Inflation: Meaning, Types, Causes, Effects and Examples in India

Inflation is one of the most important economic concepts that directly affects our everyday life. From the price of vegetables and fuel to interest rates on loans and returns on investments — inflation influences everything.

Inflation refers to the long-term rise in the prices of goods and services caused by the devaluation of currency. When inflation increases, the purchasing power of money falls. This means that with the same amount of money, people are able to buy fewer goods and services than before.

Inflationary problems arise when inflation is unexpected or rises faster than income levels. If salaries and business income do not grow at the same pace as prices, the overall standard of living declines.

A moderate level of inflation is considered healthy for an economy, as it encourages spending, production and economic growth. However, very high inflation or extremely low inflation (deflation) can severely damage economic stability. Central banks such as the Reserve Bank of India (RBI) attempt to control inflation within a target range to ensure smooth economic functioning.

What is Inflation?

Inflation is the rate at which the general level of prices of goods and services rises over time, resulting in a decline in the purchasing power of money.

For example:

- If a commodity costs ₹100 today

- And the same commodity costs ₹110 next year

- The inflation rate is 10%.

This does not mean goods have become better or more valuable — it means the value of money has reduced.

Inflation is usually measured annually and expressed as a percentage. Governments and central banks closely monitor inflation as it plays a critical role in economic planning, monetary policy and financial stability.

Inflation Meaning in Economics

In economics, inflation represents a sustained increase in the price level across the economy, not a temporary rise in the price of a few goods.

Economists view inflation as a sign of:

- Excess money supply

- Rising production costs

- Increased consumer demand

- Currency depreciation

When too much money chases too few goods, prices tend to rise — leading to inflation.

Talk to our investment specialist

Inflation Target Framework in India

In India, inflation is primarily measured using the Consumer Price Index (CPI).

The Reserve Bank of India (RBI) follows a formal inflation-targeting framework, under which price stability is maintained as a key monetary policy objective.

Under this framework:

- Target inflation rate: 4%

- Tolerance band: ±2%

- Acceptable inflation range: 2% to 6%

If CPI inflation remains above 6% or below 2% for a prolonged period, it poses serious risks to economic stability, purchasing power and long-term economic growth.

To manage inflation, the RBI uses various monetary policy tools such as:

- Repo rate adjustments

- Liquidity management measures

- Open market operations

This inflation-targeting framework helps ensure predictable prices, stable economic growth and financial discipline in the Indian economy.

How Inflation Is Measured in India

Consumer Price Index (CPI)

The CPI measures changes in prices of a basket of goods and services consumed by households, including:

- Food and beverages

- Housing

- Transport

- Clothing and footwear

- Education

- Healthcare

CPI is the most widely used inflation indicator in India.

Core Inflation

Core inflation excludes:

- Food prices

- Fuel prices

Since food and fuel prices are highly volatile, core inflation helps policymakers understand long-term inflation trends in the economy.

Types of Inflation

Inflation can be broadly classified into the following types:

1. Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand grows faster than aggregate supply. This situation typically arises during periods of strong economic growth. Common reasons include:

- Increase in household income

- Easy availability of credit

- Government fiscal stimulus

- Rapid population growth

When demand exceeds supply, prices are pulled upward — hence the term demand-pull inflation.

2. Cost-push Inflation

Cost-push inflation occurs when the cost of production increases, forcing companies to raise prices to protect profit margins. Major causes include:

- Rising crude oil prices

- Higher raw material costs

- Increase in wages

- Higher indirect taxes

- Supply chain disruptions

Cost-push inflation can occur even when demand in the economy is weak.

3. Built-in Inflation

Built-in inflation arises due to inflation expectations. When workers expect prices to rise, they demand higher wages. Higher wages increase production costs, which in turn raise prices — creating a wage–price spiral.

Causes of Inflation

There is not a single, agreed-upon answer, but there are a variety of theories, all of which play some role in inflation:

Causes of Demand-Pull Inflation

- Increase in money supply

- Higher government spending

- Fiscal stimulus

- Strong consumer demand

- Rapid global economic growth

- Currency depreciation

Causes of Cost-push Inflation

- Increase in raw material prices

- Rising labour costs

- Higher transportation costs

- Increase in indirect taxes

- Monopoly pricing power

- Supply shortages

Effects of Inflation

Inflation affects different sections of the economy in different ways.

