How to Invest in a Mutual Fund for Beginners

How to Invest in a Mutual Fund for Beginners? Newbies are always confused about how to invest in Mutual Fund. Though Mutual Fund is a good investment option, there are various questions that run into their mind related to Mutual Fund basics, best mutual funds for beginners, having an understanding about Mutual Funds and much more. In brief, Mutual Funds are an investment avenue in which invests the money deposited by numerous investors in various financial instruments. Mutual Funds are one of the prominent avenues with many individuals choosing it. These schemes help individuals to achieve their objectives. So, let us understand the various aspects of Mutual Funds through this article.

Overview of Mutual Fund Basics

To begin with, let us first understand what exactly is a Mutual Fund. In short words, Mutual Fund is an investment avenue which is formed when a number of individuals sharing a common objective of trading in shares and Bonds come together and invest their money. These individuals get units of the Mutual Fund against the money invested and are known as unitholders. The company managing Mutual Fund schemes are known as Asset Management Company. The person-in-charge of a Mutual Fund scheme is known as Fund Manager. Mutual Fund industry in India is well-regulated with Securities and Exchange Board of India (SEBI) being its regulator. SEBI forms the framework within the boundaries of which Mutual Fund companies function.

How to Choose Best Mutual Funds for Beginners

If you are new to Mutual Fund investment, you should be very careful while choosing the scheme. Choosing an improper scheme can result in losses and eat away your investments. So, let us look at the process of how to choose best Mutual Funds for Beginners.

1. Determine the Investment Objective

Any investment is done to accomplish a particular objective, for example, purchasing a house, purchasing a vehicle, planning for higher education, and much more. Therefore, determining the investment objective helps to determine various parameters.

2. Assess Your Investment Tenure

After determining the investment objective, the next parameter to be determined is the investment tenure. Determining the tenure helps on to decide which category of schemes can be chosen for investment. For instance, if the investment tenure is low then you can choose debt funds and if the investment tenure is high; then you can choose Equity Funds.

3. Decide Your Expected Return & Risk Appetite

You also need to determine the expected return and risk-appetite. Determining the expected return and risk-appetite also act as a guideline to deciding on the type of the scheme.

4. Assess the Scheme’s Performance & Fund House’s Credentials

Post deciding on the various factors such as returns and risk-appetite you should shift your focus on the performance of the scheme. Here, you should check the fund age, its previous track record, and other related parameters. Along with the scheme, you should also check on the credentials of the fund house. Moreover, also check the credentials of the fund manager managing the scheme.

5. Review Your Investments Timely

Once invested, individuals should not just a back seat. Instead, you should review your investments timely and rebalance your Portfolio timely. This will help you to earn effectively.

Best Mutual Fund Schemes for Beginners: Types of Mutual Fund Schemes

Mutual Fund schemes designed to suit the diverse requirements and preferences of individuals. So, let us look at some of the basic Mutual Fund categories.

Fund Selection Methodology used to find 5 funds

Equity Funds

Equity funds are the schemes that invest the accumulated pool of money in equity-related instruments. Various categories of equity funds include Large cap funds, mid cap funds, and Small cap funds. Beginners need to do a proper analysis before Investing in equity schemes. They can invest in equity funds through SIP mode. Even if they choose to invest in equity funds, they can choose to invest in large cap funds. Some of the Best Large Cap Funds that can be chosen for investment include:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹87.4832

↓ -1.21 ₹50,107 -6.4 -4.6 9.9 17.2 15.7 9.2 ICICI Prudential Bluechip Fund Growth ₹106.67

↓ -1.53 ₹76,646 -7 -3.7 8.8 16.5 13.9 11.3 HDFC Top 100 Fund Growth ₹1,095.59

↓ -20.09 ₹39,621 -6.2 -3.7 6.6 13.9 12.7 7.9 IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 Invesco India Largecap Fund Growth ₹65.48

↓ -1.13 ₹1,666 -7.2 -6.5 8.8 15.7 12.3 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund HDFC Top 100 Fund IDBI India Top 100 Equity Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,107 Cr). Highest AUM (₹76,646 Cr). Lower mid AUM (₹39,621 Cr). Bottom quartile AUM (₹655 Cr). Bottom quartile AUM (₹1,666 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (29 yrs). Established history (13+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.67% (top quartile). 5Y return: 13.88% (upper mid). 5Y return: 12.74% (lower mid). 5Y return: 12.61% (bottom quartile). 5Y return: 12.28% (bottom quartile). Point 6 3Y return: 17.25% (upper mid). 3Y return: 16.47% (lower mid). 3Y return: 13.86% (bottom quartile). 3Y return: 21.88% (top quartile). 3Y return: 15.65% (bottom quartile). Point 7 1Y return: 9.93% (upper mid). 1Y return: 8.77% (bottom quartile). 1Y return: 6.63% (bottom quartile). 1Y return: 15.39% (top quartile). 1Y return: 8.79% (lower mid). Point 8 Alpha: 0.30 (lower mid). Alpha: 0.35 (upper mid). Alpha: -1.99 (bottom quartile). Alpha: 2.11 (top quartile). Alpha: -1.06 (bottom quartile). Point 9 Sharpe: 0.30 (upper mid). Sharpe: 0.30 (lower mid). Sharpe: 0.09 (bottom quartile). Sharpe: 1.09 (top quartile). Sharpe: 0.20 (bottom quartile). Point 10 Information ratio: 1.22 (top quartile). Information ratio: 1.01 (upper mid). Information ratio: 0.24 (bottom quartile). Information ratio: 0.14 (bottom quartile). Information ratio: 0.72 (lower mid). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

HDFC Top 100 Fund

IDBI India Top 100 Equity Fund

Invesco India Largecap Fund

Debt Funds

These schemes invest their corpus in fixed income instruments. Debt funds are a good option for short and medium term and their prices fluctuate less as compared to equity funds. For beginners, debt funds are one of the good Mutual Funds to start with. The risk appetite of these schemes are comparatively lower than equity funds. Some of the best Mutual Funds for beginners under debt category are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Credit Risk Fund Growth ₹50.769

↑ 0.01 ₹217 0.3 1.4 6 14.4 21 7.67% 2Y 5M 5D 3Y 4M 24D Aditya Birla Sun Life Credit Risk Fund Growth ₹24.3678

↑ 0.02 ₹1,138 4.9 7.2 13.2 12 13.4 7.96% 2Y 4M 28D 3Y 2M 23D Franklin India Credit Risk Fund Growth ₹25.3348

↑ 0.04 ₹104 2.9 5 7.5 11 0% Aditya Birla Sun Life Medium Term Plan Growth ₹42.3756

↑ 0.02 ₹2,982 3.1 4.9 10.2 10 10.9 7.78% 3Y 4M 24D 4Y 6M 7D Invesco India Credit Risk Fund Growth ₹2,001.48

↑ 0.54 ₹158 1.2 2.6 6.8 9.4 9.2 7.46% 2Y 3M 4D 3Y Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Credit Risk Fund Aditya Birla Sun Life Credit Risk Fund Franklin India Credit Risk Fund Aditya Birla Sun Life Medium Term Plan Invesco India Credit Risk Fund Point 1 Lower mid AUM (₹217 Cr). Upper mid AUM (₹1,138 Cr). Bottom quartile AUM (₹104 Cr). Highest AUM (₹2,982 Cr). Bottom quartile AUM (₹158 Cr). Point 2 Oldest track record among peers (22 yrs). Established history (10+ yrs). Established history (14+ yrs). Established history (16+ yrs). Established history (11+ yrs). Point 3 Top rated. Not Rated. Rating: 1★ (bottom quartile). Rating: 4★ (upper mid). Rating: 4★ (lower mid). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 5.96% (bottom quartile). 1Y return: 13.25% (top quartile). 1Y return: 7.45% (lower mid). 1Y return: 10.22% (upper mid). 1Y return: 6.76% (bottom quartile). Point 6 1M return: 1.13% (top quartile). 1M return: 0.44% (bottom quartile). 1M return: 0.91% (upper mid). 1M return: 0.52% (bottom quartile). 1M return: 0.56% (lower mid). Point 7 Sharpe: 1.48 (lower mid). Sharpe: 2.38 (top quartile). Sharpe: 0.29 (bottom quartile). Sharpe: 2.33 (upper mid). Sharpe: 1.11 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.67% (lower mid). Yield to maturity (debt): 7.96% (top quartile). Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.78% (upper mid). Yield to maturity (debt): 7.46% (bottom quartile). Point 10 Modified duration: 2.43 yrs (bottom quartile). Modified duration: 2.41 yrs (lower mid). Modified duration: 0.00 yrs (top quartile). Modified duration: 3.40 yrs (bottom quartile). Modified duration: 2.26 yrs (upper mid). DSP Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Franklin India Credit Risk Fund

Aditya Birla Sun Life Medium Term Plan

Invesco India Credit Risk Fund

Money Market Mutual Funds

Also known as Liquid Funds these schemes invest their fund money in fixed income instruments having very short maturity period. Beginners can choose to invest in money market Mutual Funds as it is one of the safe investment avenues. This scheme is suitable for investors whose have idle funds lying in their Bank account and wish to earn more as compared savings bank account. Some of the best money market Mutual Funds for beginners are:

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity UTI Money Market Fund Growth ₹3,218.46

↑ 0.92 ₹20,497 0.4 1.4 2.9 7.1 7.5 6.96% 4M 26D 4M 26D Franklin India Savings Fund Growth ₹52.3444

↑ 0.01 ₹3,898 0.4 1.4 2.9 7.1 7.4 6.89% 5M 8D 5M 19D ICICI Prudential Money Market Fund Growth ₹396.008

↑ 0.11 ₹35,025 0.4 1.4 2.9 7.1 7.4 6.91% 5M 12D 5M 25D Nippon India Money Market Fund Growth ₹4,329.44

↑ 1.17 ₹21,699 0.4 1.3 2.8 7.1 7.4 6.48% 4M 23D 5M 3D Tata Money Market Fund Growth ₹4,925.6

↑ 1.17 ₹37,939 0.4 1.4 2.9 7.1 7.4 6.35% 5D 5D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary UTI Money Market Fund Franklin India Savings Fund ICICI Prudential Money Market Fund Nippon India Money Market Fund Tata Money Market Fund Point 1 Bottom quartile AUM (₹20,497 Cr). Bottom quartile AUM (₹3,898 Cr). Upper mid AUM (₹35,025 Cr). Lower mid AUM (₹21,699 Cr). Highest AUM (₹37,939 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (24 yrs). Established history (20+ yrs). Established history (20+ yrs). Established history (22+ yrs). Point 3 Top rated. Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Low. Risk profile: Moderately Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 7.15% (top quartile). 1Y return: 7.14% (upper mid). 1Y return: 7.14% (lower mid). 1Y return: 7.09% (bottom quartile). 1Y return: 7.08% (bottom quartile). Point 6 1M return: 0.44% (upper mid). 1M return: 0.41% (bottom quartile). 1M return: 0.42% (bottom quartile). 1M return: 0.43% (lower mid). 1M return: 0.45% (top quartile). Point 7 Sharpe: 2.26 (upper mid). Sharpe: 2.24 (lower mid). Sharpe: 2.31 (top quartile). Sharpe: 2.08 (bottom quartile). Sharpe: 2.11 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.96% (top quartile). Yield to maturity (debt): 6.89% (lower mid). Yield to maturity (debt): 6.91% (upper mid). Yield to maturity (debt): 6.48% (bottom quartile). Yield to maturity (debt): 6.35% (bottom quartile). Point 10 Modified duration: 0.41 yrs (lower mid). Modified duration: 0.44 yrs (bottom quartile). Modified duration: 0.45 yrs (bottom quartile). Modified duration: 0.40 yrs (upper mid). Modified duration: 0.01 yrs (top quartile). UTI Money Market Fund

Franklin India Savings Fund

ICICI Prudential Money Market Fund

Nippon India Money Market Fund

Tata Money Market Fund

Balanced Funds

These schemes are also known as hybrid funds. These schemes invest their corpus in both equity and debt funds. Beginners can also choose to prefer in hybrid funds as it helps them to earn regular income along with capital appreciation. Some of the best Mutual Funds for beginners under Balanced Fund category include:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Multi Asset Allocation Fund Growth ₹65.5993

↓ -0.30 ₹14,944 1.8 8.9 21.9 19 14.6 18.6 UTI Multi Asset Fund Growth ₹76.9101

↓ -0.87 ₹6,848 -2 1.9 13.2 18.9 13.7 11.1 ICICI Prudential Multi-Asset Fund Growth ₹801.868

↑ 5.72 ₹80,768 -0.5 4 14.9 18.9 18.7 18.6 ICICI Prudential Equity and Debt Fund Growth ₹393.59

↓ -3.20 ₹49,257 -3.6 -1.1 11.3 17.8 17.6 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹37.26

