eKYC for Mutual Fund Investments

The Unique Identification Authority of India (UIDAI) has come up with eKYC to make improvements to customer services. eKYC is a paperless, aadhaar based process for fulfilling norms of KYC for Mutual Fund Investments. Aadhaar eKYC simplifies KYC registration, wherein the customers need to submit their details digitally, such as— aadhaar number, PAN, aadhaar-registered mobile number and Bank details. eKYC for Mutual Funds has made the investment process easy & convenient for users by eliminating turnaround paper work and time. During the KYC process, you may need to check your KYC Status, do KYC verification, etc., as explained in this article.

Check KYC Status For Aadhaar eKYC

Investors can check their KYC status by entering their PAN details by clicking link below.

NOTE: e-KYC, which was discontinued as per Supreme Court on Sept 2018, has been contiuned again from 5th Nov'19.

You can do your eKYC using FINCASH for all mutual funds investment by sitting @Home. You can get started by clicking here Check Your KYC Status.

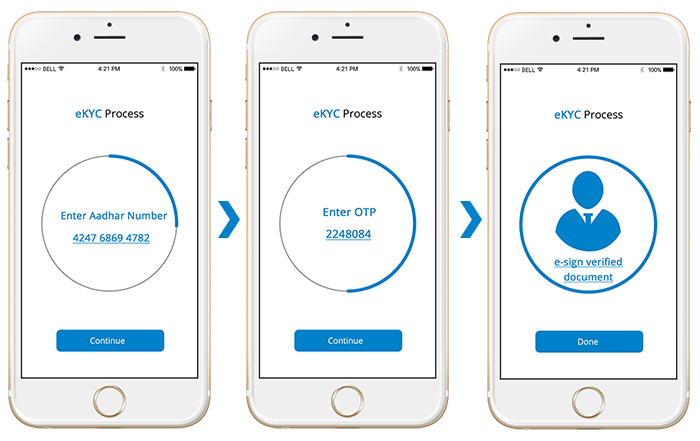

eKYC Registration Process

If you are a resident of India, you can get your eKYC done through any of the SEBI (The Securities and Exchange Board of India)- registered intermediaries like banks, Mutual Funds or KRAs. All an investor should have is an Aadhaar card. If one doesn’t have an Aadhaar, you will have to get the In-Personal Verification (IPV) done either through live video with the intermediary or by visiting their office. But, the procedure to follow for eKYC with Aadhaar is fairly easy and convenient:

1. Get Ready with Aadhaar & PAN

Go to the site of the intermediary (Fincash.com) (who provides Aadhaar based KYC) and choose an option of eKYC. Do EKYC

2. Enter PAN details

Enter Pan Details for validation of name etc. of an investor.

3. Enter your Aadhaar number

Enter Your aadhaar number to receive an OTP on your Aadhaar based registered mobile number

4. Enter the OTP

Enter OTP recieved from Aadhar to fetch KYC details from Aadhaar UADAI systems. Once validated you will move to nest step.

5. Fill in Additional Details

Your personal details will be retrieved from the Aadhaar database and you’ll be asked to confirm those details and provide other additional details

6. Submit to complete your KYC

Final Step if to submit the details to once submitted generally a ekyc number is provided which you can ask your Intermeditary to provide.

A user can invest up to INR 50,000 p.a./Fund house after a successful eKYC. If one wants to transact without any limits, then one needs to go for biometric identification.

Understand these KYC Status

In case, if you are not able to invest in a fund, there might be some issue in the registration process, thus you need to check your KYC status. For better understanding, we have listed down what each KYC Status stands for:

KYC Under Process: Your KYC documents are being accepted by the KRA and it is under process.

KYC on Hold: Your KYC process is on hold due to the discrepancy in the KYC documents. The documents/details that are incorrect need to be re-submitted.

KYC Rejected: Your KYC has been rejected by the KRA after verification of PAN details and other KYC documents. This means that you need to submit a fresh KYC Form with relevant documents.

Not Available: Your KYC record is not available in any KRAs.

Aforementioned 5 KYC statuses can also reflect as Incomplete/Existing/Old KYC. Under such a status, you may need to submit fresh KYC documents to update your KYC records.

