Mutual Fund Calculator

What is Mutual Fund?

A mutual fund is a professionally managed investment scheme. It is run by an asset management company (AMC) which acts like a mediator for the retail investors. The AMC pools in money from a large number of investors and invests it in equity shares, Bonds, money market instruments and other types of securities. Buying a mutual fund is like buying a small slice of a big pizza. Each investor, in return, is assigned a specific number of units proportionate to his invested amount in the fund. The investor is known as the unit holder. The unit holder shares the gains, losses, income and expenses of the fund in proportion to his investment in the fund.

What is a Mutual Fund Calculator ?

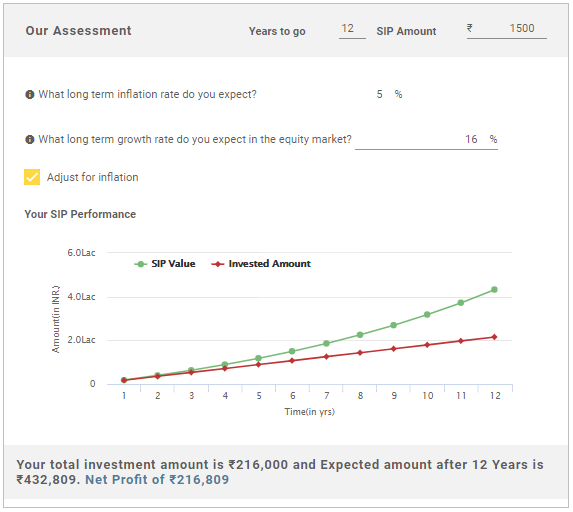

Mutual Fund Calculator helps us in Calculating our interest return for SIP investments or lump sum investment with the help of Fincash Mutual Fund Calculator below.

How does a mutual fund calculator work?

Is your mutual fund scheme generating returns in line with your expectation? Are you wondering what amount of SIP would help you in personal goal accomplishment? Get your answers by using our Mutual Fund Calculator! The Mutual Fund Calculator will give you the investment value at maturity by calculating fund returns according to your investment horizon. You can adjust the variables of the calculator like SIP/lump sum, amount of investment, frequency of SIP, expected rate of return and duration of SIP

Nature of investment ( SIP / Lumpsum )

There are basically two ways of Investing money in your favourite Mutual Funds. You can go via the SIP or the lump sum route

1. Lump sum investment

Under a lump sum, you invest one big chunk of your funds in mutual fund scheme of your choice. It generally happens when you receive huge corpus from say sale of an asset or retirement benefits. But investing a lump sum involves greater risk. That’s why it is always recommended to go via the SIP route

2. Systematic Investment Plan (SIP)

Under a SIP, you instruct the Bank to deduct a? the fixed sum from your Savings Account every month and invest it in the said mutual fund scheme. In this way, you can buy units continuously without worrying about the right time to enter the market. You get the benefit of rupee cost averaging and enjoy the Power of Compounding

Talk to our investment specialist

Types of Calculators

Lumpsum Calculator

SIP Calculator

Know Your SIP Returns

Fund Selection Methodology used to find 3 funds

Top Funds for 2026

*Best funds based on 1 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Energy Fund and BlackRock Global Funds – New Energy Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities

and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity

requirements from time to time. Research Highlights for DSP World Energy Fund Below is the key information for DSP World Energy Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (05 Mar 26) ₹63.9103 ↓ -2.35 (-3.55 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 10.8% 3 Month 28.7% 6 Month 64.3% 1 Year 164.1% 3 Year 58.8% 5 Year 31% 10 Year 15 Year Since launch 10.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (05 Mar 26) ₹32.1895 ↓ -0.88 (-2.66 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,307 28 Feb 23 ₹12,279 29 Feb 24 ₹10,745 28 Feb 25 ₹11,677 28 Feb 26 ₹25,661 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 5.5% 3 Month 27% 6 Month 55.6% 1 Year 100.7% 3 Year 23.2% 5 Year 19.4% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 3. DSP World Energy Fund

DSP World Energy Fund

Growth Launch Date 14 Aug 09 NAV (05 Mar 26) ₹26.1881 ↓ -0.06 (-0.21 %) Net Assets (Cr) ₹103 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆ Risk High Expense Ratio 1.18 Sharpe Ratio 1.88 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,595 28 Feb 23 ₹11,615 29 Feb 24 ₹11,727 28 Feb 25 ₹11,250 28 Feb 26 ₹17,970 Returns for DSP World Energy Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 5 Mar 26 Duration Returns 1 Month 1.3% 3 Month 11% 6 Month 24.1% 1 Year 58.7% 3 Year 14.4% 5 Year 11.5% 10 Year 15 Year Since launch 6% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.2% 2023 -6.8% 2022 12.9% 2021 -8.6% 2020 29.5% 2019 0% 2018 18.2% 2017 -11.3% 2016 -1.9% 2015 22.5% Fund Manager information for DSP World Energy Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Energy Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 34.4% Technology 27.82% Utility 24.89% Basic Materials 9.25% Asset Allocation

Asset Class Value Cash 3.62% Equity 96.36% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF Sustainable Energy I2

Investment Fund | -98% ₹101 Cr 417,038 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund