cKYC in India (2026) - Meaning, Process, Benefits, Documents & Status Check Guide

TL;DR / Quick Overview

- cKYC (Central KYC): One-time centralized KYC for all financial institutions in India.

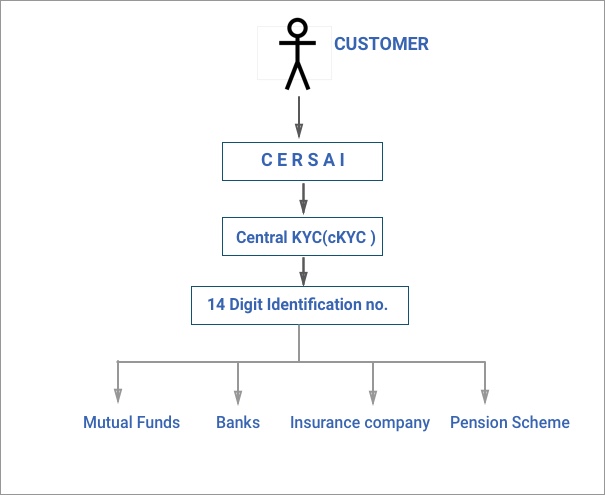

- Managed by: CERSAI (Central Registry of Securitisation and Asset Reconstruction and Security Interest of India)

- Purpose: Avoid repeating KYC for banks, Mutual Funds, insurance, NBFCs, and other entities.

- Process: Fill form → attach documents → In-Person Verification (IPV) → receive 14-digit KYC Identification Number (KIN) → KYC valid across all institutions.

- Benefits: Saves time, reduces repetitive documentation, standardizes KYC norms across financial institutions.

What is cKYC (Central KYC)?

Central KYC (cKYC) is a centralized repository storing KYC information of customers for all financial institutions in India. Earlier, KYC had to be done separately for each product or institution. With cKYC:

- One registration is enough

- Valid across banks, mutual funds, Insurance companies, NBFCs, and stock brokers

- Eliminates redundancy and ensures uniform compliance

History & Management:

- Announced in the 2012-13 Union Budget

- Live from July 2016

- Managed by CERSAI

Once your cKYC is complete, you won’t need to redo KYC for any regulated financial institution in India.

Central KYC Registry (CERSAI)

CERSAI acts as the central database for all KYC records. Its responsibilities:

- Standardize KYC norms across the financial sector

- Enable inter-usability of KYC records

- Safeguard customer data while making it accessible to regulated entities

Pro Tip: Always provide valid email and mobile number in the cKYC form for instant KIN delivery and updates.

How to Get Your Central KYC Done

You can complete cKYC with any financial institution regulated by RBI, SEBI, IRDA, or PFRDA.

Step-by-step process:

- Approach a Bank, insurance company, mutual fund house, NBFC, or stock broker.

- Fill the cKYC form accurately.

- Attach self-attested documents (ID, address proof, photo, signature).

- Complete In-Person Verification (IPV).

- For NRIs, IPV and attestation must be done in India, and NRI status must be confirmed.

- After verification, receive a 14-digit KYC Identification Number (KIN) via SMS and email within 4–5 working days.

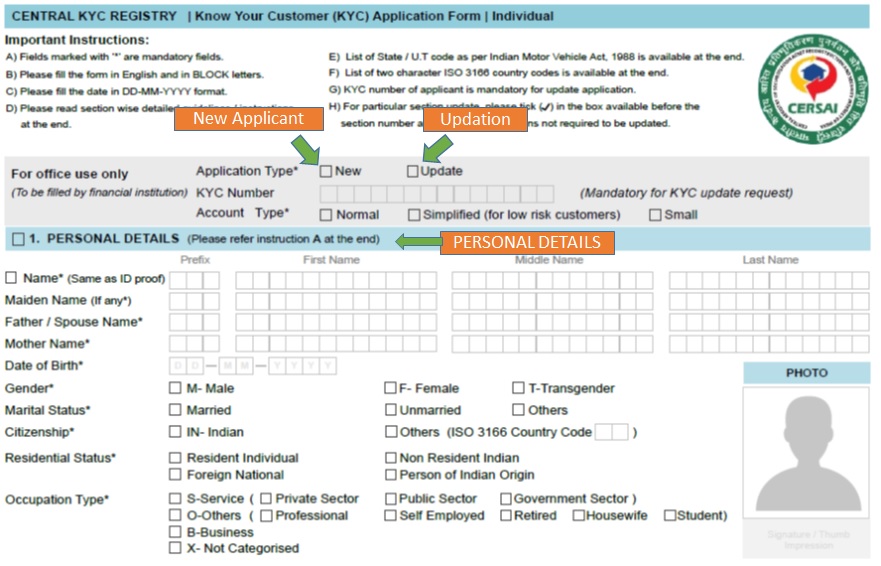

The form looks like the below:

There are various instructions given at the back of the form for filling in all the sections.

There are various instructions given at the back of the form for filling in all the sections.

