What is Risk Profile?

A risk profile is one of the most important things to analyse before making an investment. Ideally, experienced investors would know their risk ability, but a newbie would have a very little idea about the risk involved with Mutual Funds or the right mutual fund as per their risk appetite.

In many certains, most of the investors were overconfident at the time of Investing and they turn extremely nervous as the market becomes volatile. Hence, knowing your risk profile remains at the center stage of any investment.

Especially in the case of mutual fund investment, the suitability of a product largely depends upon the characteristics of the investor. Investors should know their investment objective, how long they wish to invest, ability to tolerate risk, minimum investment amount, etc.

Risk Profiling Procedure

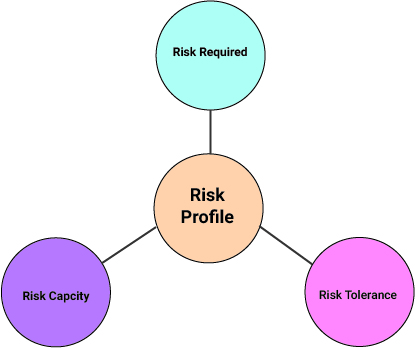

Risk– with respect to investing– is the Volatility or the fluctuation of the prices and/or investment returns. So risk assessment or risk profiling is the systematic evaluation of all the potential risks involved in the investment activity. Risk profiling gives you a clear picture of your risk appetite, i.e. evaluating your risk capacity, your required risk, and your risk tolerance. We will elaborate each term separately.

When an investor conducts their risk profiling, they have to answer a set of questions designed specifically for the purpose. The set of questions differs for different Mutual Fund Houses or distributors. The score of investor after answering the questions determines their range of taking a risk. An investor can be a high-risk taker, mid-risk taker or can be a low-risk taker.

Risk Identification and Risk Analysis

Once the risk is identified by the risk assessment procedure, that risk is then analysed. It is divided into three broad categories -

Risk Capacity

Risk capacity is the quantitative measure of taking a risk. It maps your current and future financial position which includes factors like income, savings, expenses, and liabilities. With these factors evaluated, the rate of returns required to reach your Financial goals is determined. In simple words, it is the level of the financial risk you can think of affording.

Risk Required

Risk required is determined by your risk capacity. It is the risk associated with the returns needed to reach your financial targets with available resources. Risk required educates you about what you could potentially be taking on with a certain investment. It gives you an honest perception and a clear picture about the type of the risk you are about to take.

Risk Tolerance

Risk tolerance is the level of risk you are comfortable with. It is simply your willingness to accept the fluctuations in the market that may or may not occur in order to achieve your financial objectives. Risk tolerance can be broadly divided three types

- High-Risk Tolerance

- Mid-Risk Tolerance

- Low-Risk Tolerance

Talk to our investment specialist

Risk Assessment Methodology- Factors & Influence

To determine the category in which you fall there are certain parameters considered

| Factor | Influence on Risk Profile |

|---|---|

| Family Information | |

| Earning Members | Risk appetite increases as the number of earning members increases |

| Dependent Members | Risk appetite decreases as the number of dependent members increases |

| Life expectancy | Risk appetite is higher when life expectancy is longer |

| Personal Information | |

| Age | Lower the age, higher the risk that can be taken |

| Employability | Those with steady jobs are better positioned to take risk |

| Psyche | Daring and adventurous people are better positioned mentally, to accept the downsides that come with risk |

| Financial Information | |

| Capital base | Higher the capital base, better the ability to financially take the downsides that come with risk |

| Regularity of Income | People earning regular income can take more risk than those with unpredictable income streams |

Best Mutual Funds As Per Risk Appetite

Fund Selection Methodology used to find 6 funds

Mutual Funds for Conservative Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Ultrashort Bond Aditya Birla Sun Life Savings Fund Growth ₹571.297

↓ -0.08 ₹22,857 1.3 2.9 7.1 7.4 7.4 6.81% 5M 19D 6M 11D Ultrashort Bond ICICI Prudential Ultra Short Term Fund Growth ₹28.8224

↓ 0.00 ₹17,808 1.3 2.8 6.8 7.1 7.1 7.31% 5M 5D 6M 11D Ultrashort Bond SBI Magnum Ultra Short Duration Fund Growth ₹6,214.9

↑ 0.78 ₹14,032 1.3 2.9 6.7 7.1 7 6.99% 4M 20D 6M 7D Ultrashort Bond Kotak Savings Fund Growth ₹44.5535

↓ 0.00 ₹16,788 1.3 2.8 6.6 6.9 6.8 7.12% 5M 16D 6M 11D Ultrashort Bond Nippon India Ultra Short Duration Fund Growth ₹4,186.57

