Know Everything About ITR 2 Form

Taxpayers have been divided on the basis of their source of income, income, and other additional factors to make sure seamless compliance. Those who have incomes from different categories have been categorized into different Income Tax Return Forms.

Out of all, this post is dedicated to ITR 2. So, in case you belong to this category, know more about how you can continue with this form.

Who Is Eligible to File ITR 2 Form?

ITR 2 filing is necessary for those HUFs and individuals who have been receiving their income from additional sources, except the gains and profits from profession or business. Hence, the following people cover in this form eligibility:

- Non-resident and Resident not ordinarily resident

- The ones who get their income from pension or salary

- Individuals who earn more than Rs 5000 from agriculture

- Those who earn Income from house property (more than one house property could be counted

- as well)

- People with foreign income or foreign assets

- Taxpayers who get income from Capital Gains or loss on the sale of property or investments (both long term and short term)

- People who earn their incomes from additional sources (including bets on racehorses, lottery, and other legal methods of gambling)

Who Cannot File ITR 2?

Coming to those who are not eligible to fill up this form, the list includes:

People who are eligible to File ITR 1 form

Any Hindu Undivided Fund or individual earning income from profession or business

Ready to Invest?

Talk to our investment specialist

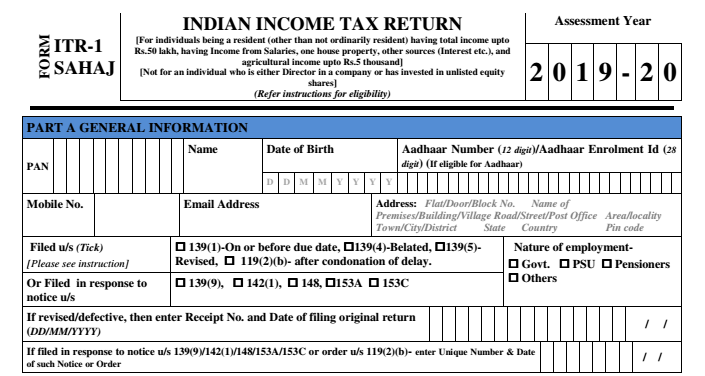

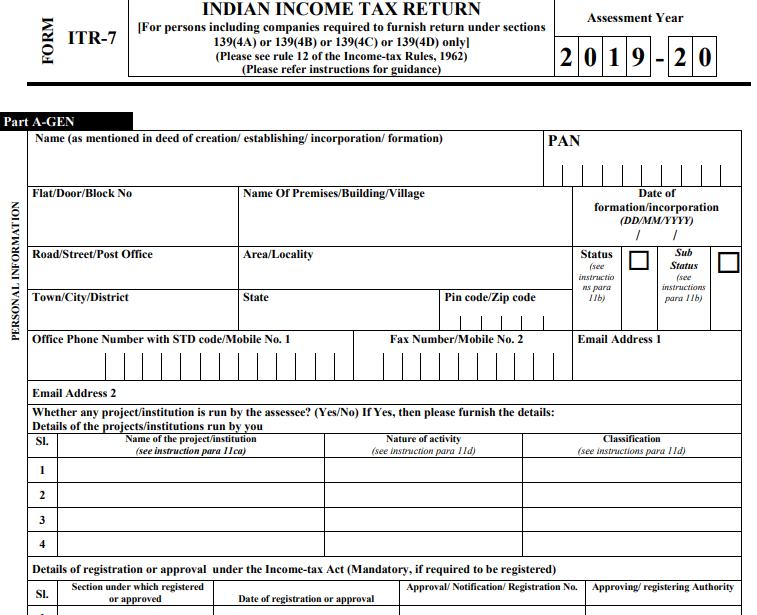

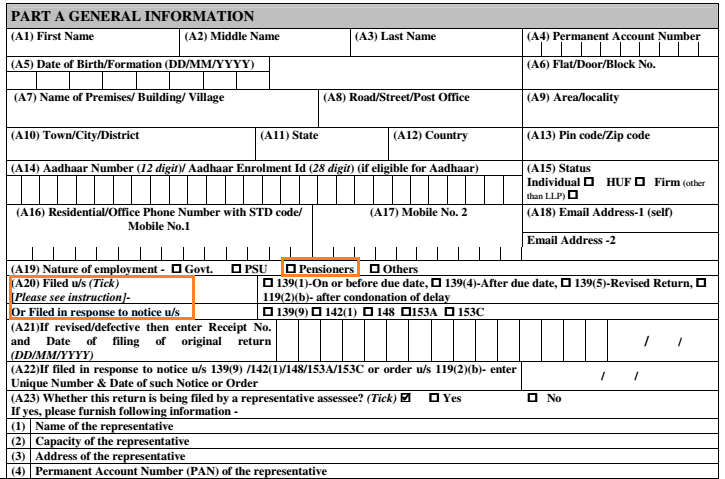

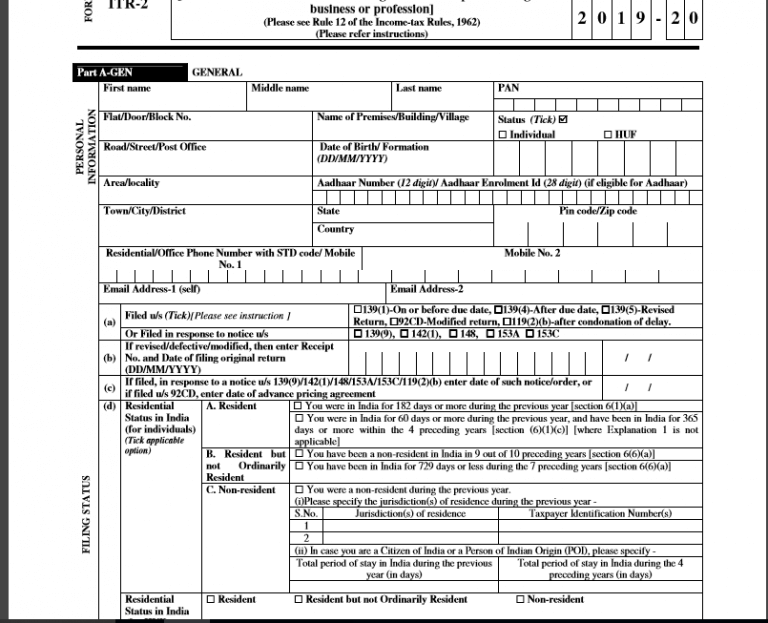

Structure of ITR 2 for AY 2019-20:

As per the last financial year, income tax ITR 2 is divided into different parts as mentioned below:

