Best Debt Mutual Funds in India for 2026 | Top Funds by Tenure & Tax Benefits

Best debt funds vary according to the tenor of investment of the investor. Investors need to be clear on their time horizon of investment when selecting the best debt fund for their investment and also factor in the interest rate scenario.

For investors with a very short holding period, say for a couple of days to a month, Liquid Funds and ultra-short term funds may be relevant. When the time horizon is one to two years then short-term funds may be the desired vehicle. For longer tenors, for more than 3 years, long-term debt funds are the most preferred instruments by investors, especially during falling interest rates. Above all, debt funds have proved to be less risky than equities when looking for short-term investments, however, the Volatility of long-term income funds may match that of equities.

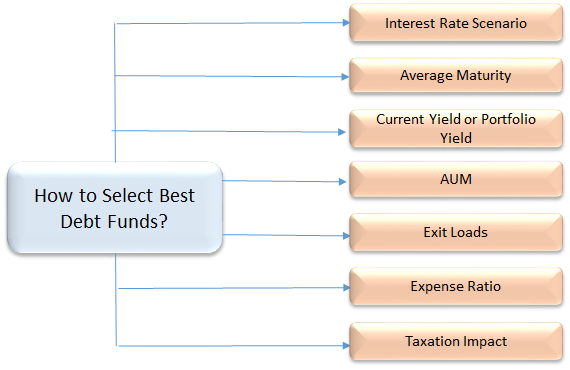

As debt funds invest in fixed income instruments like government securities, treasury bills, corporate Bonds, etc., they have the capacity of generating consistent and regular returns over time. However, there are many qualitative and quantitative factors that one needs to understand before selecting the best debt funds to invest, viz - AUM, Average Maturity, Taxation, the credit quality of the Portfolio, etc. Below we have listed the top 5 best debt funds to invest across the various categories of debt funds - Best Liquid Funds, best ultra short-term funds, best short-term funds, best long-term funds and best Gilt Funds to invest in 2026 - 2027.

Quick Summary

✅ Best for short-term: Liquid, Ultra-Short, and Money market funds

✅ Best for 1–2 years: Short-term bond funds

✅ Best for 3+ years: Gilt funds, Corporate bond funds, Dynamic Bond Funds

✅ Risks: Credit risk, Interest rate risk

✅ Tax: 20% with indexation if held for more than 3 years

Why To Invest in Debt Mutual Funds?

Debt funds are considered to be an ideal investment for generating regular income. For example, choosing dividend payout can be an option for regular income.

In debt funds, investors can withdraw required money from the investment at any point in time and can let the remaining money stay invested.

Since debt funds largely invest in government securities, corporate debt and other securities like treasury bills, etc., they are not affected by equity market volatility.

If an investor is planning to achieve short-term Financial goals or invest for short periods then debt funds can be a good option. Liquid funds, ultra short-term funds, and short-term income funds may be the desired options.

In debt funds, investors can generate fixed income every month by starting a Systematic Withdrawal Plan (SWP is a reverse of SIP / STP) to withdraw a fixed amount on a monthly basis. Also, you can change the amount of the SWP when required.

Key Benefits of Debt Funds in 2026

- Safer than equities in volatile markets

- Offer liquidity and low lock-in

- Tax-efficient with indexation benefit after 3 years

- Flexible options for all durations and risk profiles

- Suitable for conservative and semi-aggressive investors alike

Risks in Debt Mutual Funds

While Investing in debt funds, investors should be cautious about two major risks associated with them - credit risk and interest rate risk.

Credit Risk

A credit risk arises when a company that has issued the debt instruments does not make regular payments. In such cases, it has a major impact on the fund, depending on how much portion the fund has in the portfolio. Hence, it is suggested to be in debt instruments with a rating higher credit rating. An AAA rating is considered to be the highest quality with little or negligible payment default risk.

Interest Risks

The interest rate risk refers to a change in the bond price due to the change in the prevailing interest rate. When the interest rate rises in the economy the bond prices fall down and vice versa. The higher the maturity of the funds’ portfolio, the more prone it is to the interest rate risk. So in a rising interest rate scenario, it is advisable to go for lower maturity debt funds. And the reverse in a falling interest rate scenario.

Debt Mutual Fund Taxation

Tax implication on debt funds is computed in the following manner-

a. Short Term Capital Gains

If the holding period of a debt investment is less than 36 months, then it is classified as a short-term investment and these are taxed as per individual's tax slab.

b. Long Term Capital Gains

If the holding period of debt investment is more than 36 months, then it is classified as a long-term investment and is taxed at 20% with an indexation benefit.

| Capital Gains | Investment Holding Gains | Taxation |

|---|---|---|

| Short Term Capital Gains | Less than 36 months | As per individual's tax slab |

| Long Term Capital Gains | More than 36 months | 20% with indexation benefits |

📌 Note: Indexation helps adjust the purchase price with inflation, effectively reducing your tax liability.

Talk to our investment specialist

Best Debt Mutual Funds in India for Investments FY 26 - 27

Fund Selection Methodology used to find 5 funds

Top 5 Liquid Mutual Funds

Top Liquid funds with AUM/Net Assets > 10,000 Crore.

Fund NAV Net Assets (Cr) Min Investment 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹3,025.47

↑ 0.47 ₹39,028 500 0.4 1.5 2.9 6.3 6.6 6.5% 27D 30D Aditya Birla Sun Life Liquid Fund Growth ₹437.762

↑ 0.07 ₹54,615 5,000 0.4 1.4 2.9 6.3 6.5 6.19% 2M 1D 2M 1D Tata Liquid Fund Growth ₹4,278.73

↑ 0.79 ₹30,626 5,000 0.4 1.4 2.9 6.3 6.5 6.08% 1M 28D 1M 28D Invesco India Liquid Fund Growth ₹3,733.71

↑ 0.64 ₹15,884 5,000 0.4 1.4 2.9 6.3 6.5 6.44% 1M 1D 1M 1D Nippon India Liquid Fund Growth ₹6,628.8

↑ 1.19 ₹25,994 100 0.4 1.4 2.9 6.3 6.5 6.09% 1M 23D 1M 26D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Axis Liquid Fund Aditya Birla Sun Life Liquid Fund Tata Liquid Fund Invesco India Liquid Fund Nippon India Liquid Fund Point 1 Upper mid AUM (₹39,028 Cr). Highest AUM (₹54,615 Cr). Lower mid AUM (₹30,626 Cr). Bottom quartile AUM (₹15,884 Cr). Bottom quartile AUM (₹25,994 Cr). Point 2 Established history (16+ yrs). Established history (21+ yrs). Established history (21+ yrs). Established history (19+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.32% (top quartile). 1Y return: 6.30% (upper mid). 1Y return: 6.30% (lower mid). 1Y return: 6.28% (bottom quartile). 1Y return: 6.27% (bottom quartile). Point 6 1M return: 0.44% (top quartile). 1M return: 0.44% (lower mid). 1M return: 0.44% (upper mid). 1M return: 0.44% (bottom quartile). 1M return: 0.44% (bottom quartile). Point 7 Sharpe: 3.16 (top quartile). Sharpe: 3.01 (lower mid). Sharpe: 2.93 (bottom quartile). Sharpe: 3.09 (upper mid). Sharpe: 2.70 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.50% (top quartile). Yield to maturity (debt): 6.19% (lower mid). Yield to maturity (debt): 6.08% (bottom quartile). Yield to maturity (debt): 6.44% (upper mid). Yield to maturity (debt): 6.09% (bottom quartile). Point 10 Modified duration: 0.07 yrs (top quartile). Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.16 yrs (bottom quartile). Modified duration: 0.08 yrs (upper mid). Modified duration: 0.15 yrs (lower mid). Axis Liquid Fund

