Income Statement

What is an Income Statement

An income statement is one of the three important financial statements used for reporting a company's financial performance over a specific Accounting period, with the other two key statements being the balance sheet and the statement of cash flows. Also known as the profit and loss statement or the statement of revenue and expense, the income statement primarily focuses on company’s revenues and expenses during a particular period.

This specific statement offers essential insights into several aspects of the company. Generally, an income statement includes operations, the efficiency of management, potential leaky areas and if the firm is performing in line with its industry peers or not.

Explaining the Income Statement

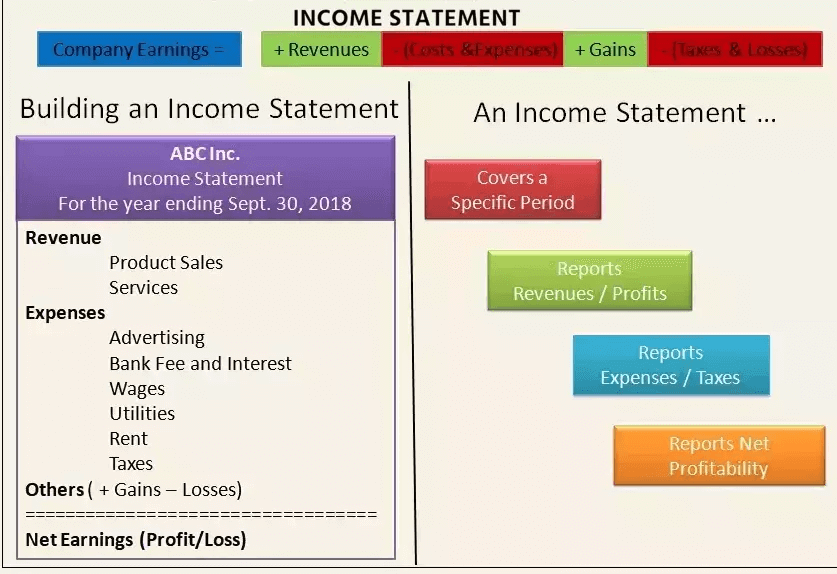

Majorly, the income statement concentrates on four different items, such as revenue, expenditure, profit, and losses. Neither does it differentiate between non-cash and cash receipts nor between non-cash and cash disbursements or payments.

Generally, an income statement begins with the sales details and then moves forward to calculate the net income and eventually computes the Earnings Per Share (EPS). Fundamentally, it provides an account of how the company realises the net revenue and transforms it into net earnings, be it loss or profit.

Income Statement Formula & Example

Mathematically, the formula to calculate net income is:

Net Income = (Revenue + Gains) – (Expenditure + Losses)

To understand this better, let’s have an example here. Suppose there is a merchandising business, which also provides sports training. This business is about to report the income statement for the recent quarter.

Now, the firm received Rs. 26000 from the sale of products and Rs. 5000 from training. It spent a total of Rs. 11000 for specific activities. The firm recognized net gains of Rs. 2000 by selling an old asset and got losses worth Rs. 800 for settling a complaint by its customer. Now, the net income for a quarter will be Rs. 21,200.

This is a simple form of the income statement that any other business can generate. This example is known as the Single-Step Income Statement and is based on a straightforward calculation that adds gains and revenue and subtracts losses and expenses.

But real companies that generally operate on the global scale have distinguished business segments that offer a mixture of services and products. These companies often get involved in strategic partnerships, acquisitions, and mergers.

Thus, an extensive range of operations, diverse expenses, varying business activities and the requirement of reporting in the standard format, according to the regulatory compliance, will lead to several complex accounting entries in an income statement.

Income Statement Details

Income statement is an important part of the company’s performance reports that must be submitted to the Exchanges/SEBI (Public Domain). While a balance sheet provides the snapshot of company’s financials as of a particular date (like, as on 30 June 2025), the income statement reports income through a particular time period and its heading indicates the duration which may read as For the (fiscal) year/quarter ended June 30, 2025.