↓ -0.11 ₹10,488 1.3 2.8 6.6 6.9 6.8 7.06% 5M 28D 8M 3D Ultrashort Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Aug 22 Research Highlights & Commentary of 6 Funds showcased

Commentary Franklin India Ultra Short Bond Fund - Super Institutional Plan Aditya Birla Sun Life Savings Fund ICICI Prudential Ultra Short Term Fund SBI Magnum Ultra Short Duration Fund Kotak Savings Fund Nippon India Ultra Short Duration Fund Point 1 Bottom quartile AUM (₹297 Cr). Highest AUM (₹22,857 Cr). Upper mid AUM (₹17,808 Cr). Lower mid AUM (₹14,032 Cr). Upper mid AUM (₹16,788 Cr). Bottom quartile AUM (₹10,488 Cr). Point 2 Established history (18+ yrs). Established history (22+ yrs). Established history (14+ yrs). Oldest track record among peers (26 yrs). Established history (21+ yrs). Established history (24+ yrs). Point 3 Rating: 1★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Low. Risk profile: Moderately Low. Risk profile: Low. Point 5 1Y return: 13.69% (top quartile). 1Y return: 7.11% (upper mid). 1Y return: 6.81% (upper mid). 1Y return: 6.71% (lower mid). 1Y return: 6.60% (bottom quartile). 1Y return: 6.56% (bottom quartile). Point 6 1M return: 0.59% (top quartile). 1M return: 0.46% (upper mid). 1M return: 0.44% (lower mid). 1M return: 0.44% (upper mid). 1M return: 0.44% (bottom quartile). 1M return: 0.43% (bottom quartile). Point 7 Sharpe: 2.57 (top quartile). Sharpe: 2.17 (upper mid). Sharpe: 2.06 (lower mid). Sharpe: 2.11 (upper mid). Sharpe: 1.52 (bottom quartile). Sharpe: 1.65 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 6.81% (bottom quartile). Yield to maturity (debt): 7.31% (top quartile). Yield to maturity (debt): 6.99% (lower mid). Yield to maturity (debt): 7.12% (upper mid). Yield to maturity (debt): 7.06% (upper mid). Point 10 Modified duration: 0.00 yrs (top quartile). Modified duration: 0.47 yrs (bottom quartile). Modified duration: 0.43 yrs (upper mid). Modified duration: 0.39 yrs (upper mid). Modified duration: 0.46 yrs (lower mid). Modified duration: 0.49 yrs (bottom quartile). Franklin India Ultra Short Bond Fund - Super Institutional Plan

Aditya Birla Sun Life Savings Fund

ICICI Prudential Ultra Short Term Fund

SBI Magnum Ultra Short Duration Fund

Kotak Savings Fund

Nippon India Ultra Short Duration Fund

Mutual Funds for Low to Moderate Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. UTI Banking & PSU Debt Fund Growth ₹22.7842

↓ -0.01 ₹1,078 1 2.7 7.4 7.5 7.8 7.04% 1Y 1M 10D 1Y 2M 19D Banking & PSU Debt HDFC Banking and PSU Debt Fund Growth ₹23.7882

↓ -0.03 ₹5,620 0.7 2.5 7.1 7.3 7.5 7.26% 3Y 1M 17D 4Y 5M 1D Banking & PSU Debt HDFC Corporate Bond Fund Growth ₹33.5919

↓ -0.05 ₹33,207 0.6 2.4 6.8 7.6 7.3 7.36% 4Y 5M 19D 7Y 8M 16D Corporate Bond Aditya Birla Sun Life Corporate Bond Fund Growth ₹116.645

↓ -0.17 ₹28,253 0.6 2.5 6.8 7.6 7.4 7.12% 4Y 10M 24D 7Y 6M 14D Corporate Bond PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 7.18% 1Y 7M 28D 1Y 11M 1D Short term Bond ICICI Prudential Short Term Fund Growth ₹62.5923

