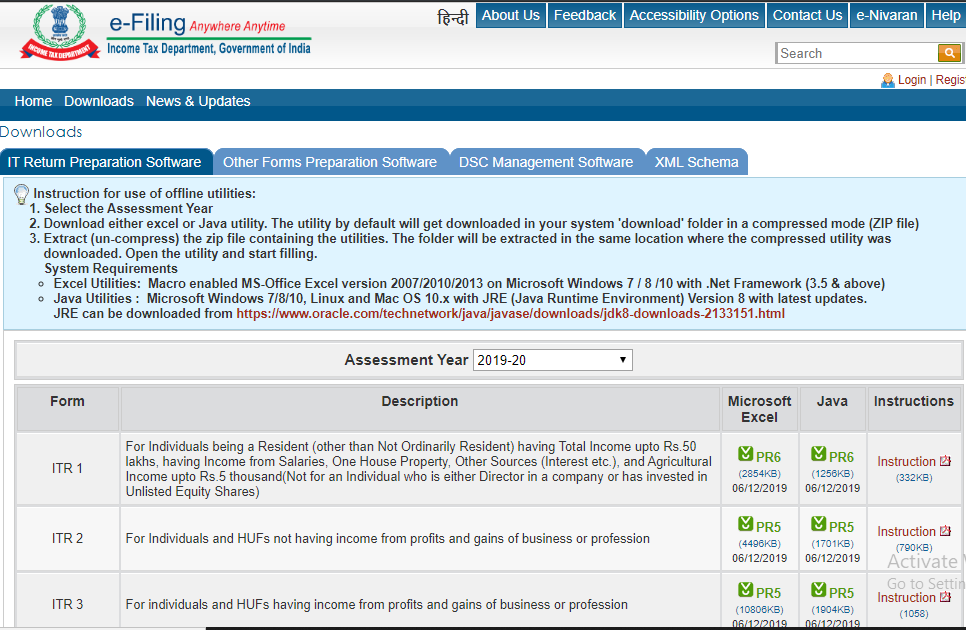

Are You Sure of the ITR Forms That You Fill?

There is no denying the fact that nobody is unfamiliar with the term taxes. While almost every taxpayer knows that forms are required to file the ITR, however, not everybody would be confident about which form to choose and which one to leave. Moreover, if you have just started paying your taxes, selecting the right sort of form may become even tedious.

To take you out from this hassle, read below about ITR forms and the right category that falls under it.

Types of ITR Forms

Considering that the government has issued 7 forms to File ITR, you must know which form includes and excludes what type of people. Below-mentioned is the detail you were yearning to get.

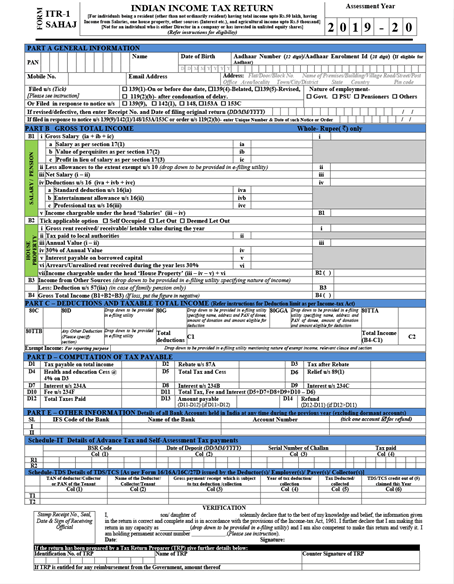

ITR-1 or Sahaj

This ITR 1 form is for those Indian residents who have a total income comprises:

- Income from pension/salary; or

- Agriculture income up to Rs. 5000; or

- Income from one house property; or

- Income from additional sources (excluding winning from racehorses or lottery)

ITR-1 form cannot be used by:

- Individuals with total income more than Rs. 50 lakhs

- People with taxable Capital Gains

- Those with income from more than one house property

- Individuals who have investments in unlisted equity shares during the financial year

- People who are non-residents (ITR for NRIs) and resident not ordinarily resident (RNOR)