Documents Required with cKYC Form

| Document Type | Examples / Notes |

|---|---|

| Proof of Identity | PAN, Aadhaar, Passport, Voter ID, Driving Licence, NREGA Job Card |

| Proof of Address | Aadhaar, Passport, Utility Bill, Bank statement, Rental Agreement |

| Photograph | Recent passport-sized photo |

| Signature | Self-attested on form |

Tip: Ensure all documents match your form details to avoid rejection.

Check Your KYC Status Download Form

Types of cKYC Accounts

| Account Type | Who it’s for | Documents Required | Notes |

|---|---|---|---|

| Normal KYC | Regular investors | Any 6 official documents (PAN, Aadhaar, Passport, Voter ID, Driving Licence, NREGA Job Card) | Standard KYC |

| Low-Risk / Simplified | Individuals without OVDs | Photo ID from Govt/PSU/Bank letter with photo attestation | Prefix ‘L’ |

| Small Account | Individuals with no valid documents | Self-attested photo + signed application | Max yearly credit: ₹1,00,000; Monthly withdrawals: ₹10,000; Max balance: ₹50,000; Prefix ‘S’ |

Central KYC Status Check Online

- Upon submission, a 14-digit KIN is issued to eligible applicants.

- SMS and email confirm your registration.

- Some KRAs may not yet display cKYC status online, but updates are expected.

- If application is rejected, contact the institution where cKYC was submitted. CERSAI does not notify users directly in such cases.

How to Be cKYC Compliant

Steps to ensure compliance:

- Fill cKYC form correctly.

- Submit self-attested proof of identity, proof of address, photo, and signature.

- Complete IPV for verification.

- Receive KIN – use this for all future financial accounts.

- Centralized storage eliminates repetitive KYC submission.

How to Update cKYC Details

1. Update Email ID

Log in to the institution’s website → Click ‘Update KYC’ → Enter new email → Verify via OTP.

2. Update Mobile Number

Platforms: CAMS, Karvy, CDSL, NSDL (eKYC required) → Enter new mobile → OTP → Submit.

3. Change Address

Log in to bank/financial institution or centralized portal → Select ‘Update KYC details’ → Address change → OTP verification

Tip: Ensure consistency of personal details across all platforms to avoid discrepancies.

Difference Between KYC, eKYC, and cKYC

| Type | How it Works | Notes |

|---|---|---|

| KYC | Paper-based, traditional process | One-time with each institution |

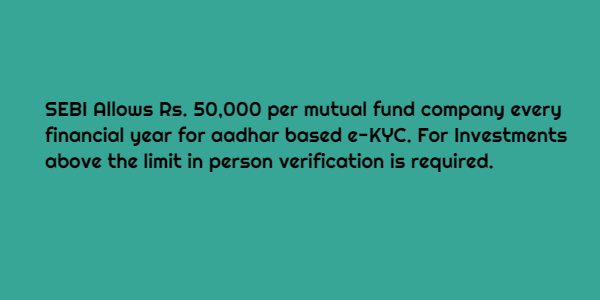

| eKYC | Aadhaar-based verification via OTP or biometric | Limited investment ₹50,000/year per MF (OTP) or unlimited (biometric) |

| cKYC | Centralized KYC for all financial institutions | One-time, issues KIN, valid across all regulated entities |

Why cKYC Was Introduced

- Eliminates multiple KYC submissions across institutions

- Standardizes KYC process for banks, mutual funds, insurance, NBFCs

- Digitizes records to save time, manpower, and resources

- Ensures compliance and transparency in financial services

New Norms in cKYC

- Promoted by Government, PSU banks, and financial institutions

- All SEBI-regulated intermediaries now register new customer KYC on CERSAI’s online platform

- Banks, insurance companies, and AMCs hand over records to CERSAI

- DotEx International is the managed service provider for CERSAI

- cKYC collects additional details: mother’s name, maiden name, details of related persons (for minors), permanent address verification

Behind cKYC: CERSAI

- Central Registry of Securitisation Asset Reconstruction and Security Interest of India

- Authorized under PMLA 2005

- Receives, stores, and retrieves KYC records digitally

- Accessible only by regulated financial entities

Common Issues & Solutions

| Issue | Solution |

|---|---|

| Delayed KIN | Contact submitting institution; confirm documents |

| Rejected Application | Check documents, ensure form is correctly filled |

| Technical Glitches | Use official portals only |

A Change for a Better Future

- cKYC reduces repeated KYC across institutions

- Makes the system efficient: saves time, resources, and money

- Early glitches are expected, but over time, cKYC becomes industry standard

- Benefits both investors and institutions

FAQs

Q1. How long does cKYC take?

A: 4–5 working days for KIN issuance after submission.

Q2. Can NRIs complete cKYC outside India?

A: IPV must be done in India; embassy attestation may be accepted.

Q3. Do I need cKYC for each institution?

A: No, one cKYC registration is valid across all regulated entities.

Q4. What is KIN?

A: 14-digit KYC Identification Number issued after successful cKYC registration.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good and correct information. At the moment CKYC is nothing but a big propaganda by Govt. My SBI branch manager is not aware of CKYC! I could not find any correct way to register cKYC online. Even the www.ckycindia.in website is totally blank.

Very good kyc

Exellent service