What is GSTR-2? How to File GSTR 2 Form?

GSTR-2 is an important Tax Return that a taxpayer has to file on a monthly or quarterly Basis. It was introduced with the coming in of Goods and Services Tax (GST).

Note: GSTR-2 has been temporarily suspended.

What is GSTR-2?

GSTR-2 is different from GSTR-1 in a way that any taxable person has to file it for the purchases they have made in a year. Every registered taxable person is supposed to fill in the details of their purchases for a tax period in GSTR-2.

Filing GSTR-2 is crucial because it contains details of all the purchase transactions of a registered dealer for a particular month. This also includes purchases that have reverse charges.

The government checks the registered dealer’s GSTR-2 with the seller’s GSTR-1 for buyer-seller Reconciliation.

What is Buyer-Seller Reconciliation?

The buyer-seller reconciliation is also called invoice matching. In this process, the taxable sales of the seller are matched with the taxable purchases of the buyer.

What is the Purpose of GSTR-2?

GSTR-2 is required because it validates GSTR-1’s entry. GSTR-2 details have to match with the seller’s GSTR-1 details and then the seller can claim Input Tax Credit (ITC).

Once the registered seller files GSTR-1, the details would be auto-populated and informed to the recipient of GSTR-2A. The recipient would confirm the details. If the details are confirmed, it will be recorded and GSTR-2 will be prepared.

Businesses with a turnover of less than Rs. 1.5 crores have to file these returns on a quarterly basis.

Filing GSTR-2 involves minimal time since most of the categories here are auto-populated from the counter-party GST return. It is important to file GSTR-2 also because you can’t file GSTR-3, which is the next return. This will lead to late filing of GST return which will have a negative outcome along with a penalty.

Talk to our investment specialist

What is GSTR-2A?

GSTR-2A is where the information is captured when the seller files GSTR-1. It is a purchase-related tax return that is generated automatically for each business on GST portal.

If the recipient disagrees with the GSTR-2A details, it would be communicated to the seller and then be reflected in the seller’s GSTR-1A. This would give the supplier an option to modify the details in GSTR-1 auto-populated from GSTR-1A.

Who Should File GSTR-2?

- Non-resident taxable person

- Composition Dealers

- Persons liable to collect TCS

- Persons liable to deduct TDS

- Input Service Distributors

- Suppliers of online information and database access or retrieval services

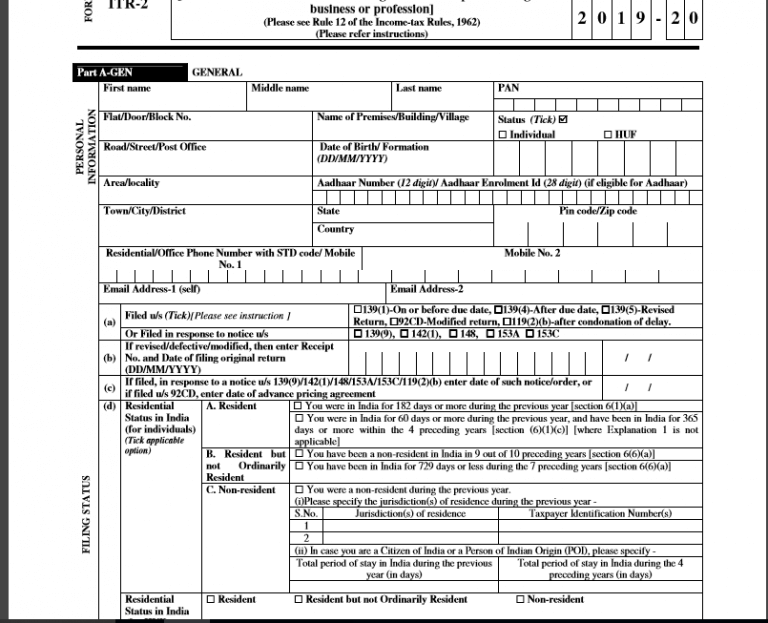

GSTR-2 Form Format

The government has prescribed 13 headings for the GSTR-2 format.

1. GSTIN

Each registered taxpayer will be allotted a 15-digit GST identification number. It will be auto-populated at the time of the GST return filing.

