Asset Management Companies in India

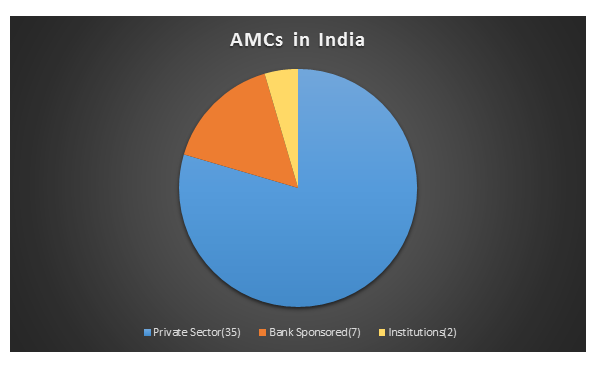

Asset management companies in India are broadly categorised into three types; bank-sponsored mutual funds, mutual fund institutions, and the private sector mutual funds. There are total 44 asset management companies in India as of today (February 2017). 35 of these AMCs are part of the private sector.

All the asset management companies are part of Association of Mutual Funds in India (AMFI). AMFI was incorporated in 1995 as a non-profit organisation of all the registered AMCs in India.

Overview of Popular AMCs in India

Since the inception of mutual funds in 1963 by the UTI act of the Parliament, the industry has overseen a significant evolution to reach its present state. The introduction of the public sector then followed by the entry of private sector has marked the momentous phases of the history of the mutual fund industry.

1987 marked the entry of the public sector in the mutual funds market. SBI mutual funds, set up in June 1987, is the oldest public sector managed AMC. SBI Mutual Fund has a rich history of more 25 years and a very impressive track record. The total asset under management (AUM) of SBI Mutual Fund is reported to be over INR 1,31,647 crores in September 2016.

Kothari Pioneer (now merged with Franklin Templeton) was the first private sector managed AMC to enter the mutual fund market in 1993. Franklin Templeton has been in the industry for over two decades now. The total AUM of Franklin Templeton stands over INR 74,576 crores as recorded on September 2016.

Over the years, many private sector AMCs penetrated the mutual funds market. HDFC Mutual Fund set up in 2000 is one of the most successful Mutual Fund Houses in India. As on June 2016, the assets under management of HDFC Mutual Fund stand over INR 2,13,322 crores.

ICICI Prudential Mutual Fund was the top performing AMC in terms of average AUM from June 2015 to June 2016. The total assets under management under ICICI Prudential are estimated at around INR 193,296 crores. This amount shows a growth rate of 24% from the previous year.

Reliance Mutual Fund is one of the most popular asset management companies in the country. Reliance AMC covers around 179 cities across India, making it one of the fastest growing mutual funds in the country. As on September 2016, the total assets under management of the Reliance Mutual Fund is recorded to be over INR 18,000 crores.

Talk to our investment specialist

Birla Sun Life Asset Management Company (BSLAMC) is also among the leading and widely known asset management companies in India. It is a joint venture of Aditya Birla Group and Sun Life Financial. The total assets under management of BSLAMC in September 2016 is reported to be INR 1,68,802 crores.

UTI Asset Management Company established in 2002, is sponsored by four public sector companies, namely LIC India, State Bank of India, Bank of Baroda and Punjab National Bank. The AUM of UTI Asset Management Company in September 2016 was estimated at INR 1,27,111 crores.

Top Asset Management Companies

1. ICICI Prudential Asset Mgmt.Company Limited

With the AUM size of approximately ₹ 3 lakh crore, ICICI Prudential Asset Management Company Ltd. is the largest asset management company (AMC) in the country. It is a joint venture between ICICI Bank in India and Prudential Plc, in UK. It was started in 1993.

Apart from mutual funds, the AMC also caters to Portfolio Management Services (PMS) and Real Estate for investors.