↓ -0.09 ₹1,329 -0.3 -1.8 12.7 17.7 16.7 -0.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Multi Asset Allocation Fund UTI Multi Asset Fund ICICI Prudential Multi-Asset Fund ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund Point 1 Lower mid AUM (₹14,944 Cr). Bottom quartile AUM (₹6,848 Cr). Highest AUM (₹80,768 Cr). Upper mid AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (23+ yrs). Oldest track record among peers (26 yrs). Established history (9+ yrs). Point 3 Top rated. Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Rating: 4★ (upper mid). Not Rated. Point 4 Risk profile: Moderate. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.57% (bottom quartile). 5Y return: 13.67% (bottom quartile). 5Y return: 18.67% (top quartile). 5Y return: 17.62% (upper mid). 5Y return: 16.67% (lower mid). Point 6 3Y return: 18.99% (top quartile). 3Y return: 18.91% (upper mid). 3Y return: 18.89% (lower mid). 3Y return: 17.78% (bottom quartile). 3Y return: 17.72% (bottom quartile). Point 7 1Y return: 21.87% (top quartile). 1Y return: 13.16% (lower mid). 1Y return: 14.92% (upper mid). 1Y return: 11.34% (bottom quartile). 1Y return: 12.74% (bottom quartile). Point 8 1M return: -2.80% (top quartile). 1M return: -4.59% (bottom quartile). 1M return: -3.54% (lower mid). 1M return: -4.87% (bottom quartile). 1M return: -3.15% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 3.54 (top quartile). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 2.05 (top quartile). Sharpe: 0.76 (lower mid). Sharpe: 1.48 (upper mid). Sharpe: 0.62 (bottom quartile). Sharpe: 0.08 (bottom quartile). SBI Multi Asset Allocation Fund

UTI Multi Asset Fund

ICICI Prudential Multi-Asset Fund

ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Solution Oriented Schemes

Solution oriented schemes are helpful for those investors who wish to create long-term wealth that mainly includes Retirement planning and a child’s future education by investing in Mutual Funds. Earlier, these plans were a part of equity or balanced schemes, but as per SEBI’s new circulation, these funds are separately categorised under solution oriented schemes. Also these schemes used to have a lock-in for three years, but now these funds have a mandatory lock-in of five years.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Child Care Plan (Gift) Growth ₹314.52

↓ -2.02 ₹1,378 -4.5 -5.2 9.8 17.5 13.3 8.3 HDFC Retirement Savings Fund - Equity Plan Growth ₹48.026

↓ -0.55 ₹6,941 -6.6 -5 6.7 15.2 16.1 5.2 Tata Retirement Savings Fund - Progressive Growth ₹60.2845

↓ -0.53 ₹2,041 -7 -7.3 6.5 13.9 9.8 -1.2 Tata Retirement Savings Fund-Moderate Growth ₹60.4975

↓ -0.47 ₹2,094 -6 -6 6.8 13.1 9.7 1 SBI Magnum Children's Benefit Plan Growth ₹110.433

↓ -0.20 ₹132 0 0.7 5.9 12.3 11.1 3.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Child Care Plan (Gift) HDFC Retirement Savings Fund - Equity Plan Tata Retirement Savings Fund - Progressive Tata Retirement Savings Fund-Moderate SBI Magnum Children's Benefit Plan Point 1 Bottom quartile AUM (₹1,378 Cr). Highest AUM (₹6,941 Cr). Lower mid AUM (₹2,041 Cr). Upper mid AUM (₹2,094 Cr). Bottom quartile AUM (₹132 Cr). Point 2 Oldest track record among peers (24 yrs). Established history (10+ yrs). Established history (14+ yrs). Established history (14+ yrs). Established history (24+ yrs). Point 3 Rating: 2★ (bottom quartile). Not Rated. Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.27% (upper mid). 5Y return: 16.09% (top quartile). 5Y return: 9.76% (bottom quartile). 5Y return: 9.67% (bottom quartile). 5Y return: 11.08% (lower mid). Point 6 3Y return: 17.47% (top quartile). 3Y return: 15.17% (upper mid). 3Y return: 13.95% (lower mid). 3Y return: 13.14% (bottom quartile). 3Y return: 12.34% (bottom quartile). Point 7 1Y return: 9.79% (top quartile). 1Y return: 6.67% (lower mid). 1Y return: 6.53% (bottom quartile). 1Y return: 6.82% (upper mid). 1Y return: 5.94% (bottom quartile). Point 8 1M return: -4.75% (upper mid). 1M return: -7.25% (bottom quartile). 1M return: -7.21% (bottom quartile). 1M return: -6.18% (lower mid). 1M return: -0.96% (top quartile). Point 9 Alpha: 0.00 (top quartile). Alpha: -1.32 (bottom quartile). Alpha: -5.02 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Point 10 Sharpe: 0.12 (top quartile). Sharpe: 0.09 (upper mid). Sharpe: -0.13 (bottom quartile). Sharpe: -0.09 (lower mid). Sharpe: -0.32 (bottom quartile). ICICI Prudential Child Care Plan (Gift)

