How to Invest in Mutual Funds Online: Invest Hassle-Free

The advancements in technology have simplified the investment process in Mutual Funds. Through online channel, people can invest in Mutual Fund through paperless means. Given the advancements in the technology, people can invest in various schemes as per their convenience from anywhere and at any time. Through online channel, people can invest in Mutual Funds either through a Mutual Fund distributor or through the fund house directly. Not just this, people can find the analysis of various schemes, do a SIP, redeem their investments as per their convenience through online.

So, let us understand the procedure of How to Invest in Mutual Funds through online channels.

How to Purchase Mutual Funds Online?

The process of purchasing Mutual Funds through online mode differs in case of purchase from Mutual Fund distributors and from Asset Management Companies (AMCs). So, let us understand the process of purchasing Mutual Funds from both these channels.

Invest Online Through Mutual Fund Distributors

Mutual Fund Distributors act as Aggregators, who provide a number of Mutual Fund schemes of various fund houses under one roof. One of the highlighting points of these distributors is they do not charge any fees from the clients. As a consequence, individuals get the entire amount at the time of investment and redemption. In addition, these online portals also provide an in-depth analysis of various schemes. For Investing through a distributor you need to have an active mobile number, PAN number, and Aadhar number. So, let us see how to invest in Mutual Funds through Mutual Fund Distributors online.

Steps to Invest in Mutual Funds Online through Mutual Fund Distributor

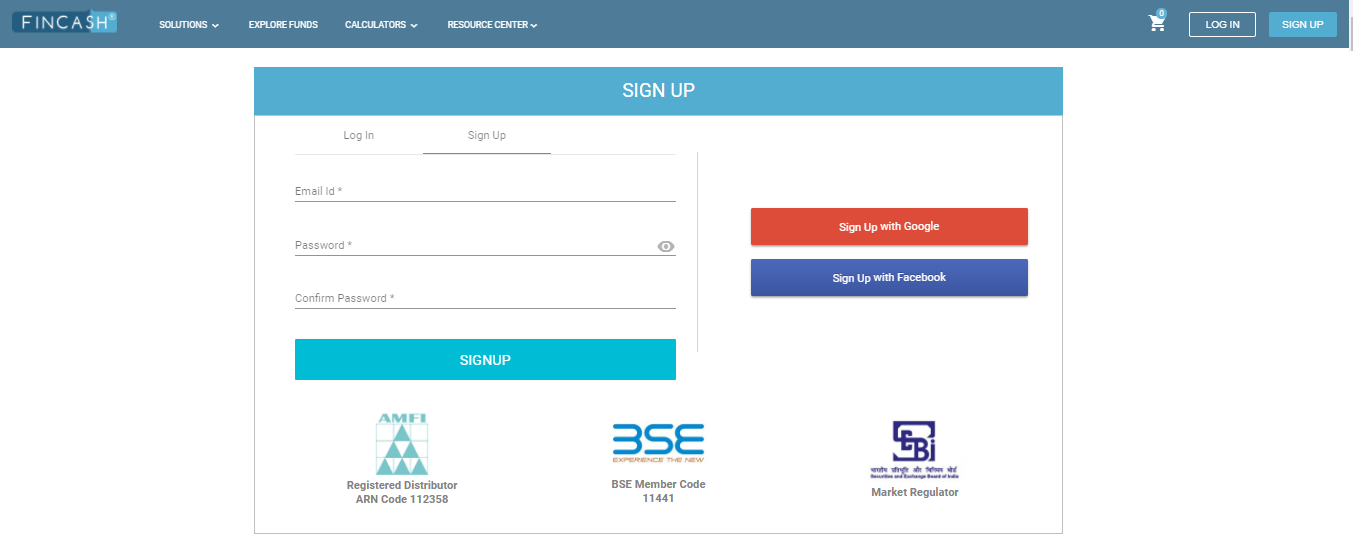

- Step 1: Log on to the distributor’s website and sign up using your credentials

- Step 2: Complete the KYC formalities if KYC is not done. This process can be done online through the eKYC procedure.

- Step 3: Complete the registration process by filling the required forms online.

- Step 4: Upload the required documents and ensure that the registration is done.

Thus, by following these simple steps, the registration procedure can be completed through a Mutual Fund distributor is completed. Upon completing the registration, people can start investing in Mutual Funds of various companies.