EKYC For Mutual Fund Via Biometric Authentication

Investors who want to get their KYC done biometrically have to visit any one of the branches of the AMC. The key advantage of the biometric system (on completion of KYC), is that there will be no upper limit on how much an investor wants to invest in a fund. It works this way:

- The machine scans your thumb impression

- Once verified, a bio-key is displayed on the screen

- You need to enter the Aadhaar number and the bio-hey to complete the KYC

eKYC Vs Mutual Fund KYC

The following table shows the difference between normal KYC and eKYC using Aadhaar for Mutual Fund Investments.

Let's have a look:

| Description | Normal KYC | eKYC | KYC Biometric |

|---|---|---|---|

| Aadhaar Card | Required | Required | Required |

| *PAN Card * | Required | Required | Required |

| Attestation of ID & Address Proof | Required | Not Required | Not Required |

| In-Personal Verification | Required | Not Required | Not Required |

| Branch Visit | Required | Not Required | Not Required |

| Amount of Purchase | No Limit | INR 50,000 p.a/AMC | No Upper Limit |

Impact And Advantages

There is over 900 million Aadhaar card registered users in India and over 170 million PAN card holders. With Aadhaar eKYC process it has become much easier to tap the masses who hold both the Aadhaar card and the PAN card. Due to a digital process, the management of the documents is eliminated. It speeds up the transactions and cuts off the time required for detailed paperwork. Also, customer convenience and services are enhanced which can attract more people to invest in Mutual Funds. Because of a centralised process and digitally stored information, it is economical for both customer and the Asset Management Companies(AMCs). Also, due to digitisation, there is a transparency in the process and less chance of some forgery or misconduct.

Advantages Of Aadhaar eKYC

- eKYC eliminates the process of paperwork, due to which there is transparency in the entire process. Customers need not submit multiple copies of their documents. This also reduces the chances of fraud and theft.

- With a UIDAI number, a user will be able to open a bank account as it will work as an identification document and will help in easier access to loans.

- While the physical KYC process takes five-seven working days, eKYC is something which is instantaneous.

- The biometric scanner used by the Mutual Fund agents or institutions to do biometric verification of the user allows the investors to a transaction of any amount.eKYC without biometric identification is restricted to INR 50,000 per asset management company per year.

Current Limitations Of eKYC

The only current limitation on eKYC is that an investor can invest up to INR 50,000 p.a. per fund house. To be eligible to invest more than that, an investor needs to complete In-personal verification (IPV) or do the biometric identification. Also, one needs to sign physically for an offline transaction.

EKYC Implications

This move is a boost to individual’s, AMC’s and the strength of the Aadhaar card itself. Individuals interested in making an investment in mutual funds can now simply do so by sending an SMS instead of going through the many rigorous procedures which were earlier required for registration. eKYC is also a boost to the AMC’s since it is a new route for KYC. Because of this, AMC databases will automatically increase due to new users being signed up with an easy process. It also increases the value of the Aadhaar card as an extremely rigorous process is simplified if one possesses an Aadhaar card for making an investment in mutual funds. As a result, SEBI’s e-KYC guidelines have made the process of Investing much simpler than before.

FAQs

1. What is Aadhaar eKYC?

Aadhaar based e-KYC is an electronic and 100% paperless process for first-time investors to Mutual Funds to complete their KYC formality using their Aadhaar Number.

2. If I have done KYC, should I need to do eKYC too?

If you have already done your KYC, you don’t need to do an electronic KYC (eKYC). For those who have already initiated their KYC and have an acknowledgment and the status from their KRAs (KYC Registration Agency), eKYC is not applicable to them. A first-time investor (Indian Resident) who has not done his/her KYC, and have an Aadhaar and PAN Card, can do an eKYC.

3. What if I don’t have a PAN?

At present, the e-KYC process works only for those who have a PAN Card. Check EKYC

4. I haven’t received my OTP as yet

The OTP sent by UIDAI might be delayed on account of network congestion. In the event of non-receipt, you may regenerate the OTP or restart the process by clicking here Re - EKYC

Important Points to Remember:

- KYC is mandatory.

- KYC is a one-time process.

- Those who are non-compliance of KYC will face rejection on Purchases/Additional Purchases/SIP Registration/SIP Renewals.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

very helpful

noramal sbi bank cky form