General Information

- Computation of Total Income

- Computation of Tax Liability on Total Income

- Details to be filled if the return has been prepared by a Tax Return Preparer

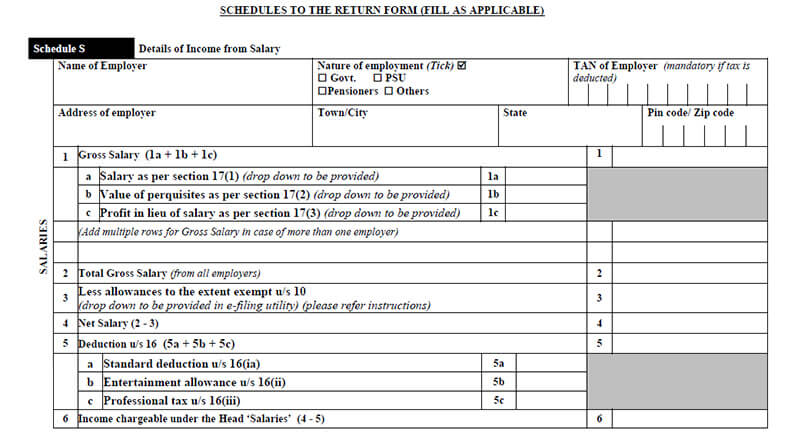

- Schedule S: Details of Income from Salaries

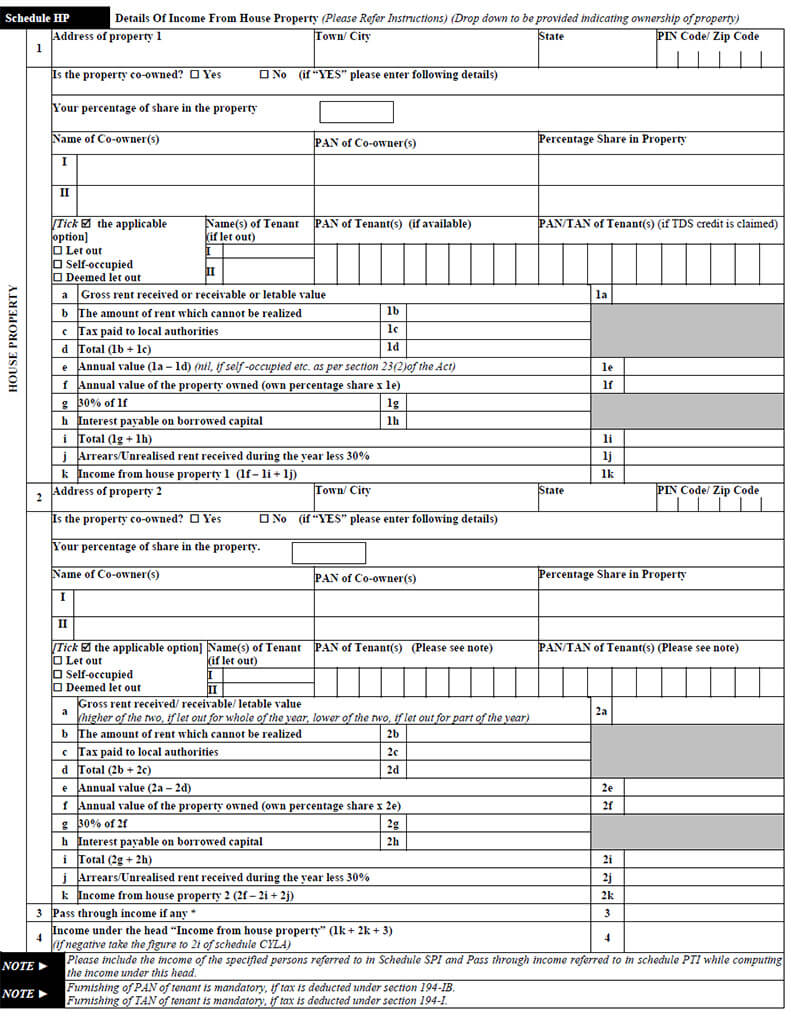

Schedule HP

Details of Income from House Property

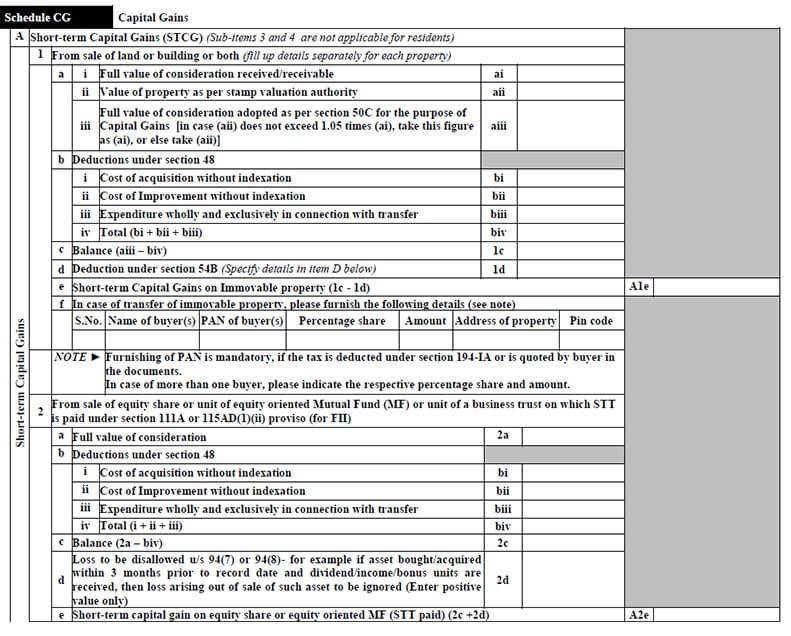

Schedule CG