Aditya Birla Sun Life Liquid Fund

Tata Liquid Fund

Invesco India Liquid Fund

Nippon India Liquid Fund

Top 5 Ultra Short Term Bond Mutual Funds

Top Ultra Short Bond funds with AUM/Net Assets > 1,000 Crore.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹571.974

↑ 0.09 ₹22,857 1,000 1.3 2.9 7.1 7.4 7.4 6.81% 5M 19D 6M 11D UTI Ultra Short Term Fund Growth ₹4,403.55

↑ 0.82 ₹3,751 5,000 1.3 2.7 6.4 6.8 6.6 7.21% 4M 29D 5M 30D ICICI Prudential Ultra Short Term Fund Growth ₹28.8556

↑ 0.00 ₹17,808 5,000 1.3 2.9 6.8 7.1 7.1 7.31% 5M 5D 6M 11D SBI Magnum Ultra Short Duration Fund Growth ₹6,220.64

↑ 1.44 ₹14,032 5,000 1.3 2.9 6.7 7.1 7 6.99% 4M 20D 6M 7D Kotak Savings Fund Growth ₹44.6176

↓ -0.01 ₹16,788 5,000 1.4 2.9 6.7 6.9 6.8 7.12% 5M 16D 6M 11D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Savings Fund UTI Ultra Short Term Fund ICICI Prudential Ultra Short Term Fund SBI Magnum Ultra Short Duration Fund Kotak Savings Fund Point 1 Highest AUM (₹22,857 Cr). Bottom quartile AUM (₹3,751 Cr). Upper mid AUM (₹17,808 Cr). Bottom quartile AUM (₹14,032 Cr). Lower mid AUM (₹16,788 Cr). Point 2 Established history (22+ yrs). Established history (22+ yrs). Established history (14+ yrs). Oldest track record among peers (26 yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Low. Risk profile: Moderately Low. Point 5 1Y return: 7.12% (top quartile). 1Y return: 6.36% (bottom quartile). 1Y return: 6.83% (upper mid). 1Y return: 6.70% (lower mid). 1Y return: 6.66% (bottom quartile). Point 6 1M return: 0.51% (top quartile). 1M return: 0.44% (bottom quartile). 1M return: 0.48% (lower mid). 1M return: 0.44% (bottom quartile). 1M return: 0.51% (upper mid). Point 7 Sharpe: 2.17 (top quartile). Sharpe: 1.15 (bottom quartile). Sharpe: 2.06 (lower mid). Sharpe: 2.11 (upper mid). Sharpe: 1.52 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.81% (bottom quartile). Yield to maturity (debt): 7.21% (upper mid). Yield to maturity (debt): 7.31% (top quartile). Yield to maturity (debt): 6.99% (bottom quartile). Yield to maturity (debt): 7.12% (lower mid). Point 10 Modified duration: 0.47 yrs (bottom quartile). Modified duration: 0.41 yrs (upper mid). Modified duration: 0.43 yrs (lower mid). Modified duration: 0.39 yrs (top quartile). Modified duration: 0.46 yrs (bottom quartile). Aditya Birla Sun Life Savings Fund

UTI Ultra Short Term Fund

ICICI Prudential Ultra Short Term Fund

SBI Magnum Ultra Short Duration Fund

Kotak Savings Fund

Top and Best Floating Rate Mutual Funds

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Floating Rate Fund - Long Term Growth ₹362.81

↑ 0.15 ₹13,350 1,000 1.2 2.9 7.3 7.6 7.7 6.79% 1Y 25D 1Y 9M 11D ICICI Prudential Floating Interest Fund Growth ₹443.542

↑ 0.10 ₹7,196 5,000 1.2 3.2 7.5 7.7 7.7 7.07% 1Y 10M 13D 3Y 10M 17D Nippon India Floating Rate Fund Growth ₹47.013

↑ 0.02 ₹8,471 5,000 1 2.7 7.5 7.8 7.9 7.17% 2Y 7M 10D 3Y 3M 4D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Aditya Birla Sun Life Floating Rate Fund - Long Term ICICI Prudential Floating Interest Fund Nippon India Floating Rate Fund Point 1 Highest AUM (₹13,350 Cr). Bottom quartile AUM (₹7,196 Cr). Lower mid AUM (₹8,471 Cr). Point 2 Established history (16+ yrs). Established history (20+ yrs). Oldest track record among peers (21 yrs). Point 3 Top rated. Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderately Low. Point 5 1Y return: 7.33% (bottom quartile). 1Y return: 7.51% (upper mid). 1Y return: 7.49% (lower mid). Point 6 1M return: 0.54% (lower mid). 1M return: 0.64% (upper mid). 1M return: 0.52% (bottom quartile). Point 7 Sharpe: 1.54 (lower mid). Sharpe: 1.80 (upper mid). Sharpe: 0.93 (bottom quartile). Point 8 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.79% (bottom quartile). Yield to maturity (debt): 7.07% (lower mid). Yield to maturity (debt): 7.17% (upper mid). Point 10 Modified duration: 1.07 yrs (upper mid). Modified duration: 1.87 yrs (lower mid). Modified duration: 2.61 yrs (bottom quartile). Aditya Birla Sun Life Floating Rate Fund - Long Term

ICICI Prudential Floating Interest Fund

Nippon India Floating Rate Fund

Top 5 Best Money Market Mutual Funds

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Money Manager Fund Growth ₹385.758

↑ 0.09 ₹28,816 1,000 1.3 2.8 7 7.4 7.4 6.62% 6M 11D 6M 11D UTI Money Market Fund Growth ₹3,217.54

↑ 0.62 ₹20,497 10,000 1.3 2.9 7.1 7.5 7.5 6.96% 4M 26D 4M 26D ICICI Prudential Money Market Fund Growth ₹395.897

↑ 0.09 ₹35,025 500 1.4 2.9 7.1 7.4 7.4 6.91% 5M 12D 5M 25D Kotak Money Market Scheme Growth ₹4,683.7

↑ 1.23 ₹32,870 5,000 1.4 2.9 7.1 7.4 7.4 6.99% 5M 8D 5M 8D Franklin India Savings Fund Growth ₹52.3327