Fund Selection Methodology used to find 3 funds

Top ICICI Prudential Mutual Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Regular Gold Savings Fund Growth ₹49.0474

↑ 0.46 ₹6,338 26.4 56.7 83.4 40.1 26.4 72 ICICI Prudential Global Stable Equity Fund Growth ₹32.03

↑ 0.29 ₹86 8.6 11.1 16.6 13.4 12.2 17.8 ICICI Prudential US Bluechip Equity Fund Growth ₹75.33

↑ 0.65 ₹3,648 6.7 11.7 18.9 17.3 14.1 15.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary ICICI Prudential Regular Gold Savings Fund ICICI Prudential Global Stable Equity Fund ICICI Prudential US Bluechip Equity Fund Point 1 Highest AUM (₹6,338 Cr). Bottom quartile AUM (₹86 Cr). Lower mid AUM (₹3,648 Cr). Point 2 Oldest track record among peers (14 yrs). Established history (12+ yrs). Established history (13+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 4★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: High. Point 5 5Y return: 26.39% (upper mid). 5Y return: 12.23% (bottom quartile). 5Y return: 14.14% (lower mid). Point 6 3Y return: 40.12% (upper mid). 3Y return: 13.37% (bottom quartile). 3Y return: 17.29% (lower mid). Point 7 1Y return: 83.39% (upper mid). 1Y return: 16.64% (bottom quartile). 1Y return: 18.95% (lower mid). Point 8 1M return: 0.06% (lower mid). Alpha: 0.00 (lower mid). Alpha: -2.57 (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Sharpe: 1.23 (lower mid). Sharpe: 0.82 (bottom quartile). Point 10 Sharpe: 3.10 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -1.43 (bottom quartile). ICICI Prudential Regular Gold Savings Fund

ICICI Prudential Global Stable Equity Fund

ICICI Prudential US Bluechip Equity Fund

2. HDFC Asset Management Company Limited

HDFC Mutual Fund is at the 2nd number by the size of AUM. With fund size of nearly ₹ 3 lakh crore, it is one of the largest mutual fund companies or AMC in the country.

Top HDFC Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Gold Fund Growth ₹47.3741

↑ 0.41 ₹11,458 26.3 56.9 82.8 39.9 26.3 71.3 HDFC Multi-Asset Fund Growth ₹76.615

↓ -0.39 ₹5,714 1.9 7 17 15.9 13.4 13.2 HDFC Arbitrage Fund Growth ₹31.832

↑ 0.01 ₹24,503 1.6 3 6.2 7 5.9 6.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary HDFC Gold Fund HDFC Multi-Asset Fund HDFC Arbitrage Fund Point 1 Lower mid AUM (₹11,458 Cr). Bottom quartile AUM (₹5,714 Cr). Highest AUM (₹24,503 Cr). Point 2 Established history (14+ yrs). Oldest track record among peers (20 yrs). Established history (18+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately Low. Point 5 5Y return: 26.32% (upper mid). 5Y return: 13.43% (lower mid). 5Y return: 5.91% (bottom quartile). Point 6 3Y return: 39.94% (upper mid). 3Y return: 15.89% (lower mid). 3Y return: 7.04% (bottom quartile). Point 7 1Y return: 82.80% (upper mid). 1Y return: 17.00% (lower mid). 1Y return: 6.24% (bottom quartile). Point 8 1M return: 0.20% (bottom quartile). 1M return: 0.90% (upper mid). 1M return: 0.64% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 3.29 (upper mid). Sharpe: 1.39 (lower mid). Sharpe: 0.87 (bottom quartile). HDFC Gold Fund

HDFC Multi-Asset Fund

HDFC Arbitrage Fund

3. Reliance Nippon Life Asset Management Limited

With Assets under Management of approximately ₹ 2.5 lakh crore, Reliance Mutual Fund is one of India’s leading mutual fund companies.