2. Name of taxpayer

Enter your legal name and trade name. Also, enter the relevant month and year of filing.

3. Inward supplies from registered taxable person

The purchases from a registered seller will be auto-populated from his GSTR-1 return. This will include details of the type, rate and amount of GST, etc. Purchases under reverse charge will not be included.

4. Inward supplies on which tax is to be paid on reverse charge

Some goods and services attract a reverse charge. This means the buyer is to pay the GST for the goods or services. If you’re a registered dealer and are purchasing anything for more than Rs.5000 per day from an unregistered dealer, you are liable to pay reverse charges.

5. Inputs/capital goods received from overseas or from SEZ units on a bill of entry

This heading must include the details of any imports of Capital goods received against a bill of entry. Details of goods received from SEZ should also be entered here.

Imports: Any imports of capital goods received against a bill of entry will be entered. Details of the bill of entry, 6-digit port codes and 7-digit bill numbers must also be reported.

Received from SEZ: Inputs or capital goods received from sellers in an SEZ will be entered here.

6. Amendments to details of inward supplies furnished in returns for earlier tax periods in Tables 3, 4 and 5

The taxpayer can’t revise GST Return once submitted. It can be revised in the following month under the same heading. You can then amend any details of the purchase of goods and services in the earlier months. The seller will also be notified about the changes. The seller will then be required to accept the changes in the GSTR-1A return.

6A. It will have all the revisions of input goods/services (except imports)

6B. It will include any change in amount/tax calculated on imported goods and goods from SEZ. The taxpayer is required to mention the changes made in the bill of the Entry/Import Report.

6C. The taxpayer is required to report all debit and credit notes issued regarding purchases. The debit/credit note issued under the reverse charge mechanism will also get auto-populated here from GSTR-1 and other applicable returns.

6D. Changes in debit /credit note of previous months will be reported here.

7. Supplies received from composition taxable person and other exempt/Nil rated/Non-GST supplies received

This includes purchases from composition dealer and other exempt/nil/non-GST supplies. Petrol, diesel, which is not covered under GST, are the Non-GST included here. Also, both interstate and intrastate supplies will need to be entered here.

8. ISD credit received

This will include details of the input tax credit received from a registered Input Service distributor (ISD). This data will be auto-populated from GSTR-6 filed by ISD.

9. TDS and TCS credit received

TDS Credit Received– This will be applicable if you have engaged in specific contracts with government bodies. The government will deduct a certain percentage of the transaction value as Tax Deduction at Source. All information will get auto-populated here from GSTR-7 filed by the government.

TCS Credit Received– This will be applicable for online sellers registered with E-commerce operator. The e-commerce operator will collect tax at source at the time of making payment to sellers. This information will be auto-populated from the GSTR-8 of e-commerce operator.

10. Consolidated statement of advances paid/advance adjusted on account of receipt of supply

If you have made an advance payment during the month, it will appear here. Advance receipts under reverse charges are also included.

Usually, the seller would issue an advanced Receipt when he gets an advance payment. If the case is of reverse charges, the buyer is required to issue an advance receipt if he/she makes the payment in advance.

11. Input tax credit reversal/reclaim

ITC can be claimed only on goods and services purchased for business purposes. If otherwise, it can’t be claimed. Under this heading, the taxpayer is required to fill in the details of ITC that can’t be claimed during the month during various ITC rules.

12. Addition and reduction of amount of output tax for mismatch and other reasons

This heading captures any additional Tax Liability that can arise from corrections made to the GSTR-3 of the previous month.

13. HSN summary of inward supplies

A registered dealer has to provide HSN wise summary of goods purchased which be entered by the taxpayer under this heading.

Penalty for Filing GSTR-2 Late?

Filing GSTR-2 late would only attract the following penalty:

Interest

If you Fail to file GSTR-2 on the due date, you will be liable to pay an interest of 18% per annum. The taxpayer will calculate this amount based on the amount of outstanding tax to be paid. The time period will begin from the day of filing to the date of payment.

Late Fee

As per the act, failing to file GSTR-2 on time will attract a Late Fee of Rs.100. You have to pay Rs.100 for CGST and Rs. 100 for SGST. This means you will be spending Rs.200 per day. The maximum would be Rs.5000.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like

very very goog