↑ 0.01 ₹3,898 10,000 1.4 2.9 7.1 7.4 7.4 6.89% 5M 8D 5M 19D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Money Manager Fund UTI Money Market Fund ICICI Prudential Money Market Fund Kotak Money Market Scheme Franklin India Savings Fund Point 1 Lower mid AUM (₹28,816 Cr). Bottom quartile AUM (₹20,497 Cr). Highest AUM (₹35,025 Cr). Upper mid AUM (₹32,870 Cr). Bottom quartile AUM (₹3,898 Cr). Point 2 Established history (20+ yrs). Established history (16+ yrs). Established history (20+ yrs). Established history (22+ yrs). Oldest track record among peers (24 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Moderately Low. Point 5 1Y return: 6.99% (bottom quartile). 1Y return: 7.13% (top quartile). 1Y return: 7.12% (lower mid). 1Y return: 7.05% (bottom quartile). 1Y return: 7.13% (upper mid). Point 6 1M return: 0.47% (top quartile). 1M return: 0.45% (lower mid). 1M return: 0.43% (bottom quartile). 1M return: 0.46% (upper mid). 1M return: 0.42% (bottom quartile). Point 7 Sharpe: 1.91 (bottom quartile). Sharpe: 2.26 (upper mid). Sharpe: 2.31 (top quartile). Sharpe: 2.13 (bottom quartile). Sharpe: 2.24 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.62% (bottom quartile). Yield to maturity (debt): 6.96% (upper mid). Yield to maturity (debt): 6.91% (lower mid). Yield to maturity (debt): 6.99% (top quartile). Yield to maturity (debt): 6.89% (bottom quartile). Point 10 Modified duration: 0.53 yrs (bottom quartile). Modified duration: 0.41 yrs (top quartile). Modified duration: 0.45 yrs (bottom quartile). Modified duration: 0.44 yrs (upper mid). Modified duration: 0.44 yrs (lower mid). Aditya Birla Sun Life Money Manager Fund

UTI Money Market Fund

ICICI Prudential Money Market Fund

Kotak Money Market Scheme

Franklin India Savings Fund

Top 5 Short Term Bond Mutual Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 7.18% 1Y 7M 28D 1Y 11M 1D ICICI Prudential Short Term Fund Growth ₹62.6304

↑ 0.07 ₹22,707 1.1 2.8 7.5 7.6 8 7.51% 2Y 9M 4D 4Y 7M 20D Nippon India Short Term Fund Growth ₹54.8695

↑ 0.02 ₹8,684 1 2.7 7.4 7.6 7.9 7.17% 2Y 8M 1D 3Y 2M 26D Aditya Birla Sun Life Short Term Opportunities Fund Growth ₹49.4175

↑ 0.03 ₹9,748 1 2.7 7.2 7.5 7.7 7.22% 2Y 9M 18D 3Y 6M 25D UTI Short Term Income Fund Growth ₹32.8634

↑ 0.03 ₹3,166 1 2.4 6.9 7.4 7.3 7.33% 2Y 2M 19D 3Y 1M 6D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 29 Sep 23 Research Highlights & Commentary of 5 Funds showcased

Commentary PGIM India Short Maturity Fund ICICI Prudential Short Term Fund Nippon India Short Term Fund Aditya Birla Sun Life Short Term Opportunities Fund UTI Short Term Income Fund Point 1 Bottom quartile AUM (₹28 Cr). Highest AUM (₹22,707 Cr). Lower mid AUM (₹8,684 Cr). Upper mid AUM (₹9,748 Cr). Bottom quartile AUM (₹3,166 Cr). Point 2 Established history (23+ yrs). Oldest track record among peers (24 yrs). Established history (23+ yrs). Established history (22+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 6.08% (bottom quartile). 1Y return: 7.47% (top quartile). 1Y return: 7.42% (upper mid). 1Y return: 7.22% (lower mid). 1Y return: 6.89% (bottom quartile). Point 6 1M return: 0.43% (bottom quartile). 1M return: 0.59% (top quartile). 1M return: 0.54% (lower mid). 1M return: 0.56% (upper mid). 1M return: 0.51% (bottom quartile). Point 7 Sharpe: -0.98 (bottom quartile). Sharpe: 1.17 (top quartile). Sharpe: 0.76 (upper mid). Sharpe: 0.64 (lower mid). Sharpe: 0.54 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.18% (bottom quartile). Yield to maturity (debt): 7.51% (top quartile). Yield to maturity (debt): 7.17% (bottom quartile). Yield to maturity (debt): 7.22% (lower mid). Yield to maturity (debt): 7.33% (upper mid). Point 10 Modified duration: 1.66 yrs (top quartile). Modified duration: 2.76 yrs (bottom quartile). Modified duration: 2.67 yrs (lower mid). Modified duration: 2.80 yrs (bottom quartile). Modified duration: 2.22 yrs (upper mid). PGIM India Short Maturity Fund

ICICI Prudential Short Term Fund

Nippon India Short Term Fund

Aditya Birla Sun Life Short Term Opportunities Fund

UTI Short Term Income Fund

Top 5 Medium to Long Term Bond Mutual Funds

Top Medium to Long Term Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Income Fund Growth ₹72.2179

↑ 0.22 ₹2,087 1.1 2.1 5.4 7.1 5.9 7.8% 5Y 2M 19D 9Y 2M 26D ICICI Prudential Bond Fund Growth ₹41.2565

↑ 0.13 ₹2,917 1.3 2.4 6 7.6 6.7 7.27% 6Y 6M 16Y 10M 17D Aditya Birla Sun Life Income Fund Growth ₹127.364

↑ 0.45 ₹1,977 1 1.6 4.6 6.6 5.1 7.24% 6Y 8M 23D 14Y 5M 23D HDFC Income Fund Growth ₹59.2958

↑ 0.26 ₹858 1.3 1.9 5.2 6.9 5.5 6.99% 6Y 3M 22D 12Y 3M 14D Kotak Bond Fund Growth ₹78.051

