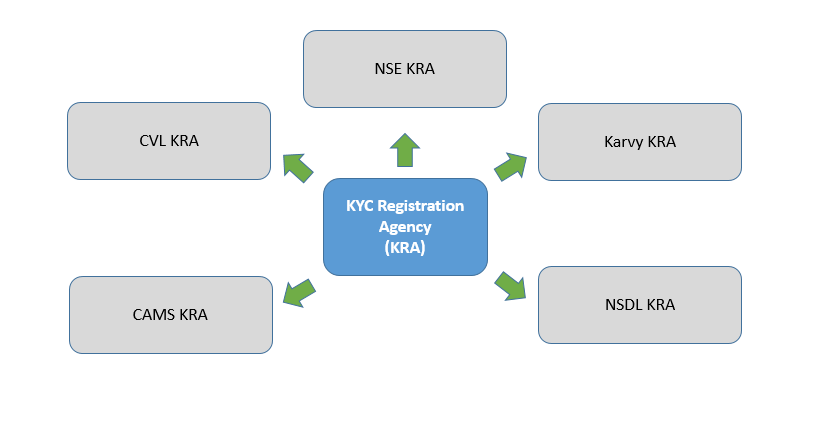

KRA - KYC Registration Agency

KRA full form is KYC Registration Agency. KRA is registered with SEBI under the KYC Regulations Act of 2011. This agency is responsible for maintaining the KYC records of the investors centrally.

These registration agencies maintain these records on behalf of the capital market intermediaries such as Asset Management Companies, stock brokers etc. that are registered with SEBI. There are different KRA portals such as CAMSKRA, CVLKRA, Karvy KRA etc. to check KYC Status.

What is the need for KRA?

Previously, the KYC process across different SEBI registered intermediaries like venture capital funds, Portfolio managers, Mutual Funds, etc. was not uniform at all. There was a separate KYC process for each intermediary which was very tiresome for investors. Thus, in order to bring uniformity in the KYC process, SEBI introduced the concept of KYC Registration Agency. KYC registration agency eliminates the duplication of the KYC process for different intermediaries. As per the SEBI guidelines of 2011, the investors who wish to invest in Mutual Funds or become KYC complaint have to register with any one of the above-mentioned agencies. Once the customers are registered or are KYC compliant, they can start Investing in Mutual Funds. Once an investor completes a KYC process with any SEBI registered KYC registration agency, they don’t have to repeat the process while interacting with any other KYC registration agencies. The records of the completed KYC process are stored centrally by the agency and can be accessed by other intermediaries and KYC registration agencies. Also, any changes that may occur in the future are also updated centrally. This can be done by giving a single request to the agency through any registered intermediary.

Check KYC Status

There are five different KYC Registration Agencies in place to help the investors.

