 44AE. However, the companies that have been registered as Limited Liability Partnerships (LLP) cannot choose this form.

ITR 5

This form is for LLPs, Association of Persons (AOPs), Body of Individuals (BOIs), Artificial Juridical Person (AJP), Estate of deceased, Estate of insolvent, Business trusts, and Investment funds.

ITR 6

ITR 6 is for those companies that don’t claim any exemptions under Sector 11.

ITR7

Lastly, this one is for those companies and individuals that are furnishing return under Section 139 (4B), 139 (4C), 139 (4D), 139 (4E) or 139 (4F).

Benefits of Filing ITR

Now the question arises why income tax return filing is important? Although filing an ITR form is mandatory, however, there is an exception to this lot. Those with the Gross Income Total (GTI) below 2.5 lakhs are not required to file an ITR. This limit is 3 lakhs for people between the age of 60 to 80, and 5 lakhs for people above the age of 80.

Below-mentioned are some of the advantages of income tax return filing that you must keep in mind:

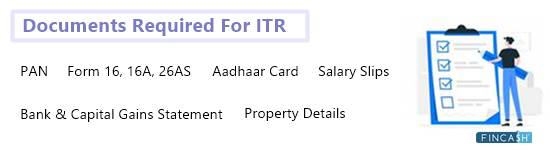

1. Seamless Approval of Loan & Visa

When it comes to filing a loan, be it a two-wheeler one or a Home Loan, an ITR Receipt turns out to be an essential document. Not just that, but even if you would have to file for a visa or a passport, you would have to show a copy of your ITR to the embassy or the consultant. Thus, filing it is quite necessary.

2. Dodge Penalties

In case you miss filing the ITR, despite falling under the GTI category that makes it mandatory to file the form, you will not be liable to receive any benefits of income tax return. In addition, you also might be charged with a fine up to ₹5,000-₹10,000 by the tax officer as per the circumstances.

3. Carrying Losses Forward

One of the major ITR benefits is that you get an opportunity to carry-forward those losses that were against the Capital gains. However, you can do so only if you have filed the ITR in that specific assessment year. Even if you have the income below the limit of exemption, you must ideally file the return.

4. Helps Buying Insurance Policy

Undoubtedly, insurance is one such thing that has become the need of the hour today. However, in case you look forward to getting a policy with high coverage, the company would demand your ITR receipts to ensure that you are not a tax-evading person.

Takeaway

Now that you have understood the benefits of income tax return, for sure, you would not want to evade it, right? Not just in the scenarios mentioned above, however, filing ITR can turn out to be vital in several other situations as well, right from preventing extra interests to experiencing a seamless credit card process.

Also, even if you don’t come under the benchmark limit to File ITR, you can still file a nil ITR, just to be on the safe side.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

there are so many tools are available on web for ITR FILE is this kind of tools are safe for us? muneemg.in