↑ 0.18 ₹2,041 1 1.8 4.9 6.7 5.4 7.27% 6Y 2M 8D 10Y 11M 19D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Income Fund ICICI Prudential Bond Fund Aditya Birla Sun Life Income Fund HDFC Income Fund Kotak Bond Fund Point 1 Upper mid AUM (₹2,087 Cr). Highest AUM (₹2,917 Cr). Bottom quartile AUM (₹1,977 Cr). Bottom quartile AUM (₹858 Cr). Lower mid AUM (₹2,041 Cr). Point 2 Established history (27+ yrs). Established history (17+ yrs). Oldest track record among peers (30 yrs). Established history (25+ yrs). Established history (26+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 5.38% (upper mid). 1Y return: 6.01% (top quartile). 1Y return: 4.56% (bottom quartile). 1Y return: 5.19% (lower mid). 1Y return: 4.86% (bottom quartile). Point 6 1M return: 0.79% (bottom quartile). 1M return: 1.05% (top quartile). 1M return: 0.85% (lower mid). 1M return: 1.01% (upper mid). 1M return: 0.61% (bottom quartile). Point 7 Sharpe: -0.29 (upper mid). Sharpe: 0.10 (top quartile). Sharpe: -0.48 (bottom quartile). Sharpe: -0.39 (lower mid). Sharpe: -0.40 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.80% (top quartile). Yield to maturity (debt): 7.27% (upper mid). Yield to maturity (debt): 7.24% (bottom quartile). Yield to maturity (debt): 6.99% (bottom quartile). Yield to maturity (debt): 7.27% (lower mid). Point 10 Modified duration: 5.22 yrs (top quartile). Modified duration: 6.50 yrs (bottom quartile). Modified duration: 6.73 yrs (bottom quartile). Modified duration: 6.31 yrs (lower mid). Modified duration: 6.19 yrs (upper mid). SBI Magnum Income Fund

ICICI Prudential Bond Fund

Aditya Birla Sun Life Income Fund

HDFC Income Fund

Kotak Bond Fund

Top 5 Banking and PSU Debt Mutual Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity UTI Banking & PSU Debt Fund Growth ₹22.7971

↑ 0.01 ₹1,078 1.1 2.6 7.4 7.5 7.8 7.04% 1Y 1M 10D 1Y 2M 19D HDFC Banking and PSU Debt Fund Growth ₹23.7925

↑ 0.02 ₹5,620 0.8 2.4 6.9 7.3 7.5 7.26% 3Y 1M 17D 4Y 5M 1D Kotak Banking and PSU Debt fund Growth ₹67.9177

↑ 0.02 ₹5,495 1 2.9 7.4 7.5 7.7 7.22% 3Y 1M 10D 4Y 3M 22D ICICI Prudential Banking and PSU Debt Fund Growth ₹33.9608

↑ 0.04 ₹9,583 1 2.7 7 7.5 7.6 7.32% 3Y 2M 8D 5Y 9M 29D Aditya Birla Sun Life Banking & PSU Debt Fund Growth ₹378.883

↑ 0.44 ₹8,979 0.8 2.3 6.8 7.3 7.3 7.02% 3Y 6M 29D 4Y 10M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Banking & PSU Debt Fund HDFC Banking and PSU Debt Fund Kotak Banking and PSU Debt fund ICICI Prudential Banking and PSU Debt Fund Aditya Birla Sun Life Banking & PSU Debt Fund Point 1 Bottom quartile AUM (₹1,078 Cr). Lower mid AUM (₹5,620 Cr). Bottom quartile AUM (₹5,495 Cr). Highest AUM (₹9,583 Cr). Upper mid AUM (₹8,979 Cr). Point 2 Established history (12+ yrs). Established history (11+ yrs). Oldest track record among peers (27 yrs). Established history (16+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 7.36% (upper mid). 1Y return: 6.92% (bottom quartile). 1Y return: 7.37% (top quartile). 1Y return: 7.04% (lower mid). 1Y return: 6.79% (bottom quartile). Point 6 1M return: 0.46% (bottom quartile). 1M return: 0.47% (bottom quartile). 1M return: 0.55% (top quartile). 1M return: 0.53% (lower mid). 1M return: 0.53% (upper mid). Point 7 Sharpe: 1.05 (top quartile). Sharpe: 0.36 (bottom quartile). Sharpe: 0.56 (lower mid). Sharpe: 0.74 (upper mid). Sharpe: 0.28 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.04% (bottom quartile). Yield to maturity (debt): 7.26% (upper mid). Yield to maturity (debt): 7.22% (lower mid). Yield to maturity (debt): 7.32% (top quartile). Yield to maturity (debt): 7.02% (bottom quartile). Point 10 Modified duration: 1.11 yrs (top quartile). Modified duration: 3.13 yrs (lower mid). Modified duration: 3.11 yrs (upper mid). Modified duration: 3.19 yrs (bottom quartile). Modified duration: 3.58 yrs (bottom quartile). UTI Banking & PSU Debt Fund

HDFC Banking and PSU Debt Fund

Kotak Banking and PSU Debt fund

ICICI Prudential Banking and PSU Debt Fund

Aditya Birla Sun Life Banking & PSU Debt Fund

Top 5 Credit Risk Mutual Funds

Top Credit Risk funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity HDFC Credit Risk Debt Fund Growth ₹25.1432

↑ 0.03 ₹6,902 1.5 3.2 7.9 7.7 8 8.56% 2Y 4M 6D 3Y 9M 11D SBI Credit Risk Fund Growth ₹47.6236

↑ 0.03 ₹2,164 1.4 3.1 7.8 8.2 7.9 8.66% 1Y 11M 26D 2Y 6M 7D Kotak Credit Risk Fund Growth ₹30.9097

↑ 0.01 ₹706 1.2 3.3 8.8 7.8 9.1 8.22% 2Y 2M 12D 2Y 9M 11D Nippon India Credit Risk Fund Growth ₹36.8231

↑ 0.03 ₹1,031 1.7 3.5 8.9 8.5 8.9 8.73% 2Y 25D 2Y 5M 12D ICICI Prudential Regular Savings Fund Growth ₹33.4941

↑ 0.01 ₹5,940 1.2 3.7 9 8.5 9.5 8.68% 2Y 3M 7D 3Y 7M 17D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Credit Risk Debt Fund SBI Credit Risk Fund Kotak Credit Risk Fund Nippon India Credit Risk Fund ICICI Prudential Regular Savings Fund Point 1 Highest AUM (₹6,902 Cr). Lower mid AUM (₹2,164 Cr). Bottom quartile AUM (₹706 Cr). Bottom quartile AUM (₹1,031 Cr). Upper mid AUM (₹5,940 Cr). Point 2 Established history (11+ yrs). Oldest track record among peers (21 yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 1★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 7.87% (bottom quartile). 1Y return: 7.76% (bottom quartile). 1Y return: 8.80% (lower mid). 1Y return: 8.92% (upper mid). 1Y return: 9.04% (top quartile). Point 6 1M return: 0.63% (upper mid). 1M return: 0.56% (lower mid). 1M return: 0.15% (bottom quartile). 1M return: 0.83% (top quartile). 1M return: 0.05% (bottom quartile). Point 7 Sharpe: 1.14 (bottom quartile). Sharpe: 1.31 (bottom quartile). Sharpe: 1.75 (lower mid). Sharpe: 2.16 (upper mid). Sharpe: 2.90 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 8.56% (bottom quartile). Yield to maturity (debt): 8.66% (lower mid). Yield to maturity (debt): 8.22% (bottom quartile). Yield to maturity (debt): 8.73% (top quartile). Yield to maturity (debt): 8.68% (upper mid). Point 10 Modified duration: 2.35 yrs (bottom quartile). Modified duration: 1.99 yrs (top quartile). Modified duration: 2.20 yrs (lower mid). Modified duration: 2.07 yrs (upper mid). Modified duration: 2.27 yrs (bottom quartile). HDFC Credit Risk Debt Fund