The income statement focuses on the four key items - revenue, expenses, gains and losses. It does not cover receipts (money received by the business) or the cash payments/disbursements (money paid by the business). It starts with the details of sales, and then works down to compute the net income and eventually the earnings per share (EPS). Essentially, it gives an account of how the net revenue realized by the company gets transformed into net earnings (profit or loss).

The following are covered in the income statement, though its format may vary depending upon the local regulatory requirements, the diversified scope of the business and the associated operating activities:

1. Revenues and Gains

Operating Revenue

Revenue realized through primary activities is often referred to as operating revenue. For a company manufacturing a product, or for a wholesaler, distributor or retailer involved in the business of selling that product, the revenue from primary activities refers to revenue achieved from sale of the product. Similarly, for a company (or its franchisees) in the business of offering services, revenue from primary activities refers to the revenue or fees earned in exchange of offering those services.

Talk to our investment specialist

Non-operating Revenue

Revenues realized through secondary, non-core business activities are often referred to as non-operating recurring revenues. These revenues are sourced from the earnings which are outside of purchase and sale of goods and services, and may include income from interest earned on business capital lying in the Bank, rental income from business property, income from strategic partnerships like royalty payment receipts or income from an advertisement display placed on business property.

Gains

Also called as other income, gains indicate the net money made from other activities, like sale of long-term assets. These include the net income realized from one-time non-business activities, like a company selling its old transportation van, unused land, or a subsidiary company.

Revenue should not be confused with receipts. Revenue is usually accounted for in the period when sales are made or services are delivered. Receipts are the cash received, and are accounted for when the money is actually received. For instance, a customer may take goods/services from a company on 28 September which will lead to the revenue being accounted for in the month of September. Owing to his good reputation, the customer may be given a 30-day payment window. It will give him time till 28 October to make the payment which is when the receipts are accounted for.

2. Expenses and Losses

Expenses linked to primary activities

All expenses incurred for earning the normal operating revenue linked to the primary activity of the business. They include cost of goods sold (COGS), selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D) expenses. Typical items that make up the list are employee wages, sales commissions, and expenses for utilities like electricity and transportation.

Expenses linked to secondary activities: All expenses linked to non-core business activities, like interest paid on loan money.

Losses

All expenses that go towards loss-making sale of long-term assets, one-time or any other unusual costs, or expenses towards lawsuits. While primary revenue and expenses offer insights into how well the company’s core business is performing, the secondary revenue and expenses account for the company’s involvement and its expertise in managing the ad-hoc, non-core activities.

Compared to the income from sale of manufactured goods, a substantially high interest income from money lying in the bank indicates that the business may not be utilizing the available cash to its full potential by expanding the production capacity, or it is facing challenges in increasing its market share amid competition. Recurring rental income gained by hosting billboards at the company factory situated along a highway indicates that the management is capitalizing upon the available resources and assets for additional profitability.

3. Uses of Income Statement

Though the main purpose of income statement is to convey details of profitability and business activities of the company to the stakeholders, it also provides detailed insights into the company’s internals for comparison across different businesses and sectors. Such statements are also prepared more frequently at department- and segment-levels to gain deeper insights by the company management for checking the progress of various operations all throughout the year, though such interim reports may remain internal to the company.

Based on income statements, management can take decisions like expanding to new geographies, pushing sales, increasing production capacity, increased utilization or outright sale of assets, or shutting down a department or product line. Competitors may also use them to gain insights about the success parameters of a company and focus areas, like increasing R&D spends. Creditors may find limited use of income statements as they are more concerned about company’s future cash flows, instead of its past profitability.

Research analysts use the income statement to compare year-on-year and quarter-on-quarter performance. One can infer whether company's efforts in reducing the cost of sales helped it improve profits over time, or whether the management managed to keep a tab on operating expenses without compromising on profitability.

The Bottom Line

An income statement provides valuable insights into various aspect of a business. They include company’s operations, the efficiency of its management, the possible leaky areas that may be eroding profits, and whether company is performing in line with industry peers.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Assist me as soon as possible for obtaining form 26AS