Structure of Mutual Funds in India

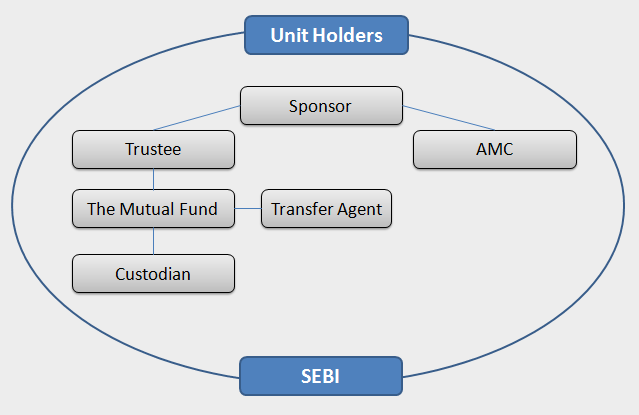

The structure of Mutual Funds in India is a three-tier one that comes with other substantial components. It is not only about varying AMCs or banks creating or floating a variety of mutual fund schemes. However, there are a few other players that play a major role into the mutual fund structure. There are three distinct entities involved in the process – the sponsor (who creates a Mutual Fund), trustees and the asset management company (which oversees the fund management). The structure of Mutual Funds has come into existence due to SEBI (Securities and Exchange Board of India) Mutual Fund Regulations, 1996 that plays the role of a primary watchdog in all of the transactions. Under these regulations, a Mutual Fund is created as a Public Trust. We will look into the structure of Mutual Funds in a detailed manner.

An Overview

What is popular known as a mutual fund is, in reality, a business type. In the mutual fund business, there are almost 30-40 companies and firms that are referred to as the fund houses.

These are registered and have got the allowance to operate mutual fund schemes through a government regulatory body, known as the Securities and Exchange Board of India (SEBI).

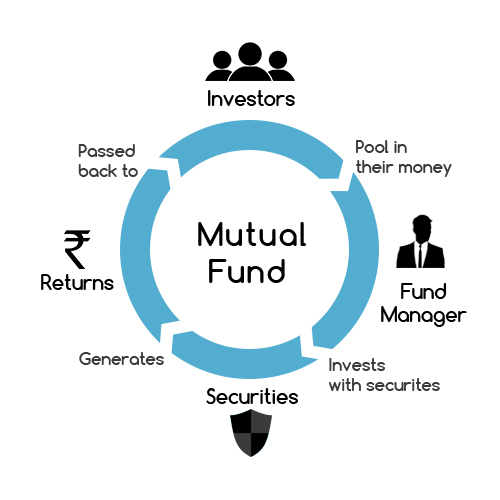

It is such schemes that are purchased and sold daily by investors, who are the common people. Basically, it works as

Mutual Fund Business > Fund House > Individual Scheme > Investors

The Structure of Mutual Fund

The Fund Sponsor

The Fund Sponsor is the first layer in the three-tier structure of Mutual Funds in India. SEBI regulations say that a fund sponsor is any person or any entity that can set up a Mutual Fund to earn money by fund management. This fund management is done through an associate company which manages the investment of the fund. A sponsor can be seen as the promoter of the associate company. A sponsor has to approach SEBI to seek permission for a setting up a Mutual Fund. However, a sponsor is not allowed to work alone. Once SEBI agrees to the inception, a Public Trust is formed under the Indian Trust Act, 1882 and is registered with SEBI. After the successful creation of the trust, trustees are registered with SEBI and appointed to manage the trust, protect the unit holder’s interest and to comply by the mutual fund regulations of SEBI. Subsequently, an asset management company is created by the sponsor that should be complying with the Companies Act, 1956 to regulate the management of funds.

Considering that sponsor is the primary entity that promotes the mutual fund company and that the mutual funds are going to regulate public money, there are eligibility criteria given by SEBI for the fund sponsor:

- The sponsor must have experience in financial services for a minimum of five years with a positive net worth for all the previous five years.

- The net worth of the sponsor in the immediate last year has to be greater than the capital contribution of the AMC.

- The sponsor must show profits in at least three out of five years which includes the last year as well.

- The sponsor must have at least 40% share in the net worth of the asset management company.

As clear as it could be, the role of a sponsor is quite vital and must carry highest amount of credibility. The strict and rigorous norms define that the sponsor must have adequate liquidity as well as faithfulness to return the money of investors in case there is any financial crisis or meltdown.

Thus, any entity that fulfills the above criteria can be termed as a sponsor of the Mutual Fund.

Trust and Trustees

Trust and trustees form the second layer of the structure of Mutual Funds in India. Also known as the protectors of the fund, trustees are generally employed by the fund sponsor. Just as can be comprehended with the name, they have a critical role to play as far as maintaining the investors’ trust and tracking the fund’s growth are concerned.

A trust is created by the fund sponsor in favour of the trustees, through a document called a trust deed. The trust is managed by the trustees and they are answerable to investors. They can be seen as primary guardians of fund and assets. Trustees can be formed by two ways – a Trustee Company or a Board of Trustees. The trustees work to monitor the activities of the Mutual Fund and check its compliance with SEBI (Mutual Fund) regulations. They also monitor the systems, procedures, and overall working of the asset management company. Without the trustees’ approval, AMC cannot float any scheme in the market. The trustees have to report to SEBI every six months about the activities of the AMC. Also, SEBI has established tightened transparency rules to avert any type of conflict of interest between the AMC and the sponsor. Therefore, it is critical for trustees to behave independently and take satisfactory measures to keep the hard-earned money of investors protected. Even trustees have to get registered under SEBI. And furthermore, SEBI regulates their registration by revoking or suspending the registry if any condition is found to be breached.

