Step-by-Step Guide to Know How to File ITR

There was a time when filing ITR used to be a task filled with anxiety. Along with the stress of things going wrong, there was a fear of standing in long queues as well.

Maybe, not anymore!

Now that government has made it mandatory to File ITR, you must comprehend how to file Income Tax Return online for salaried employees or business owners as soon as possible. However, don’t fret out. If you have never filed your tax returns and would want to know how to file ITR online, this article will walk you through the step-by-step guide for the same.

Filing ITR Online

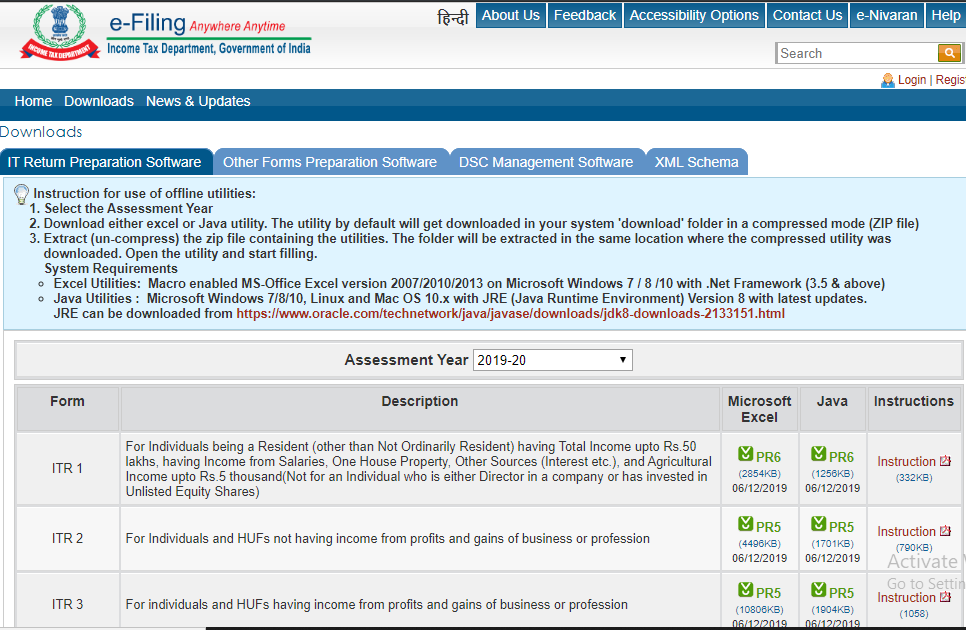

1. Visit the Official Government Portal

Although there are several private portals that guide you through how to fill ITR, the one introduced by the government is more liable, comprehensive and free. So, visit the website, and you will find several options on the homepage to choose from. Go with the appropriate option.

Talk to our investment specialist

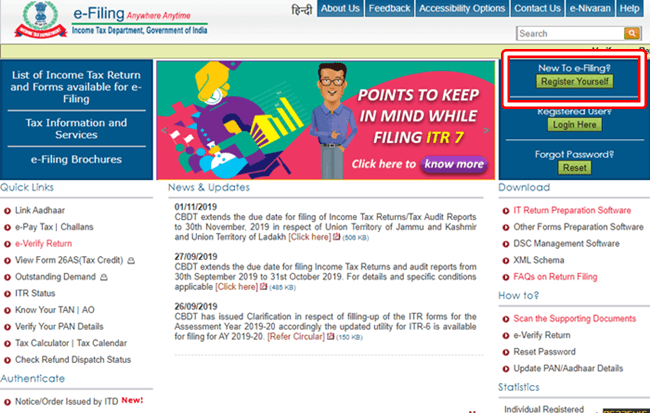

2. Login or Register

The next step would be opening the dashboard. For that, if you have already registered on the portal, then click on Login Here option. However, if you are new to the website, choose Register Yourself.

3. The Next Step

If you chose to log in, your dashboard will open up on your screen. However, if you are still figuring out how to fill ITR online and are registering here for the first time, you will have to add some more information about yourself.