A part of Reliance Anil Dhirubhai Ambani (ADA) Group, Reliance Mutual Fund is one of the fastest growing AMCs in India.

Top Reliance Mutual Fund Funds 2026

No Funds available.

4. Aditya Birla Sun Life Asset Management Company Limited

Formerly known as Birla Sun Life Asset Management Company, this fund house is the 3rd largest in terms of the AUM size. Presently it is known as Aditya Birla Sun Life (ABSL) Asset Management Company Ltd. It is a joint venture between the Aditya Birla Group in India and Sun Life Financial Inc of Canada. It was set up as a joint venture in 1994.

Top Aditya Birla Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Gold Fund Growth ₹46.022

↑ 0.38 ₹1,781 26.1 56.6 82.8 40 26.4 72 Aditya Birla Sun Life International Equity Fund - Plan B Growth ₹28.8036

↑ 0.07 ₹93 10.3 10 13.8 18.9 9 Aditya Birla Sun Life Commodity Equities Fund - Global Agri Plan Growth ₹35.7925

↑ 0.13 ₹13 5.9 -4.4 -3 19.4 8.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Aditya Birla Sun Life Gold Fund Aditya Birla Sun Life International Equity Fund - Plan B Aditya Birla Sun Life Commodity Equities Fund - Global Agri Plan Point 1 Highest AUM (₹1,781 Cr). Lower mid AUM (₹93 Cr). Bottom quartile AUM (₹13 Cr). Point 2 Established history (13+ yrs). Oldest track record among peers (18 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: High. Point 5 5Y return: 26.39% (upper mid). 5Y return: 8.98% (lower mid). 5Y return: 8.67% (bottom quartile). Point 6 3Y return: 39.97% (upper mid). 3Y return: 18.95% (bottom quartile). 3Y return: 19.45% (lower mid). Point 7 1Y return: 82.81% (upper mid). 1Y return: 13.75% (lower mid). 1Y return: -3.01% (bottom quartile). Point 8 1M return: 0.26% (bottom quartile). Alpha: 0.00 (lower mid). Alpha: -3.41 (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Sharpe: 0.85 (lower mid). Sharpe: -0.44 (bottom quartile). Point 10 Sharpe: 3.08 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.10 (bottom quartile). Aditya Birla Sun Life Gold Fund

Aditya Birla Sun Life International Equity Fund - Plan B

Aditya Birla Sun Life Commodity Equities Fund - Global Agri Plan

5. SBI Funds Management Private Limited

SBI Funds Management Pvt Limited is a joint venture between the State Bank of India (SBI) and financial services company Amundi, a European Asset Management company in France. It was launched in 1987.

Top SBI Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Gold Fund Growth ₹46.4429

↑ 0.39 ₹15,024 26.6 57.2 83.1 40.4 26.6 71.5 SBI PSU Fund Growth ₹37.1063

↓ -0.20 ₹5,980 9.9 21.3 36.4 36.1 28 11.3 SBI Magnum COMMA Fund Growth ₹115.043

↓ -1.00 ₹896 7.9 11.8 30.4 21.9 16.9 12.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary SBI Gold Fund SBI PSU Fund SBI Magnum COMMA Fund Point 1 Highest AUM (₹15,024 Cr). Lower mid AUM (₹5,980 Cr). Bottom quartile AUM (₹896 Cr). Point 2 Established history (14+ yrs). Established history (15+ yrs). Oldest track record among peers (20 yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: High. Point 5 5Y return: 26.55% (lower mid). 5Y return: 27.98% (upper mid). 5Y return: 16.92% (bottom quartile). Point 6 3Y return: 40.39% (upper mid). 3Y return: 36.09% (lower mid). 3Y return: 21.87% (bottom quartile). Point 7 1Y return: 83.09% (upper mid). 1Y return: 36.41% (lower mid). 1Y return: 30.37% (bottom quartile). Point 8 1M return: 0.35% (bottom quartile). Alpha: 0.05 (upper mid). Alpha: -1.28 (bottom quartile). Point 9 Alpha: 0.00 (lower mid). Sharpe: 0.63 (bottom quartile). Sharpe: 0.73 (lower mid). Point 10 Sharpe: 3.25 (upper mid). Information ratio: -0.63 (bottom quartile). Information ratio: -0.23 (lower mid). SBI Gold Fund

