What is ITR 7 and How to File ITR 7 Form?

If you get a chance to file an Income Tax Return without undergoing the hassle of collecting and gathering documents, it turns out to be extremely helpful, isn’t it? That is exactly how ITR 7 helps you out.

This post comprises everything about this ITR form – from the applicability to the structure. Read ahead to understand more.

ITR 7 Form: Who Gets to Fill It?

ITR 7 applicability comprises those companies that garner their income from such properties that are used for religious or charitable purposes. Apart from that, properties that have been held under legal or trusts obligations as a whole or in parts also come under the same category.

Further, below-mentioned is the additional eligibility criteria for form 7 of ITR:

- Entities getting income from a news agency, scientific research institutions, and more under Section 139 (4C)

- Entities getting income from institutions, colleges, universities or village industries under section 139 (4D)

- Individuals getting income from property registered under trust

- Non-government or government educational institutions mentioned under section 10 (23A) and 10 (23B)

Structure of ITR 7

Now that you have understood what ITR 7 means, following is the structure of this form.

Talk to our investment specialist

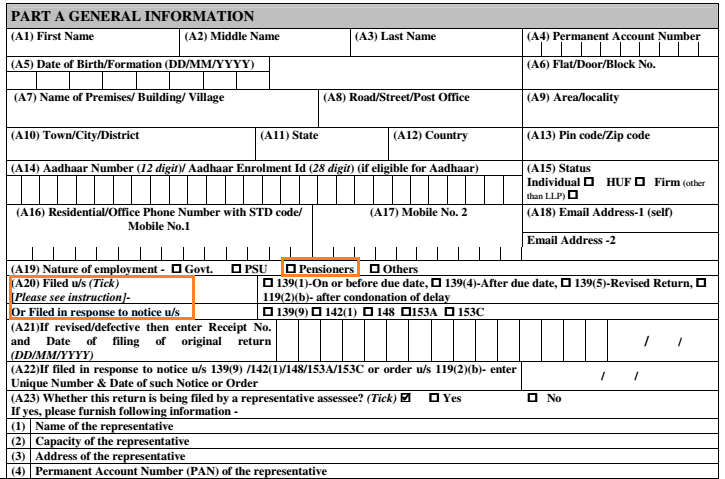

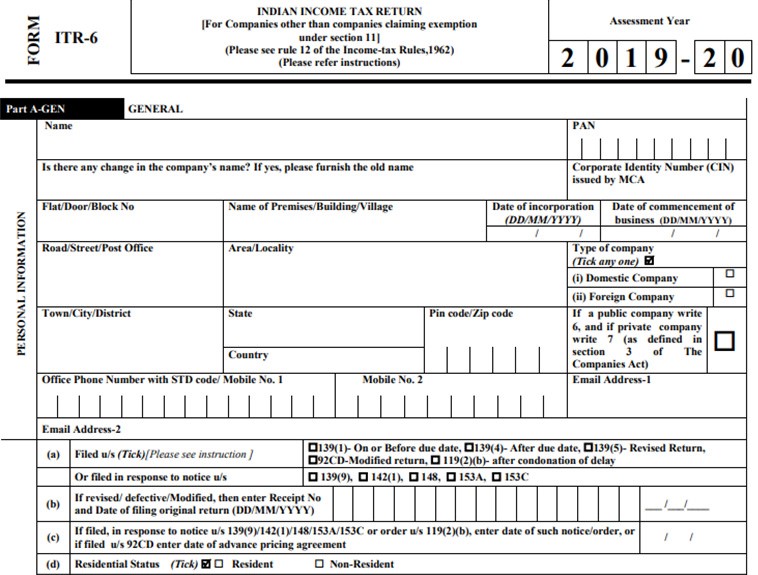

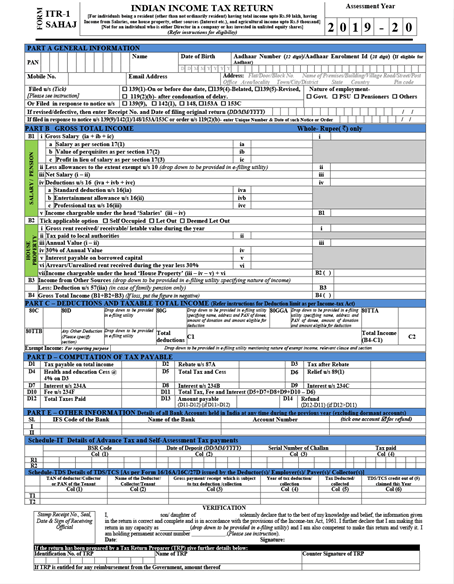

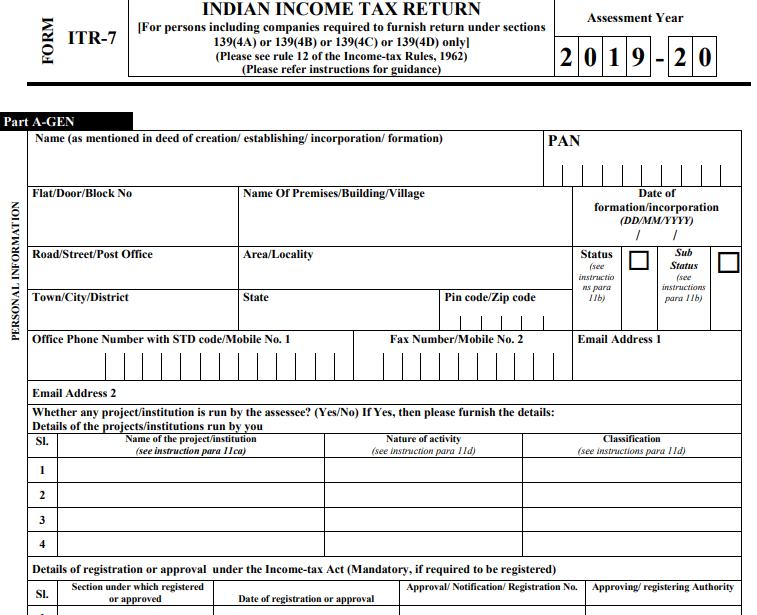

Part-A: General information

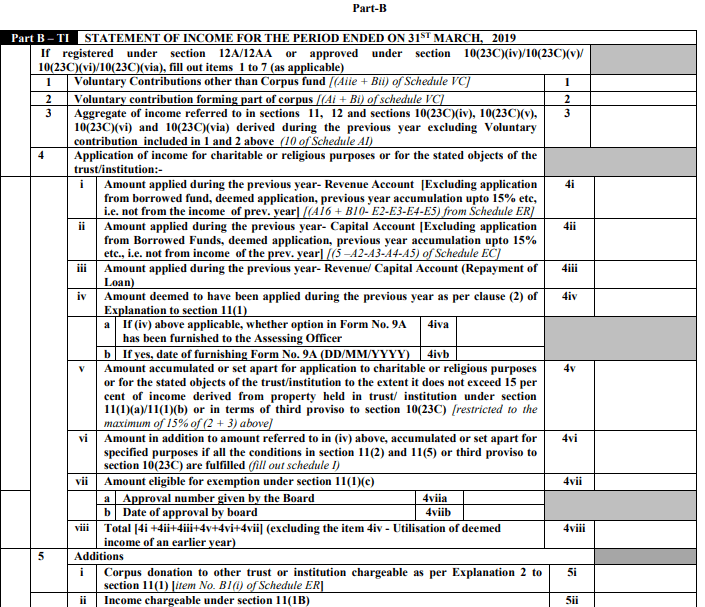

Part-B: Total income and tax computation

- Schedule-I: Details of amounts gathered

- Schedule-J: Details of institutions’ or trusts’ fund investments as per the last day of the previous year

- Schedule-K: Particular statement of Managers, Founders, Trustees, Authors, and more of the institution of the trust

- Schedule-LA: Details of the political party (if applicable)

- Schedule-ET: Details of the Electoral Trust (if applicable)

- Schedule AI: Total income derived during the year exempting voluntary contributions

