Karvy KRA

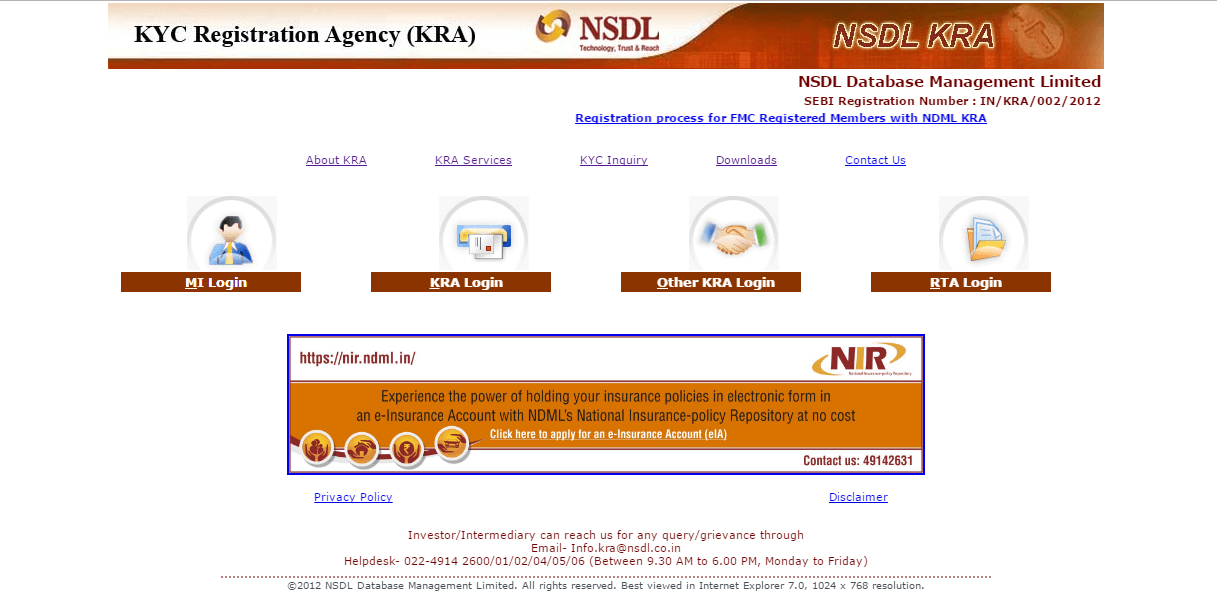

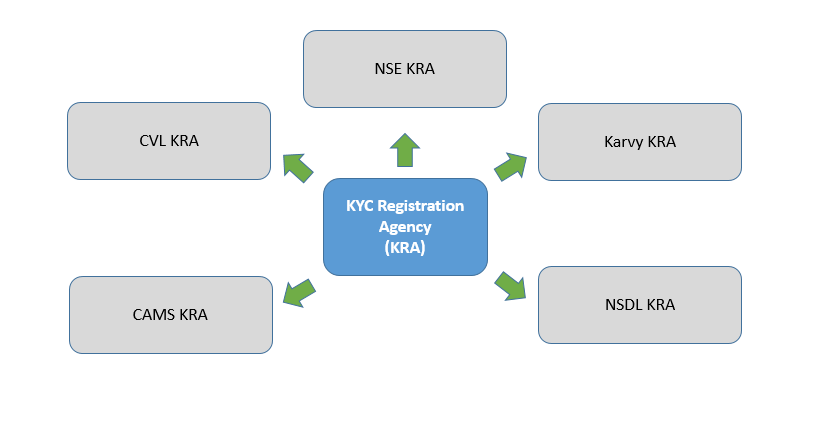

Karvy KRAis one of the five KYC registration agencies (KRA) along with other KRAs such as CVLKRA, CAMS KRA, NSDL KRA and NSE KRA. Karvy KRA offers KYC related services for Asset Management Companies and other agencies that are compliant with SEBI.

