Systematic Transfer Plan (STP)

Do you know that you can switch your Mutual Fund units from one scheme to another? Have you heard about STP? If yes, it’s good. If not, don’t worry, this article will help you with the same. In STP or Systematic Transfer Plan, the investor instructs the Mutual Fund to redeem the units of one scheme and invest it in another scheme on a regular basis. People who are having considerable money but are confused about the Volatility in equity markets can choose to invest through STP. So, let us look at the various aspects of Systematic Transfer Plan such as what is it, types of STP, benefits of STP, online investment in STP, and much more.

Talk to our investment specialist

What is Systematic Transfer Plan or STP?

Systematic Transfer Plan or STP is a twin of Systematic Investment plan (SIP) which helps people to take advantage of market volatility. However, the source from where the funds in SIP and STP are deposited is different. As mentioned earlier, in STP the investor gives instructions to the AMC to withdraw the units from one scheme and invest it in another scheme. However, STP can be exercised within the schemes of same fund house and not other fund houses. In addition, it is suitable for those people who want to invest a lumpsum amount but are not sure about the market volatilities. Such people can invest the lumpsum amount in a debt fund and then transfer a fixed amount in Equity Funds on a regular basis. So, let us understand how an STP works.

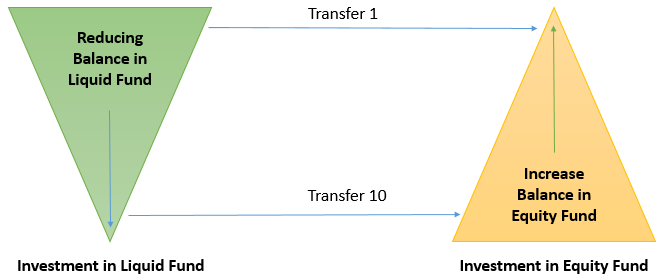

Assume that you have sold a car and its net proceeds are INR 3,50,000. You want to invest this money into equity funds however, you need afraid of the market volatilities. Therefore, you invest the entire amount in a liquid fund. Then, you start Investing INR 35,000 monthly into equity funds for a tenure of 10 months. This process of transferring funds from one scheme to another is known as STP. The image for explaining this process is given below as follows.

In this image, we can say that as the transfer from Liquid Funds to equity funds goes, the balance in liquid funds get reduced which is reflected by an increasing balance in equity funds.

Benefits of Systematic Transfer Plan

STP has its own benefits like SIP. These benefits are listed below as follows.

Rupee Cost Averaging

Similar to SIP, STP is also applicable for rupee cost averaging. This is because, in STP, people transfer a fixed amount into equity funds at regular intervals. In other words, they invest in the scheme at different price points. Therefore, when the market is showing a downward trend then people can get more units while in case of an upward trend, people will get less units. As a consequence, the purchase prices gets averaged out over a period of time. Hence, the concept of rupee cost averaging applies.

Consistent Returns

Another advantage of STP is consistent returns. People can earn consistent returns through STP as in this method, the money is invested in debt/liquid funds that fetch interest income till the entire money is not transferred to equity funds. These debt funds earn more income as compared to savings Bank account and people can help to click and ensure to perform better.

Portfolio Rebalancing

People can use STP as a technique to rebalance their Portfolio. For example, if people feel that their allocation towards debt funds is higher then; they can transfer the excess money to equity funds through Systematic Transfer Plan and vice versa. As a consequence, investors can earn more returns effectively and pave way for wealth creation.

Convenience in Frequency

People can choose the frequency of STP as per their convenience. STPs can be daily, weekly, monthly, and quarterly that is offered by the fund house. Consequently, people can choose the STP frequency as per their choice. They even can specify the dates on which the STP transaction needs to be conducted. If in case the STP date is not specified, then the AMC takes the default date.

Categories of STP

STP is classified into various types such as Fixed STP, Capital Appreciation STP, and Flexi STP. So, let us understand what each of these categories means.

Fixed STP: In fixed STP, individuals transfer a fixed sum of money to the target Mutual Fund scheme. This STP amount is decided at the beginning of the investment.

Capital Appreciation: In this category of Systematic Transfer Plan, individuals transfer the profits or income generated from the first scheme is transferred to the target Mutual Fund. In this type, investors can ensure that their principal portion remains safe.

Flexi STP: Under flexi STP, people can transfer variable amount from an existing scheme to a target scheme. Here, the individual needs to transfer a minimum fixed amount and the variable amount will depend on the volatility of the market. In case if the markets are showing downtrends then; people can invest more in the target scheme taking the advantage of falling prices. On the contrary, in case of increasing prices, people can invest only the minimum amount.

Costs and Tax Rules Related to Systematic Transfer Plan

As we know that nothing is available for free similarly, in case of Systematic Transfer Plan, there are certain costs associated with it. So, let us have a glance through the costs and tax implication associated with STP.

Systematic Transfer Plan Taxation

Most of the transactions in case of Systematic Transfer Plan is done from debt funds to equity funds. Every transfer done in case of STP is considered to be a withdrawal and are subject to Capital Gains. Whenever the transfer takes place from debt fund to equity funds then; the capital gain rules for debt funds apply. If the transfer is done within a period of three years then, such transfer is applicable to short-term capital gain and any transfer done after three years is applicable for long-term capital gain. In case of debt funds, the short-term capital gain is taxed as per the individual’s applicable tax rates while the long-term capital gain is taxed at 20% with indexation benefits. Therefore, people should be aware of such benefits while investing through Systematic Transfer Plan so that they can plan their investments accordingly and enjoy maximum benefits.

Exit Load

People before investing in any debt scheme should check whether the debt fund have exit load or not. Though most of the liquid funds do not have exit load, however; if you choose ultra short-term funds does attract exit load. Therefore, people should consider these load implications before investing or else, they might not be able to enjoy maximum benefits.

STP Vs SIP

Though SIP and STP sound the same there still exist some differences between them. In case of a SIP, the money is invested from the investor’s bank account to the target Mutual Fund scheme. On the contrary, in case of STP, the investor’s money is transferred from one Mutual Fund scheme (probably debt fund) to the target Mutual Fund scheme (Equity Fund). Therefore, there exists a difference in the source of funds from where the money is coming. Also, in STP, people can earn more returns as the money is invested in debt funds as compared to SIP, where money is in bank accounts. This is because the debt funds earn more income as compared to bank interest.

Conclusion- To conclude, we can say that Systematic Transfer Plan has its own advantages. However, people, before investing or opting for any plans, need to understand the scheme’s modalities completely. They also should check whether the scheme offers STP option or not. Moreover, they can consider the opinion of a financial advisor. This will ensure that people will earn maximum returns on their investment.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.