SBI Credit Risk Fund

Kotak Credit Risk Fund

Nippon India Credit Risk Fund

ICICI Prudential Regular Savings Fund

Top 5 Dynamic Bond Mutual Funds

Top Dynamic Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Dynamic Bond Fund Growth ₹36.6683

↑ 0.12 ₹4,241 1.8 2.3 6 7.4 5.5 6.85% 2Y 10M 17D 5Y 8M 16D Axis Dynamic Bond Fund Growth ₹30.566

↑ 0.08 ₹1,143 1.5 2.9 7.1 7.6 7.1 6.73% 4Y 25D 6Y 6M 18D Aditya Birla Sun Life Dynamic Bond Fund Growth ₹47.7347

↑ 0.11 ₹1,857 1.5 2.4 6.8 7.5 7 7.69% 6Y 11D 12Y 7M 28D HDFC Dynamic Debt Fund Growth ₹91.0206

↑ 0.33 ₹633 1.7 2.1 4.6 6.7 4.7 7.07% 6Y 11M 12D 17Y 10M 20D Bandhan Dynamic Bond Fund Growth ₹34.2869

↓ -0.01 ₹2,275 1 2.1 3.7 6.6 3.4 6.76% 1Y 3M 2Y 22D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Dynamic Bond Fund Axis Dynamic Bond Fund Aditya Birla Sun Life Dynamic Bond Fund HDFC Dynamic Debt Fund Bandhan Dynamic Bond Fund Point 1 Highest AUM (₹4,241 Cr). Bottom quartile AUM (₹1,143 Cr). Lower mid AUM (₹1,857 Cr). Bottom quartile AUM (₹633 Cr). Upper mid AUM (₹2,275 Cr). Point 2 Established history (22+ yrs). Established history (14+ yrs). Established history (21+ yrs). Oldest track record among peers (28 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 6.03% (lower mid). 1Y return: 7.14% (top quartile). 1Y return: 6.78% (upper mid). 1Y return: 4.61% (bottom quartile). 1Y return: 3.74% (bottom quartile). Point 6 1M return: 1.11% (upper mid). 1M return: 0.99% (lower mid). 1M return: 0.84% (bottom quartile). 1M return: 1.12% (top quartile). 1M return: 0.46% (bottom quartile). Point 7 Sharpe: -0.23 (lower mid). Sharpe: 0.15 (top quartile). Sharpe: 0.10 (upper mid). Sharpe: -0.47 (bottom quartile). Sharpe: -0.49 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.85% (lower mid). Yield to maturity (debt): 6.73% (bottom quartile). Yield to maturity (debt): 7.69% (top quartile). Yield to maturity (debt): 7.07% (upper mid). Yield to maturity (debt): 6.76% (bottom quartile). Point 10 Modified duration: 2.88 yrs (upper mid). Modified duration: 4.07 yrs (lower mid). Modified duration: 6.03 yrs (bottom quartile). Modified duration: 6.95 yrs (bottom quartile). Modified duration: 1.25 yrs (top quartile). SBI Dynamic Bond Fund

Axis Dynamic Bond Fund

Aditya Birla Sun Life Dynamic Bond Fund

HDFC Dynamic Debt Fund

Bandhan Dynamic Bond Fund

Top 5 Corporate Bond Mutual Funds

Top Corporate Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity HDFC Corporate Bond Fund Growth ₹33.6115

↑ 0.06 ₹33,207 0.9 2.3 6.7 7.6 7.3 7.36% 4Y 5M 19D 7Y 8M 16D Aditya Birla Sun Life Corporate Bond Fund Growth ₹116.749

↑ 0.25 ₹28,253 1 2.4 6.7 7.6 7.4 7.12% 4Y 10M 24D 7Y 6M 14D ICICI Prudential Corporate Bond Fund Growth ₹31.0524

↑ 0.04 ₹33,250 1.1 2.9 7.5 7.7 8 7.36% 3Y 4M 24D 6Y 4D Kotak Corporate Bond Fund Standard Growth ₹3,915.67

↑ 3.85 ₹17,265 1 2.6 7.3 7.6 7.8 7.36% 3Y 1M 28D 4Y 3M 11D Nippon India Prime Debt Fund Growth ₹62.1218

↑ 0.05 ₹8,888 0.9 2.4 7.2 7.7 7.8 7.12% 3Y 6M 14D 4Y 9M 4D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Corporate Bond Fund Aditya Birla Sun Life Corporate Bond Fund ICICI Prudential Corporate Bond Fund Kotak Corporate Bond Fund Standard Nippon India Prime Debt Fund Point 1 Upper mid AUM (₹33,207 Cr). Lower mid AUM (₹28,253 Cr). Highest AUM (₹33,250 Cr). Bottom quartile AUM (₹17,265 Cr). Bottom quartile AUM (₹8,888 Cr). Point 2 Established history (15+ yrs). Oldest track record among peers (29 yrs). Established history (16+ yrs). Established history (18+ yrs). Established history (25+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 6.74% (bottom quartile). 1Y return: 6.72% (bottom quartile). 1Y return: 7.45% (top quartile). 1Y return: 7.27% (upper mid). 1Y return: 7.20% (lower mid). Point 6 1M return: 0.63% (lower mid). 1M return: 0.66% (upper mid). 1M return: 0.66% (top quartile). 1M return: 0.57% (bottom quartile). 1M return: 0.48% (bottom quartile). Point 7 Sharpe: 0.24 (bottom quartile). Sharpe: 0.22 (bottom quartile). Sharpe: 1.04 (top quartile). Sharpe: 0.64 (upper mid). Sharpe: 0.54 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.36% (top quartile). Yield to maturity (debt): 7.12% (bottom quartile). Yield to maturity (debt): 7.36% (upper mid). Yield to maturity (debt): 7.36% (lower mid). Yield to maturity (debt): 7.12% (bottom quartile). Point 10 Modified duration: 4.47 yrs (bottom quartile). Modified duration: 4.90 yrs (bottom quartile). Modified duration: 3.40 yrs (upper mid). Modified duration: 3.16 yrs (top quartile). Modified duration: 3.54 yrs (lower mid). HDFC Corporate Bond Fund