KYC – Know Your Customer – is a one-time process to confirm and authenticate the identity of an investor. This process is compulsory for all customers buying products of financial institutions such as banks, stock exchanges, Mutual Fund Houses etc. Before the inception of KRA, an investor had to carry out the KYC verification process with each of these financial institutions separately. SEBI then introduced the KYC registration agency (KRA) in order to bring uniformity in the registration process. As mentioned before, Karvy KRA is one such KRA among the other four that provide investors with KYC related services. With Karvy KRA you can check your KYC Status, download the KYC Form and complete the KYC KRA verification.

About KARVY

Karvy Data Management Services (KDMS) is one of India's emerging leaders in providing business and knowledge process services. It mainly focuses on the delivery of the business related services through an innovative strategy. KRISP KRA - more popularly known as Karvy KRA - was brought to investors by KDMS. KDMS aims to expand its reach by riding on the increasing penetration of financial products in current Indian market. Karvy runs as an independent institution backed by a strong team of seasoned professionals and the latest technology for data management. Karvy KRA keeps the records of its clients in a centralised manner on behalf of the SEBI registered market intermediaries.

Talk to our investment specialist

KYC FORM

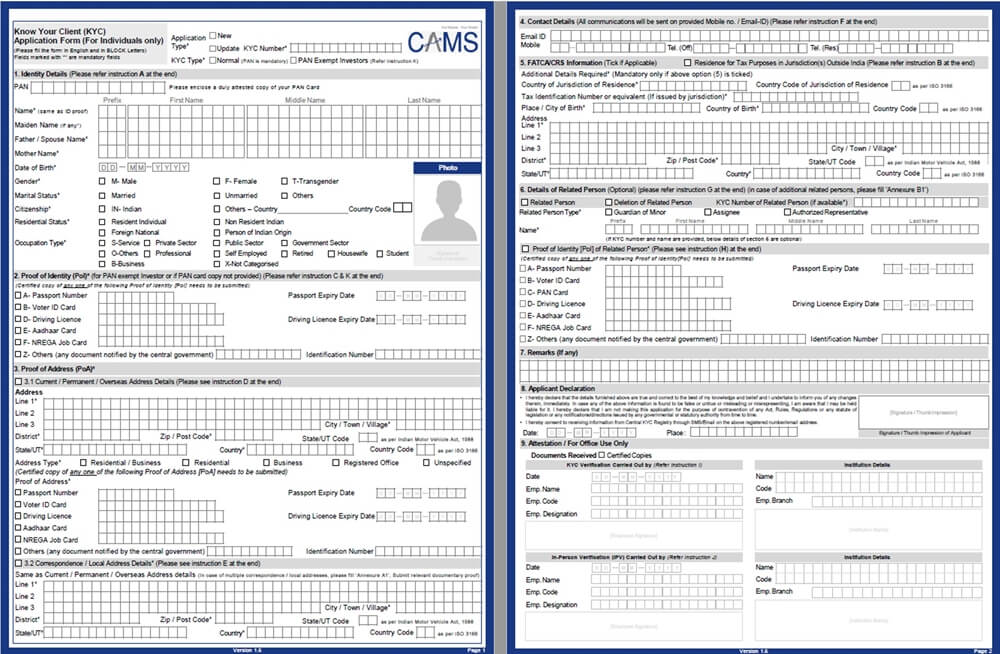

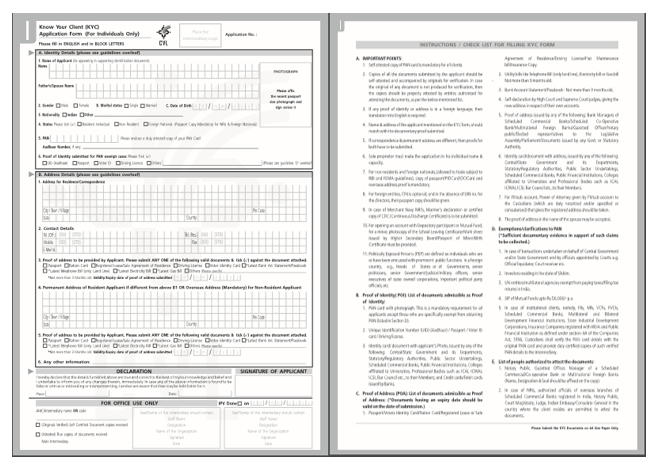

Karvy KRA website provides two types of KYC form for download

- KYC application form for individual and non-individual (to verify regular KYC)

- Intermediary registration form (for those who want to do KYC process through Karvy KRA)

- KARVY INDIVIDUAL KYC FORM- Download Now!

- KARVY NON-INDIVIDUAL KYC FORM- Download Now! Download Now!