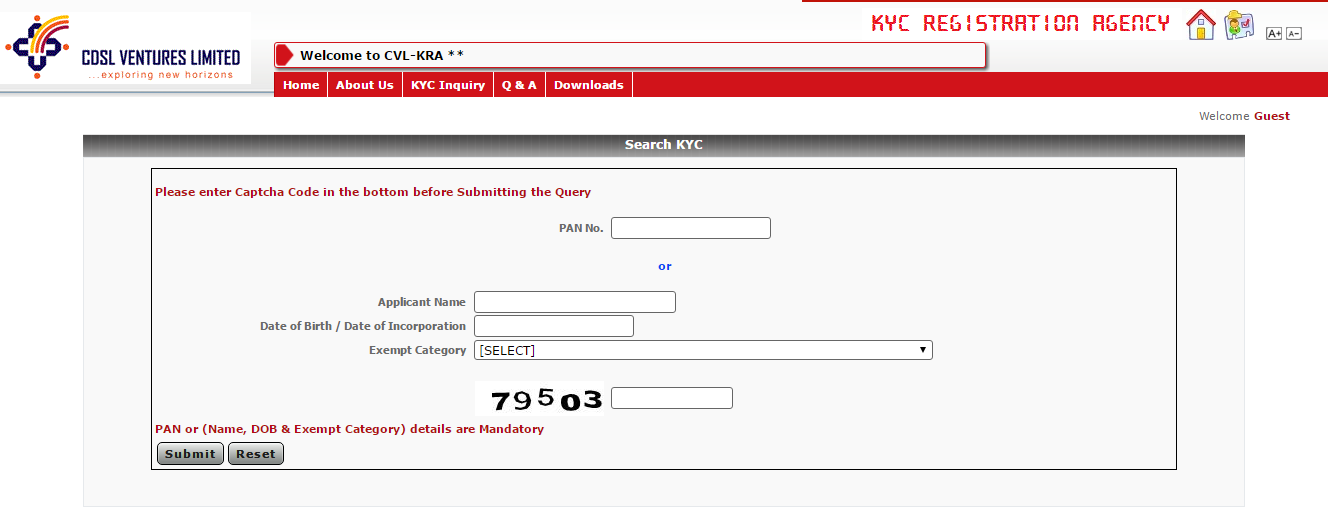

CVL KRA

CVL KRA is one of the KYC registration agencies (KRA) in the country where you can check your KYC status. CVLKRA offers KYC and KYC related services for all the fund houses, stockbrokers and other agencies that are SEBI complaint. CDSL Ventures Limited – CVL – is a wholly owned subsidiary of the Central Depository Services of India (CDSL). CDSL is the second securities depository in India behind the National Securities Depository. CVL relies on its knowledge in the securities market domain and sustaining the data confidentiality. CVLKRA was the first central-KYC (cKYC) Registration Agency in the securities market. CVL was earlier administered by the Mutual Fund industry to handle the record keeping and customer profiling for giving out KYC verification to the Mutual Fund investors.

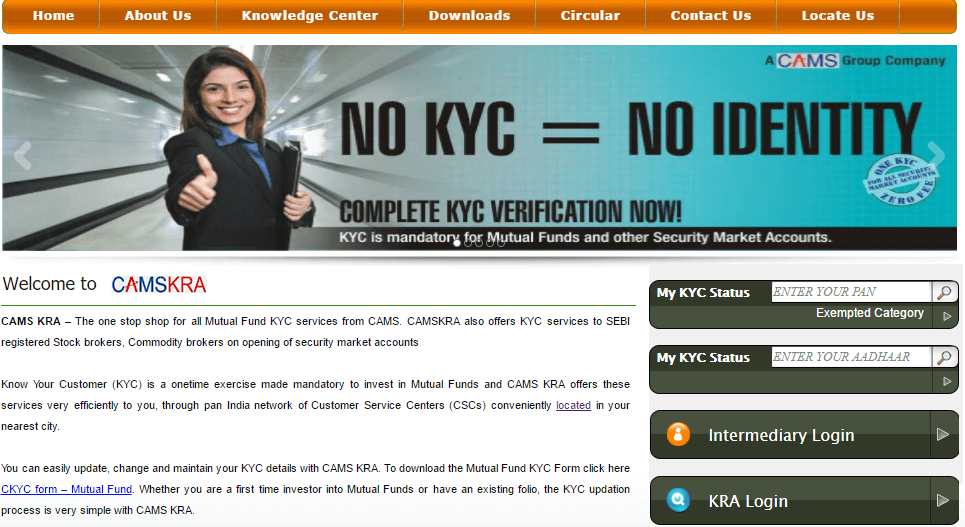

CAMS KRA

CAMS stands for Computer Age Management Services Pvt Ltd, was established in 1988 to focus on software development. In the 1990s it shifted its focus towards the Mutual Fund industry and became an R & T agent (Registrar & Transfer Agent) for Mutual Funds. An R & T agent handles all the procedures for handling investor forms, redemptions, etc. for Mutual Fund entities. CAMS set up a subsidiary – CAMS Investor Services Pvt. Ltd. (CISPL) – for the purpose of KYC processing. CISPL was given the authority to act as a KYC Registration Agency (KRA) in June 2012. In the month of July 2012, CAMS KRA was launched by CISPL to carry out the common KYC verification process across all the financial intermediaries regulated by SEBI. CAMS KRA also provides a platform for a paperless Aadhaar-based verification process to be KYC compliant in order to start investing in the Mutual Funds. You can check your KYC status for both eKYC and regular KYC process on its website.