Aditya Birla Sun Life Corporate Bond Fund

ICICI Prudential Corporate Bond Fund

Kotak Corporate Bond Fund Standard

Nippon India Prime Debt Fund

Top 5 Gilt Mutual Funds

Top (Erstwhile Axis Fixed Income Opportunities Fund) To generate stable returns by investing in debt & money market instruments across the yield curve & credit spectrum. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns Research Highlights for Axis Credit Risk Fund Below is the key information for Axis Credit Risk Fund Returns up to 1 year are on (Erstwhile DHFL Pramerica Credit Opportunities Fund) The investment objective of the Scheme is to generate income and capital appreciation by investing predominantly in corporate debt. There can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for PGIM India Credit Risk Fund Below is the key information for PGIM India Credit Risk Fund Returns up to 1 year are on The investment objective of the scheme is to generate steady and reasonable income, with low risk and high level of liquidity from a portfolio of predominantly debt & money market securities by Banks and Public Sector Undertakings (PSUs). Research Highlights for UTI Banking & PSU Debt Fund Below is the key information for UTI Banking & PSU Debt Fund Returns up to 1 year are on The primary objective of the schemes is to generate regular income through investments in debt and money market instruments. Income maybe generated through the receipt of coupon payments or the purchase and sale of securities in the underlying portfolio. The schemes will under normal market conditions, invest its net assets in fixed income securities, money market instruments, cash and cash equivalents. Research Highlights for Aditya Birla Sun Life Savings Fund Below is the key information for Aditya Birla Sun Life Savings Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Floating Rate Fund - Short Term) The primary objective of the schemes is to generate regular income through investment in a portfolio comprising substantially of floating rate debt / money market instruments. The schemes may invest a portion of its net assets in fixed rate debt securities and money market instruments. Research Highlights for Aditya Birla Sun Life Money Manager Fund Below is the key information for Aditya Birla Sun Life Money Manager Fund Returns up to 1 year are on GILT funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Constant Maturity Fund Growth ₹65.5106

↑ 0.35 ₹1,836 1.6 2.3 6.4 7.9 6.7 6.88% 6Y 11M 1D 9Y 9M 4D ICICI Prudential Gilt Fund Growth ₹105.512

↑ 0.43 ₹9,240 1.5 2.4 6.1 7.5 6.8 7.38% 8Y 3M 7D 20Y 3M 11D UTI Gilt Fund Growth ₹64.3416

↑ 0.18 ₹521 1.7 3 5.5 7.1 5.1 6.72% 5Y 8M 12D 8Y 3M 25D SBI Magnum Gilt Fund Growth ₹67.235

↑ 0.38 ₹10,552 1.9 2.2 4.9 7.3 4.5 6.45% 5Y 5M 16D 10Y 11M 5D Nippon India Gilt Securities Fund Growth ₹38.1823

↑ 0.19 ₹1,851 1.3 1.3 3.1 6.3 3.7 7.32% 9Y 4M 13D 21Y 8M 5D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 10 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Constant Maturity Fund ICICI Prudential Gilt Fund UTI Gilt Fund SBI Magnum Gilt Fund Nippon India Gilt Securities Fund Point 1 Bottom quartile AUM (₹1,836 Cr). Upper mid AUM (₹9,240 Cr). Bottom quartile AUM (₹521 Cr). Highest AUM (₹10,552 Cr). Lower mid AUM (₹1,851 Cr). Point 2 Established history (25+ yrs). Oldest track record among peers (26 yrs). Established history (24+ yrs). Established history (25+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 6.45% (top quartile). 1Y return: 6.15% (upper mid). 1Y return: 5.47% (lower mid). 1Y return: 4.92% (bottom quartile). 1Y return: 3.13% (bottom quartile). Point 6 1M return: 1.19% (lower mid). 1M return: 1.29% (top quartile). 1M return: 1.05% (bottom quartile). 1M return: 1.25% (upper mid). 1M return: 1.07% (bottom quartile). Point 7 Sharpe: -0.04 (upper mid). Sharpe: 0.16 (top quartile). Sharpe: -0.28 (lower mid). Sharpe: -0.38 (bottom quartile). Sharpe: -0.63 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.88% (lower mid). Yield to maturity (debt): 7.38% (top quartile). Yield to maturity (debt): 6.72% (bottom quartile). Yield to maturity (debt): 6.45% (bottom quartile). Yield to maturity (debt): 7.32% (upper mid). Point 10 Modified duration: 6.92 yrs (lower mid). Modified duration: 8.27 yrs (bottom quartile). Modified duration: 5.70 yrs (upper mid). Modified duration: 5.46 yrs (top quartile). Modified duration: 9.37 yrs (bottom quartile). SBI Magnum Constant Maturity Fund

ICICI Prudential Gilt Fund

UTI Gilt Fund

SBI Magnum Gilt Fund

Nippon India Gilt Securities Fund

1. Axis Credit Risk Fund

Axis Credit Risk Fund

Growth Launch Date 15 Jul 14 NAV (10 Mar 26) ₹22.5146 ↑ 0.03 (0.15 %) Net Assets (Cr) ₹363 on 31 Jan 26 Category Debt - Credit Risk AMC Axis Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.57 Sharpe Ratio 2.08 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Yield to Maturity 8.64% Effective Maturity 2 Years 8 Months 1 Day Modified Duration 2 Years 3 Months 14 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,610 28 Feb 23 ₹11,056 29 Feb 24 ₹11,870 28 Feb 25 ₹12,802 28 Feb 26 ₹13,945 Returns for Axis Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 0.6% 3 Month 1.5% 6 Month 3.6% 1 Year 8.7% 3 Year 8% 5 Year 6.8% 10 Year 15 Year Since launch 7.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.7% 2023 8% 2022 7% 2021 4% 2020 6% 2019 8.2% 2018 4.4% 2017 5.9% 2016 6.4% 2015 9.8% Fund Manager information for Axis Credit Risk Fund

Name Since Tenure Devang Shah 15 Jul 14 11.56 Yr. Akhil Thakker 9 Nov 21 4.23 Yr. Data below for Axis Credit Risk Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.4% Equity 5.68% Debt 91.43% Other 0.5% Debt Sector Allocation

Sector Value Corporate 81.88% Government 9.54% Cash Equivalent 2.4% Credit Quality

Rating Value A 19.02% AA 61.51% AAA 19.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Gs 2033

Sovereign Bonds | -5% ₹17 Cr 1,700,000 Jubilant Bevco Limited

Debentures | -4% ₹16 Cr 1,500 Jtpm Metal TRaders Limited

Debentures | -4% ₹15 Cr 1,500 Aditya Birla Renewables Limited

Debentures | -4% ₹15 Cr 1,500 Narayana Hrudayalaya Limited

Debentures | -4% ₹15 Cr 1,500 Infopark Properties Limited

Debentures | -4% ₹15 Cr 1,500 Altius Telecom Infrastructure Trust

Debentures | -4% ₹15 Cr 1,500 Aditya Birla Digital Fashion Ventures Limited

Debentures | -4% ₹15 Cr 1,500 6.48% Gs 2035

Sovereign Bonds | -4% ₹15 Cr 1,500,000

↑ 1,000,000 Vedanta Limited

Debentures | -3% ₹12 Cr 1,200 2. PGIM India Credit Risk Fund

PGIM India Credit Risk Fund

Growth Launch Date 29 Sep 14 NAV (21 Jan 22) ₹15.5876 ↑ 0.00 (0.01 %) Net Assets (Cr) ₹39 on 31 Dec 21 Category Debt - Credit Risk AMC Pramerica Asset Managers Private Limited Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.85 Sharpe Ratio 1.73 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Yield to Maturity 5.01% Effective Maturity 7 Months 2 Days Modified Duration 6 Months 14 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 Returns for PGIM India Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 0.3% 3 Month 0.6% 6 Month 4.4% 1 Year 8.4% 3 Year 3% 5 Year 4.2% 10 Year 15 Year Since launch 6.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for PGIM India Credit Risk Fund

