Risk Assessment

What is Risk Assessment?

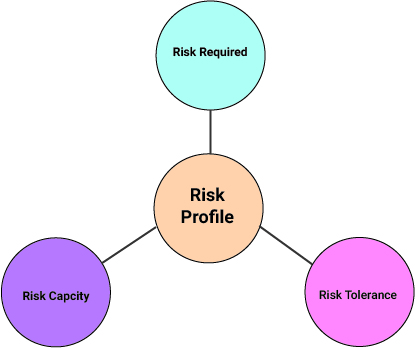

Risk– with respect to Investing– is the Volatility or the fluctuation of the prices and/or investment returns. So risk assessment is the systematic evaluation of all the potential risks involved in the investment activity. It is a general term used across many industries to determine the likelihood of loss on an loan, asset, or investment.

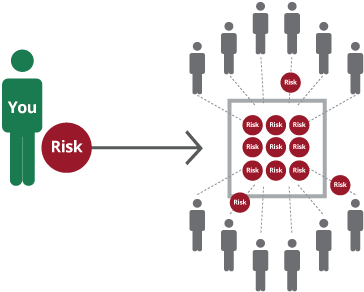

Assessing risk is essential for determining how worthwhile an investment is and the best process to mitigate risk. It presents the upside reward compared to the risk profile. It also determines the rate of return necessary to make a particular investment succeed.

Risk assessments help identify these inherent business risks and provide measures, processes and controls to reduce the impact of these risks to business operations.

Talk to our investment specialist

Risk Assessment Methodology- Factors & Influence

To determine the category in which you fall there are certain parameters considered

| Factor | Influence on Risk Profile |

|---|---|

| Family Information | |

| Earning Members | Risk appetite increases as the number of earning members increases |

| Dependent Members | Risk appetite decreases as the number of dependent members increases |

| Life expectancy | Risk appetite is higher when life expectancy is longer |

| Personal Information | |

| Age | Lower the age, higher the risk that can be taken |

| Employability | Those with steady jobs are better positioned to take risk |

| Psyche | Daring and adventurous people are better positioned mentally, to accept the downsides that come with risk |

| Financial Information | |

| Capital base | Higher the capital base, better the ability to financially take the downsides that come with risk |

| Regularity of Income | People earning regular income can take more risk than those with unpredictable income streams |

Goal of Risk Assessment

Some of the common goals and objectives of conducting risk assessment and business and industries are-

Identifying and documenting risks, threats to the organization's assets and infrastructure

Mitigate the identified risks, threats and vulnerabilities

Developing an accurate inventory of data and IT assets

Understanding the return on investment if funds are invested to offset potential risk.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.