Form 16 - Guidelines to Downloading Form 16

Form 16 is a certificate issued by an employer validating the fact that TDS (Tax Deduction at Source) is deducted and deposited with the authorities on behalf of the employee.

Form 16 is an important document that is issued in accordance with the provisions of income tax Act,1961. It has all information you need when you file Income Tax Return. The form is issued annually, usually before 15th June of the next year. It immediately follows the financial year in which the tax is deducted.

Understanding Form 16

Form 16 has basically has two components to it- Part A and Part B. In case an employee loses Form 16, a duplicate can beI issued by the employer.

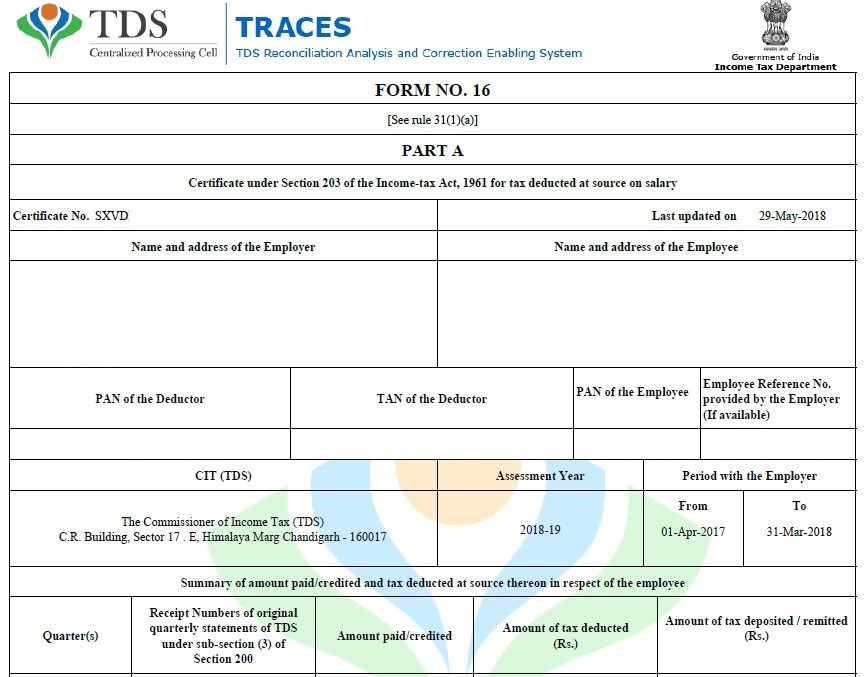

Part A

This part of Form 16 is issued by the government. It is generated and downloaded by the employer through the TRACES portal. This form shows quarter-wise details of your tax deposited with the government. If an individual changes the job in one financial year, every employer will issue a separate Part A of Form 16, for the period of employment.

The details mentioned in Part A are:

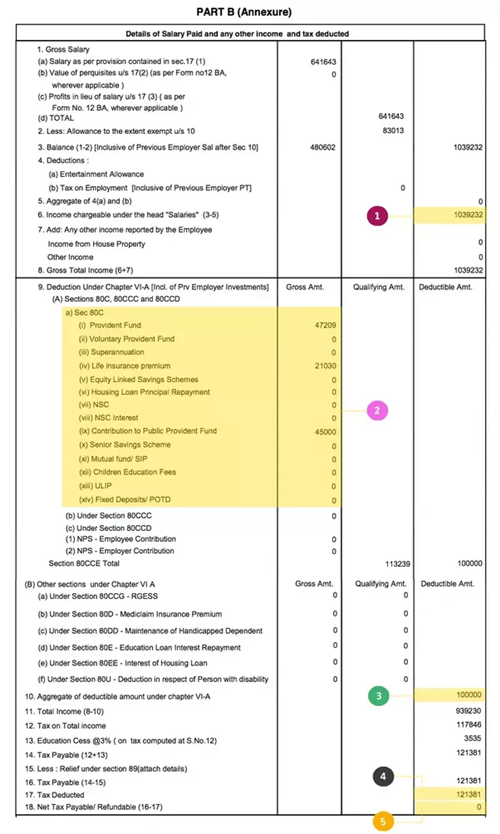

Part B

Part B of Form 16 is an annexure to Part A. The form contains the breakup of the salary earned by the employee, deductions and exemptions, along with the tax computation after considering all the components on the Basis of current tax slab rates.