Name Since Tenure Data below for PGIM India Credit Risk Fund as on 31 Dec 21

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. UTI Banking & PSU Debt Fund

UTI Banking & PSU Debt Fund

Growth Launch Date 3 Feb 14 NAV (10 Mar 26) ₹22.7971 ↑ 0.01 (0.04 %) Net Assets (Cr) ₹1,078 on 15 Feb 26 Category Debt - Banking & PSU Debt AMC UTI Asset Management Company Ltd Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 0.54 Sharpe Ratio 1.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.04% Effective Maturity 1 Year 2 Months 19 Days Modified Duration 1 Year 1 Month 10 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,389 28 Feb 23 ₹11,440 29 Feb 24 ₹12,307 28 Feb 25 ₹13,219 28 Feb 26 ₹14,200 Returns for UTI Banking & PSU Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 0.5% 3 Month 1.1% 6 Month 2.6% 1 Year 7.4% 3 Year 7.5% 5 Year 7.3% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.8% 2023 7.6% 2022 6.7% 2021 10.3% 2020 2.8% 2019 8.9% 2018 -1% 2017 6.8% 2016 6.4% 2015 11.7% Fund Manager information for UTI Banking & PSU Debt Fund

Name Since Tenure Anurag Mittal 1 Dec 21 4.17 Yr. Data below for UTI Banking & PSU Debt Fund as on 15 Feb 26

Asset Allocation

Asset Class Value Cash 13.54% Debt 86.2% Other 0.26% Debt Sector Allocation

Sector Value Corporate 61.23% Government 30.06% Cash Equivalent 8.44% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.38% Gs 2027

Sovereign Bonds | -8% ₹87 Cr 850,000,000 Kotak Mahindra Bank Ltd.

Debentures | -6% ₹71 Cr 750,000,000 Union Bank of India

Domestic Bonds | -6% ₹70 Cr 750,000,000

↑ 750,000,000 National Housing Bank

Debentures | -5% ₹60 Cr 6,000

↑ 2,500 Axis Bank Limited

Debentures | -5% ₹55 Cr 550 Export Import Bank Of India

Debentures | -5% ₹50 Cr 5,000 Small Industries Development Bank Of India

Debentures | -5% ₹50 Cr 5,000 Power Finance Corporation Limited

Debentures | -4% ₹40 Cr 400 National Bank For Agriculture And Rural Development

Debentures | -4% ₹40 Cr 4,000 HDFC Bank Limited

Debentures | -3% ₹35 Cr 350 4. Aditya Birla Sun Life Savings Fund

Aditya Birla Sun Life Savings Fund

Growth Launch Date 16 Apr 03 NAV (10 Mar 26) ₹571.974 ↑ 0.09 (0.02 %) Net Assets (Cr) ₹22,857 on 31 Jan 26 Category Debt - Ultrashort Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.55 Sharpe Ratio 2.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.81% Effective Maturity 6 Months 11 Days Modified Duration 5 Months 19 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,424 28 Feb 23 ₹10,957 29 Feb 24 ₹11,766 28 Feb 25 ₹12,673 28 Feb 26 ₹13,576 Returns for Aditya Birla Sun Life Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 0.5% 3 Month 1.3% 6 Month 2.9% 1 Year 7.1% 3 Year 7.4% 5 Year 6.3% 10 Year 15 Year Since launch 7.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.9% 2022 7.2% 2021 4.8% 2020 3.9% 2019 7% 2018 8.5% 2017 7.6% 2016 7.2% 2015 9.2% Fund Manager information for Aditya Birla Sun Life Savings Fund

Name Since Tenure Sunaina Cunha 20 Jun 14 11.63 Yr. Kaustubh Gupta 15 Jul 11 14.56 Yr. Monika Gandhi 22 Mar 21 4.87 Yr. Data below for Aditya Birla Sun Life Savings Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 47.38% Debt 52.33% Other 0.29% Debt Sector Allocation

Sector Value Corporate 54.83% Cash Equivalent 30.8% Government 14.08% Credit Quality

Rating Value AA 25.17% AAA 74.83% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shriram Finance Limited

Debentures | -3% ₹610 Cr 60,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹543 Cr 54,000 Nirma Limited

Debentures | -2% ₹485 Cr 48,500 Bharti Telecom Limited

Debentures | -2% ₹397 Cr 40,000 7.25% Gujarat Sgs 2026

Sovereign Bonds | -2% ₹375 Cr 37,500,000 Muthoot Finance Limited

Debentures | -2% ₹350 Cr 35,000 Mankind Pharma Limited

Debentures | -1% ₹321 Cr 32,000

↓ -2,500 National Bank For Agriculture And Rural Development

Debentures | -1% ₹302 Cr 30,000 Avanse Financial Services Limited

Debentures | -1% ₹300 Cr 30,000 Power Finance Corporation Limited

Debentures | -1% ₹296 Cr 30,000 5. Aditya Birla Sun Life Money Manager Fund

Aditya Birla Sun Life Money Manager Fund

Growth Launch Date 13 Oct 05 NAV (10 Mar 26) ₹385.758 ↑ 0.09 (0.02 %) Net Assets (Cr) ₹28,816 on 31 Jan 26 Category Debt - Money Market AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Low Expense Ratio 0.35 Sharpe Ratio 1.91 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.62% Effective Maturity 6 Months 11 Days Modified Duration 6 Months 11 Days Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,400 28 Feb 23 ₹10,944 29 Feb 24 ₹11,784 28 Feb 25 ₹12,686 28 Feb 26 ₹13,580 Returns for Aditya Birla Sun Life Money Manager Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 10 Mar 26 Duration Returns 1 Month 0.5% 3 Month 1.3% 6 Month 2.8% 1 Year 7% 3 Year 7.4% 5 Year 6.3% 10 Year 15 Year Since launch 6.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.4% 2023 7.8% 2022 7.4% 2021 4.8% 2020 3.8% 2019 6.6% 2018 8% 2017 7.9% 2016 6.8% 2015 7.7% Fund Manager information for Aditya Birla Sun Life Money Manager Fund

Name Since Tenure Kaustubh Gupta 15 Jul 11 14.56 Yr. Anuj Jain 22 Mar 21 4.87 Yr. Mohit Sharma 1 Apr 17 8.84 Yr. Data below for Aditya Birla Sun Life Money Manager Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 83.39% Debt 16.34% Other 0.27% Debt Sector Allocation

Sector Value Cash Equivalent 45.99% Corporate 43.02% Government 10.71% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 5.63% Gs 2026

Sovereign Bonds | -3% ₹770 Cr 77,000,000 Bank of Baroda

Debentures | -3% ₹758 Cr 15,500

↑ 15,500 19/02/2026 Maturing 182 DTB

Sovereign Bonds | -2% ₹499 Cr 50,000,000

↑ 50,000,000 02/10/2026 Maturing 364 DTB

Sovereign Bonds | -1% ₹386 Cr 40,000,000

↑ 40,000,000 Kotak Mahindra Bank Ltd.

