What is Reconciliation?

In the Accounting context, reconciliation refers to the practice of checking and comparing two different sets of financial records to ensure that the data in both accounting books are accurate. The process is mainly used to verify that the accounts are 100% consistent as well as complete. The term tells us the differences between different accounts.

There can be differences in the final balance of the general ledger and trial balance because of many reasons. Usually, it happens due to the payment or deposit timings. However, larger and unacceptable discrepancies can indicate fraudulent activities. Reconciliation is important to ensure that the accounts are accurate. Depending on the size of the business, reconciliation must be required on a weekly or monthly basis. Some companies reconcile their accounts every day.

How to Reconcile Accounts?

So far, the only method used for accounts reconciliation is the double-entry bookkeeping system. The Generally Accepted accounting principles (GAAP) has made it compulsory for all businesses to pass the entries twice in the ledger. That’s the reason why the financial transactions appear in two different sections in the general ledger. Using this method, the Accountant can detect all kinds of errors in accounting on both sides of the ledger. It makes it easier for the accountant to rectify these mistakes given that they occurred due to the payment timing issues and other such causes.

There is one more way to reconcile accounts, i.e. the account conversion method. The accountant is supposed to gather all the canceled checks as well as the receipts and match them with all the transactions passed in the ledger book to ensure that nothing is omitted. However, a majority of small and large-scale organizations use the double-entry system for reconciliation. You must have noticed that the transactions are recorded in two main accounts of the firms, i.e. income statement and balance sheet. In one account, the entry is debited while the other one presents the transaction on the credit side.

Talk to our investment specialist

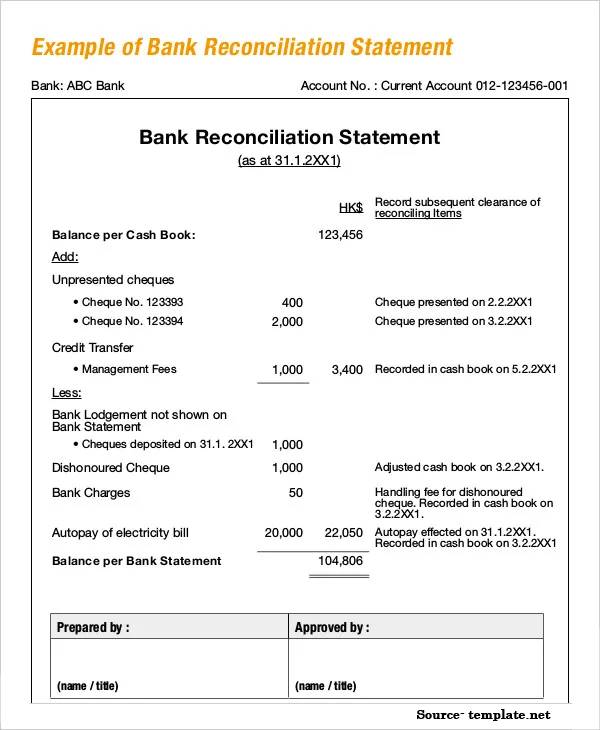

Reconciliation Example

For example, on receiving the amount due on the invoice, the business mentions it in the accounts payable on their balance sheet while passing the same entry as an expense in the Income Statement. All the entries on the right and left sides of the general ledger must match. Most people reconcile their accounts occasionally. They bring checks and all kinds of receipts and compare those with the financial accounts to detect any error or omission. They also check these receipts with their Bank statement. This is known as the personal account reconciliation that enables the users to identify if the money had been withdrawn fraudulently.

In addition to that, personal reconciliation gives you a clear picture of all your expenses, income, outstanding payments, and more. Sometimes, financial institutions or the accountant could make mistakes when passing entries in the books of accounts. Reconciliation helps identify these errors, making it easier for you to rectify them. The main purpose of reconciliation is to confirm that all entries in the books of accounts match the account holder’s personal records.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.