SBI PSU Fund

SBI Magnum COMMA Fund

6. UTI Asset Management Company Ltd

UTI Mutual Fund is a part of Unit Trust of India (UTI). It was registered with SEBI in 2003. It is promoted by SBI, LIC, Bank of Baroda and PNB.

UTI is one of the oldest and largest mutual funds in India.

Top UTI Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Arbitrage Fund Growth ₹36.4369

↑ 0.02 ₹10,957 1.6 3 6.4 7.1 6 6.5 UTI Liquid Cash Plan Growth ₹4,449.82

↑ 0.73 ₹31,334 1.5 3 6.3 6.9 5.9 6.5 UTI Money Market Fund Growth ₹3,214.36

↑ 0.60 ₹20,497 1.4 3 7.2 7.5 6.3 7.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary UTI Arbitrage Fund UTI Liquid Cash Plan UTI Money Market Fund Point 1 Bottom quartile AUM (₹10,957 Cr). Highest AUM (₹31,334 Cr). Lower mid AUM (₹20,497 Cr). Point 2 Established history (19+ yrs). Oldest track record among peers (22 yrs). Established history (16+ yrs). Point 3 Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Top rated. Point 4 Risk profile: Moderately Low. Risk profile: Low. Risk profile: Low. Point 5 5Y return: 5.98% (lower mid). 1Y return: 6.34% (bottom quartile). 1Y return: 7.22% (upper mid). Point 6 3Y return: 7.13% (lower mid). 1M return: 0.54% (bottom quartile). 1M return: 0.61% (lower mid). Point 7 1Y return: 6.43% (lower mid). Sharpe: 3.00 (upper mid). Sharpe: 2.26 (lower mid). Point 8 1M return: 0.65% (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Yield to maturity (debt): 6.51% (bottom quartile). Yield to maturity (debt): 6.96% (upper mid). Point 10 Sharpe: 1.31 (bottom quartile). Modified duration: 0.09 yrs (upper mid). Modified duration: 0.41 yrs (lower mid). UTI Arbitrage Fund

UTI Liquid Cash Plan

UTI Money Market Fund

7. Kotak Mahindra Asset Management Company Limited

Kotak Mahindra Mutual Fund is a part of the Kotak Group established in 1985 by Mr. Uday Kotak. Kotak Mahindra Asset Management Company (KMAMC) is the asset manager for Kotak Mahindra Mutual Fund (KMMF). KMAMC started its operations in 1998.

Top Kotak Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Gold Fund Growth ₹60.8539

↑ 0.60 ₹6,556 26.2 56.7 82.6 39.8 26.1 70.4 Kotak Global Emerging Market Fund Growth ₹35.829

↑ 0.27 ₹539 20 31.2 54.1 22.8 8.9 39.1 Kotak Asset Allocator Fund - FOF Growth ₹262.488

↓ -0.55 ₹2,398 3.5 12.1 24 21.1 18.3 15.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Kotak Gold Fund Kotak Global Emerging Market Fund Kotak Asset Allocator Fund - FOF Point 1 Highest AUM (₹6,556 Cr). Bottom quartile AUM (₹539 Cr). Lower mid AUM (₹2,398 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Point 3 Rating: 1★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 26.12% (upper mid). 5Y return: 8.87% (bottom quartile). 5Y return: 18.30% (lower mid). Point 6 3Y return: 39.82% (upper mid). 3Y return: 22.79% (lower mid). 3Y return: 21.13% (bottom quartile). Point 7 1Y return: 82.55% (upper mid). 1Y return: 54.07% (lower mid). 1Y return: 23.95% (bottom quartile). Point 8 1M return: 0.23% (lower mid). Alpha: -1.44 (bottom quartile). 1M return: 0.10% (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Sharpe: 2.63 (lower mid). Alpha: 0.00 (lower mid). Point 10 Sharpe: 3.55 (upper mid). Information ratio: -0.59 (bottom quartile). Sharpe: 1.38 (bottom quartile). Kotak Gold Fund