- Those who have an agriculture income more than Rs. 5000

- People with foreign income or assets

- Individuals with profession or business

- Those who are a directory of a company

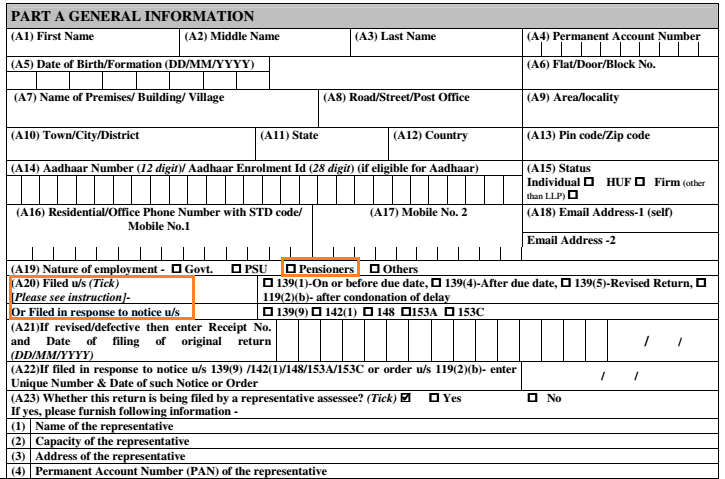

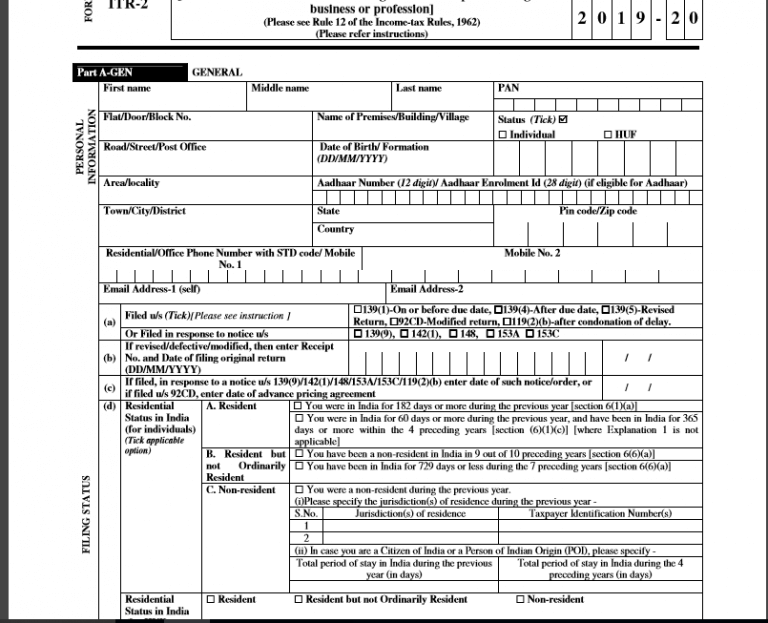

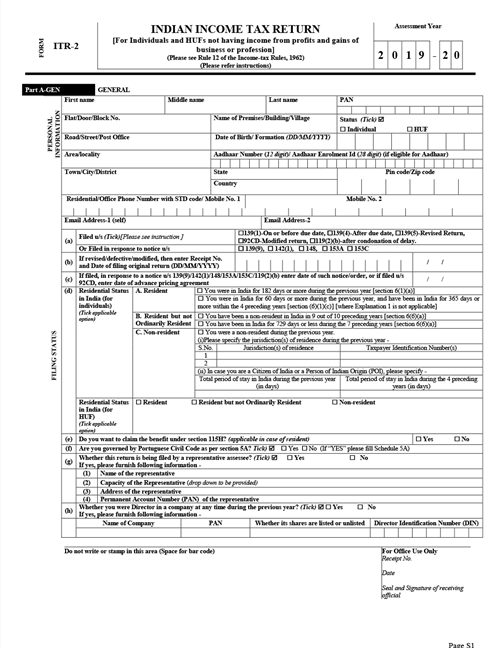

ITR-2

This specific form is for hindu undivided family (HUF) or individuals whose total gross income is not more than Rs. 50 lakhs. The sources include:

- Income from pension/salary; or

- income from other sources (including winnings from horse race and lottery); or

- Income from house property

Apart from this, the ones who can use this form are:

- Individual directors of a company

- People with an agricultural income of more than Rs. 5000

- Individuals with investments in unlisted equity shares during the financial year

- Those with income from capital gains

- People with income from foreign income/foreign assets

- Individuals who are non-resident (NRIs) or resident not ordinarily resident (RNOR)

ITR-2 cannot be used by the ones whose total income is sourced from a profession or a business.