The details are-

Why do you need Form 16?

Form 16 is important as it serves as a proof that the government has received the tax deducted by the employer

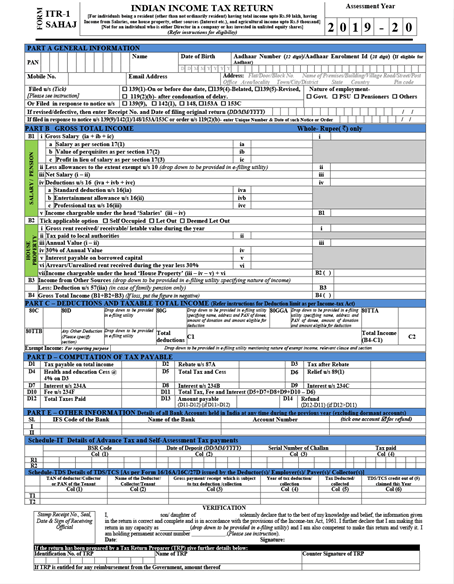

The form helps in the process of filing Income Tax Return with the Income Tax Department

When you apply for loans, many banks and other financial institutions demand form 16 for verification of the person’s credentials

Talk to our investment specialist

Process of Form 16

The last date to deposit the TDS is 30th April of every year. Returns for the last quarter i.e., Jan to March is to be filed latest by 31st May. As per the process laid by the IT Department, the TDS entries get updated in the department's database once the employer files the return.

After the TDS return is filed, it takes 10 to 15 days to reflect the entries in the department’s database. Thereafter, the employer downloads the Form-16 and issues it to the employee.

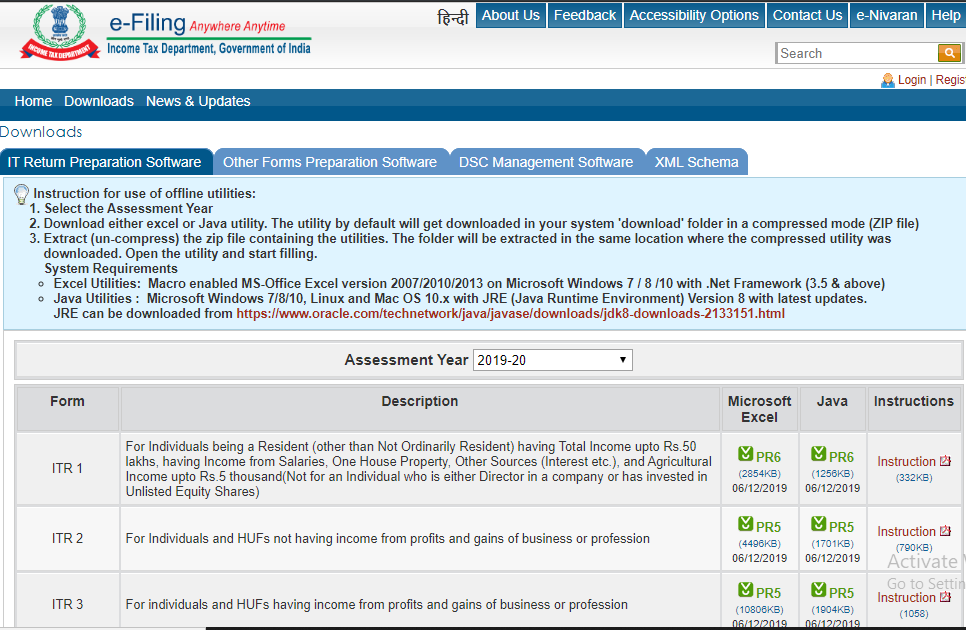

How to Download Form 16?