Kotak Global Emerging Market Fund

Kotak Asset Allocator Fund - FOF

8. Franklin Templeton Mutual Fund

Franklin Templeton India office was set up in 1996 as Templeton Asset Management India Pvt. Limited. This mutual fund has now set up by the name, Franklin Templeton Asset Management (India) Pt Limited.

Top Franklin Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin India Short Term Income Plan - Retail Plan Growth ₹15,041.3

↑ 0.11 ₹13 192.1 192.1 192.1 47.3 32.5 Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 16.5 26.1 41.2 16.8 4.1 23.7 Franklin India Feeder - Franklin European Growth Fund Growth ₹11.5467

↑ 0.04 ₹18 7.4 16.2 12.5 10 8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 May 25 Research Highlights & Commentary of 3 Funds showcased

Commentary Franklin India Short Term Income Plan - Retail Plan Franklin Asian Equity Fund Franklin India Feeder - Franklin European Growth Fund Point 1 Bottom quartile AUM (₹13 Cr). Highest AUM (₹372 Cr). Lower mid AUM (₹18 Cr). Point 2 Oldest track record among peers (24 yrs). Established history (18+ yrs). Established history (11+ yrs). Point 3 Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: High. Risk profile: High. Point 5 1Y return: 192.10% (upper mid). 5Y return: 4.12% (bottom quartile). 5Y return: 8.03% (lower mid). Point 6 1M return: 192.10% (upper mid). 3Y return: 16.78% (lower mid). 3Y return: 10.03% (bottom quartile). Point 7 Sharpe: -90.89 (bottom quartile). 1Y return: 41.22% (lower mid). 1Y return: 12.50% (bottom quartile). Point 8 Information ratio: -2.42 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -7.92 (bottom quartile). Point 9 Yield to maturity (debt): 0.00% (upper mid). Sharpe: 2.24 (upper mid). Sharpe: 0.02 (lower mid). Point 10 Modified duration: 0.00 yrs (upper mid). Information ratio: 0.00 (upper mid). Information ratio: -1.04 (lower mid). Franklin India Short Term Income Plan - Retail Plan

Franklin Asian Equity Fund

Franklin India Feeder - Franklin European Growth Fund

9. DSP Blackrock Mutual Fund

DSP BlackRock is a joint venture between DSP Group and BlackRock, world’s largest investment management firm. DSP BlackRock Trustee Company Private Ltd. is the trustee for the DSP BlackRock Mutual Fund.

Top DSP Mutual Fund Funds 2026

No Funds available.

10. Axis Mutual Fund

Axis Mutual Fund had launched its first scheme in 2009. Mr. Chandresh Kumar Nigam is the MD & CEO. Axis Bank Limited holds 74.99% in Axis Mutual Fund. The remaining 25% is held by Schroder Singapore Holdings Private Limited.