↓ -0.04 ₹22,707 1 2.9 7.6 7.7 8 7.51% 2Y 9M 4D 4Y 7M 20D Short term Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary UTI Banking & PSU Debt Fund HDFC Banking and PSU Debt Fund HDFC Corporate Bond Fund Aditya Birla Sun Life Corporate Bond Fund PGIM India Short Maturity Fund ICICI Prudential Short Term Fund Point 1 Bottom quartile AUM (₹1,078 Cr). Lower mid AUM (₹5,620 Cr). Highest AUM (₹33,207 Cr). Upper mid AUM (₹28,253 Cr). Bottom quartile AUM (₹28 Cr). Upper mid AUM (₹22,707 Cr). Point 2 Established history (12+ yrs). Established history (11+ yrs). Established history (15+ yrs). Oldest track record among peers (29 yrs). Established history (23+ yrs). Established history (24+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 7.43% (upper mid). 1Y return: 7.07% (upper mid). 1Y return: 6.84% (lower mid). 1Y return: 6.82% (bottom quartile). 1Y return: 6.08% (bottom quartile). 1Y return: 7.58% (top quartile). Point 6 1M return: 0.44% (lower mid). 1M return: 0.42% (bottom quartile). 1M return: 0.52% (upper mid). 1M return: 0.60% (top quartile). 1M return: 0.43% (bottom quartile). 1M return: 0.48% (upper mid). Point 7 Sharpe: 1.05 (upper mid). Sharpe: 0.36 (upper mid). Sharpe: 0.24 (lower mid). Sharpe: 0.22 (bottom quartile). Sharpe: -0.98 (bottom quartile). Sharpe: 1.17 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.04% (bottom quartile). Yield to maturity (debt): 7.26% (upper mid). Yield to maturity (debt): 7.36% (upper mid). Yield to maturity (debt): 7.12% (bottom quartile). Yield to maturity (debt): 7.18% (lower mid). Yield to maturity (debt): 7.51% (top quartile). Point 10 Modified duration: 1.11 yrs (top quartile). Modified duration: 3.13 yrs (lower mid). Modified duration: 4.47 yrs (bottom quartile). Modified duration: 4.90 yrs (bottom quartile). Modified duration: 1.66 yrs (upper mid). Modified duration: 2.76 yrs (upper mid). UTI Banking & PSU Debt Fund

HDFC Banking and PSU Debt Fund

HDFC Corporate Bond Fund

Aditya Birla Sun Life Corporate Bond Fund

PGIM India Short Maturity Fund

ICICI Prudential Short Term Fund

Mutual Funds for Moderate to High Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Aditya Birla Sun Life Medium Term Plan Growth ₹42.3202

↓ -0.06 ₹2,982 2.7 5 10.3 10 12 10.9 Medium term Bond Nippon India Strategic Debt Fund Growth ₹16.3947

↓ -0.01 ₹136 1.2 3 9.5 8.5 9.1 9.6 Medium term Bond Kotak Medium Term Fund Growth ₹23.8014

↓ -0.07 ₹1,987 0.8 3.6 8.4 8.3 6.7 8.9 Medium term Bond Axis Strategic Bond Fund Growth ₹29.217

↓ -0.02 ₹2,044 1.2 3.2 8.1 8.1 6.8 8.2 Medium term Bond ICICI Prudential Medium Term Bond Fund Growth ₹46.8673

↓ -0.11 ₹5,687 0.9 3.4 8.3 7.9 6.8 9 Medium term Bond SBI Magnum Medium Duration Fund Growth ₹53.0351

↓ -0.07 ₹6,830 0.9 2.9 7.2 7.6 6.3 7.5 Medium term Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Aditya Birla Sun Life Medium Term Plan Nippon India Strategic Debt Fund Kotak Medium Term Fund Axis Strategic Bond Fund ICICI Prudential Medium Term Bond Fund SBI Magnum Medium Duration Fund Point 1 Upper mid AUM (₹2,982 Cr). Bottom quartile AUM (₹136 Cr). Bottom quartile AUM (₹1,987 Cr). Lower mid AUM (₹2,044 Cr). Upper mid AUM (₹5,687 Cr). Highest AUM (₹6,830 Cr). Point 2 Established history (16+ yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (13+ yrs). Established history (21+ yrs). Oldest track record among peers (22 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 10.29% (top quartile). 1Y return: 9.54% (upper mid). 1Y return: 8.43% (upper mid). 1Y return: 8.12% (bottom quartile). 1Y return: 8.28% (lower mid). 1Y return: 7.16% (bottom quartile). Point 6 1M return: 0.59% (upper mid). 1M return: 0.67% (upper mid). 1M return: 0.29% (bottom quartile). 1M return: 0.68% (top quartile). 1M return: 0.28% (bottom quartile). 1M return: 0.40% (lower mid). Point 7 Sharpe: 2.33 (top quartile). Sharpe: 1.03 (bottom quartile). Sharpe: 1.32 (upper mid). Sharpe: 1.06 (lower mid). Sharpe: 1.53 (upper mid). Sharpe: 0.54 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.78% (bottom quartile). Yield to maturity (debt): 7.10% (bottom quartile). Yield to maturity (debt): 8.24% (top quartile). Yield to maturity (debt): 8.16% (lower mid). Yield to maturity (debt): 8.24% (upper mid). Yield to maturity (debt): 8.18% (upper mid). Point 10 Modified duration: 3.40 yrs (lower mid). Modified duration: 3.58 yrs (bottom quartile). Modified duration: 3.08 yrs (upper mid). Modified duration: 3.22 yrs (upper mid). Modified duration: 3.53 yrs (bottom quartile). Modified duration: 3.06 yrs (top quartile). Aditya Birla Sun Life Medium Term Plan

