Default Risk

What is Default Risk?

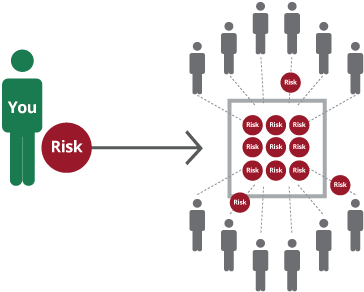

Default risk is considered as such a risk that a lender takes when lending money to somebody. Whether the borrower is able to pay back the required payment on a debt obligation stays unclear. Generally, investors and lenders are exposed to default risk in almost every form of credit extension.

If the default risk is higher, it will lead to higher required return and thus; a higher interest rate.

Explaining Default Risk

When a lender provides credit to a borrower, there is always a chance that the loan amount may not be paid back. The evaluation that looks into this probability is known as default risk. It doesn’t just apply to individuals, but companies that issue Bonds and are unable to make interest payments on such bonds because of financial restrictions.

Whenever a lender provides money, assessing the default risk of a borrower is an essential part of the risk management strategy. Also, determining the financial health of a company is also vital in gauging this risk.

According to extensive economic changes or financial changes in the company, default risk can alter as well. The reason behind this is that economic recession can affect the earnings and revenues of several companies; thus, impacting their competence to pay interest payments on debt or to repay the debt itself.

Moreover, for a company facing a low pricing power, increased competition, and other such financial factors may impact its ability to repay. To mitigate default risk, companies need to generate adequate cash flow and net income.

How is Default Risk Calculated?

Generally, lenders assess the financial statements of a company and employ a variety of financial ratios to comprehend the possibility of debt repayment. To begin with, they keep a keen eye on free cash flow, which is generated after the company reinvests and can be calculated by deducting capital expenses from operating cash flow.

Talk to our investment specialist

If this figure is around zero or negative, it represents that the company is facing troubles generating the cash required to deliver committed payments; thus, indicating higher default risk. The next aspect that is measured is the interest coverage ratio, which can easily be calculated by dividing the earnings before taxes and interest of a company by its regular debt interest payments.

If the ratio is on the higher side, it indicates that the company is generating enough income to cover its interest payments and has a lower possibility of default risk.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.