KYC Status

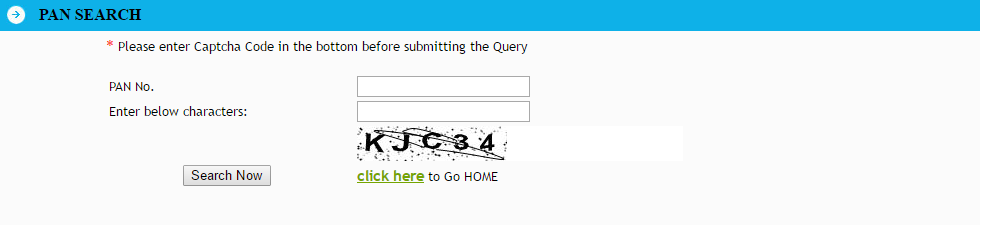

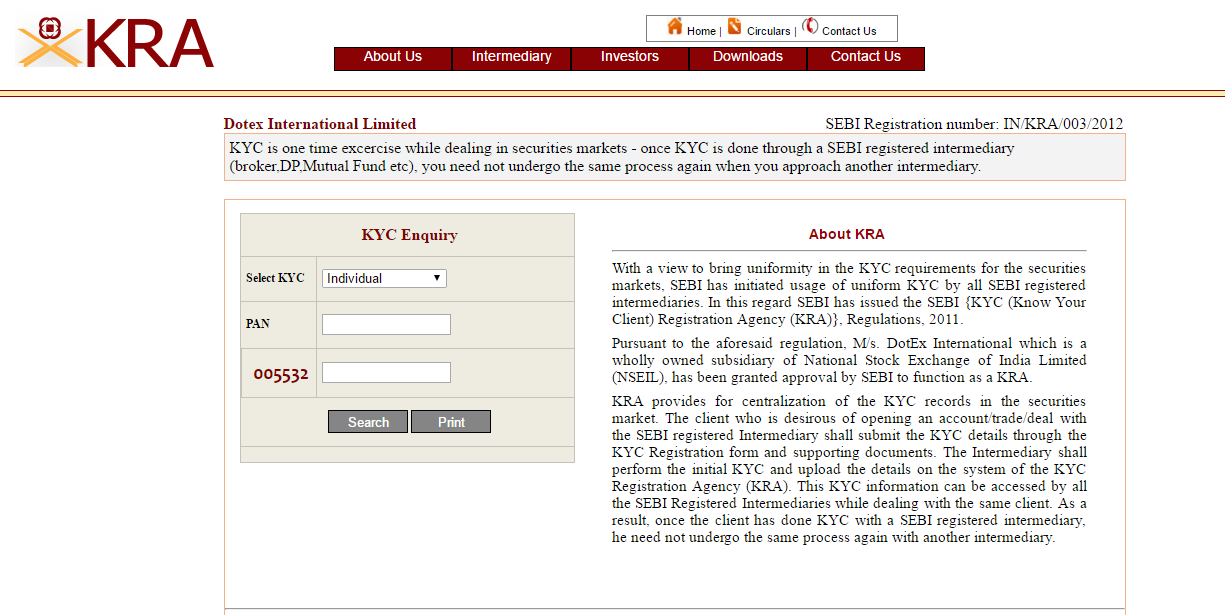

Your KYC status – PAN based - can be checked on the Karvy KRA portal. To do a KYC enquiry, you need to click on the KYC enquiry link on the home page of the Karvy KRA website. You then need to enter your PAN Card number and the security captcha to know your current KYC details.

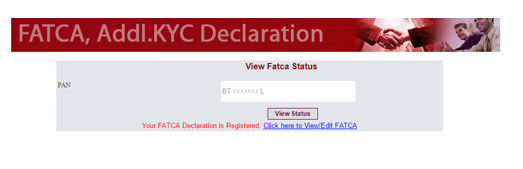

KARVY FATCA Status

You can also check your FATCA declaration status with the help of Karvy KRA. To know the FATCA status, you need to enter your PAN card number. If you have FATCA declaration registered, the result will show a positive response. You can also view or edit your FATCA details by clicking the link given on the page.

CAMS KARVY Consolidated Account Statement

CAMS, Karvy, SBFS and FTAMIL have come together to provide better services and convenience to the investors. They provide investors with a consolidated account statement of their investment Portfolio. If you have registered your email in your investment folios across the funds serviced by Karvy, CAMS, SBFS and FTAMIL, then you can use the Mailback Service get the consolidated Account Statement of your investment portfolio.

Services by KARVY KRA

On the website of Karvy, you can find useful links for following services

- KYC services

- Frequently Asked Questions (FAQ)

- KYC Form and other downloads

- News about new regulations and circulars

- You can post your query to Karvy

- Contact Karvy

FAQs

1. What is KYC?

A: KYC stands for Know Your Customer. When you invest in Mutual Funds or even open a Bank account, you must furnish your KYC details to the bank or the financial institute. This is done to prevent any fraudulent activity and protects the rights of all parties involved, i.e., the bank, the financial institute, and the investor.

2. How can Karvy KYC help me?