It is a common misconception if the salaried employee can download Form 16. However, it is important to know that Form16 can be given only by your employer in case there is any Tax Deduction at Source. Employees can't download this form.

An employer can download Form 16 through the TRACES (tdscpc.gov.in) portal.

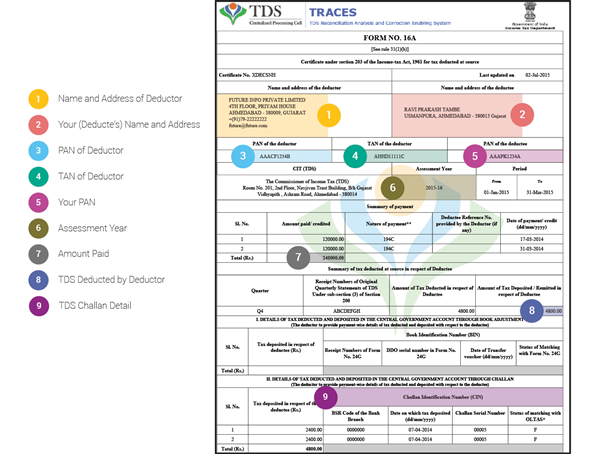

Form 16A

Form 16A is also a TDS Certificate issued by employers on deducting Tax at Source. Form 16 is only for salary income, while Form 16A is applicable on income other than salary. For instance, income generated in the form of interest of insurance commission, rent receipts, securities, FDs etc.

The certificate also has details of the name and address of deductor/deductee, PAN/TAN details, challan details of TDS deposited.

Form 16 FAQs

1. Will I get Form 16 even if there is no TDS?

Form 16 is issued only when there is tax deducted. The purpose is to serve it as a proof of tax deducted and deposited on behalf of the employee. If there is no tax deducted, employer is not required to issue Form 16 to the employee.

2. Is is true that TDS is deducted, but certificate is not issued?

As per the Income Tax Act, it is mandatory for an employer to furnish a certificate, in the format of Form 16.

3. How to get Form 16 from previous employer?

As per provisions, it mandatory for an employer to issue Form 16 to the employee if TDS has been deducted from the employee's salary. If you need Form 16 for any previous year, you can ask your employer to issue you the same.

4. Can ITR be filed without Form 16?

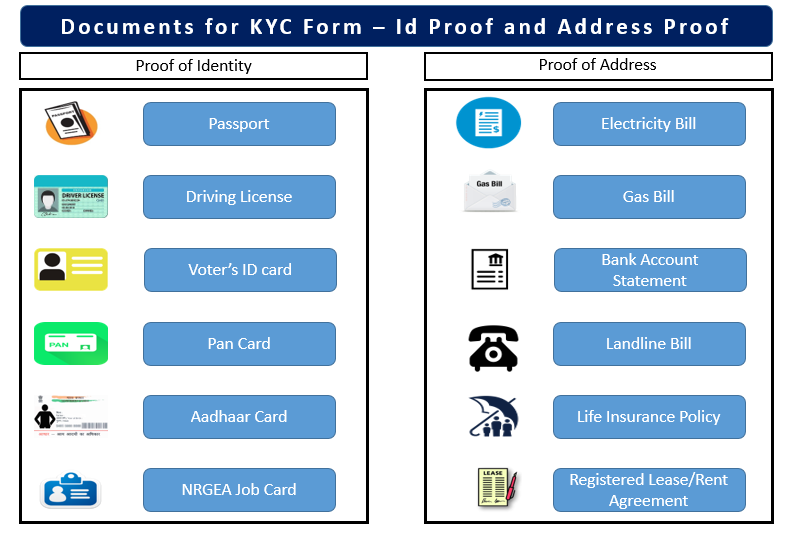

One can still file a tax return even if you don't have a form 16. However, one will need several other documents related to their incomes & expenses like your payslips, Form 26AS, TDS certificates from banks, rent receipts, Tax Saving Investment proofs, travel expense bills, home & education loan certificates, all Bank statements etc.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.