- Schedule ER: Amount applied to religious or charitable purposes in India (Revenue Account)

- Schedule EC: Amount applied to religious or charitable purposes in India (Capital Account)

- Schedule-HP: Details of income under the head Income from house property

- Schedule-CG: Details of income under the head Capital Gains

- Schedule-OS: Details of income under the head income from other sources

- Schedule-VC: Details of voluntary contributions received

- Schedule-OA: General information about profession or business

- Schedule-BP: Details of income under the head profit and gains from business or profession

- Schedule-CYLA: Statement of income after setting off the current year’s losses

- Schedule-MAT: Details of minimum alternate tax payable under section 115JB (n)

- Schedule-MATC: Details of tax credit under section 115JAA

- Schedule AMT: Details of alternate minimum tax payable under section 115JC (p)

- Schedule AMTC: Information regarding tax credit under section 115JD

- Schedule PTI: Information regarding pass-through income from business trust or investment fund as per section 115UA, 115

- Schedule-SI: Statement of income chargeable to tax at special rates

- Schedule 115TD: Accreted income under section 115TD

- Schedule FSI: Information regarding income collected from abroad

- Schedule TR: Information regarding taxes paid abroad

- Schedule FA: Details of foreign assets

How to Fill ITR 7 for AY 2019-20?

Being an annexure-less ITR form, this one doesn’t allow offline filing. Thus, you would have to choose the online method. For that, follow some simple steps:

- Open the official website of the income tax Department

- If you have an account, log into it or register if you are a new user

- Open your dashboard

- Select Form 7

- Fill in the details

- Sign the verification form digitally

And that is it

Final Words:

Now that you know what ITR 7 means and how you can file it, the process is not going to pose any significant hurdles. So, if you come under the ITR 7 applicability, go for this form without missing out.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.