NSE KRA

NSE KRA is one of the five KYC registration agencies (KRA) in India. NSEKRA offers KYC and KYC related services for the Mutual Fund Houses, stockbrokers and other agencies that are registered with SEBI.

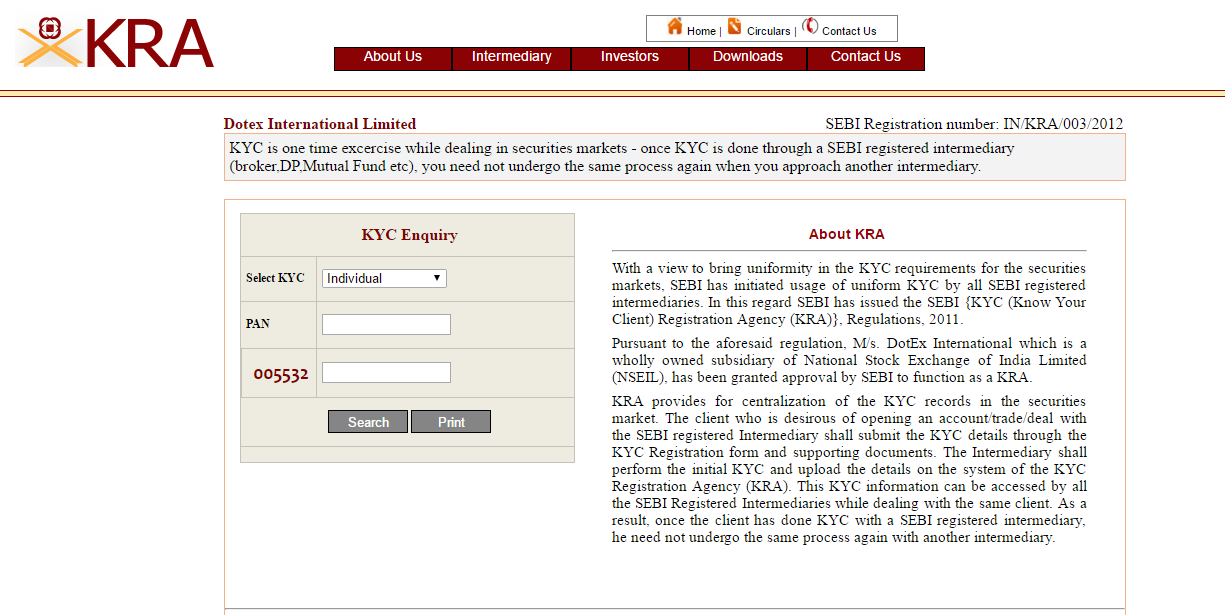

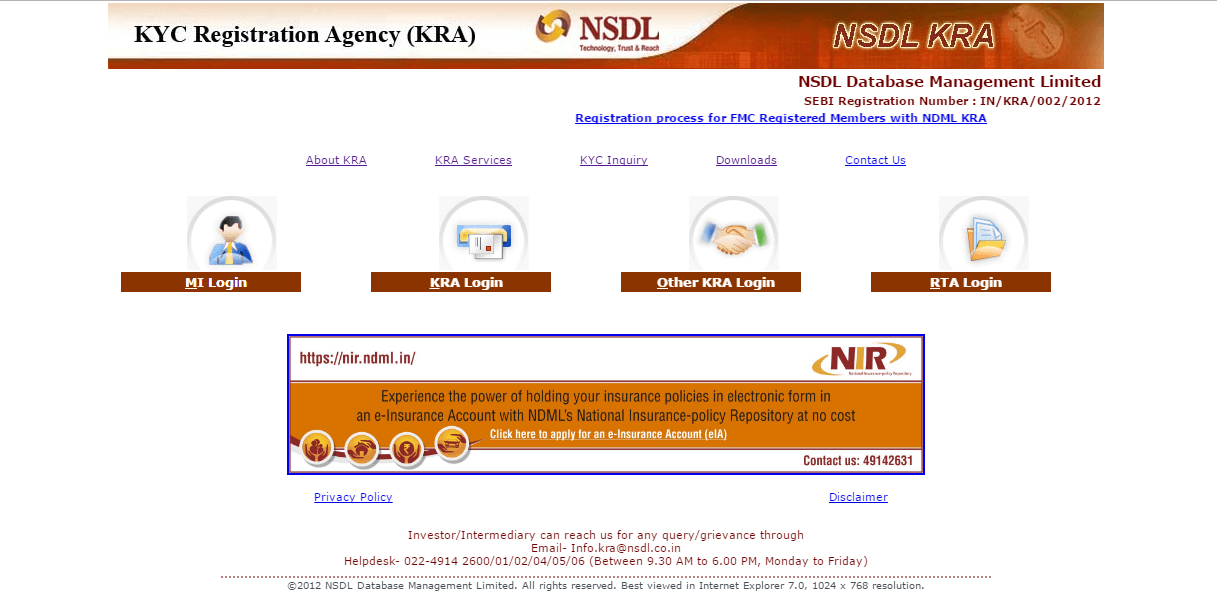

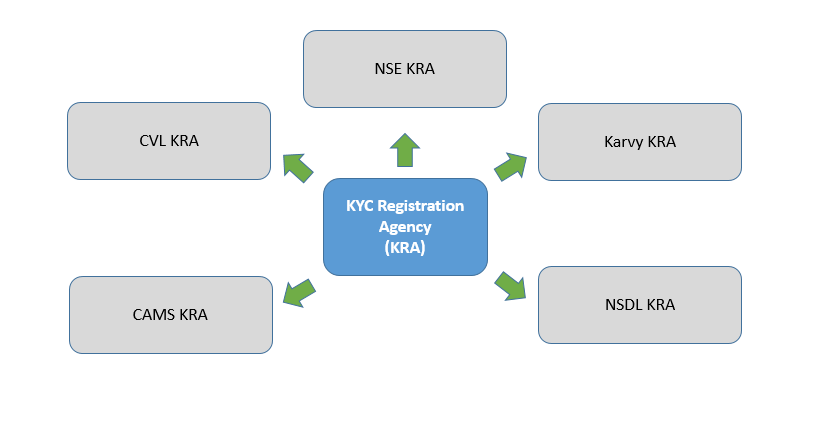

KYC - Know Your Customer – is a one-time process to verify the identity of an investor and the process is mandatory for all the financial institutions such as banks, Mutual Fund houses etc. Earlier, each of these financial institutions had a separate KYC verification process. Thus to bring uniformity in the registration process, SEBI introduced the KYC registration agency (KRA). As said earlier NSE KRA along with the other four KRA provide KYC related services to clients. You can check the KYC Status of your application, download the KYC Form and complete the KYC KRA verification with NSE KRA. CVLKRA, CAMSKRA, NSDL KRA, and Karvy KRA are the other four KRAs.

About NSE KRA

The National Stock Exchange (NSE) is the leading stock exchange in the country and fourth largest in the world in terms of equity trending volumes in 2015 according to WFE (World Federation of Exchanges). NSE provides real-time and high-speed streaming of data about trade quotations and other markets-related information. NSE has a fully integrated working business structure. NSE launched its KYC registration agency (KRA) with the help of its subsidiary DotEx International. NSE decided to offer the KRA facility after SEBI brought in the KRA regulation in 2011. The National stock exchange is in the field of listings, clearing and settlement services, trading services, indices, etc. It aims to keep delivering innovatively in both non-trading & trading business environments, providing quality data & services to clients and other participants in the market.