Talk to our investment specialist

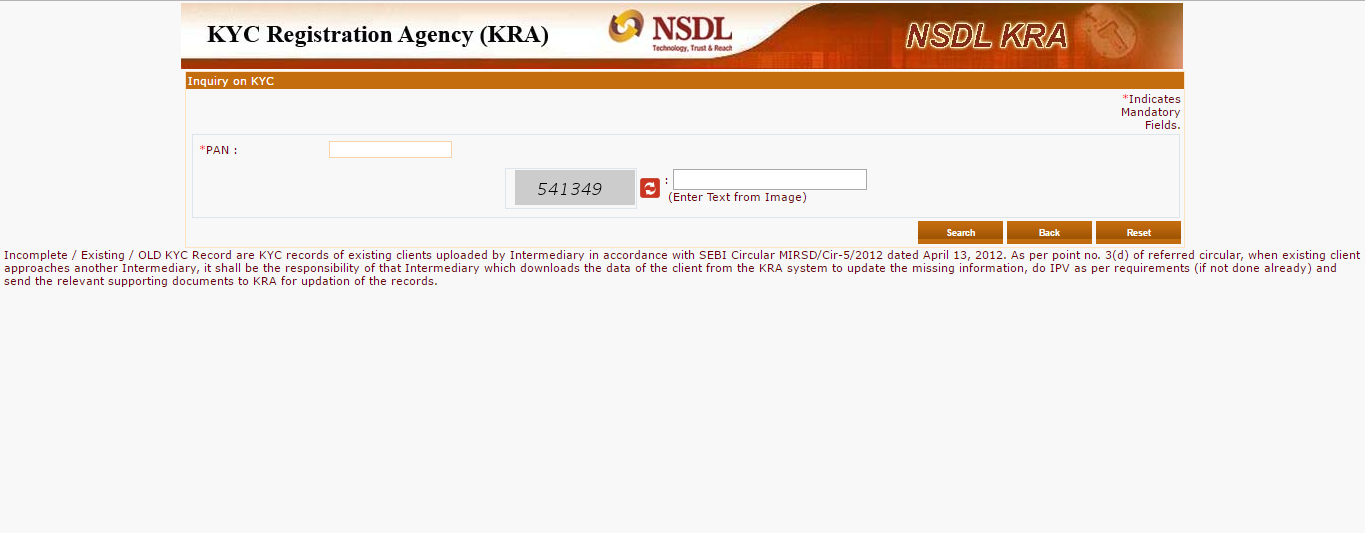

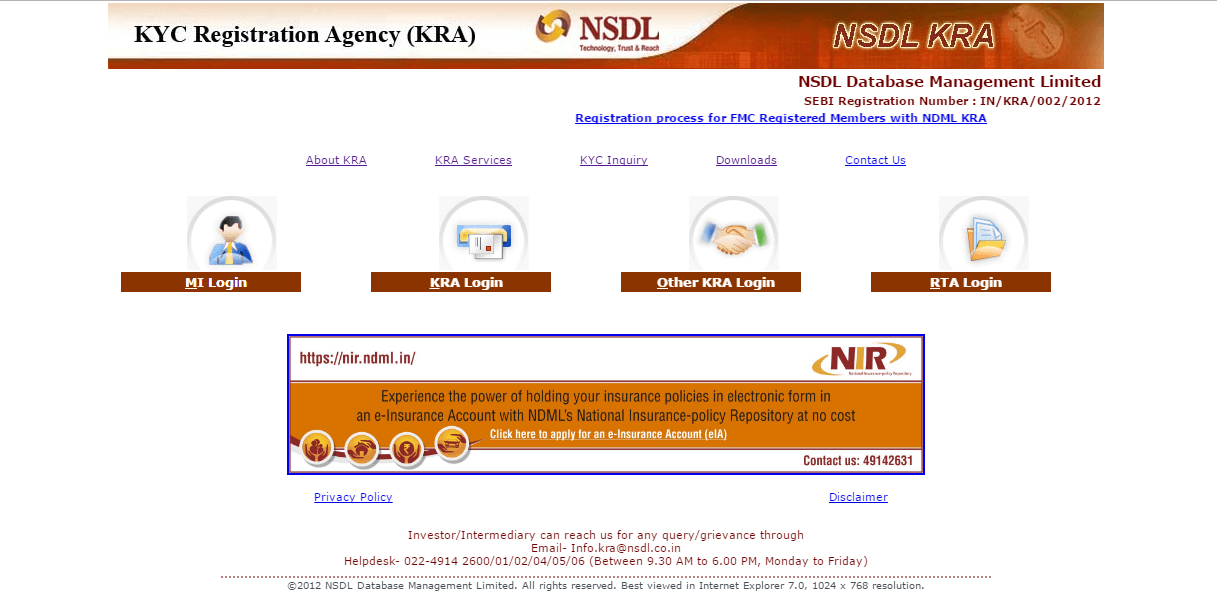

NSDL KRA

NSDL Database Management Limited is a fully owned subsidiary of National Securities Depository Ltd. (NSDL). NSDL Data Management Ltd (NDML) is one of the leading entities in India in providing business and knowledge process services. It mainly focuses on delivering the best possible services to the customers with the help of an innovative framework. NDML KRA functions as an independent entity backed by a strong team of professionals with a vast amount of experience. NDML KRA uses the latest technology for centralised data management for its clients. It does this on behalf of the SEBI compliant securities market entities and allows you to check your KYC status.