HDFC Retirement Savings Fund - Equity Plan

Tata Retirement Savings Fund - Progressive

Tata Retirement Savings Fund-Moderate

SBI Magnum Children's Benefit Plan

Investing in Mutual Funds for Beginners: SIP & Lump Sum Mode

Individuals can invest in Mutual Funds either through SIP or lump sum mode. In SIP or Systematic Investment plan, the investments take place at regular intervals in a small amount. Contrarily, in lump sum mode, a considerable amount is deposited as a one-shot activity. For beginners, it is always preferable to invest through SIP mode. This is because, since the investment amount is small, it does not hamper people’s current budget. SIP is done generally in the context of equity funds in which individuals can earn more if they hold their investment for a longer tenure. In addition, SIP has a lot of advantages such as the Power of Compounding, rupee cost averaging, and disciplined savings habit.

Talk to our investment specialist

Understanding Mutual Fund Calculator

mutual fund calculator is also known sip calculator. It is one of the tools that help individuals to determine the SIP amount. This calculator helps individuals to determine the savings amount that they need to today for attaining their future objectives. The calculator also shows how the value of SIP grows over a period of time in a virtual environment.

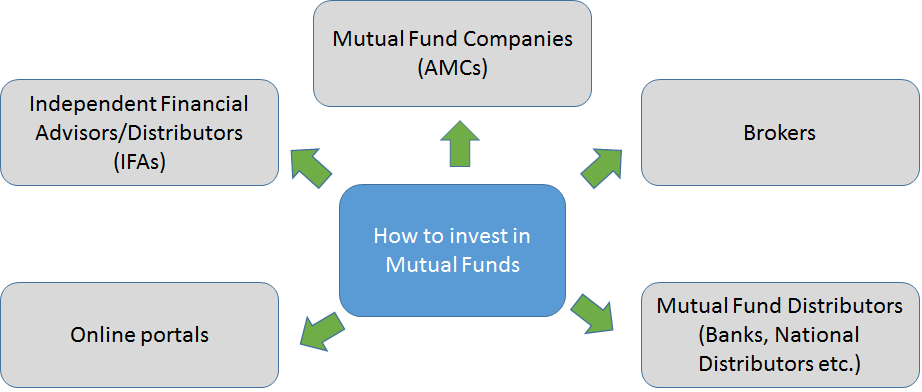

Online Mutual Funds: Invest Hassle-Free

The advancements in technology have eased out the life of individuals even in terms of investment. Individuals can invest in Mutual Funds through online mode in just a few clicks. People can transact in Mutual Funds at any time and from anywhere through online mode. Individuals opting for online mode can invest in Mutual Funds either through distributors or through the fund house directly. However, it is always advised to invest through Mutual Fund Distributors as individuals can find a number of schemes of various fund houses under one roof.

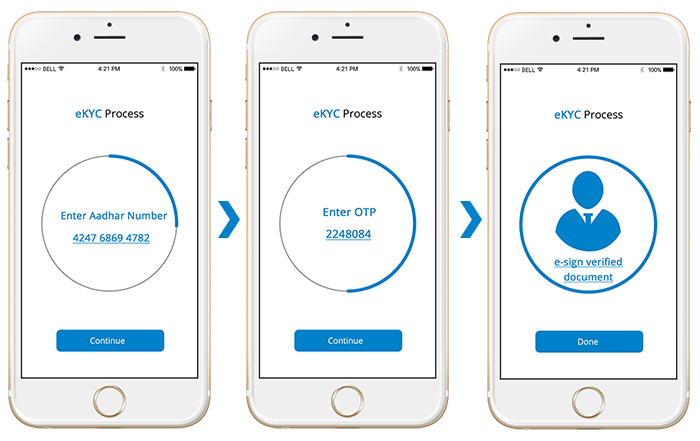

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Thus, from the above points, it can be said that Mutual Funds are one of the prominent investment avenues. However, it is advised that before in any scheme people should understand its modalities completely. In addition, they should ensure whether the scheme’s approach is in-line with their objectives. If required, people can also consult a financial consultant. This will help individuals by ensuring that their investment is safe and paves way for wealth creation.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.