Nippon India Strategic Debt Fund

Kotak Medium Term Fund

Axis Strategic Bond Fund

ICICI Prudential Medium Term Bond Fund

SBI Magnum Medium Duration Fund

Mutual Funds for High Risk Takers

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Nippon India Small Cap Fund Growth ₹156.598

↓ -2.84 ₹65,812 -5.9 -6.8 11.6 19.3 21 -4.7 Small Cap Motilal Oswal Midcap 30 Fund Growth ₹86.7601

↓ -1.29 ₹34,432 -15.2 -17 -2.4 19.7 20.8 -12.1 Mid Cap HDFC Mid-Cap Opportunities Fund Growth ₹194.099

↓ -5.05 ₹92,187 -4.5 0.9 19.6 24.2 20.7 6.8 Mid Cap Edelweiss Mid Cap Fund Growth ₹99.781

↓ -2.04 ₹13,802 -3.6 -0.5 19.6 24.5 19.7 3.8 Mid Cap Invesco India Mid Cap Fund Growth ₹171.28

↓ -3.24 ₹10,058 -7.5 -4.6 20 25.3 19.2 6.3 Mid Cap Nippon India Multi Cap Fund Growth ₹286.827

↓ -5.21 ₹48,809 -4.8 -4.3 13.8 20.4 19.2 4.1 Multi Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 4 Mar 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Nippon India Small Cap Fund Motilal Oswal Midcap 30 Fund HDFC Mid-Cap Opportunities Fund Edelweiss Mid Cap Fund Invesco India Mid Cap Fund Nippon India Multi Cap Fund Point 1 Upper mid AUM (₹65,812 Cr). Lower mid AUM (₹34,432 Cr). Highest AUM (₹92,187 Cr). Bottom quartile AUM (₹13,802 Cr). Bottom quartile AUM (₹10,058 Cr). Upper mid AUM (₹48,809 Cr). Point 2 Established history (15+ yrs). Established history (12+ yrs). Established history (18+ yrs). Established history (18+ yrs). Established history (18+ yrs). Oldest track record among peers (20 yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 20.99% (top quartile). 5Y return: 20.79% (upper mid). 5Y return: 20.70% (upper mid). 5Y return: 19.68% (lower mid). 5Y return: 19.24% (bottom quartile). 5Y return: 19.19% (bottom quartile). Point 6 3Y return: 19.28% (bottom quartile). 3Y return: 19.69% (bottom quartile). 3Y return: 24.18% (upper mid). 3Y return: 24.50% (upper mid). 3Y return: 25.29% (top quartile). 3Y return: 20.36% (lower mid). Point 7 1Y return: 11.65% (bottom quartile). 1Y return: -2.36% (bottom quartile). 1Y return: 19.65% (upper mid). 1Y return: 19.65% (upper mid). 1Y return: 20.04% (top quartile). 1Y return: 13.85% (lower mid). Point 8 Alpha: -0.64 (bottom quartile). Alpha: -12.33 (bottom quartile). Alpha: 3.73 (top quartile). Alpha: 1.70 (upper mid). Alpha: 0.00 (upper mid). Alpha: -0.46 (lower mid). Point 9 Sharpe: -0.19 (bottom quartile). Sharpe: -0.54 (bottom quartile). Sharpe: 0.49 (top quartile). Sharpe: 0.33 (upper mid). Sharpe: 0.35 (upper mid). Sharpe: 0.09 (lower mid). Point 10 Information ratio: 0.02 (lower mid). Information ratio: -0.10 (bottom quartile). Information ratio: 0.47 (upper mid). Information ratio: 0.49 (top quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.49 (upper mid). Nippon India Small Cap Fund

Motilal Oswal Midcap 30 Fund

HDFC Mid-Cap Opportunities Fund

Edelweiss Mid Cap Fund

Invesco India Mid Cap Fund

Nippon India Multi Cap Fund

The Importance of Risk Profiling

Risk profiling gives you the clear picture of all the risk and returns expectations from an investment. It helps you create a focused strategy to invest in a manner that will help you reach your financial goals. Your financial advisor is expected to give you all the necessary information regarding risk assessment and help you carry out the same. Securities and Exchange Board of India (SEBI) and The Association of Mutual Funds of India (AMFI) both have stated the guidelines and norms for carrying out a detailed risk assessment of the investor and then suggest them the appropriate schemes. Such approach helps in reducing the losses that might occur if an investor invests in a scheme that is out of their risk appetite.

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.