Karvy KRA

Karvy Data Management Services (KDMS) is one of India’s prominent leaders in providing business and knowledge process services. KRISP KRA – more popularly known as Karvy KRA – was brought to the customers by KDMS. KDMS plans to expand its reach by tapping the increasing popularity of investing in financial products in the current Indian Market. Karvy runs as an independent entity backed by a strong team of seasoned experts of the markets and it uses the latest technology for data management. Karvy KRA maintains the records of its clients in a centralised manner on behalf of the SEBI registered market entities and allows you to check your KYC status.

NSE KRA

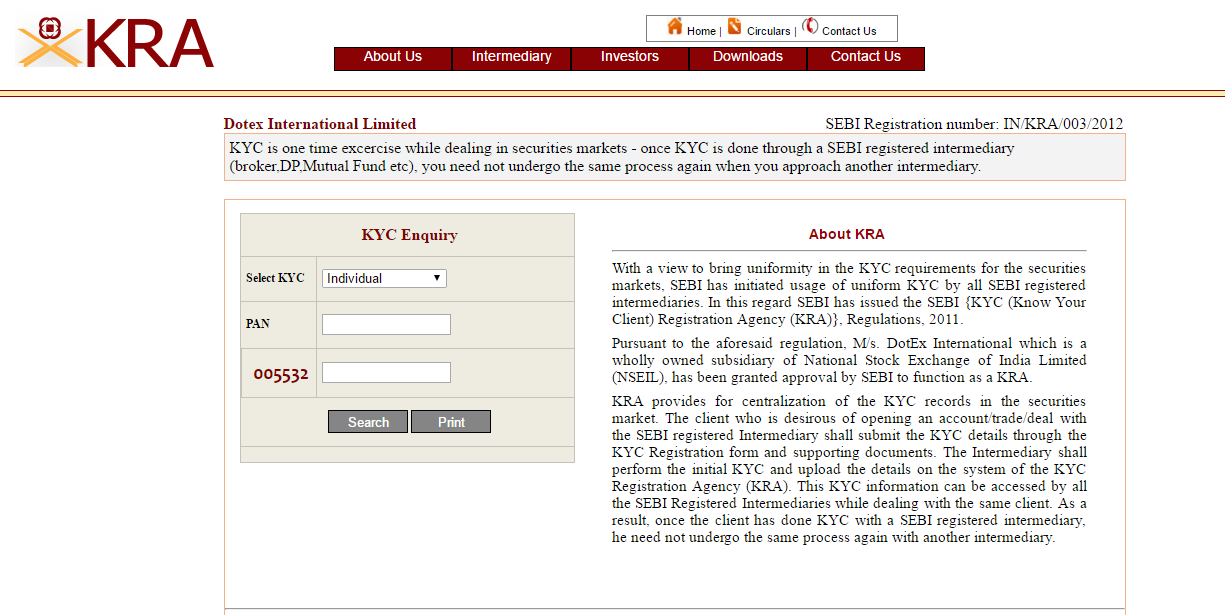

The National Stock Exchange (NSE) is one of the leading stock exchanges in the country and is ranked as the fourth largest in the world in terms of equity trending volumes in 2015(according to World Federation of Exchanges). NSE gives out real-time and high-speed streaming of data about trade quotations and other markets-related details. NSE has a fully integrated working business model and has launched its KYC registration agency (KRA) with the help of its subsidiary DotEx International. It decided to offer the KRA facilities such as providing KYC status to the investors after SEBI brought in the KRA regulation in 2011. It aims to keep delivering innovatively in both non-trading & trading business environments, and providing quality data & services to clients & other participants in the securities market.