Talk to our investment specialist

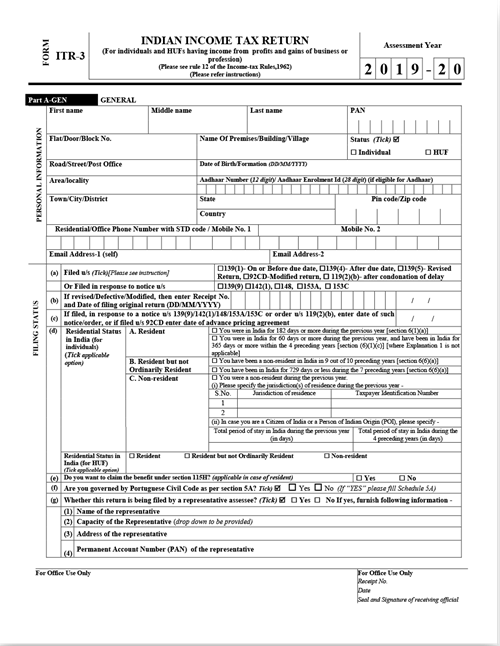

ITR-3

The current ITR 3 form is used by those Hindu Undivided Family or individuals who receive income from a profession or a proprietary business. Further, those who have income from below sources can use this form:

- Individual director of a company

- Profession or a business

- Investments in unlisted equity shares during the financial year

- From salary/pension

- Income from house property

- Income from a partnership in a firm

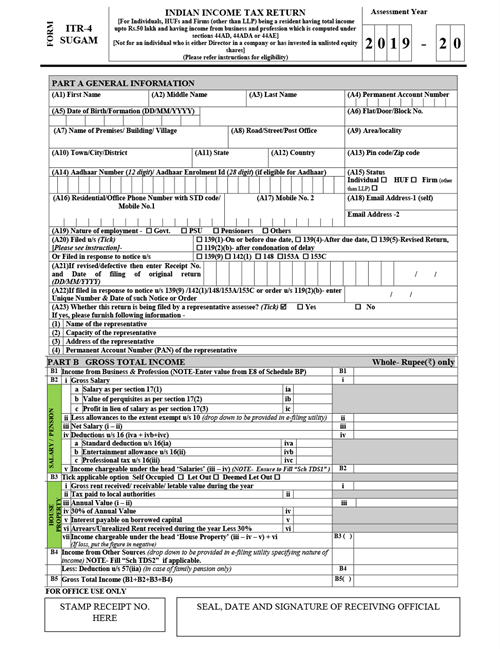

ITR-4 or Sugam

The current ITR 4 form can be used by:

- Individuals or HUFs

- Partnership firms (excluding LLPs)

- Residents with an income from a profession or a business (not more than Rs. 2 crores)

- Those who have chosen the presumptive income scheme according to Section 44AD, Section 44ADA, and Section 44AE.

The form cannot be used by:

- People with a total income of more than Rs. 50 lakhs

- Those with income from more than one house property

- Individuals with foreign income or assets

- People with a loss to be carried forward or brought forward loss under any head of income

- Non-residents (NRIs) and resident not ordinarily resident (RNOR)

- People with signing authority in accounts situated abroad

- Directors of a company

- Individuals with investments in unlisted equity shares

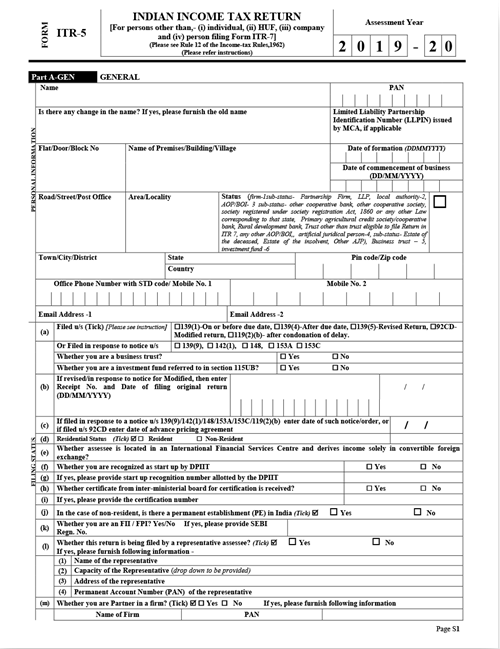

ITR-5

Moving forward, ITR 5 form is for:

- Association of Persons (AOPs)