A: The Karvy KYC is an online database where you can register your KYC details for Mutual Fund investment. It is registered under the Securities and Exchange Board of India (SEBI) as a centralized database for maintaining all KYC details of registered customers. So if you do KYC registration on the Karvy KRA portal, you will not have to repeat it anymore, irrespective of the number of mutual fund investments you make.

3. How is KYC verification done online?

A: KYC verification is done online with the help of One Time Password (OTP) sent to your registered mobile number. When you type in the number, your KYC verification will be done. However, it will take some time for you to receive a confirmation that the KYC verification process is completed.

4. How is KYC verification done offline?

A: KYC verification can be done offline when someone visits you and carries out a biometric verification. However, this process can take longer, and hence, online verification is preferred.

5. Can I check the status of my KYC verification online?

A: Yes, you can check your KYC verification status by logging onto Karvy KRA's website and providing the login details. After that, you can check your KYC status. If it shows pending, then the verification process is still underway. If it shows completed, then the KYC verification is done.

6. Can I download the KYC form from the website?

A: Yes, you can download the KYC form from the Karvy website itself. Otherwise, you can fill the form online. You can download the form if you are planning to submit the form physically to an intermediary.

7. If I send the form through an intermediary, how will I get a confirmation?

A: Once the duly filled-in form and the necessary details reach the KRA, a letter will be sent to the client informing him that the documents have been received from the intermediary. After confirmation of the KYC details, a confirmation mail and a letter will also be sent to the client.

8. Will the data I share be protected?

A: Yes, Karvy KRA maintains a database as per the SEBI regulations, and the information shared by the customers cannot be used for commercial purposes. Hence, you can be assured that the data you share will be protected.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good opportunity