Top Axis Mutual Fund Funds 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Gold Fund Growth ₹46.1544

↑ 0.43 ₹2,835 26.7 57 82.9 40.1 26.4 69.8 Axis Triple Advantage Fund Growth ₹45.6231

↓ -0.10 ₹2,051 5.1 13.3 25.1 17 12.4 15.3 Axis Credit Risk Fund Growth ₹22.5247

↑ 0.01 ₹363 1.6 4 8.9 8 6.9 8.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 27 Feb 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Axis Gold Fund Axis Triple Advantage Fund Axis Credit Risk Fund Point 1 Highest AUM (₹2,835 Cr). Lower mid AUM (₹2,051 Cr). Bottom quartile AUM (₹363 Cr). Point 2 Established history (14+ yrs). Oldest track record among peers (15 yrs). Established history (11+ yrs). Point 3 Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 26.39% (upper mid). 5Y return: 12.35% (lower mid). 1Y return: 8.90% (bottom quartile). Point 6 3Y return: 40.11% (upper mid). 3Y return: 17.03% (lower mid). 1M return: 1.14% (lower mid). Point 7 1Y return: 82.93% (upper mid). 1Y return: 25.06% (lower mid). Sharpe: 2.08 (lower mid). Point 8 1M return: 0.27% (bottom quartile). 1M return: 1.80% (upper mid). Information ratio: 0.00 (bottom quartile). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Yield to maturity (debt): 8.64% (upper mid). Point 10 Sharpe: 3.44 (upper mid). Sharpe: 1.69 (bottom quartile). Modified duration: 2.29 yrs (bottom quartile). Axis Gold Fund

Axis Triple Advantage Fund

Axis Credit Risk Fund

List of Asset Management Companies in India

The complete list of asset management companies in India is as follows:

| AMC | Type of AMC | Inception Date | AUM in Crores (#As on March 2018) |

|---|---|---|---|

| BOI AXA Investment Managers Private Limited | Bank Sponsored - Joint Venture (Predominantly Indian) | March 31, 2008 | 5727.84 |

| Canara Robeco Asset Management Company Limited | Bank Sponsored - Joint Venture (Predominantly Indian) | December 19, 1987 | 12205.33 |

| SBI Funds Management Private Limited | Bank Sponsored - Joint Venture (Predominantly Indian) | June 29, 1987 | 12205.33 |

| Baroda Pioneer Asset Management Company Limited | Bank Sponsored - Joint Venture (Predominantly Foreign) | November 24, 1994 | 12895.91 |

| IDBI Asset Management Ltd. | Bank Sponsored - Others | March 29, 2010 | 10401.10 |

| Union Asset Management Company Private Limited | Bank Sponsored - Others | March 23, 2011 | 3743.63 |

| UTI Asset Management Company Ltd | Bank Sponsored - Others | February 01, 2003 | 145286.52 |

| LIC Mutual Fund Asset Management Limited | Indian Institutions | April 20, 1994 | 18092.87 |

| Edelweiss Asset Management Limited | Private Sector - Indian | April 30, 2008 | 11353.74 |

| Escorts Asset Management Limited | Private Sector - Indian | April 15, 1996 | 13.23 |

| IIFL Asset Management Ltd. | Private Sector - Indian | March 23, 2011 | 596.85 |

| Indiabulls Asset Management Company Ltd. | Private Sector - Indian | March 24, 2011 | 8498.97 |

| JM Financial Asset Management Limited | Private Sector - Indian | September 15, 1994 | 12157.02 |

| Kotak Mahindra Asset Management Company Limited(KMAMCL) | Private Sector - Indian | June 23, 1998 | 122426.61 |

| L&T Investment Management Limited | Private Sector - Indian | January 03, 1997 | 65828.9 |

| Mahindra Asset Management Company Pvt. Ltd. | Private Sector - Indian | February 04, 2016 | 3357.51 |

| Motilal Oswal Asset Management Company Limited | Private Sector - Indian | December 29, 2009 | 17705.33 |

| Essel Funds Management Company Ltd | Private Sector - Indian | December 04, 2009 | 924.72 |

| PPFAS Asset Management Pvt. Ltd. | Private Sector - Indian | October 10, 2012 | 1010.38 |

| Quantum Asset Management Company Private Limited | Private Sector - Indian | December 02, 2005 | 1249.50 |

| Sahara Asset Management Company Private Limited | Private Sector - Indian | July 18, 1996 | 58.35 |