- Limited Liability Partnerships (LLPs)

- Body of Individuals (BOIs)

- Estate of Insolvent

- Estate of Decreased

- Investment Funds

- Business Trusts

- Artificial Juridical Person (AJP)

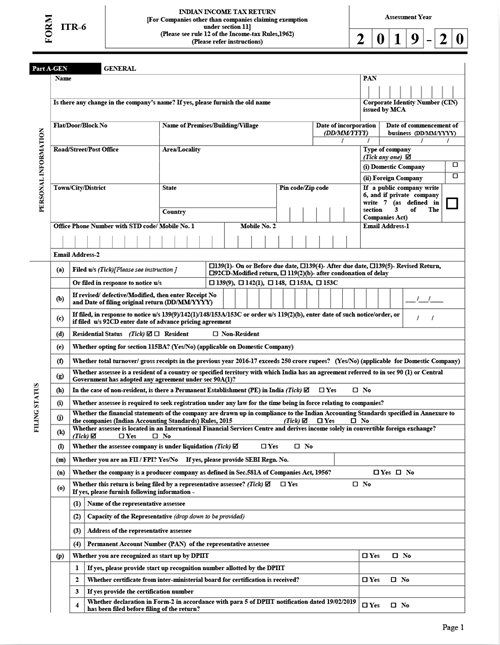

ITR-6

This particular form is used by companies. However, those who have claimed an exemption under section 11, which is - Income from property held for religious or charitable purposes – are not included in this category.

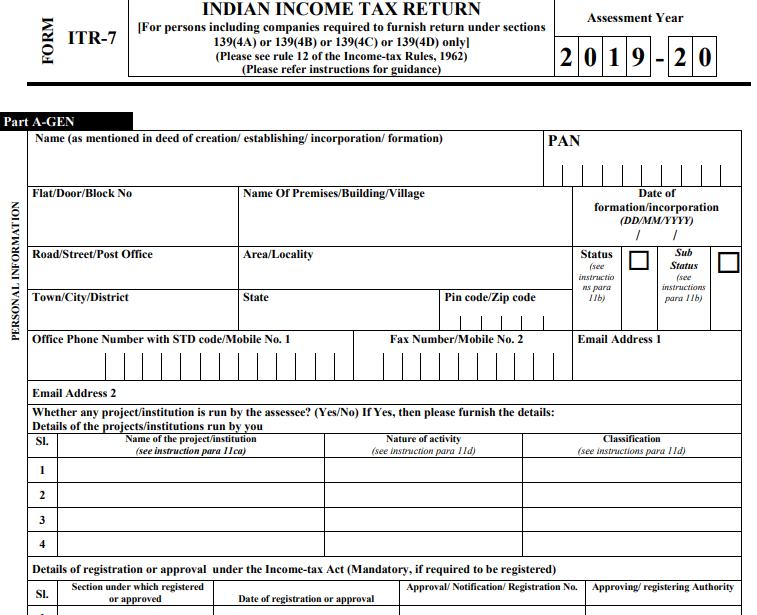

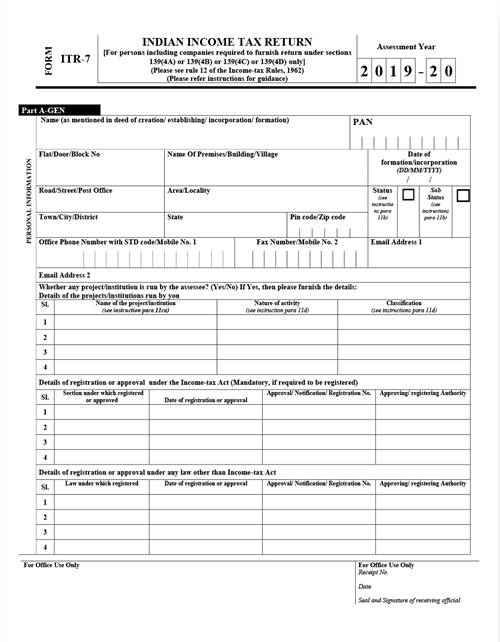

ITR-7

Last but not the least, this form is for those companies and individuals who are filing the return under the sections 139 (4A), 139 (4B), 139 (4C), 139 (4D), 139 (4E) or 139 (4F).

Conclusion

So, there you have it. That is the complete list of ITR forms, and the people included as well as excluded in these categories. Now, find your form cautiously and be prepared to file your ITR return.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.