Are You Liable for ITR Filing? Know the Details Here!

ITR 2021 Budget Update

Finance Minister Nirmala Sitharaman announced no filing of income tax Return by senior citizens (above 75 years of age) who have only pension and interest income.

Pension from the ex-employer is taxed under the income tax head of Salary while family pension is taxed as ‘income from other sources’.

Interest income received from SCSS, Bank FD etc., is taxed as per one’s income slab under the head ‘income from other sources’.

Budget 2021 has extended the ITR filing due dates for a certain category of taxpayers whose accounts need to be audited. The timeline for filing revised returns has also been proposed to be reduced from April 1, 2021.

ITR filing is made easy. Details of Capital Gains, income from list securities, dividend income, income from interest on bank deposits will come pre-filled in ITR.

Almost every other person with an income is eligible for ITR filing. For a majority of people who are already recognized with the ins and outs, the process may seem quite simple and straightforward.

However, the ones who are filing it for the first time may experience certain hurdles throughout the way. If you are unfamiliar with the several sections of income tax, just the idea of filing an ITR may give you goosebumps.

Irrespective of the confusion that you go through, it is mandatory to file the returns under certain circumstances. Having said that, now the question comes into the picture – Who should file ITR? Read on to get your answers.

Who should so for ITR Filing?

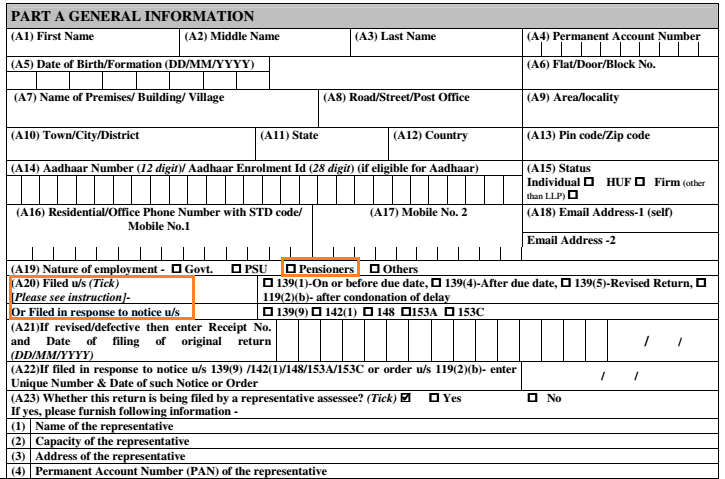

Basically, filing ITR return is a mandatory process for every Indian, including the NRIs. However, the threshold slabs differ on the basis of the age factor. For instance, those who are lesser than 60 years of age are required to have a gross annual income of more than Rs. 2.5 lakh (excluding the deductions under Sections 80c to 80U).

And, as far as the ones who are above 60 years, but below 80 years are required to have a gross annual income of Rs. 3 lakhs. And, for the super senior citizens, i.e. with an age of 80 years and above, the threshold is Rs. 5 lakhs.

Apart from this, residents who have financial interests and assets in an entity that is located outside the geographical territory of the country and have signing authority in foreign accounts should mandatorily file the returns.