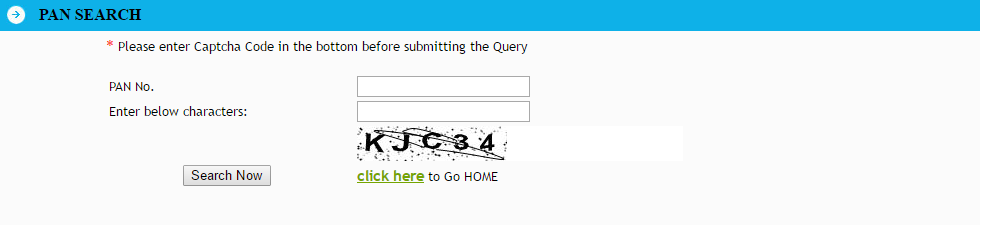

If you have applied for a KYC process, either a PAN based KYC process or an Aadhaar based KYC process, you can check you KYC status on any of the above mentioned KRA websites. For PAN based KYC status check, you need to provide your PAN Card number to the agency and for Aadhaar based KYC, provide the Aadhaar card number.

What does the KYC Status mean?

KYC Registered: Your records are successfully registered with the KRA.

KYC Under Process: Your KYC process is being accepted by the KRA and it is under process.

KYC On Hold: Your KYC process is on hold due to the discrepancy in the KYC documents. The documents that are incorrect need to be re-submitted.

KYC Rejected: Your KYC has been rejected by the KRA after verification of PAN with other KRAs. This means that your PAN is available with other KRA.

Not Available: Your KYC record is not available in any KRAs.

Aforementioned 5 KYC statuses can also reflect as Incomplete/Existing/Old KYC. Under such a status, you may need to submit fresh KYC documents to update your KYC records.

KRA Registration Process

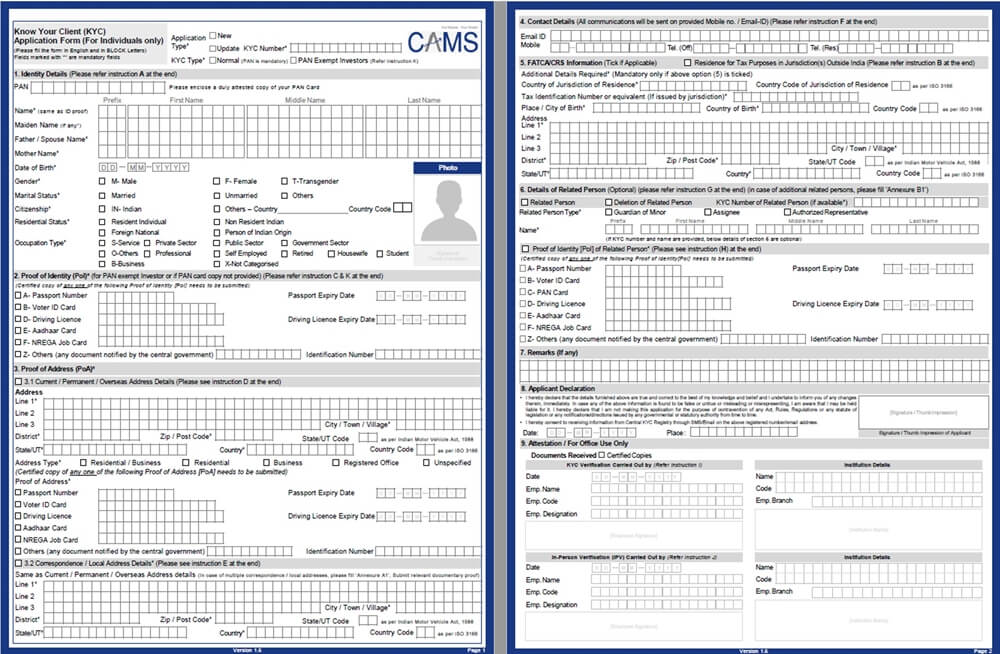

1. Fill-up KYC Form Along with correct set of documents

If an investor wants to complete their KYC through a KYC Registration Agency, they need to fill the KYC Form. Along with the correctly filled KYC form, you will need to submit the self-attested set of documents for proof of identity and proof of address (for individual KYC process). For non-individual KYC there are other sets of documents prescribed by SEBI. You can download KYC form of each KRA from their respective website.

2. Documents submission and KYC verification

After you submit the required documents, the financial entity that you are interacting with checks if the details mentioned in KYC form are correct and match with the submitted documents. In case of any discrepancies, the entity will raise the issue in the KRA system and update it after receiving the required KYC document from the customer. Also, there is an In-Person Verification (IPV) process for further authentication of the client. Investors can check their PAN card based KYC status on any of the KRA websites.