Talk to our investment specialist

Asset Management Companies

Asset Management Companies are the third layer in the structure of Mutual Funds. Registered under SEBI, it is a type of company that is created under the Companies Act. An AMC is meant to float a variety of mutual fund schemes that are in compliance with the requirements of investors and the nature of a market. The asset management company acts as the fund manager or as an investment manager for the trust. A small fee is paid to the AMC for managing the fund. The AMC is responsible for all the fund-related activities. It initiates various schemes and launches the same. Furthermore, it also creates mutual funds with the sponsor and the trustee and regulate its development. The AMC is bound to manage funds and provide services to the investor. It solicits these services with other elements like brokers, auditors, bankers, registrars, lawyers, etc. and works with them by getting into an agreement together. To ensure that there is no conflict between the AMCs, there are certain restrictions imposed on the business activities of the companies.

Other Components in the Structure of Mutual Funds

Custodian

A custodian is one such entity that is responsible for the safekeeping of the securities of the Mutual Fund. Registered under SEBI, they manage the investment account of the Mutual Fund, ensure the delivery and transfer of the securities. Also, custodians allow investors to upgrade their holdings at a specific point of time and assist them in monitoring their investments. They also collect and track the bonus issue, dividends & interests received on the Mutual Fund investment.

Registrar and Transfer Agents (RTAS)

RTAs act as an essential link between investors and fund managers. To the fund managers, they serve by keeping them updated with the details of investors. And, to the investors, they serve by delivering the advantages of the fund. Even they are registered under SEBI and execute a variety of tasks and responsibilities. These are the entities who provide services to Mutual Funds. RTAs are more like the operational arm of Mutual Funds. Since the operations of all Mutual Fund companies are similar, it is economical in scale and cost effective for all the 44 AMCs to seek the services of RTAs. CAMS, Karvy, Sundaram, Principal, Templeton, etc are some of the well-known RTAs in India. Their services include

- Processing investors’ application

- Keeping a record of investors’ details

- Sending out account statements to the investors

- Sending out periodic reports

- Processing the payouts of the dividends

- Updating the investor details i.e. adding new members and removing those who have withdrawn from the fund.

Auditor

Auditors audit and scrutinise record books of accounts and annual reports of various schemes. They are known as the independent watchdogs who have a responsibility of auditing the financials of sponsor, trustees and the AMC. Each AMC hires an independent auditor to analyse the books so as to keep their transparency and integrity intact.

Brokers

Mainly, the brokers work with a responsibility to attract more investors and to disseminate the funds. AMC uses the services of brokers to buy and sell securities on the stock market. Moreover, brokers have to study the market and foresee the market’s future movement. The AMCs uses research reports and recommendations from many brokers to plan their market moves.

Example of Three-Tiered Fund House Structure

Although there are several companies and organizations that are running according to this system, however, one of the major companies is the Aditya Birla Sun Life Mutual Fund. Its structure goes the following way:

Sponsor A joint venture between Sun Life (India) AMC Investment Inc. and Aditya Birla Capital Limited that is based in Canada.

Trustee Aditya Birla Sun Life Trustee Pvt. Ltd.

AMC Aditya Birla Sun Life AMC Limited

Conclusion

Now, these are those participants who play essential roles in the mutual funds’ management. Each of them has an individual responsibility and role. However, still, their functionality remains interlinked with one another. The three-tier structure of the Mutual Funds is in place keeping the fiduciary nature of the Mutual Funds in mind. It ensures that each element of the system works independently and efficiently. This structure of Mutual Funds is in line with the international standards and thus there is a proper separation of responsibilities and functioning of each constituent of the structure.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Frequently Asked Questions

1. What is Net Asset Value (NAV)?

A. The performance of a specific mutual fund scheme is referred as the Net Asset Value (NAV).

2. Should I pay to the distributor who is selling me mutual fund schemes?

A. For any mutual fund scheme, no entry load is charges. You can choose to pay a distributor on the basis of your assessment of different factors, including the services that the distributor has rendered.

3. How can I fill the application form of a mutual fund?

A. Filling up the form is quite an easy task. Simply answer to the things asked, such as name, number of units applied for, address and others.

4. What is a Systematic Investment Plan (SIP)?

A. A Systematic Investment plan (SIP) is a system that enables investors to invest on a regular basis. Through this, you can invest even the smallest amount in mutual funds.

5. Can I invest cash in mutual funds?

A. Yes, you can. Cash investments of up to Rs. 50,000 for each visitor, for each financial year and for each mutual fund are allowed.

6. Are Non-Resident Indians (NRIs) allowed to invest in mutual funds?

A. Yes, non-resident Indians can invest in Mutual Funds. However, required details and documents would have to be submitted.

7. Where can I find information related to mutual funds?

A. Almost every mutual fund has respective websites. Still, you can access the website of Association of Mutual Funds in India (AMFI) by visiting www.amfindia.com. Or, you can visit www.sebi.gov.in to find more information.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.