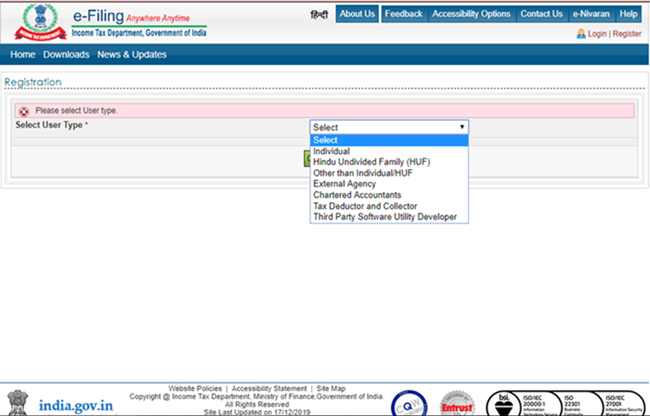

The next step for new users would be to choose the User Type. There would be several options in the list, such as Individual, hindu undivided family (HUF), External Agency, Other than Individual/HUF, Tax Collector, Chartered Accountants, and Third-Party Software Utility Developer.

Once selected; next you would have to enter the current and permanent address. Lastly, you would have to enter the Captcha code and click the Submit button.

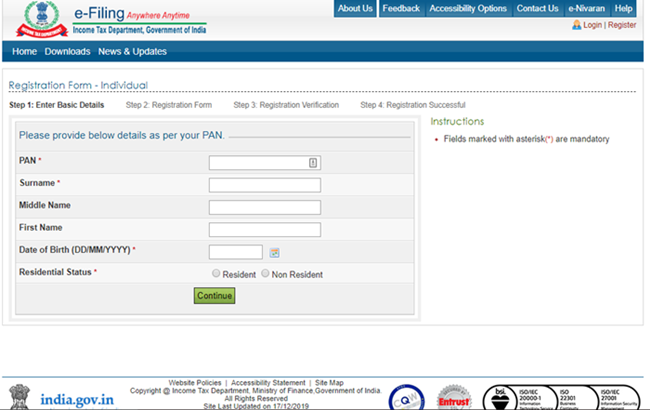

4. Basic Details, Verification & Activation

Once submitted, you would then have to enter your personal information, such as PAN, DOB, and more. After that, your PAN will be verified along with the transaction ID and contact details. In the end, you will have to activate the account by clicking on the link received via email.

5. Filing ITR

Once everything is done, the process of filing ITR begins from the dashboard you just logged into.

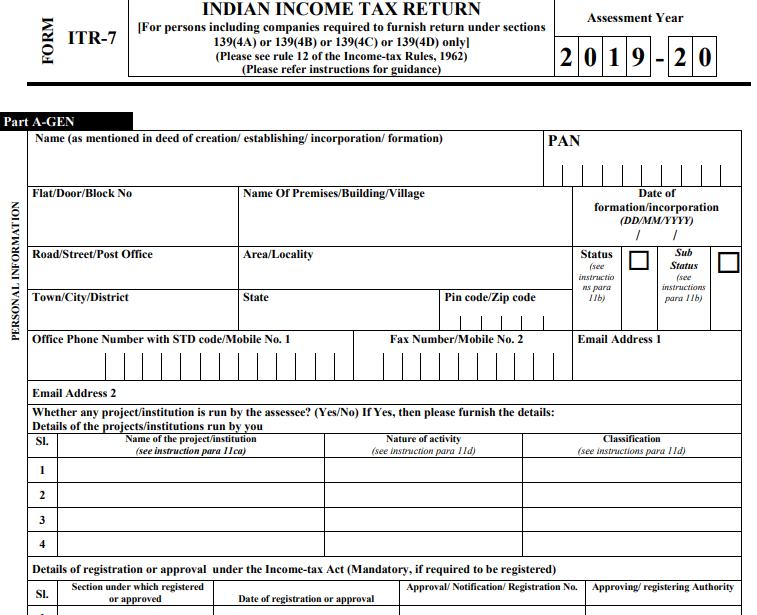

To file ITR, select the relevant assessment year, ITR form name and the submission mode as Prepare and Submit Online

In case you had filed ITR before, you can choose those details, and it will be automatically filled; now click Continue

After this, you will be redirected to a new page where you can fill the form; however, to avoid mistakes and to understand how to fill income tax return online, just read the General Instructions provided at the beginning

Now, fill up the information in relevant tabs, such as Income details, General information, Taxes paid and verification, Tax details, 80G and more in the form

Before you submit the form, recheck it again to prevent mistakes

Click Preview & Submit button

Once that is done, the ITR will be uploaded, and you can then verify your return using the available options, such as Aadhaar OPT, Electronic Verification Code or by sending the signed printout offline to the CPC office

Wrapping Up

Even if you don’t know how to file ITR, just a bit of research here and there will help you out of the confusion. If not, simply keep following the steps mentioned above and your ITR will be filed without any significant hassles.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.