| Shriram Asset Management Co. Ltd. | Private Sector - Indian | December 05, 1994 | 42.55 |

| Sundaram Asset Management Company Limited | Private Sector - Indian | August 24, 1996 | 31955.35 |

| Tata Asset Management Limited | Private Sector - Indian | June 30, 1995 | 46723.25 |

| Taurus Asset Management Company Limited | Private Sector - Indian | August 20, 1993 | 475.67 |

| BNP Paribas Asset Management India Private Limited | Private Sector - Foreign | April 15, 2004 | 7709.32 |

| Franklin Templeton Asset Management (India) Private Limited | Private Sector - Foreign | February 19, 1996 | 102961.13 |

| Invesco Asset Management (India) Private Limited | Private Sector - Foreign | July 24, 2006 | 25592.75 |

| Mirae Asset Global Investments (India) Pvt. Ltd. | Private Sector - Foreign | November 30, 2007 | 15034.99 |

| Axis Asset Management Company Ltd. | Private Sector - Joint Venture -Predominantly Indian | September 04, 2009 | 73858.71 |

| Birla Sun Life Asset Management Company Limited | Private Sector - Joint Venture -Predominantly Indian | December 23, 1994 | 244730.86 |

| DSP BlackRock Investment Managers Private Limited | Private Sector - Joint Venture -Predominantly Indian | December 16, 1996 | 85172.78 |

| HDFC Asset Management Company Limited | Private Sector - Joint Venture -Predominantly Indian | June 30, 2000 | 294968.74 |

| ICICI Prudential Asset Mgmt.Company Limited | Private Sector - Joint Venture -Predominantly Indian | October 13, 1993 | 310166.25 |

| IDFC Asset Management Company Limited | Private Sector - Joint Venture -Predominantly Indian | March 13, 2000 | 69075.26 |

| Reliance Nippon Life Asset Management Limited | Private Sector - Joint Venture -Predominantly Indian | June 30, 1995 | 233132.40 |

| HSBC Asset Management (India) Private Ltd. | Private Sector - Joint Venture -Predominantly Foreign | May 27, 2002 | 10543.30 |

| Principal PNB Asset Management Co. Pvt. Ltd. | Private Sector - Joint Venture -Predominantly Foreign | November 25, 1994 | 7034.80 |

| DHFL Pramerica Asset Managers Private Limited | Private Sector - Joint Venture -Others | May 13, 2010 | 24,80,727 |

*AUM source- MorningStar

Type of Equity Mutual Funds Offered by AMC's

Mutual Fund Companies manage large sums of money invested in various schemes. Investors place confidence in the fund manager as well as the AMC while investing in their schemes.

A large AUM can be both positive, as well as negative. If invested efficiently, it can deliver manifold returns for its investors.

Different Categories of Mutual Funds are as follows:

Large Cap Funds

In this type of mutual fund, the investment is made in large-cap companies. These companies are stable, have a proven track record and good ratings. These companies have historically given returns between 12% and 18%. Moderate risk is involved and it is suggested to invest in these funds for more than 4 years.

Mid Cap Funds

In this type of mutual fund, the investment is made in mid-cap companies. These companies come after Large cap funds in the hierarchy.These companies have historically given returns between 15% and 20%. The risk is slightly more than large-cap funds. It is suggested to invest in these funds for more than 5 years.

Small Cap Funds

In this type of mutual fund, the investment is made in small cap companies. These companies offer 16-22% return. This category is a high risk- high return one.

Balanced Fund

This fund has a combination of equity and debt in its portfolio. Depending on the proportion of investment made in equity and debt, the risk and returns are accordingly determined. Investment can be made via lump sum investment or through SIP (Systematic Investment Plan) mode in any of these fund categories.

An investor can take any investment decision taking into account his/her investment objective, investment duration and risk-return capacity.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.