Invest Online Through AMCs

Another source of online investing in Mutual Funds can be through the fund houses or AMCs directly. Through online mode, people in this case too can invest in just a few clicks. However, one of the drawbacks of investing through the fund houses directly is that people can invest in schemes of just one company and not other fund houses. Here, if individuals want to invest in schemes of other fund houses, they need to separately register on the fund house’s website. However, people need to repeat the KYC formalities. So, let us look at the steps of how to invest through AMCs using online mode.

Steps to Invest in Mutual Funds Online through AMCs

- Step 1: Log on to the AMC’s website and select the Invest Online option

- Step 2: Fill up the registration form and giving all the required details online

- Step 3: Give your Bank details and other required details

- Step 4: Upload the required documents and complete your registration

Thus, in this case, also we can see that the registration process is quite simple. Once the registration is complete, you can invest in schemes that suit your requirements. However, it would be again reiterated that through AMCs people can invest in schemes of only the respective Mutual Fund company.

Therefore, from the above two modes, we can say that it is easy to invest in Mutual Funds. However, people should give some of their details related to FATCA and PMLA. FATCA refers to Foreign Account Tax Compliance Act which aims to curb tax evasion. To comply this act, individuals need to fill in the self-certified FATCA form. They also need to adhere to the guidelines of Prevention of Money Laundering Act (PMLA). As per this, people need to give their bank details along with the soft copy of bank statement or passbook or a cancelled cheque copy.

Talk to our investment specialist

SIP Online: Smart Way to Invest

In the previous section, we saw that people can invest in various schemes through online mode. Similarly, they can also do SIP through online mode. Through online channels, people can start a SIP, check how many SIP instalments have been deducted, check the performance of the SIP, and many other related actions. Since the mode of investment is online, people can also choose the online mode of payment that is, through NEFT/RTGS or Net Banking. Additionally, through net banking, people can ensure that their SIP payment gets deducted automatically by setting up the required biller.

Online Mutual Fund Calculator

mutual fund calculator is also known as sip calculator. This calculator helps individuals to check how much money they need to invest in the current date to accomplish their objectives. It also shows how the SIP grows over a given timeframe. In order to calculate the current SIP investment amount, some of the input data that you need to enter include your current income, your present expenses, the expected rate of returns on your investment, and much more.

Fund Selection Methodology used to find 5 funds

Top 5 Best Mutual Funds to Invest for 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹40.288

↑ 0.27 ₹372 16.5 26.1 41.2 16.8 4.1 23.7 DSP Natural Resources and New Energy Fund Growth ₹110.438

↑ 0.34 ₹1,765 15.2 25.4 38.8 25.1 21.5 17.5 DSP US Flexible Equity Fund Growth ₹78.698

↓ -0.52 ₹1,119 5.4 16.9 34.3 23.6 17.2 33.8 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 2.1 6.6 24.2 28.6 24 3.7 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹63.89

↓ -1.06 ₹3,641 -1.2 8 22.1 18.2 13.4 17.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Franklin Build India Fund Aditya Birla Sun Life Banking And Financial Services Fund Point 1 Bottom quartile AUM (₹372 Cr). Lower mid AUM (₹1,765 Cr). Bottom quartile AUM (₹1,119 Cr). Upper mid AUM (₹3,003 Cr). Highest AUM (₹3,641 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (16+ yrs). Established history (12+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 4.12% (bottom quartile). 5Y return: 21.46% (upper mid). 5Y return: 17.18% (lower mid). 5Y return: 24.04% (top quartile). 5Y return: 13.43% (bottom quartile). Point 6 3Y return: 16.78% (bottom quartile). 3Y return: 25.07% (upper mid). 3Y return: 23.63% (lower mid). 3Y return: 28.56% (top quartile). 3Y return: 18.25% (bottom quartile). Point 7 1Y return: 41.22% (top quartile). 1Y return: 38.81% (upper mid). 1Y return: 34.28% (lower mid). 1Y return: 24.24% (bottom quartile). 1Y return: 22.11% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: 2.18 (top quartile). Alpha: 0.00 (bottom quartile). Alpha: 0.61 (upper mid). Point 9 Sharpe: 2.24 (top quartile). Sharpe: 1.32 (upper mid). Sharpe: 1.15 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 1.03 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.16 (bottom quartile). Information ratio: 0.00 (bottom quartile). Information ratio: 0.25 (top quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Franklin Build India Fund

Aditya Birla Sun Life Banking And Financial Services Fund

How to Invest in Mutual Funds with Fincash?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

To conclude, it can be said, that it is easy to invest in Mutual Fund Online. However, people should always invest through the channels in which they are comfortable. In addition, can also consult the opinion of a financial advisor to ensure that their investments give them the required results.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.