3. Uploading and updating your details

All the KYC registration agencies accept the KYC documents in a scanned format. This is done as per the SEBI’s regulation for KRAs. An investor can choose to update their details in the KRA system can do so by filling out the KYC update form in any KYC Registration Agency.

Functions of a KYC Registration Agency

A KYC Registration Agency’s functions and duties are defined by the SEBI KRA Regulations 2011. They are as follows –

KYC registration agency is responsible for storing, guarding, and retrieving the KYC records that are submitted to the various intermediaries that are registered with SEBI

All the original KYC documents will be retained by the KYC registration agency in both electronic and physical form for a specified period. Also, it needs to make sure that the retrieval of the KYC information is processed within a specified period of time

Any update in the information of the client should be disseminated by the KYC registration agency to all the intermediaries that are associated with the agency with respect to the client.

The agency should have electronic connectivity with the other KYC registration agencies in order to have interoperability among the agencies.

KYC Registration Agency should send a letter of confirmation to each client on receiving the KYC documents from the intermediary.

FAQs

1. What is KYC?

A: KYC is the acronym for Know, Your Customer. According to the KYC Regulations Act of 2011, all banks and financial institutions must have the duly filled KYC forms of their customers as a part of the system. This process is supervised by the Securities and Exchange Board of India or SEBI.

2. Who fills the KYC form?

A: KYC form is filled by the customer of the Bank or the financial institution. For example, you want to open a Demat account with a bank, you will need to submit the KYC form and other relevant documents. Suppose you are interested in investing in mutual funds. In that case, there are five different types of KYC form, and you will have to fill based on whether you are investing as an individual or a hindu undivided family (HUF) and other similar details.

3. Can I check the KYC status online?

A: Yes, you can check the KYC status online. However, it will depend upon through which agency you have registered your KYC documents.

4. Are there registered agencies to submit your KYC documents?

A: Yes, you must submit your KYC documents through one of the five SEBI registered agencies. The agencies responsible for KYC registration to help investors are as follows:

- CDSL Ventures Limited (CVL)

- Computer Age Management Services Pvt Ltd.

- NSDL Database Management Limited

- Karvy Data Management Services

- The National Stock Exchange or NSE

All of these are SEBI registered agencies responsible for KYC registration.

5. What details will I need to check my KYC registration status online?

A: To check your KYC registration status online, you will have to log in to the specific agency's website through which you have registered your KYC documents. After that, you will have to provide your PAN details and your Aadhar number to get your KYC registration status.

6. Why is KYC important?

A: KYC was introduced to prevent any fraudulent and illegal activities. It authenticates the customers and ensures and assesses the risks involved in the transaction. It is essential to protect the interest of the customers and the financial institution.

7. Can the KYC process be completed online?

A: Yes, the KYC process can be completed online. For that, you will have to provide your PAN details and your Aadhar card number. You will receive an OTP UIDAI, and when you type in the correct OTP, the registration and verification process will be completed. Hence, you must give the mobile number you had provided during your Aadhar card registration; otherwise, you will not complete the registration process.

8. What is in-person verification of KYC?

A: For in-person verification, you will have to be physically present to complete the registration process. In this process, you will have to submit the form with the necessary details and then follow the in-person verification process.

9. How can you change NRI status to resident status in KYC?

A: The KYC is a form that you have to provide your bank if you want to open a Savings Account, term deposit, DEMAT account, or want to have any such financial transaction through the bank. This document provides the banks with specific necessary details such as identity proof, customer authentication, and risk assessment. However, if you are a Non-Resident Indian and want to convert your NRE or NRO accounts into a standard savings account, you will have to change your KYC form accordingly. Earlier the SEBI had made it mandatory that separate registration agencies would handle the KYC aspect of customers.

For example, CAMS KRA or the Computer Age Management Services Pvt Ltd launched the eKYC for a paperless Aadhaar-based verification process for KYC. As an NRI, if you are changing your residential status, you can use this method to change your KYC status and convert your NRE and NRO accounts to regular savings accounts. Similarly, the National Securities Depository Ltd and the Karvy Data Management Services or KDMS, both working on behalf of the SEBI, allow you to check and change your KYC documents. You will have to apply for the changes, provide the necessary documents to change your KYC status.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

very nice and clear

How can you change NRI status to resident status in KYC?