Debentures | -1% ₹384 Cr 8,000 7.49% Gujarat Sgs 2026

Sovereign Bonds | -1% ₹329 Cr 32,500,000 06/11/2026 Maturing 364 DTB

Sovereign Bonds | -1% ₹240 Cr 25,000,000 7.57% Gujarat Sgs 2026

Sovereign Bonds | -1% ₹238 Cr 23,500,000 Karur Vysya Bank Ltd.

Debentures | -1% ₹236 Cr 5,000 Canara Bank

Domestic Bonds | -1% ₹233 Cr 5,000

↑ 5,000

How to Evaluate Best Debt Mutual Funds

In order to select the best debt funds you wish to invest in, it is necessary to consider some of the important parameters such as average maturity, credit quality, AUM, expense ratio, tax implication., etc. Let's have an in-depth look-

1. Average Maturity/Duration

Average maturity is an essential parameter in debt funds that is sometimes overlooked by investors, who tend to invest for a long period without considering the risks involved. Investors need to decide their debt fund investment based on its maturity period, Matching the time period of investment with the maturity period of the debt fund is a good way to ensure you don't end up taking unnecessary risk. Thus, it is advisable to know the average maturity of a debt fund, before investing, in order to aim for optimum risk returns in debt funds. Looking at the average maturity (duration is a similar factor) is important, for example, a liquid fund may have an average maturity of a couple of days to maybe a month, this would mean it is a great option for an investor who is looking to invest money for a couple of days. Similarly, if you are looking at the time frame of one-year Investment plan then, a short-term debt fund can be ideal.

2. Interest Rate Scenario

Understanding the market environment is very important in debt funds which are affected by interest rates and its fluctuations. When the interest rate rises in the economy, the bond price falls and vice-versa. Also, during the time when the interest rates rise, new bonds are issued in the market with a higher yield than the older bonds, making those older bonds of lower value. Therefore, investors are more attracted towards newer bonds in the market and also a re-pricing of older bonds takes place. In case a debt fund is having an exposure to such "older bonds" then when the interest rates rise, the NAV of the debt fund would be impacted negatively. Furthermore, as debt funds are exposed to interest rate fluctuations, it disturbs the prices of the underlying bonds in the fund portfolio. For instance, long-term debt funds are at a higher risk during times of rising interest rates. During this time making a short-term investment plan will lower your interest rate risks.

If one has good knowledge of interest rates and can monitor the same, one can even take advantage of this. In a falling interest rate market, long-term debt funds would be a good choice. However, during the times of rising interest rates then it would be wise to be in funds with shorter average maturities like short-term funds, Ultra Short Term fund or even liquid funds.

3. Current Yield or Portfolio Yield

The yield is a measure of the interest income generated by the bonds in the portfolio. Funds that invest in debt or bonds that have a higher coupon rate (or yield) would have a higher overall portfolio yield. The yield to maturity(YTM) of a debt mutual fund indicates the running yield of the fund. When comparing debt funds on the basis of YTM, one should also look at that fact that how is the extra yield being generated. Is this at the cost of as lower portfolio quality? Investing in not so good quality instruments has its own issues. You don't want to end up investing in a debt fund which has such bonds or securities that may default later on. So, always look at the portfolio yield and balance it off with the credit quality.

4. Credit Quality of Portfolio

In order to invest in best debt funds, checking the credit quality of the bonds and debt securities is an essential parameter. Bonds are assigned a credit rating by various agencies based on their ability to pay the money back. A bond with AAA rating is considered to be the best credit rating and also implies a safe and secure investment. If one truly wants safety and considers this as the paramount parameter in selecting the best debt fund, then getting into a fund with very high-quality debt instruments (AAA or AA+) may be the desired option.

5. Assets Under Management (AUM)

This is the foremost parameter to consider while choosing the best debt funds. AUM is the total amount invested in a particular scheme by all investors. Since, most Mutual Funds’ total AUM is invested in debt funds, investors need to select scheme assets that have a considerable AUM. Being in a fund which has a large exposure to corporates may be risky, since their withdrawals may be large which may affect the overall fund performance.

6. Expense Ratio

An important factor to be considered in debt funds is its expense ratio. A higher expense ratio creates a larger impact on the funds’ performance. For example, liquid funds have the lowest expense ratios which are up to 50 bps (BPS is a unit to measure interest rates wherein one bps is equal to 1/100th of 1%) whereas, other debt funds could charge up to 150 bps. So to make a choice between one debt mutual fund, it is important to consider the management fee or the fund running expense.

7. Taxation Impacts

Debt funds offer the benefit of long-term capital gains (more than 3 years) with indexation benefits. And the short term capital gains (less than 3 years) is taxed at 30%.

Things to consider as an investor

1. Fund Objectives

Debt Fund aims to earn optimal returns by maintaining a diversified portfolio of various types of securities. You can expect them to perform in a predictable manner. It is because of this reason, that debt funds are popular among conservative investors.

2. Fund Types

Debt funds are further divided into various categories like liquid funds, Monthly Income Plan (MIP), fixed maturity plans (FMP), dynamic bond funds, income funds, credit opportunities funds, GILT funds, short-term funds and ultra short-term funds.

3. Risks

Debt funds are basically exposed to interest rate risk, credit risk, and liquidity risk. The fund value may fluctuate due to the overall interest rate movements. There’s a risk of default in the payment of interest and principal by the issuer. Liquidity risk happens when the fund manager is unable to sell the underlying security due to lack of demand.

4. Cost

Debt funds charge an expense ratio to manage your money. Till now SEBI had mandated the upper limit of expense ratio to be 2.25% (Might change time to time with regulations.).

5. Investment Horizon

An investment of 3 months to 1 year would be ideal for liquid funds. If you have a longer horizon of say 2 to 3 years, you may go for short-term bond funds.

6. Financial Goals

Debt funds can be used to achieve a variety of goals like earning additional income or for purpose of liquidity.

How to Invest in Best Debt Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Debt funds are one of the best ways to invest your money and generate income on a regular basis by choosing the relevant product matching your risk profile. So, investors looking to generate steady income or take advantage of the debt markets, can consider the above best debt funds for 2026 - 2027 and start investing!_

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

The article is nice and informative but it could be in more simple words because lot of people have much less knowledge in such sector