KYC Form

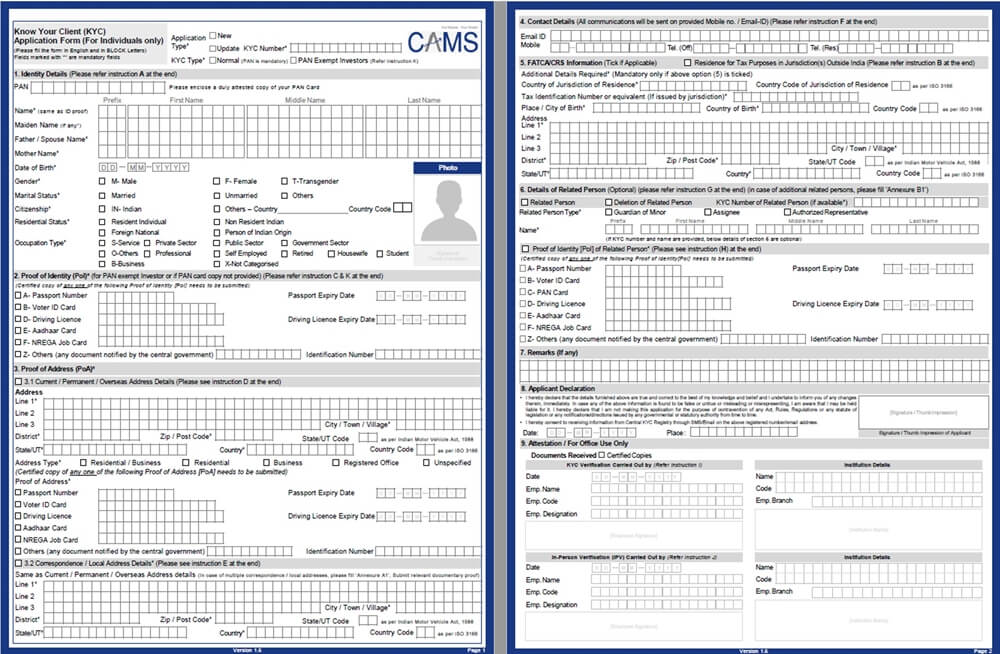

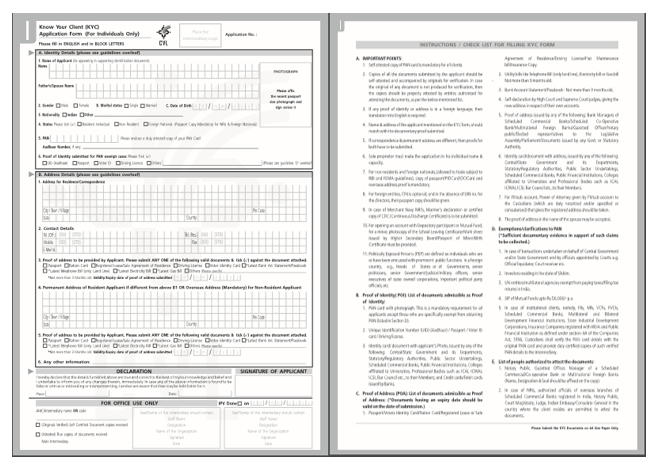

You can download the KYC form from the NSE KRA website. There are two basic types of KYC forms available for download on the NSE KRA website

- KYC form for Individual

- KYC form for Non-individual

NSEKRA INDIVIDUAL KYC FORM- Download Now!

NSEKRA NON-INDIVIDUAL KYC FORMDownload Now! Download Now!

KYC Status

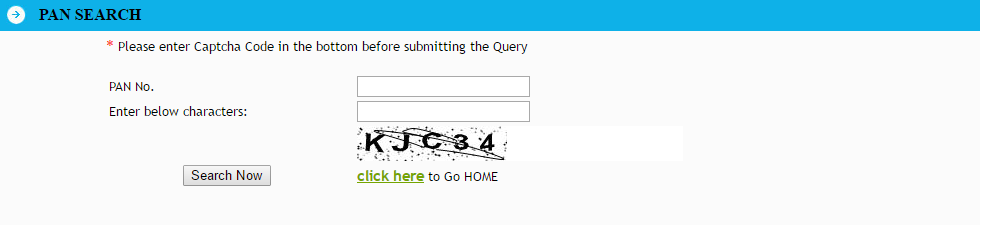

Your KYC status – PAN based - can be checked on the NSE KRA website. You need to enter your PAN Card number, select the KYC enquiry type (Individual/Non-Individual) and enter the captcha code. You will get the all the details about your KYC status on the NSE KRA portal.

KYC Documents for NSEKRA

The Government of India has provided the list of six documents that are called as Officially Valid Documents (OVD) as a proof of identity and also for address proof. These documents are required to be attached with a correctly filled KYC form during the time of submission at the NSE KRA intermediary. These documents are necessary for KYC verification. Here is the list of the KYC documents –

- Passport

- Driving Licence

- Voter’s Identity Card

- PAN card

- aadhaar card

- A valid document which has your residential proof in case the above-mentioned documents do not contain your address details

FAQs

1. Who offers the NSE KRA facility?

A: The NSE KRA facility is offered by the NSE Data & Analytics formed in 2000. It is a subsidiary wholly owned by the National Stock Exchange of India Ltd. (NSEIL).

2. What is the main feature of the KYC facility?

A: The primary feature of the KYC is that it is a single database through which details of stockbrokers, clients, investors, Portfolio managers, and Mutual Funds can be accessed. It protects the rights of the investors and the corporate.

3. Who can access the NSE KYC KRA?

A: The NSE KYC KRA can be accessed by SEBI registered intermediaries like brokers, depository participants, mutual funds, and portfolio managers. They need to access the database to ensure that the investors' information is correct and matches the KYC details on their form.

4. Is there communication between other KRAs?

A: Yes, interoperability is essential when it comes to KYC KRAs. Interoperability is necessary to check if the client's information is already available on a similar KRA system.

5. Who can check KYC status?

A: KYC details are usually uploaded by an individual or a non-individual. A non-individual KYC will be if you are filling a KYC on behalf of a company of which you are a partner. Here you will need to provide an intermediary logo on the KYC form. Otherwise, you can fill-up the KYC form as an individual investor. In both cases, you can check the KYC status online by logging in to NSE KYC KRA's website.

6. Can I change the details in KYC after submission?

A: Yes, if you want to update your mobile number or change the address then, you will have to log into your account in NSE KYC KRA. After that, you will have to click on update details and accordingly make the changes. When you make changes, a OTP will be sent to your registered mobile number or email ID.

7. Is the data shared with anyone?

A: No, NSE KRA has a strict protocol that does not allow the data you provide to be shared with any third parties. The data you provide is used to safeguard your investment and the other investors' rights; hence, it cannot be used for commercial purposes.

8. Do I need to repeat the process?

A: No, if you have registered once with NSE KRA, you do not need to repeat the process with any other KYC registration agency. Your information will be updated in a centralized database, accessed by your fund manager, Bank, or financial institute.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

WHILE CONTRIBUTING THE AMOUNT IN NPS GETTING ERROR LIKE User is not eligible for subsequent contribution. HOW TO FIX THE ISSUE.