Reduced Purchasing Power: As prices rise, the value of money declines. People can purchase fewer goods and services with the same income

Higher Cost of Living: Inflation increases household expenses such as food, rent, fuel and education

Uncertainty: High or unpredictable inflation creates uncertainty, discouraging long-term investments and business expansion

Interest Rates: To control inflation, central banks often increase interest rates, making loans costlier and reducing spending

Income Redistribution: Inflation affects people differently:

- Fixed-income earners suffer the most

- Borrowers may benefit

- Savers lose purchasing power

Impact of Inflation on Investments

Inflation plays a crucial role in determining real investment returns.

Fixed Deposit: It often struggle to beat inflation, especially after taxes.

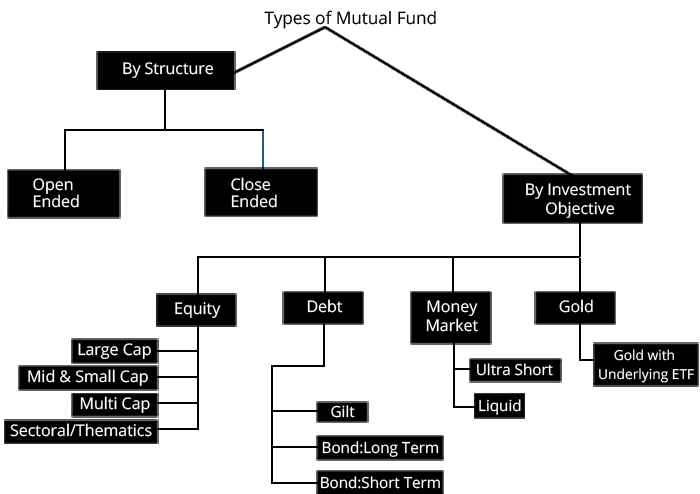

Mutual Funds: Equity Mutual Funds have historically delivered inflation-beating returns over the long term.

Gold: It is considered a hedge against inflation during periods of high uncertainty.

Equity Markets: Companies with strong pricing power are better positioned to pass rising costs to consumers.

Inflation vs Deflation vs Disinflation

| Term | Meaning |

|---|---|

| Inflation | Rising prices |

| Deflation | Falling prices |

| Disinflation | Slowing rate of inflation |

Is Inflation Good or Bad?

Inflation is neither entirely good nor entirely bad.

- Moderate inflation supports economic growth

- High inflation reduces purchasing power and savings

- Deflation discourages spending and investment

Therefore, central banks aim to maintain low and stable inflation.

FAQs

1. What are the main effects of inflation?

A: The main effect of inflation is that the cost of goods and services will increase over a given period. For example, the cost of similar commodities can double in 20 years due to inflation. When inflation is high, the cost of living increases and the currency's purchasing power reduces. Hence, the cost of goods and services increases.

2. Does inflation affect economic growth?

A: Yes, inflation affects the economy. Slow inflation is necessary to promote growth and help economic progress. It also encourages the consumer to purchase and save. However, hyperinflation can prove to be harmful to the economy as it can cause the piece of goods and services to increase significantly and lead to hoarding, reduced savings, and prevent economic growth.

3. Who measures inflation in India?

A: Inflation in India is measured by the Ministry of Statistics and Programme Implementation (MoSPI) through the Consumer Price Index (CPI).

4. How is inflation measured?

A: Inflation is measured using price indices such as CPI. Some countries also use Wholesale Price Index (WPI) and Producer Price Index (PPI).

5. Does inflation affect the price of goods?

A: Yes, inflation leads to a continuous rise in the prices of goods and services.

Final Note

Inflation is an unavoidable part of a growing economy. Understanding how inflation works helps individuals make better financial decisions — from saving and Investing to long-term financial planning. When managed effectively by policymakers, inflation supports economic expansion while preserving purchasing power over time.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very helpful information

Very informative