Computation of Income under Capital Gains

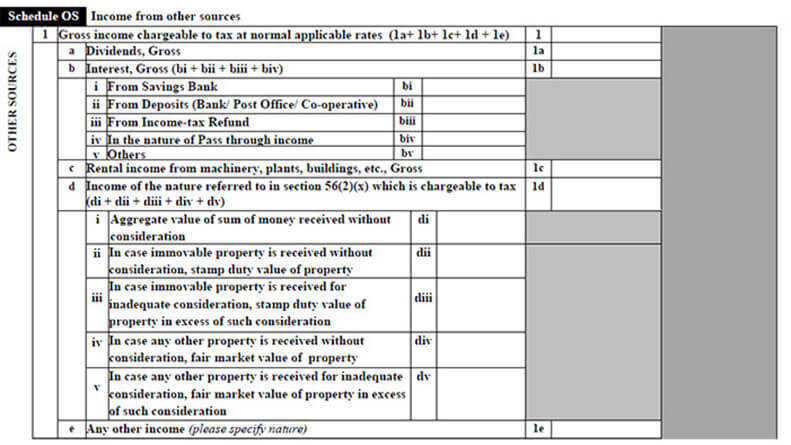

Schedule OS

Computation of Income under income from other sources

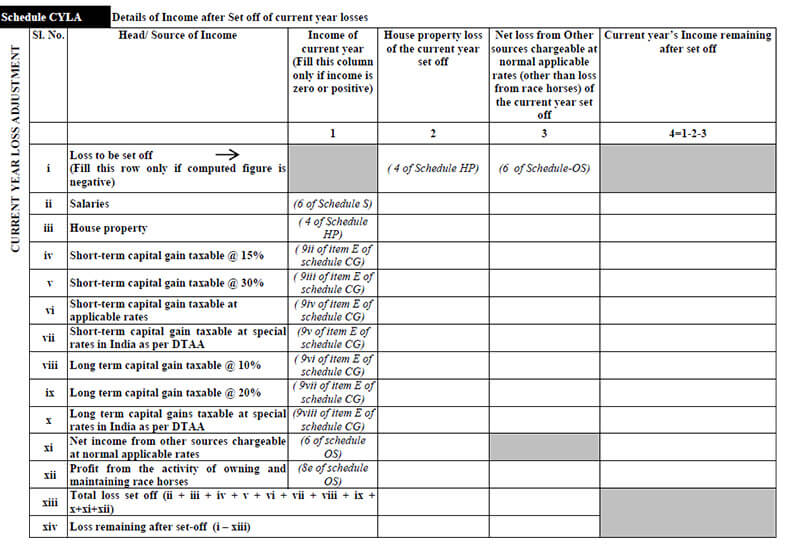

Schedule CYLA

statement of income after set off of current year’s losses

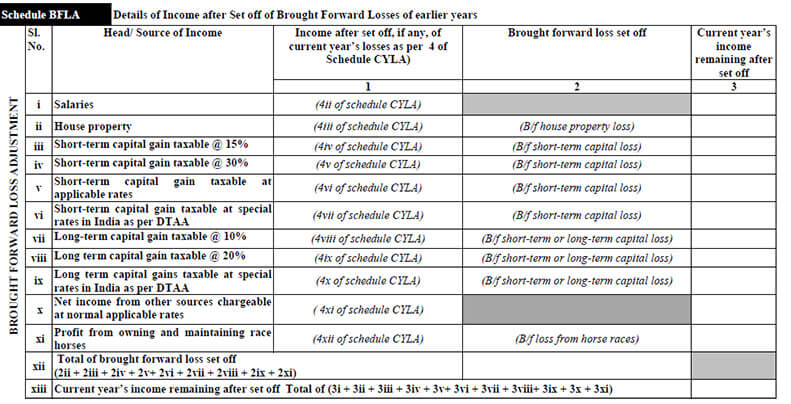

Schedule BFLA

Statement of income after set off of unabsorbed loss brought forward from earlier years