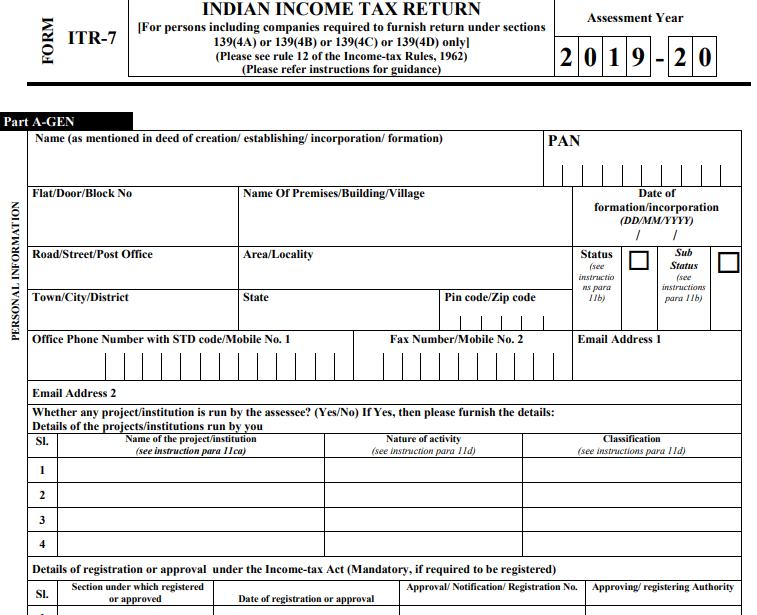

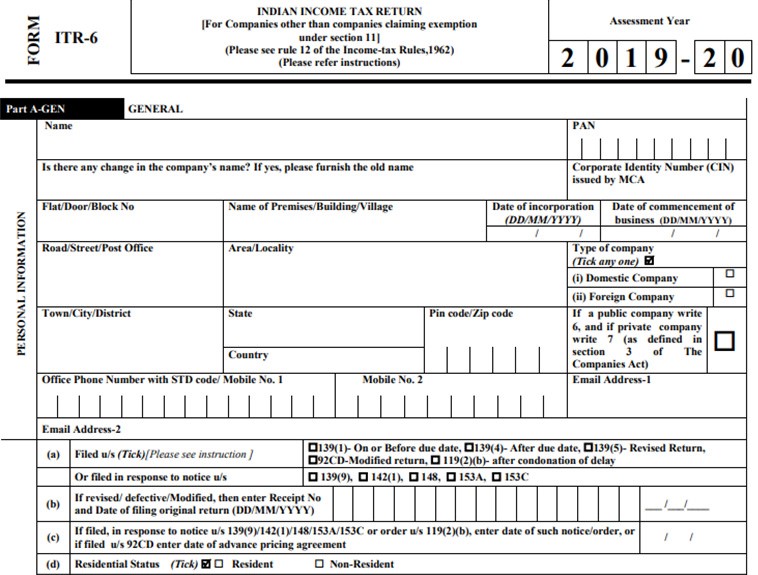

Furthermore, trade unions, medical or educational institutes, political parties, local authorities, companies, firms, LLPs, the body of individuals (BOIs), the association of persons (AOPs), and Hindu undivided families (HUFs) are required to file Income Tax Returns.

Moving forward, the Budget of 2019 has made ITR mandatory for additional categories with a purpose to cover more individuals under the tax net. Accordingly, those who own a deposit of more than Rs. 1 crore in banks, have purchased foreign exchange of more than Rs. 2 lakhs, or have paid more than Rs. 1 lakh for an electricity bill are required to file the ITR from the next assessment year.

Talk to our investment specialist

Reasons to Justify ITR Return File

As it is already prevalent, filing the ITR return is a mandatory process. The primary purpose behind this process is to allow individuals to declare the details of their income to the tax department. This helps figure out the amount that an individual has to pay as a tax for that specific financial year.

On top of that, this income declaration also assists individuals to gain deductions in taxation and claim refund for any extra amount that would have deducted at the source. Although it may sound hectic, however, the process can help people avail several financial advantages in case they have any prior investments.

Another considerable reason to file the ITR adequately, on time, is to prevent unnecessary penalties. In some cases, people may even get a sentence to jail on skipping the taxes. Hence, to keep such problems at a bay, taxes should be filed well within the given timeline.

What happens when don't File ITR before the Deadline

For newcomers, it is common to miss upon the deadline to file ITR online. However, not everybody would be aware of the repercussions of the same. Basically, the deadline is up to August 31 every year. But, if you miss that date, you can still file your returns.

When you file a return after the due date, it is known as a belated return. Before the end of the assessment year, you can file the returns any time. Thus, you can do so by March 31st of the next year.

For instance, if you missed filing your ITR by August 31, 2019, you can file it anytime till March 31, 2020.

But, you may have to pay the penalty as per the Section 234F of the Income Tax Act. Accordingly, if you file the return after August 31, but before December 31 of the assessment year, you would have to pay Rs. 5,000 as fine. Further, if you file after December 31 but before March 31, the fine can go up to Rs. 10,000.

Conclusion

In case your taxable income is less than Rs. 2.5 lakhs, filing the returns is not necessary for you. But, you can still file the ITR as Nil Return to keep a record. There would be innumerable instances when you would need the income tax as proof, such as while applying for a loan, passport, visa, and more. So, make sure you are well-equipped and prepared beforehand.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.