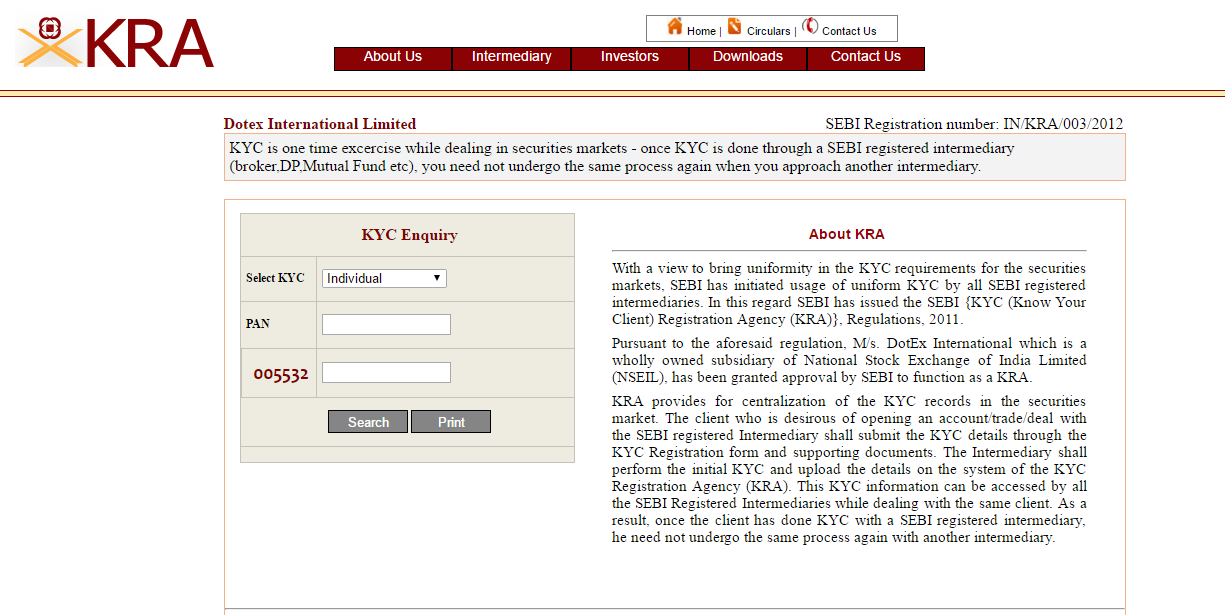

NSE Reintroduces Do Not Exercise Facility

From April 28, 2022, the National Stock Exchange (NSE) will restore the 'Do not Exercise (DNE)' Facility for stock options contracts. Traders can better manage the involved risk due to these adjustments, particularly when it comes to out-of-the-money contracts.

It will enable them to sell their open positions, thus, avoiding the dangers of physical delivery.

What is a Do Not Exercise Facility?

The Securities and Exchange Board of India (SEBI) mandated physical settlement of all options transactions in 2019. The Do Not Exercise was originally introduced in 2017 when the Securities Transaction Tax (STT) was applied to the total contract value, rather than the option premium value, as it is now.

Clients can also notify their brokers not to exercise the option strike price if the STT amount is larger than the premium value of the corresponding option contract by utilising a DNE command.

However, due to a change in the STT tax law, DNE was phased out in October 2021. This removal led to physical delivery coming into danger. If a client didn't settle his option contract before its expiry, he was forced to take or give delivery of the relevant stock, regardless of whether he had sufficient monies in his account.

Many retail investors who bought Hindalco's out-of-money put options incurred catastrophic losses due to a lack of awareness of the new restrictions that went into effect in October 2021.

Talk to our investment specialist

Why is DNE being Restored?

The mechanism, implemented in 2017, provided a Fail-safe for options traders throughout the cash-settlement phase of options contracts. The approach became obsolete with the emergence of physical delivery settlement since the danger of incurring securities transaction tax was absent.

However, Market participants pointed out that eliminating the 'Do not exercise' option has increased the danger of significant losses for traders whose out-of-the-money options suddenly became in-the-money at the time of expiry.

According to a SEBI notice, if the current price of a stock closes below the strike price, the trader holding the Put Option must either sell the position before expiry or arrange shares from the auction.

Traders were required to either square off their in-the-money bets before the contract expired or secure physical delivery under the current system. A put option buyer with in-the-money contracts at the expiry time faced a particularly difficult scenario, as they would have to buy the shares from the auction and deliver them to the put writer.

The risk became true in January after numerous traders complained of massive losses in Hindalco Industries' out-of-money put options expiring in December that unexpectedly became in-the-money on the expiry day due to a sharp drop in the share price in the closing hours of the session.

Significance of DNE

Several traders who held stock options until expiry have difficulty due to their failure to deliver shares to settle trades in the last three derivative expiry days. This is because they did not have the shares in their demat accounts or did not have the funds to fulfil the promise.

If held until expiration, futures and options trades in India are settled with shares. Most Indian traders use futures and options to speculate rather than take or give shares on delivery.

On the other hand, Brokers noted that in previous months, traders have been unable to exit options contracts before they expired on the last Thursday of the month. To fulfil the physical settlement, the value of their shares has been several times the amount of their options trade or even their Net worth.

How will DNE Work?

On expiry days in options contracts, this facility will be available to specify a 'Do Not Exercise' instruction. Brokers would get the option to specify not to exercise in respect of the Close-To-Money (CTM) option during the expiry day.

The following is how the Close-To-Money (CTM) striking Range will be determined:

- Three ITM options that strike precisely below the final settlement price are considered 'CTM' for Call Options

- Three ITM options that strike exactly above the final settlement price are called 'CTM' for Put Options

Conclusion

The DNE facility is expected to eliminate several hazards related to physical settlement. Brokers won't be able to exercise options contracts on behalf of clients under this system. And that is how DNE comes into action and is beneficial for the people.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.