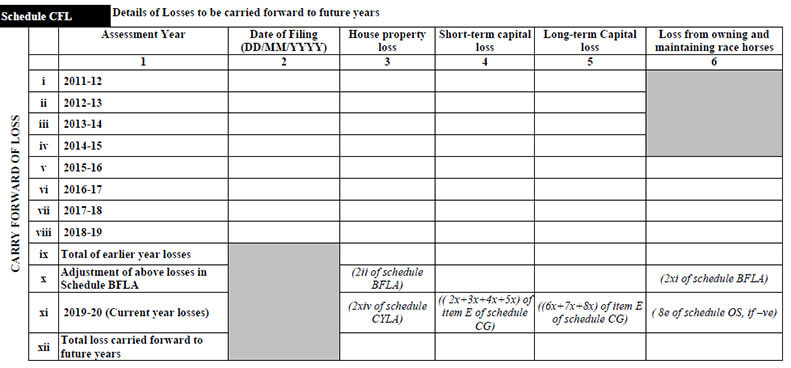

Schedule CFL

Statement of losses to be carried forward to future years

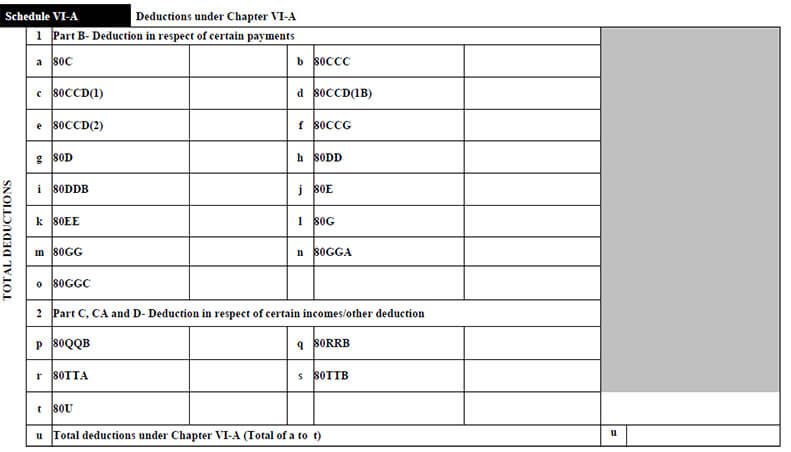

Schedule VIA

Statement of deductions (from total income) under Chapter VIA

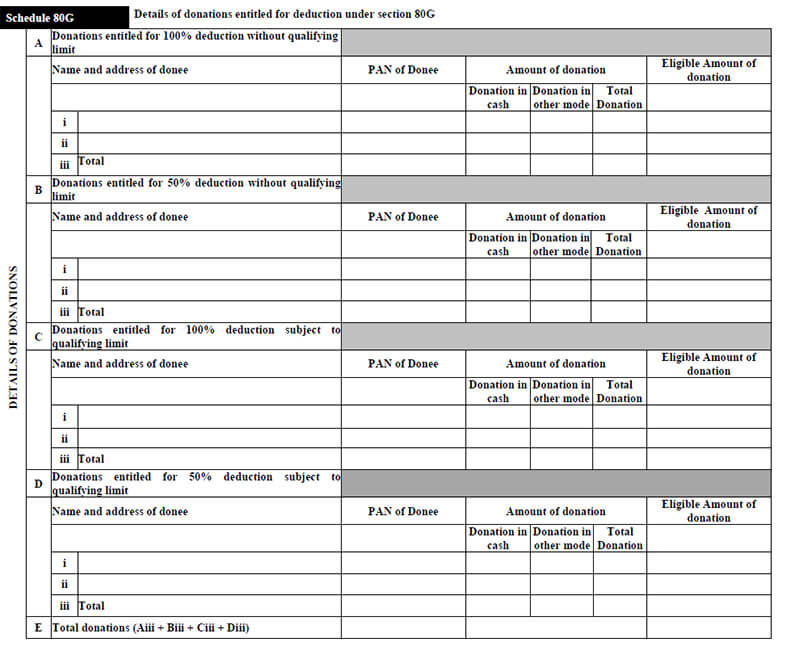

Schedule 80G

Statement of donations entitled for deduction under Section 80G

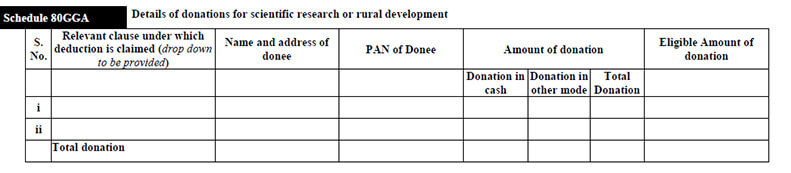

