All About GSTR-3B Form

GSTR-3B is another important GST return that you have to file on a monthly basis. It’s the most important return filing after GSTR-1, GSTR-2 and GSTR-3.

Note: GSTR-2 and GSTR-3 have been suspended temporarily.

What is GSTR-3B?

GSTR-3B keeps a record of your monthly transactions and summarises your returns monthly. As a taxpayer, you will have to list the total value of your business purchases and sales every month.

After the filing of this return, the income tax Department (ITD) will calculate your invoice claims as per the monthly transaction report. You will be in for trouble if it does not match with the preliminary details you have submitted.

Remember to file a separate GSTR-3B for each GSTIN. Pay the tax liability on or before the last filing date of GSTR-3B. Make sure there is no error before submission as it can’t be revised.

Who has to File GSTR-3B?

Everyone registered for GST is supposed to file GSTR-3B. You have to file even in case of ‘nil returns’.

However, the following are not to file GSTR-3B.

- Non-resident taxable person

- Composition Dealers

- Input Service Distributors

- Suppliers of Online Information and Database Access or Retrieval services (OIDAR)

Format of GSTR-3B

The GSTR-3B format as mentioned below:

- Your GSTIN number

- The business’ legal registered name

- Details of sales and purchases if accountable for reverse charge

- Details of inter-state sales made to buyers under the composition scheme. Also, details of unregistered buyers and Unique identification number (UIN) holders

- Eligible Input Tax Credit

- Value of nil-rated, non-GST and inward supplies

- Payment of tax

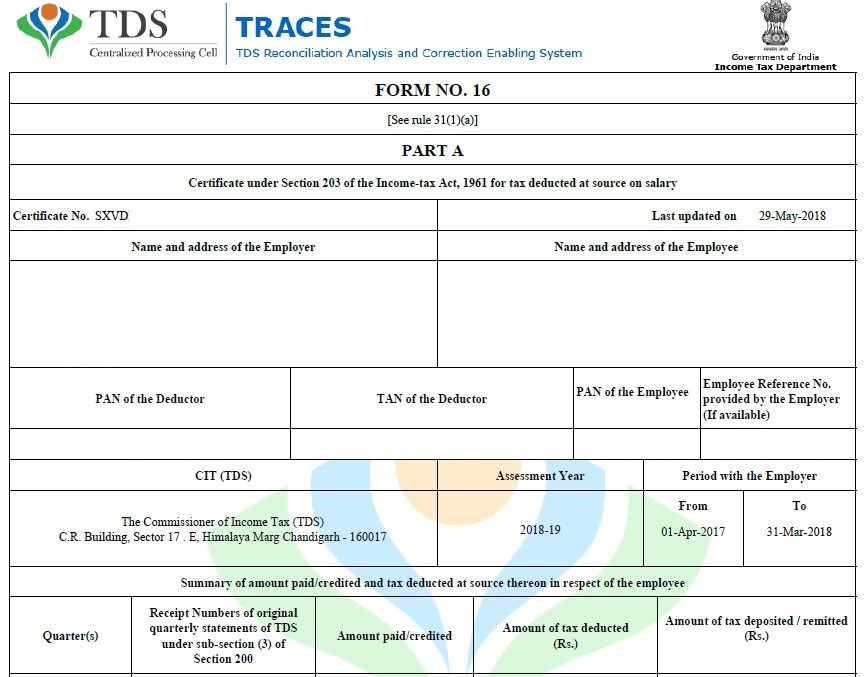

- TCS/TDS credit (Tax Calculated at Source/Tax Deducted at Source)

Talk to our investment specialist

How to File GSTR-3B Online?

You can file the GSTR-3B return online or take help from a CA. Download the GST form online, fill it with careful scrutinization and then upload it.

Following are the steps to file GSTR-3B online:

- Login on to the GST portal

- Click on ‘Services’

- Click on ‘Returns’ and then click on ‘Returns Dashboard’

- Now you will see ‘File Returns’ page

- Select the relevant ‘Financial Year’

- Now click on the ‘Return-filing Period’ from the dropdown menu and click on ‘Search’

- Select ‘Monthly Return GSTR-3B’

- Now click on the ‘Prepare Online’ button

- You will be directed to GSTR 3B form. Fill the details

- You can click on ‘Save GSTR 3B’ if you want to edit the information later

- Click ‘Submit’ once all the relevant details are entered

- After you click the ‘Submit’ button, a success message will be displayed on the top of your screen

- The status of the return will change from ‘Not filed’ to ‘Submitted’

- This will enable ‘Payment of Tax’. You can now pay the taxes

- Then click on the ‘Offset Liability’ button.

- You will get a pop-up message. Click ‘Ok’

- Now select the checkbox for declaration

- From the ‘Authorised Signatory’ list, choose either ‘File GSTR 3B with EVC’ or ‘File GSTR 3B’ with DSC’ button

- A warning message is displayed. Confirm whether you want to proceed with the filing

- Click on the ‘Proceed’ button

- A success message is displayed

- Click the ‘Ok’ button to affirm the message

Due Dates for Filing GSTR-3B

The due dates for filing this return is on a monthly basis.

Here are the due dates for filing:

| Period- Monthly | Due Date |

|---|---|

| January- March 2020 | 24th of every month |

Penalty for Late Filing

Filing GSTR-3B after the due date attracts both late fees and interest. The late fee amount will be applicable every day till the date of actual payment.

Interest

You will be liable to pay 18% interest p.a. on your dues if you fail to pay the amount late. In case you are in a habit of deliberately missing the GST payments, a 100% penalty will be levied on your tax amount.

Late Fees

A late fee of Rs. 50 will be applicable per day till the date of payment on late filing of GSTR-3B. Taxpayers with ‘NIL liability will have to pay Rs.20 per day.

Conclusion

Filing this return is extremely important, hence, make sure you check it twice before submitting. Ensure all your entries are correct and don’t miss out on filing GSTR-3B every month.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like