Schedule 80GGA

Statement of donations for scientific research or rural development

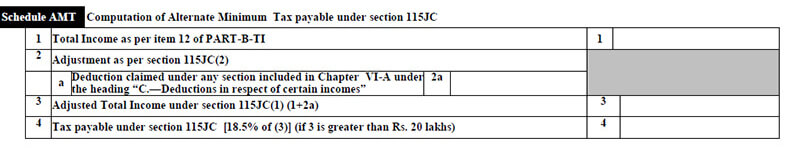

Schedule AMT

Computation of Alternate Minimum Tax payable under section 115JC

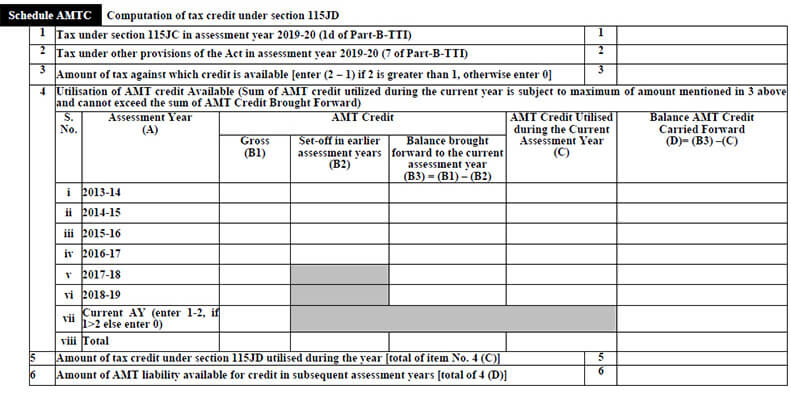

Schedule AMTC

Computation of tax credit under section 115JD

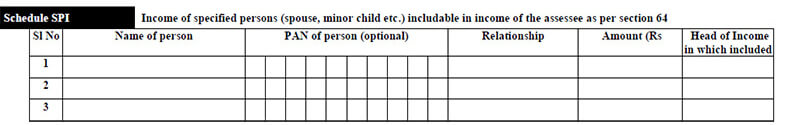

Schedule SPI

Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, CG and OS

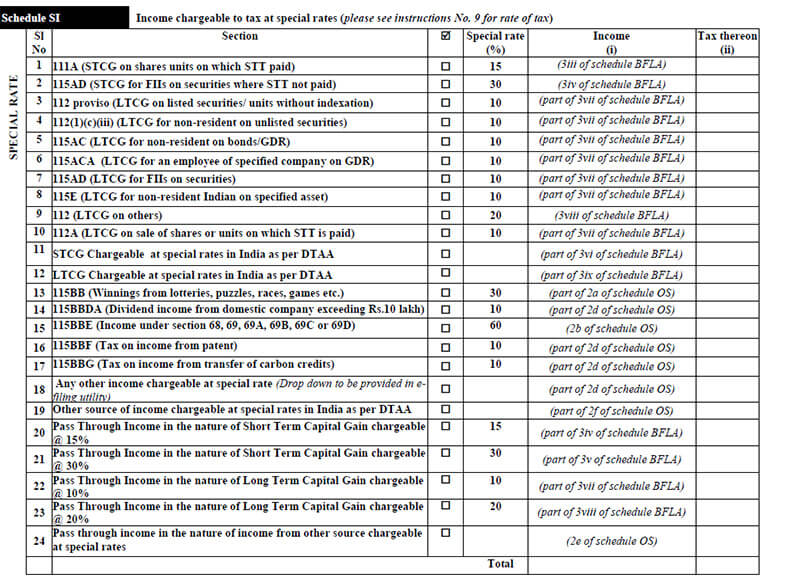

Schedule SI

Statement of income which is chargeable to tax at special rates

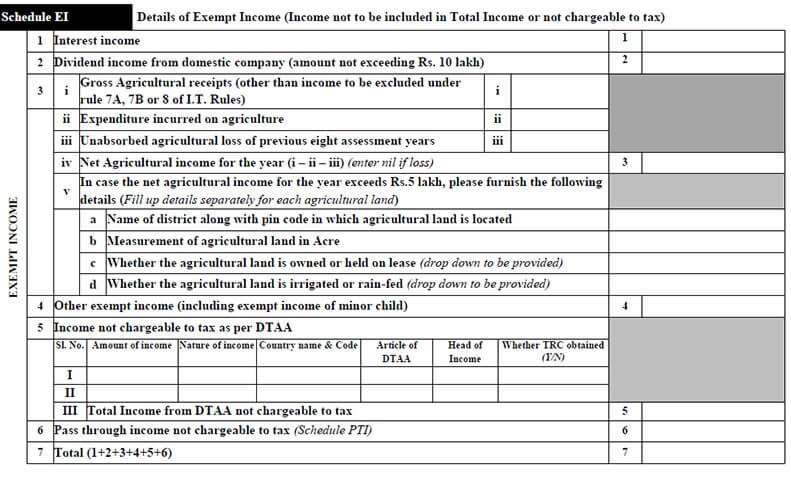

Schedule EI

Details of exempt Income

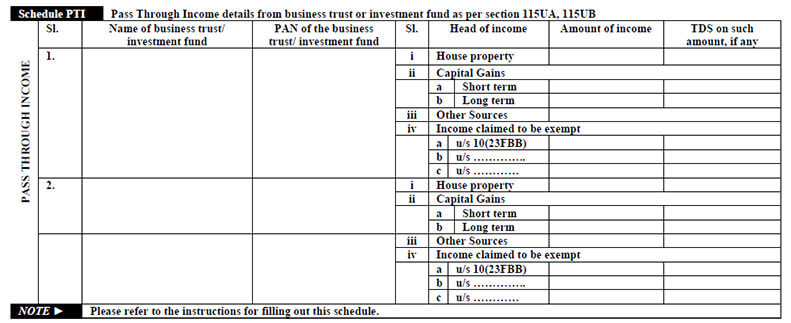

Schedule PTI

Pass through income details from business trust or investment fund as per Section 115UA, 115UB

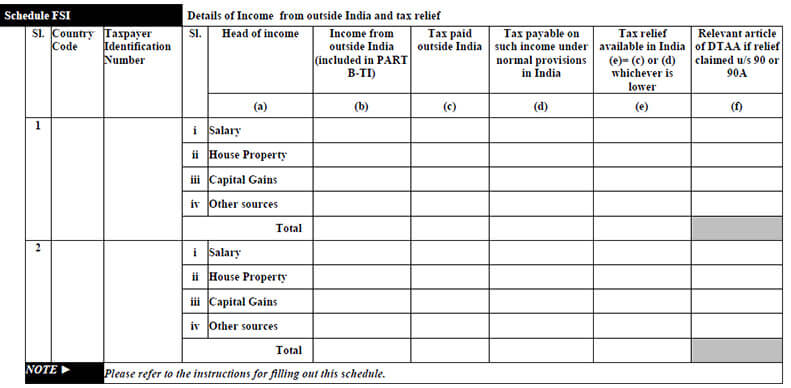

Schedule FSI

Statement of income accruing or arising outside India

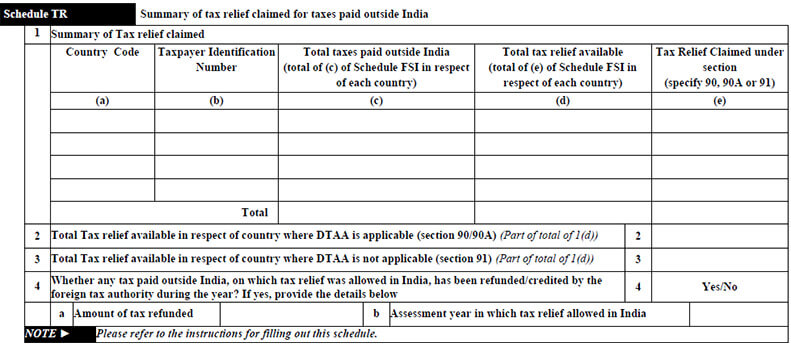

Schedule TR

Details of Taxes paid outside India

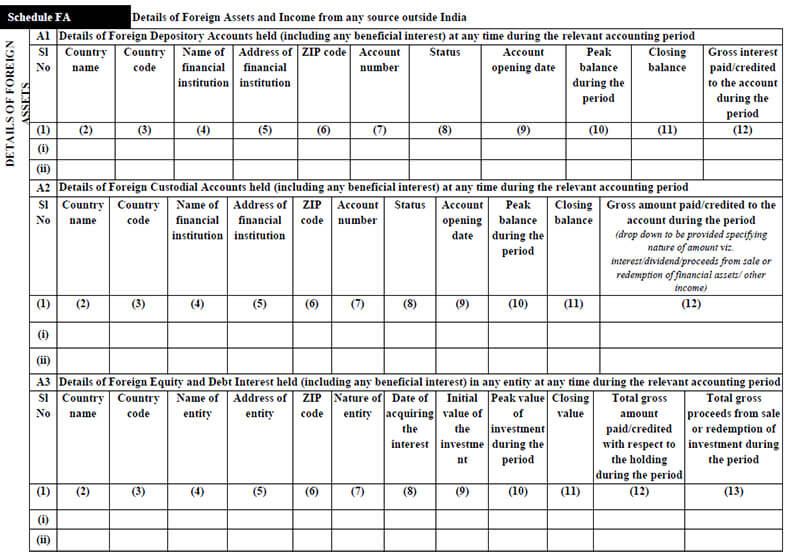

Schedule FA

Details of Foreign Assets and income from any source outside India

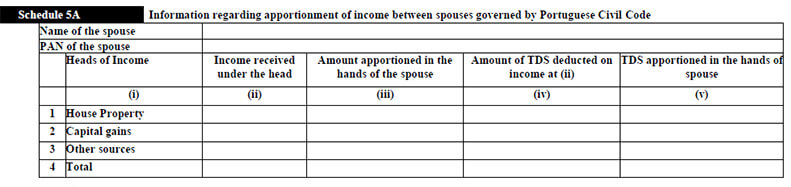

Schedule 5A

Statement of apportionment of income between spouses governed by Portuguese Civil Code

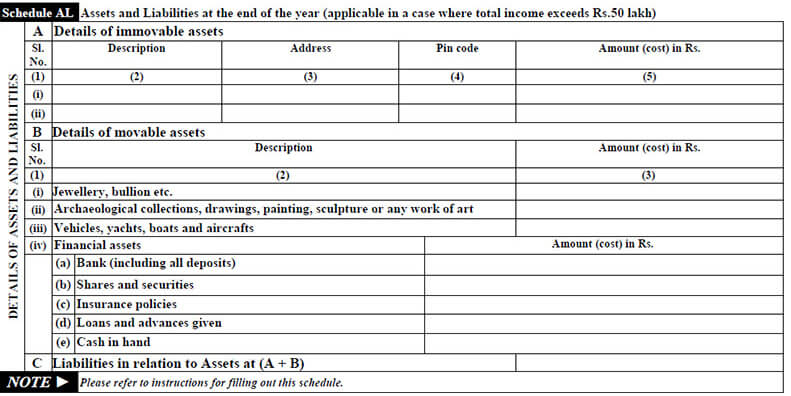

Schedule AL

Asset and liability at the year-end (applicable in case income exceeds Rs 50 lakhs)

How to File ITR 2 Income Tax?

There are two different ways of submitting ITR 2 form – online and offline.

Offline Submission

When it comes to filing ITR 2 offline, only the ones who are 80 years or above age are allowed to do so. And, as far as the method is concerned, it can either be done by furnishing a return in a physical form of paper or by furnishing a return in a bar-code form.

Online Submission

The ITR 2 online filing is one of the easiest ways to file the return. You can simply follow the below-mentioned steps:

- Visit the government website

- Log into your dashboard and click Prepare and submit ITR form

- Select ITR-Form 2

- Fill your details and click the Submit button

- If applicable, upload your digital signature certificate (DSC)

- Click submit

Final Words

Filing up ITR 2 is not a tough task. All you have to do is collect required documents if you belong to the eligible category. Sign up on the portal if you haven’t yet. In case you are new to ITR and filing, you can take professional help as well.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.